1,050% Price Hike: AT&T Challenges Broadcom's VMware Acquisition Cost

Table of Contents

Keywords: AT&T, Broadcom, VMware, acquisition cost, price hike, antitrust, merger, litigation, technology, business news, VMware pricing, Broadcom acquisition, anti-competitive practices

The proposed acquisition of VMware by Broadcom has hit a major snag, with AT&T alleging a staggering 1,050% price increase for VMware's networking services. This unprecedented price hike has ignited a legal battle, raising serious concerns about potential anti-competitive practices and the impact on the tech industry. This article delves into the details of this contentious situation, exploring the key arguments and potential consequences of this dramatic increase in the Broadcom VMware acquisition cost.

The Alleged 1,050% Price Increase: A Closer Look

AT&T's claim centers around a dramatic increase in the cost of several key VMware networking services following Broadcom's acquisition. The specifics of the alleged price hikes remain somewhat opaque, with both parties releasing statements but offering limited concrete details. However, the sheer magnitude of the increase – a claimed 1,050% – has sent shockwaves through the industry.

-

Specific VMware networking services impacted: While AT&T hasn't publicly listed every service affected, reports suggest that key networking and virtualization products are at the center of the dispute. These could include elements of VMware's NSX platform, crucial for network virtualization and management.

-

Comparison of old and new pricing structures: AT&T claims a drastic shift from previously negotiated rates to significantly inflated prices post-acquisition. The exact figures remain undisclosed publicly, fueling speculation and adding to the controversy surrounding the Broadcom VMware acquisition cost.

-

AT&T's evidence supporting the claim: AT&T is expected to present detailed evidence in court to support its claim. This evidence is likely to include contractual agreements, pricing documentation, and internal communications demonstrating the pre- and post-acquisition cost differences. The strength of this evidence will be crucial to the outcome of the legal battle.

Antitrust Concerns and Regulatory Scrutiny

The dramatic price hike has sparked significant antitrust concerns. A 1,050% increase suggests a potential abuse of market power, particularly given Broadcom's already substantial presence in the technology sector. This raises the question of whether the acquisition, and the subsequent pricing strategy, could stifle competition and harm consumers.

-

How the price hike could stifle competition: The steep increase could price smaller competitors out of the market, limiting customer choice and potentially leading to reduced innovation. Existing customers facing such a significant cost jump may be forced to seek less desirable alternatives or even scale back on vital services.

-

Ongoing regulatory investigations or reviews: Regulatory bodies, such as the Federal Trade Commission (FTC) in the US and the European Commission (EC) in Europe, are likely to scrutinize the acquisition and the reported price increases. Their investigations will determine whether Broadcom’s actions violate antitrust laws.

-

Potential impact on consumers and businesses: The higher costs could ripple through the economy, impacting businesses relying on VMware technologies and, ultimately, consumers through increased prices for goods and services. This potential broad impact underscores the severity of the situation and the necessity of thorough regulatory review.

Broadcom's Response and Defense Strategy

Broadcom has responded to AT&T's allegations, but their official statements have not fully addressed the core concerns raised by the massive price increase. Their defense strategy likely hinges on several key arguments.

-

Summary of Broadcom’s official statement: Broadcom has generally maintained that the pricing adjustments reflect market conditions and the value of their services. However, this statement lacks specifics and fails to directly address the magnitude of the claimed increase.

-

Broadcom's arguments against AT&T’s claims: Broadcom's arguments might include asserting that the price increases are justified due to increased costs, enhanced features, or changed contractual terms. They may also question the validity of AT&T's evidence or focus on nuances of the contractual agreements.

-

Any counter-arguments or evidence presented by Broadcom: Broadcom's legal team is expected to provide compelling counter-arguments and supporting evidence to refute AT&T's claims. The strength of this counter-evidence will significantly influence the outcome of the litigation.

Potential Outcomes and Future Implications

The legal battle between AT&T and Broadcom will significantly shape the future of mergers and acquisitions in the tech sector. Several potential outcomes exist:

-

Possible scenarios: The case could be dismissed, a settlement reached, or AT&T could successfully challenge the price increases. Each outcome will have significantly different implications for Broadcom, VMware, and the broader technology landscape.

-

Impact on future mergers and acquisitions in the tech sector: The outcome could influence future regulatory scrutiny of major tech mergers, potentially discouraging similar acquisitions if deemed anti-competitive.

-

Potential impact on VMware's customers and the broader market: Depending on the outcome, VMware's customers may face either sustained price increases or a return to more competitive pricing. This directly impacts their budgets and operations, with implications rippling across the tech market.

Conclusion

AT&T's claim of a 1,050% price hike following Broadcom's VMware acquisition represents a significant challenge to the deal and raises critical questions about potential anti-competitive practices. The ensuing legal battle has profound implications for the technology sector, impacting not only the companies involved but also the broader market and consumers. The antitrust concerns surrounding the Broadcom VMware acquisition cost are substantial, and the outcome will serve as a precedent for future mergers and acquisitions.

Call to Action: Stay informed about the evolving situation surrounding the Broadcom-VMware acquisition and the dramatic AT&T price hike. Follow this blog for updates on this crucial development in the technology landscape. Continue learning about the complexities of major tech acquisitions and the potential for anti-competitive practices. Learn more about the impact of the Broadcom VMware acquisition cost.

Featured Posts

-

Transforming The Indian Insurance Industry The Impact Of Ind As 117

May 15, 2025

Transforming The Indian Insurance Industry The Impact Of Ind As 117

May 15, 2025 -

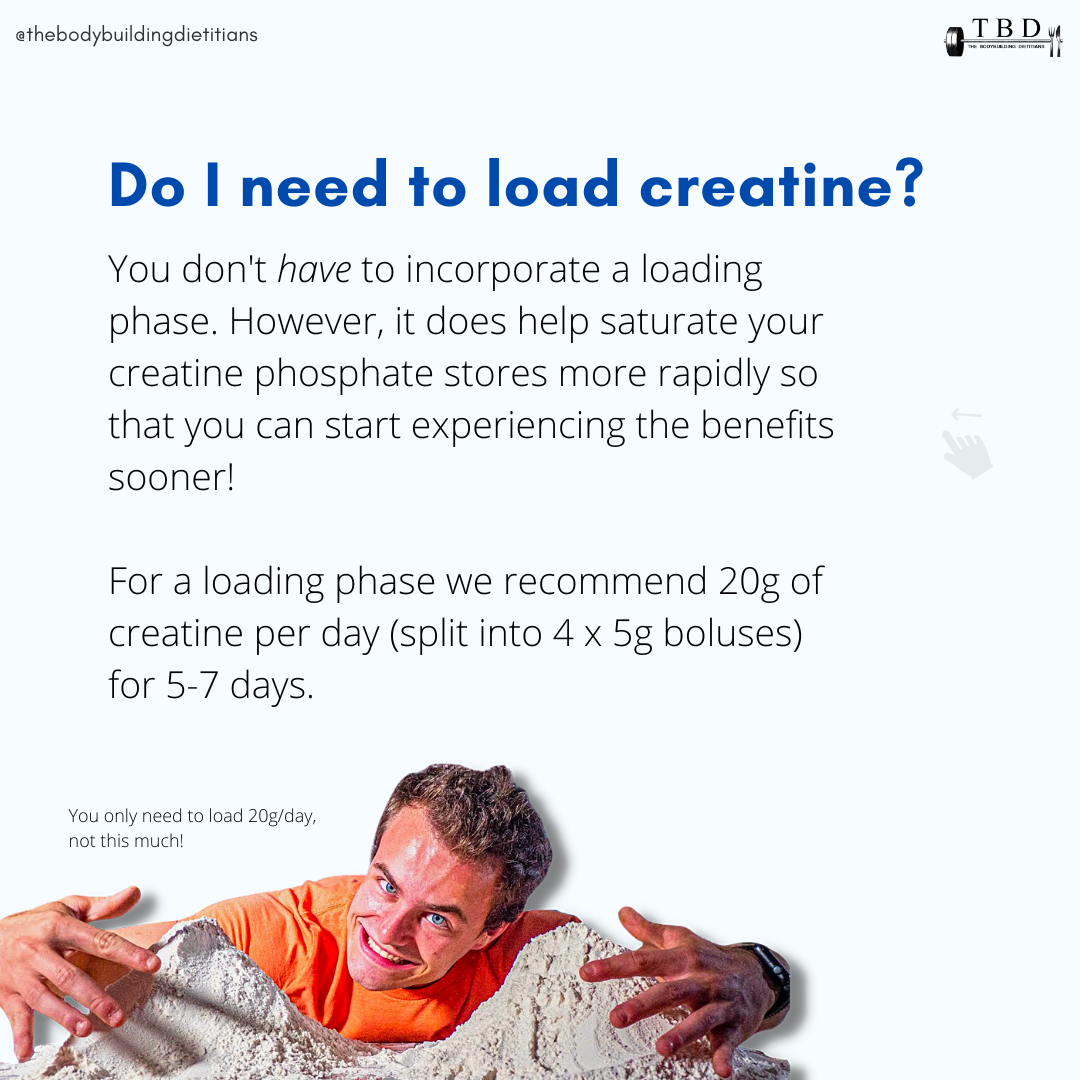

Creatine Supplements Everything You Need To Know

May 15, 2025

Creatine Supplements Everything You Need To Know

May 15, 2025 -

The Truth About Barbie Ferreiras Exit From Euphoria And Her Cast Relationships

May 15, 2025

The Truth About Barbie Ferreiras Exit From Euphoria And Her Cast Relationships

May 15, 2025 -

What Is Creatine A Guide To Its Uses And Effects

May 15, 2025

What Is Creatine A Guide To Its Uses And Effects

May 15, 2025 -

Kim And Snells Mlb Friendship Positive Influence On Korean Baseball Players

May 15, 2025

Kim And Snells Mlb Friendship Positive Influence On Korean Baseball Players

May 15, 2025

Latest Posts

-

Earthquakes Cant Overcome Rapids Steffens Loss Highlights Defensive Gaps

May 15, 2025

Earthquakes Cant Overcome Rapids Steffens Loss Highlights Defensive Gaps

May 15, 2025 -

Lafc Triumphs Over San Jose Earthquakes Amid Key Injury

May 15, 2025

Lafc Triumphs Over San Jose Earthquakes Amid Key Injury

May 15, 2025 -

Decentralisation Du Repechage Lnh Analyse D Une Decision Controversee

May 15, 2025

Decentralisation Du Repechage Lnh Analyse D Une Decision Controversee

May 15, 2025 -

Le Repechage De La Lnh Decentralise Un Succes Mitige

May 15, 2025

Le Repechage De La Lnh Decentralise Un Succes Mitige

May 15, 2025 -

La Lnh Regrette T Elle Sa Decision De Decentraliser Son Repechage

May 15, 2025

La Lnh Regrette T Elle Sa Decision De Decentraliser Son Repechage

May 15, 2025