$10.5 Million Fine For Resorts World Casino In Las Vegas: Money Laundering Allegations

Table of Contents

The Allegations: What Led to the $10.5 Million Fine?

Resorts World Casino faced serious allegations of financial crimes, specifically violations related to anti-money laundering (AML) compliance. The regulatory investigation uncovered evidence suggesting the casino failed to adequately address suspicious activity, leading to the significant $10.5 million fine. These alleged violations represent a serious breach of trust and demonstrate a lack of sufficient due diligence in identifying and reporting potentially illicit financial transactions.

The alleged violations included:

- Failure to properly report suspicious transactions: Resorts World Casino allegedly failed to file timely and accurate suspicious activity reports (SARs) with the appropriate authorities, a crucial aspect of AML compliance. This omission allowed potentially laundered funds to flow through the casino undetected.

- Inadequate anti-money laundering (AML) compliance procedures: The investigation revealed shortcomings in the casino's overall AML program. This included insufficient training for staff, inadequate monitoring systems, and a lack of robust internal controls to detect and prevent money laundering.

- Potential involvement in structuring transactions to avoid detection: Authorities alleged that the casino may have facilitated the structuring of transactions—breaking down large sums of money into smaller amounts to avoid triggering reporting requirements—a common tactic used in money laundering schemes.

- Lack of sufficient due diligence on high-roller customers: The investigation focused on the casino's due diligence practices for high-stakes gamblers. It is alleged that insufficient checks were performed to verify the source of funds for some high-roller customers, potentially allowing individuals involved in illicit activities to use the casino to launder money.

Evidence presented by the regulatory authorities included internal casino documents, transaction records, witness testimonies, and financial analyses demonstrating a pattern of suspicious activity and insufficient compliance with AML regulations.

The Regulatory Response and Investigation

The Nevada Gaming Control Board (NGCB) led the investigation into Resorts World Casino's alleged money laundering activities. The investigation involved a thorough review of the casino's financial records, operational procedures, and compliance programs. This rigorous regulatory scrutiny employed various methods, including data analysis, interviews with casino staff, and examination of suspicious activity reports (SARs). The process spanned several months, involving multiple stages of review and evidence gathering.

The NGCB's findings directly resulted in the $10.5 million fine. This significant financial penalty reflects the seriousness of the violations and serves as a deterrent to future non-compliance. The legal ramifications include potential further penalties, limitations on the casino's gaming license, and reputational damage that could impact future operations.

The regulatory response can be summarized as follows:

- Length of the investigation: The investigation spanned several months, demonstrating the comprehensive nature of the regulatory scrutiny.

- Types of evidence examined: The NGCB examined a wide range of evidence, including financial records, SARs, and witness testimonies.

- Specific violations identified: The investigation uncovered multiple violations of AML regulations, including failures to report suspicious transactions and inadequate compliance procedures.

- Imposed penalties: The $10.5 million fine is a significant penalty, sending a clear message about the importance of AML compliance.

Impact on Resorts World Casino and the Las Vegas Gambling Industry

The $10.5 million fine represents a substantial financial blow to Resorts World Casino, impacting its profitability and potentially affecting its investment plans. Beyond the financial impact, the allegations and subsequent fine have severely damaged the casino's brand reputation. Customer trust has been eroded, and investor confidence may have been shaken, leading to potential stock price fluctuations (if applicable).

This incident has broader implications for the Las Vegas gambling industry. The increased regulatory scrutiny following this case will likely lead to stricter enforcement of AML regulations across all casinos. The industry may see an increase in the implementation of more robust AML compliance programs and enhanced training for staff to prevent similar incidents.

The impacts can be summarized as:

- Stock price fluctuations: Depending on the casino's status as a publicly traded company, the fine could negatively impact its stock price.

- Changes in customer behavior: Negative publicity surrounding the case might lead to a decrease in customers.

- Increased regulatory scrutiny across the industry: Other casinos will likely face increased scrutiny from regulatory bodies.

- Potential for stricter AML regulations: The incident may prompt regulators to introduce stricter AML regulations.

Lessons Learned and Future Implications for Casinos

This case underscores the critical importance of robust AML compliance programs for casinos. Casinos must prioritize employee training on AML regulations, implement advanced monitoring systems to detect suspicious activity, and maintain rigorous due diligence procedures for all customers, particularly high-rollers. Failure to do so can lead to significant financial penalties, reputational damage, and even the potential loss of a gaming license. The future will likely see increased regulatory oversight and enforcement, emphasizing the need for proactive and comprehensive AML compliance strategies.

Conclusion: Understanding the Resorts World Casino Fine and Preventing Future Money Laundering Incidents

The $10.5 million fine imposed on Resorts World Casino serves as a powerful reminder of the severe consequences of failing to comply with AML regulations. The allegations of money laundering, the subsequent regulatory investigation, and the significant financial penalty highlight the crucial need for casinos to prioritize and invest in robust anti-money laundering measures. This case should act as a cautionary tale for the entire gambling industry.

The Resorts World Casino money laundering case underscores the importance of proactive AML compliance. Learn more about AML compliance regulations and best practices to prevent similar incidents in your organization. Share this article to raise awareness about the risks of money laundering in casinos and the importance of robust AML compliance programs. Let's work together to strengthen AML compliance within the casino industry and prevent future instances of this serious financial crime.

Featured Posts

-

Teylor Svift Rekordni Prodazhi Vinilovikh Plativok Za Ostannye Desyatilittya

May 18, 2025

Teylor Svift Rekordni Prodazhi Vinilovikh Plativok Za Ostannye Desyatilittya

May 18, 2025 -

Easy A Full Episode Listings On Bbc Three Hd

May 18, 2025

Easy A Full Episode Listings On Bbc Three Hd

May 18, 2025 -

Air Trunk Billionaire Makes Second Sydney Real Estate Acquisition

May 18, 2025

Air Trunk Billionaire Makes Second Sydney Real Estate Acquisition

May 18, 2025 -

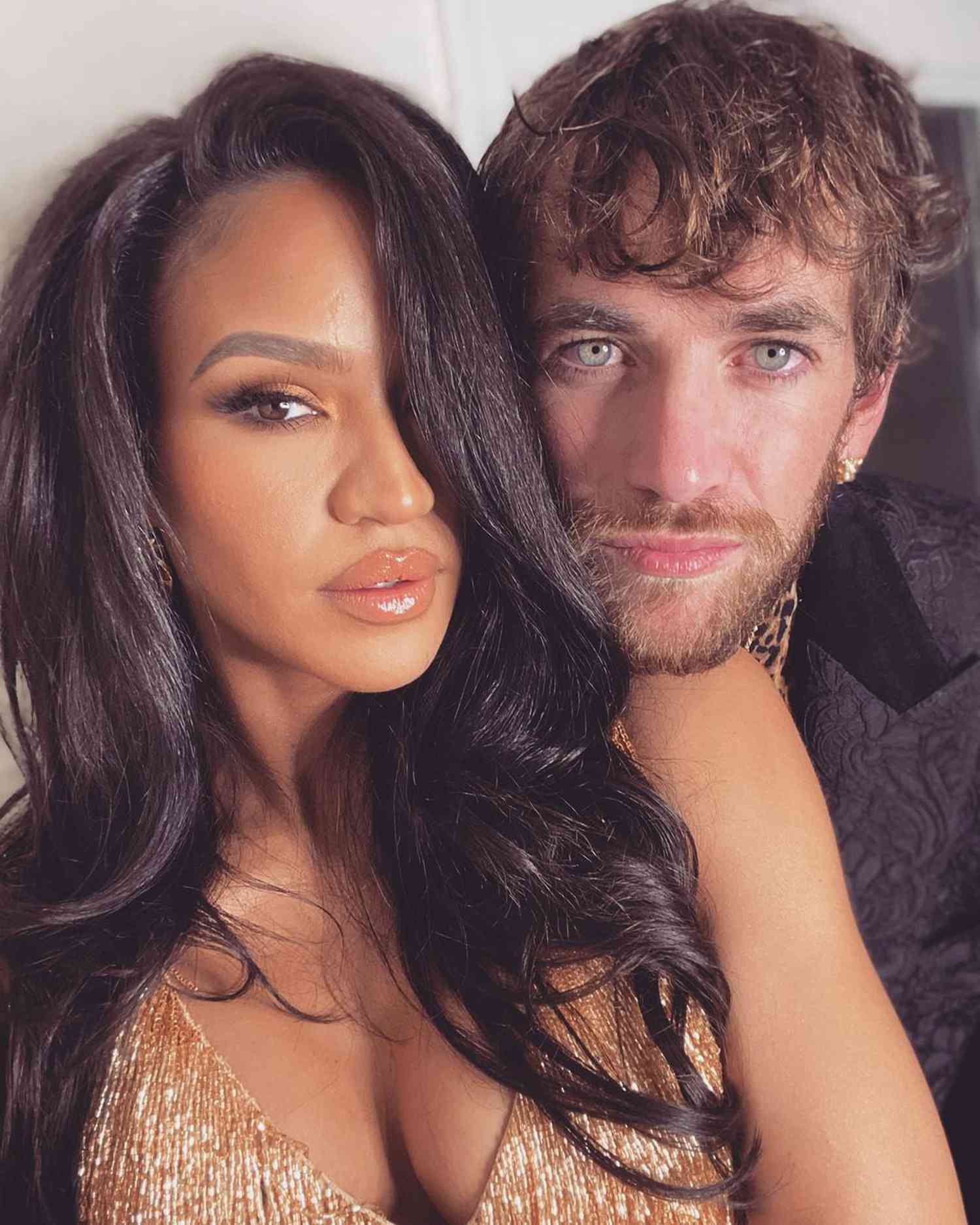

Photo Gallery Cassie And Alex Fine At The Mob Land Premiere

May 18, 2025

Photo Gallery Cassie And Alex Fine At The Mob Land Premiere

May 18, 2025 -

Eid Solidarity Owaisis Ghibli Style Post Condemns Waqf Bill Supports Palestine

May 18, 2025

Eid Solidarity Owaisis Ghibli Style Post Condemns Waqf Bill Supports Palestine

May 18, 2025