100,000 Job Cuts Predicted: TD Bank Warns Of Imminent Recession

Table of Contents

TD Bank's recent announcement predicting 100,000 job cuts has ignited widespread concern about an impending recession. This alarming forecast underscores a growing unease within the financial sector, raising serious questions about the stability of the global economy and its impact on individuals and businesses. This article delves into the details of TD Bank's prediction, exploring its potential ramifications and offering insights into how to navigate this potentially turbulent economic period.

TD Bank's Recession Prediction: A Deep Dive

TD Bank's prediction of 100,000 job cuts stems from a confluence of worrying economic indicators. The bank cites persistently high inflation, coupled with aggressive interest rate hikes by central banks globally, as key drivers of this pessimistic outlook. They point to a slowing economic growth rate and decreased consumer spending as further evidence supporting their recessionary forecast.

- Key factors contributing to the prediction: High inflation, rising interest rates, decreased consumer confidence, slowing GDP growth.

- Specific sectors most vulnerable to job losses: Technology, manufacturing, retail, and the housing market are expected to be particularly hard hit, mirroring trends seen in previous economic downturns.

- Comparison to previous recessionary periods: While the exact impact remains uncertain, the scale of the predicted job losses is comparable to the initial phases of previous recessions, suggesting a potentially significant economic contraction. This necessitates proactive measures from both individuals and businesses.

Impact on Different Sectors: Preparing for the Economic Downturn

The predicted 100,000 job cuts will not impact all sectors equally. The ripple effect of a recession will be felt across various industries, with some suffering more acutely than others.

- Which industries are expected to be hit hardest? Tech companies, facing reduced venture capital funding and decreased consumer demand for non-essential goods and services, are expected to experience significant layoffs. Manufacturing could see reduced output due to decreased consumer spending and supply chain disruptions. The retail sector is also vulnerable due to decreased consumer confidence.

- Strategies for businesses to mitigate potential losses: Implementing cost-cutting measures, diversifying revenue streams, focusing on efficiency, and investing in employee retention are crucial for business survival during an economic downturn.

- Advice for individuals to safeguard their financial stability: Building an emergency fund, reducing debt, diversifying investments, and upskilling to enhance job security are critical steps for individuals to navigate an economic downturn.

Government Response and Policy Implications

The potential for a significant recession necessitates a robust government response. While the specific measures remain to be seen, potential strategies include fiscal stimulus packages, targeted support for vulnerable sectors, and monetary policy adjustments.

- Potential government interventions: Government intervention could involve direct financial aid to businesses and individuals, tax cuts to stimulate spending, and infrastructure investments to create jobs. Increased unemployment benefits might also be considered.

- Analysis of the effectiveness of past recessionary responses: Past responses have varied in their effectiveness, with some leading to a quicker recovery than others. The success of any intervention depends on factors like its timing, scale, and design.

- Discussion of potential long-term economic consequences: A prolonged recession could lead to long-term consequences including increased national debt, higher unemployment rates, and slower economic growth.

Preparing for a Recession: Practical Steps for Individuals and Businesses

Proactive steps are crucial for both individuals and businesses to navigate the potential economic downturn.

- Tips for individuals to manage finances during a recession: Create a detailed budget, build an emergency fund (ideally 3-6 months of living expenses), reduce unnecessary expenses, and explore additional income streams.

- Strategies for businesses to navigate economic uncertainty: Develop a contingency plan, reduce operating costs, prioritize cash flow management, and explore strategic partnerships. Consider offering employee training or retraining programs to enhance skills and prepare for potential market changes.

- Resources for further information and support: Numerous government agencies and financial institutions offer resources and support during economic downturns. Consult financial advisors and seek expert guidance for personalized advice.

Conclusion

TD Bank's prediction of 100,000 job cuts underscores the serious possibility of an imminent recession. Understanding the potential impact on various sectors and taking proactive steps to prepare is crucial for individuals and businesses alike. The information presented highlights the necessity for careful financial planning and strategic decision-making in the face of economic uncertainty. Don't wait for the recession to hit – prepare for an economic downturn now. Stay informed about the evolving economic situation and take proactive steps to mitigate the potential impact of a recession. Learn more about preparing for a recession and developing a robust financial strategy by exploring additional resources and expert advice.

Featured Posts

-

6000

May 28, 2025

6000

May 28, 2025 -

Jennifer Lopez American Music Awards Host In Las Vegas

May 28, 2025

Jennifer Lopez American Music Awards Host In Las Vegas

May 28, 2025 -

Tren Menikah Kontrak Di Bali Bule Incar Properti Milik Warga Lokal

May 28, 2025

Tren Menikah Kontrak Di Bali Bule Incar Properti Milik Warga Lokal

May 28, 2025 -

Smartphone Samsung Galaxy S25 512 Go Avis Prix Et Bon Plan

May 28, 2025

Smartphone Samsung Galaxy S25 512 Go Avis Prix Et Bon Plan

May 28, 2025 -

Guaranteed Approval Loans No Credit Check Direct Lender Options

May 28, 2025

Guaranteed Approval Loans No Credit Check Direct Lender Options

May 28, 2025

Latest Posts

-

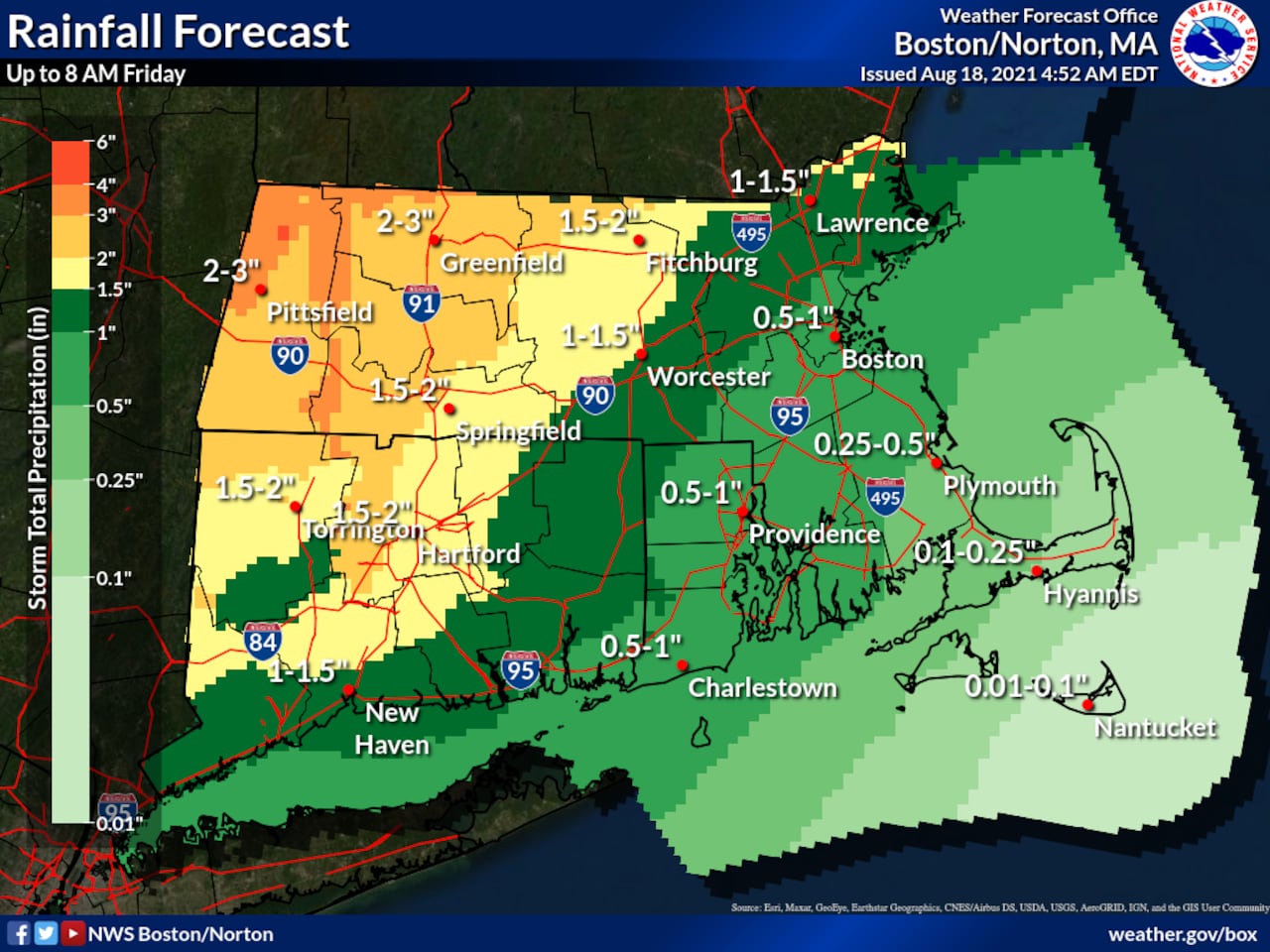

Understanding The Rise In Rainfall Climate Change In Western Massachusetts

May 31, 2025

Understanding The Rise In Rainfall Climate Change In Western Massachusetts

May 31, 2025 -

Netflixs You A Look At The Final Season

May 31, 2025

Netflixs You A Look At The Final Season

May 31, 2025 -

Black Mirror On Netflix 5 Dystopian Visions That Became Reality

May 31, 2025

Black Mirror On Netflix 5 Dystopian Visions That Became Reality

May 31, 2025 -

You Netflix Was The Final Season Worth The Wait

May 31, 2025

You Netflix Was The Final Season Worth The Wait

May 31, 2025 -

Five Chillingly Accurate Predictions From Black Mirror On Netflix

May 31, 2025

Five Chillingly Accurate Predictions From Black Mirror On Netflix

May 31, 2025