1 Reason To Buy This AI Quantum Computing Stock During A Market Dip

Table of Contents

The Undervalued Potential of IonQ (IONQ)

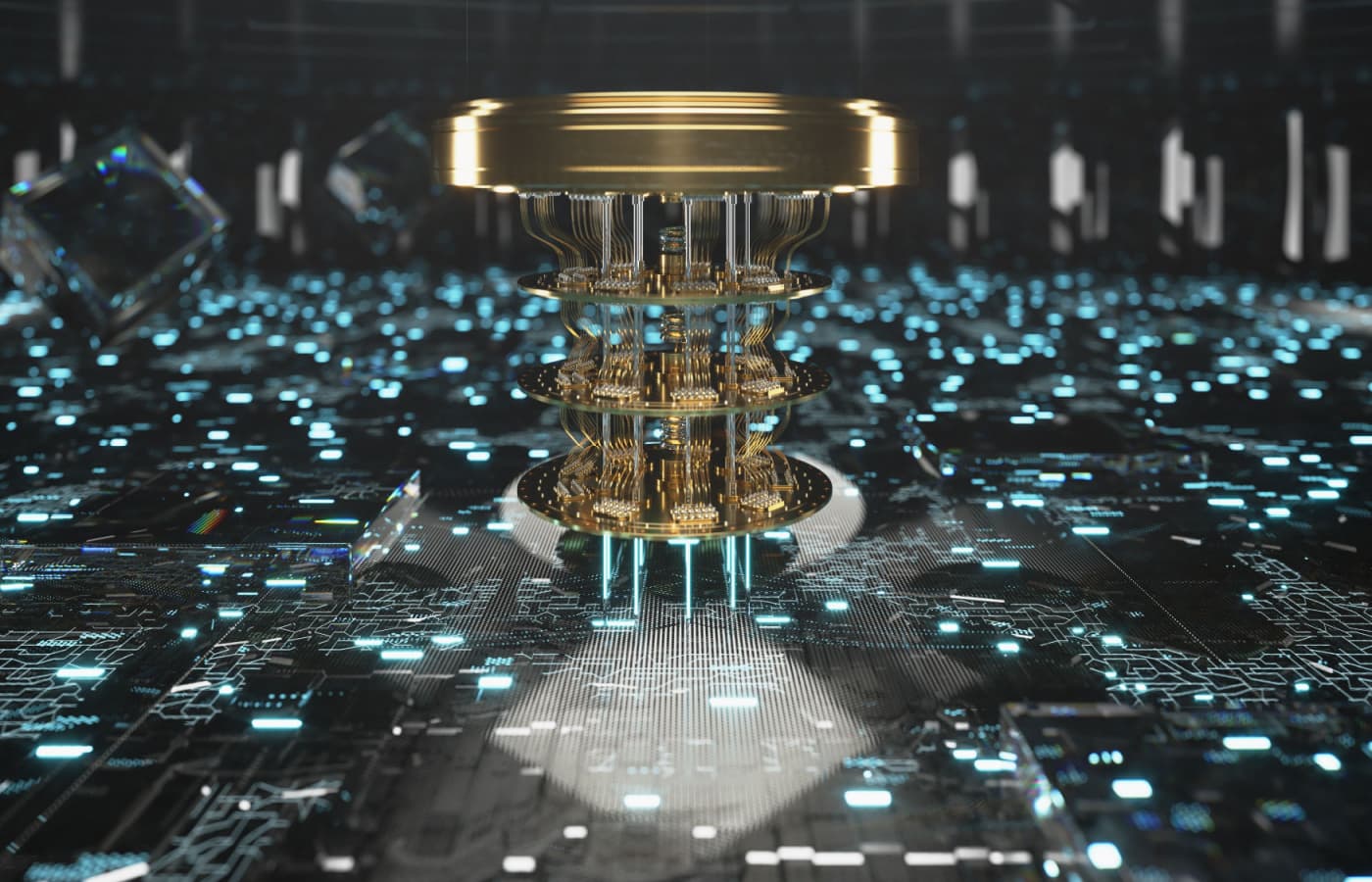

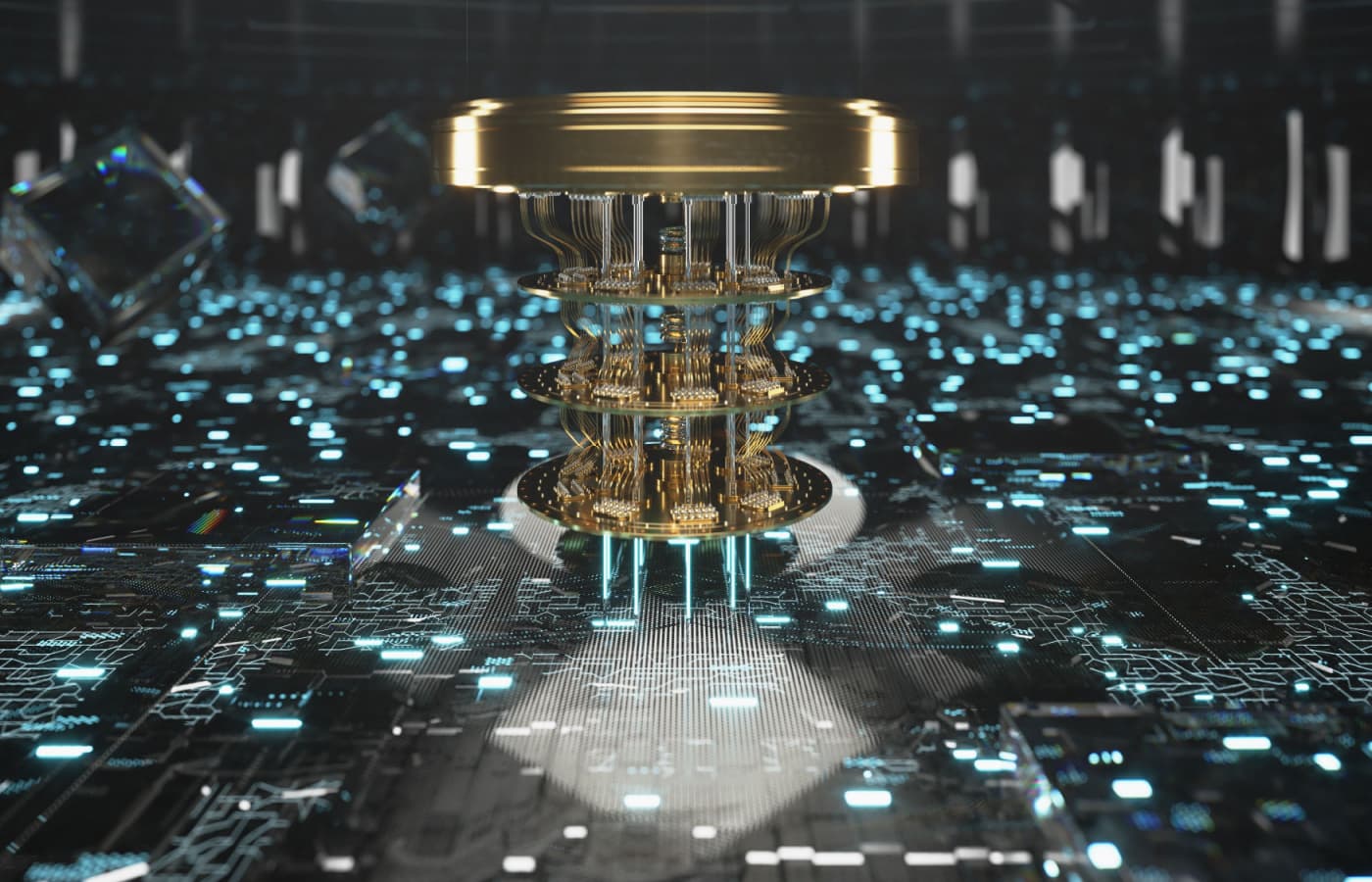

IonQ is a leading player in the trapped-ion quantum computing space, known for its innovative approach to building scalable and fault-tolerant quantum computers. Its technology utilizes individual trapped ions as qubits, offering high fidelity and scalability potential. This sets it apart from other competitors in the nascent quantum computing market.

Market Dip Creates Buying Opportunity

The recent market correction has significantly impacted many technology stocks, including those in the quantum computing sector. This has resulted in IonQ's stock price being undervalued compared to its long-term growth potential. While its current price might reflect short-term market anxieties, the underlying value proposition of IonQ remains strong.

- Undervaluation Evidence: Compared to its initial public offering (IPO) price and its historical highs, IonQ's current stock price presents a compelling entry point for long-term investors. A detailed analysis considering its technological advancements and projected market growth showcases a significant undervaluation.

- Financial Metrics:

- P/E Ratio: While current P/E ratios might appear high compared to traditional sectors, they are relatively low when considering the disruptive potential and future growth projections of the AI quantum computing market.

- Growth Potential: IonQ's revenue projections indicate substantial growth in the coming years, driven by increased demand for quantum computing solutions.

- Strategic Partnerships: The company's strategic alliances with major corporations and research institutions underscore its position in the industry and its future revenue streams.

Long-Term Growth in AI Quantum Computing

The AI quantum computing market is poised for explosive growth. Experts predict a multi-billion dollar market within the next decade, driven by the potential of quantum computers to solve complex problems currently intractable for classical computers. IonQ is strategically positioned to capture a significant share of this market.

- Market Growth Projections: Industry analysts predict substantial growth in the AI quantum computing sector, with estimates ranging from billions to tens of billions of dollars over the next 10 years.

- Technological Breakthroughs: IonQ's continuous advancements in trapped-ion technology, leading to increased qubit counts and improved coherence times, further strengthen its competitive advantage.

- Potential Applications: The potential applications of IonQ's technology are vast and span multiple sectors:

- Drug Discovery: Accelerating drug development through efficient molecular simulations.

- Materials Science: Designing novel materials with enhanced properties.

- Financial Modeling: Improving risk assessment and portfolio optimization.

- Artificial Intelligence: Enhancing machine learning algorithms and accelerating AI development.

Resilience Against Market Volatility

While subject to market fluctuations, IonQ exhibits certain characteristics that mitigate its vulnerability to general market dips. Its focus on long-term technological development and strategic partnerships provides a buffer against short-term market volatility.

- Strong Fundamentals: IonQ's focus on technological innovation and building a robust quantum computing platform provides a solid foundation for long-term growth.

- Government Contracts and Research Funding: Securing government contracts and research grants provides a stable revenue stream, reducing reliance on solely commercial sales.

- Strategic Partnerships: Collaborations with leading companies in various sectors diversify revenue streams and mitigate risks associated with dependence on a single market segment.

Conclusion

The current market dip offers a compelling opportunity to invest in the future of computing by acquiring shares of IonQ (IONQ). Its undervalued potential, coupled with the long-term growth prospects of the AI quantum computing sector and its resilience to market fluctuations, make it a strong candidate for inclusion in a well-diversified portfolio.

Call to Action: Don't miss out on this unique chance to capitalize on the potential of AI quantum computing. Research IonQ (IONQ) and consider adding it to your investment strategy today. Remember to conduct thorough due diligence before making any investment decisions. Learn more about investing in AI quantum computing stocks and explore other opportunities in this exciting sector. Investing in IonQ represents a strategic play on the future of computing and artificial intelligence.

Featured Posts

-

Legal Action Against Big Bear Ai Bbai Contact Gross Law Firm Before June 10 2025

May 20, 2025

Legal Action Against Big Bear Ai Bbai Contact Gross Law Firm Before June 10 2025

May 20, 2025 -

Complete Guide To The Nyt Mini Crossword March 5 2025

May 20, 2025

Complete Guide To The Nyt Mini Crossword March 5 2025

May 20, 2025 -

Michael Kors Launches Jet Set Luxury Collection On Amazon With Suki Waterhouse

May 20, 2025

Michael Kors Launches Jet Set Luxury Collection On Amazon With Suki Waterhouse

May 20, 2025 -

Nyt Mini Crossword Answers Today March 18 2025 Clues And Solutions

May 20, 2025

Nyt Mini Crossword Answers Today March 18 2025 Clues And Solutions

May 20, 2025 -

12 Ai Stocks Redditors Recommend A Comprehensive Guide

May 20, 2025

12 Ai Stocks Redditors Recommend A Comprehensive Guide

May 20, 2025

Latest Posts

-

How A Billionaire Boy Shapes The World Philanthropy Power And Politics

May 20, 2025

How A Billionaire Boy Shapes The World Philanthropy Power And Politics

May 20, 2025 -

Billionaire Boy Exploring The Challenges And Responsibilities Of Extreme Wealth

May 20, 2025

Billionaire Boy Exploring The Challenges And Responsibilities Of Extreme Wealth

May 20, 2025 -

Understanding The Billionaire Boy Phenomenon Family Fortune And Future

May 20, 2025

Understanding The Billionaire Boy Phenomenon Family Fortune And Future

May 20, 2025 -

The Life And Times Of A Billionaire Boy Inheritance Influence And Impact

May 20, 2025

The Life And Times Of A Billionaire Boy Inheritance Influence And Impact

May 20, 2025 -

79 Manazerov Uprednostnuje Osobne Stretnutia Home Office Vs Kancelaria

May 20, 2025

79 Manazerov Uprednostnuje Osobne Stretnutia Home Office Vs Kancelaria

May 20, 2025