1,050% VMware Price Increase: AT&T Challenges Broadcom's Acquisition Proposal

Table of Contents

The Shocking VMware Price Increase and its Implications

The reported 1,050% increase in VMware pricing is unprecedented. While the exact details of which products and services experienced this drastic jump remain somewhat opaque, reports suggest certain crucial elements of the VMware portfolio, particularly those critical for large-scale enterprise deployments like those used by telecom giants, have seen this astronomical price surge. This isn't a minor adjustment; it represents a potential cost explosion for businesses heavily reliant on VMware's virtualization technology.

The impact on AT&T and other major VMware customers is potentially devastating:

- Skyrocketing Operational Costs: The price increase translates directly into significantly higher operational expenditures for telecom companies, impacting their bottom lines severely.

- Service Price Hikes or Reduced Services: To absorb the increased costs, AT&T and others may be forced to increase prices for their services to customers or, conversely, reduce the quality or scope of services offered.

- Decreased Profitability and Competitiveness: The added financial burden directly impacts profitability, making these companies less competitive in the market.

- Industry-Wide Ripple Effect: The reliance on VMware within the telecom industry is substantial. This price hike could disrupt the entire ecosystem, forcing a reassessment of technology dependencies.

Several factors might explain such a dramatic price hike. One prominent theory is that Broadcom, anticipating the acquisition, is positioning VMware for higher profitability prior to the merger. Another is that the current market dynamics, with increased demand and limited supply of certain specialized VMware services, could be contributing to the increase.

AT&T's Opposition to Broadcom's Acquisition of VMware

AT&T's opposition to Broadcom's acquisition isn't merely a response to the price hike; it's a strategic maneuver driven by deep concerns about the implications of the merger. The 1,050% VMware price increase, however, significantly fuels AT&T's argument, serving as compelling evidence of the potential for monopolistic practices post-acquisition.

AT&T's key concerns include:

- Reduced Market Competition: The merger could significantly reduce competition in the virtualization market, potentially stifling innovation and giving Broadcom/VMware unchecked power to dictate pricing.

- Stifled Innovation: A lack of competition might lead to decreased investment in research and development, slowing the pace of technological advancement in virtualization.

- Post-Acquisition Price Gouging: The VMware price increase is viewed as a precursor to even steeper price increases once Broadcom completes its acquisition, effectively locking in customers and extracting higher profits.

- Aggressive Legal Challenges: AT&T is actively employing legal and regulatory channels to challenge the acquisition, highlighting the potential for anti-competitive behavior.

The Future of VMware and the Telecom Industry

The ongoing legal and regulatory battles surrounding Broadcom's acquisition will significantly shape the future of VMware and the telecom industry. Several outcomes are possible: the acquisition might be blocked, leading to a reassessment of VMware's pricing strategy; it might proceed with significant regulatory stipulations; or it might proceed without major changes, potentially leading to further price increases and industry disruption.

Regardless of the outcome, telecom companies face a crucial decision:

- Exploring Alternative Virtualization Technologies: Companies might shift to alternative virtualization platforms to reduce their dependence on VMware.

- Negotiating Stronger Contracts: Aggressive contract negotiations with VMware, focusing on long-term price stability, are crucial.

- Cost-Optimization Strategies: Companies will need to implement internal strategies to mitigate the impact of higher VMware costs.

The Broader Context: Mergers, Acquisitions, and Antitrust Concerns

The Broadcom-VMware deal highlights a broader trend: the increasing scrutiny of large tech mergers and acquisitions. Regulatory bodies worldwide are paying closer attention to the potential anti-competitive effects of these deals, recognizing their impact on innovation, pricing, and consumer choice. This case sets a significant precedent for future mergers and acquisitions, underscoring the importance of rigorous antitrust review. Cases like the proposed merger of Microsoft and Activision Blizzard are relevant parallels, demonstrating the ongoing tension between corporate expansion and the need to maintain a competitive market.

Conclusion

The 1,050% VMware price increase, coupled with AT&T's staunch opposition to Broadcom's acquisition, signals a pivotal moment for the tech industry. The potential consequences are far-reaching, from increased costs for telecom companies to broader concerns about monopolies and market competition. The outcome of this battle will not only determine the future of VMware but will also influence the regulatory landscape surrounding future mergers and acquisitions in the tech sector. Stay informed about the ongoing developments regarding the VMware price increase and the Broadcom acquisition. Further research into the implications of this case and potential alternative solutions for businesses reliant on VMware products is crucial to navigate this evolving situation. The impact of this massive VMware price increase and the Broadcom acquisition needs careful consideration by all stakeholders.

Featured Posts

-

Tigers Notebook Tracking Parker Meadows Recovery

May 31, 2025

Tigers Notebook Tracking Parker Meadows Recovery

May 31, 2025 -

Chinas Military Buildup A Comparison With Americas Waning Might

May 31, 2025

Chinas Military Buildup A Comparison With Americas Waning Might

May 31, 2025 -

A Speedy Review Of Molly Jongs How To Lose Your Mother Memoir

May 31, 2025

A Speedy Review Of Molly Jongs How To Lose Your Mother Memoir

May 31, 2025 -

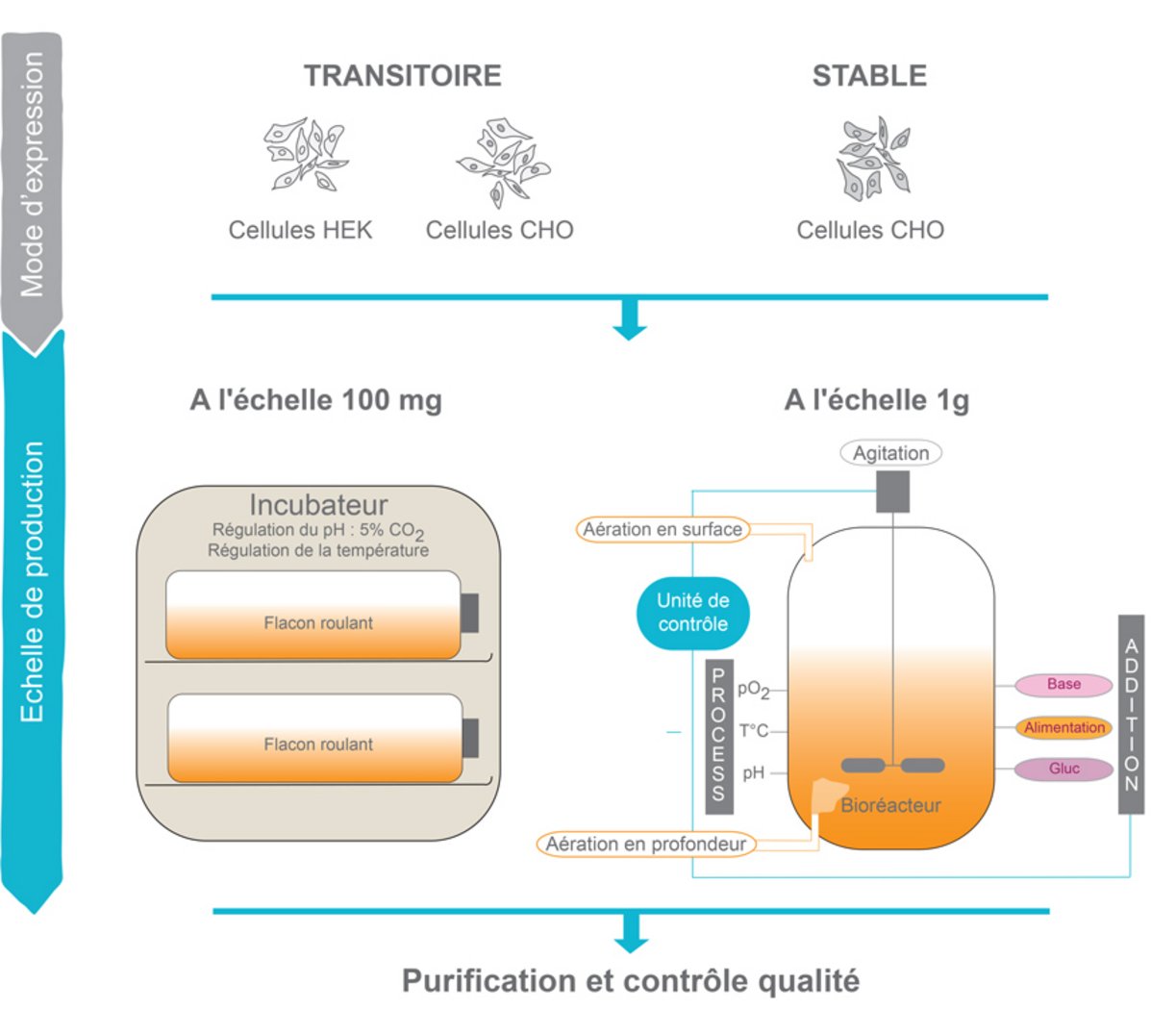

Sanofi Et Dren Bio Un Partenariat Pour Les Anticorps Bispecifiques

May 31, 2025

Sanofi Et Dren Bio Un Partenariat Pour Les Anticorps Bispecifiques

May 31, 2025 -

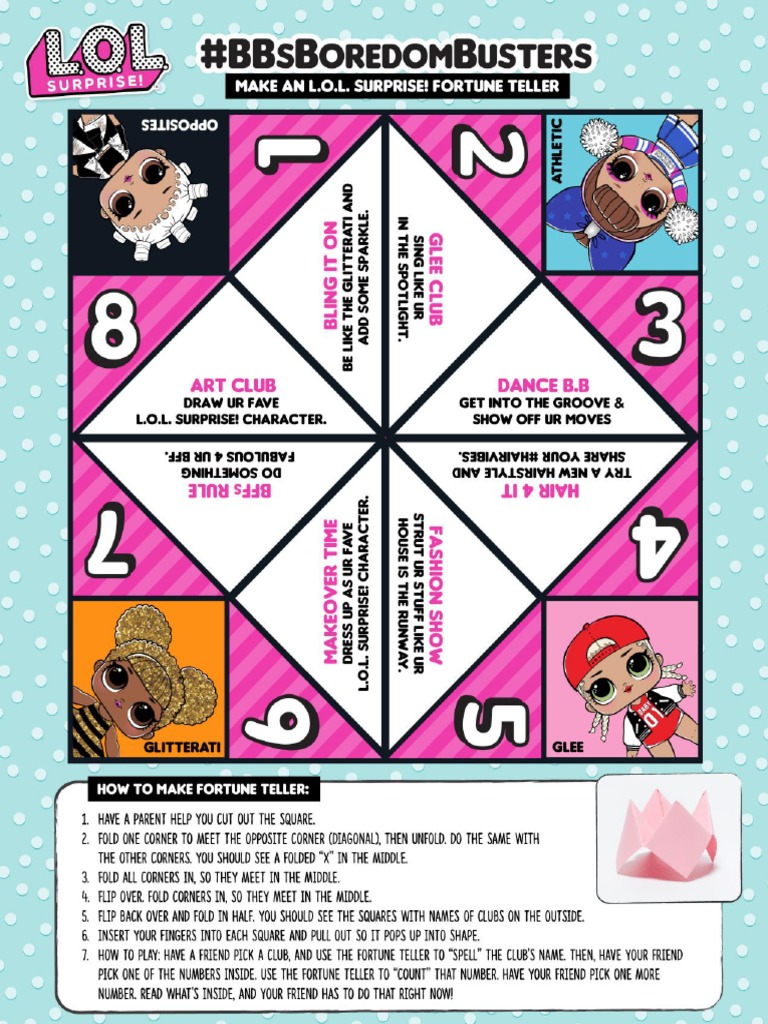

From Surprise To Fortune How A Banksy Changed Two Lives

May 31, 2025

From Surprise To Fortune How A Banksy Changed Two Lives

May 31, 2025