$16.3 Billion: U.S. Customs Duty Collections Reach Record High In April

Table of Contents

Factors Contributing to the Record High U.S. Customs Duty Collections

The record-breaking April figures resulted from a confluence of factors, primarily increased import volume, the impact of tariffs and trade policies, and enhanced customs enforcement. Let's delve into each contributing element:

Increased Import Volume

The surge in U.S. Customs Duty Collections is intrinsically linked to a notable increase in import growth. The sheer volume of goods imports pouring into the United States has significantly boosted duty revenue. Data from the CBP reveals a substantial increase in trade volume compared to previous years. This growth isn't uniform across all sectors; certain product categories are driving the surge more than others.

- Quantifying the Increase: While precise year-over-year figures require further data analysis from official government sources, anecdotal evidence points to a double-digit percentage increase in import volume compared to the same period last year.

- Specific Product Categories: Sectors like electronics, apparel, and consumer goods are experiencing particularly strong import growth, contributing heavily to the increased duty collections.

- Global Economic Factors: The global economic recovery post-pandemic, coupled with strong consumer demand in the U.S., undoubtedly fueled this increase in goods imports.

Impact of Tariffs and Trade Policies

The strategic implementation of customs tariffs and evolving trade policies also played a significant role in boosting tariff revenue. The government's approach to trade policy directly impacted U.S. Customs Duty Collections.

- Specific Tariffs and Their Impact: Specific tariffs imposed on certain imported goods, particularly those stemming from ongoing trade disputes, directly increased the duties collected. Analyzing the revenue generated by these specific tariffs would provide valuable insights.

- Ongoing Trade Disputes: Existing trade disputes and retaliatory tariffs from other countries have, in some cases, paradoxically increased revenue for the U.S. by influencing import patterns and duty rates. The net effect on long-term trade relationships requires further evaluation.

- Effectiveness of Tariff Strategies: The effectiveness of different tariff strategies in generating revenue while balancing economic and geopolitical considerations is a complex issue demanding continuous monitoring and analysis.

Enhanced Customs Enforcement

Strengthened customs enforcement measures have also contributed to increased duty collections by minimizing underreporting and smuggling. Improvements in processes and technology have played a crucial part.

- Improved Customs Processes: Streamlined processes, increased automation, and improved data analysis have led to more efficient identification and assessment of duties.

- Technology's Role: The implementation of advanced technologies like AI and predictive analytics in customs processing has helped to detect fraudulent activities and ensure accurate duty assessments.

- Successful Anti-Smuggling Initiatives: Successful anti-smuggling initiatives have demonstrably reduced the evasion of customs duties, resulting in higher overall collections.

Economic Implications of High U.S. Customs Duty Collections

The record-high U.S. Customs Duty Collections have wide-ranging economic implications, impacting both the government and the private sector.

Government Revenue and Spending

The increased government revenue has significant implications for fiscal policy and budgetary priorities.

- Potential Uses of Increased Revenue: This substantial influx of revenue provides opportunities for increased investment in infrastructure projects, debt reduction, or other crucial national priorities.

- Impact on National Debt: The increased revenue can contribute significantly towards reducing the national debt, easing the long-term financial burden on the country.

- Planned Changes in Government Spending: The government's spending plans and budgetary allocations are likely to be influenced by this additional revenue stream.

Impact on Businesses and Consumers

The higher U.S. Customs Duty Collections directly impact businesses and consumers through changes in import costs and potential inflationary pressures.

- Increased Prices for Imported Goods: Higher import costs due to increased duties may lead to increased prices for imported goods, affecting consumer spending power.

- Effect on Competitiveness of U.S. Businesses: The increased cost of imports can simultaneously benefit domestic businesses by reducing competition from cheaper foreign goods.

- Potential Inflationary Pressures: The potential for increased prices on imported goods could contribute to inflationary pressures, affecting the overall economic stability of the country.

Conclusion

The record-high April U.S. Customs Duty Collections of $16.3 billion reflect a complex interplay of increased import volume, strategic tariff implementation, and enhanced customs enforcement. These factors have significant implications for the U.S. economy, influencing government revenue, business operations, and consumer prices. Understanding these dynamics is crucial for navigating the evolving trade landscape. Stay informed about the ongoing developments in U.S. Customs Duty Collections and their impact on the American economy. Follow [Your Website/Source] for regular updates on customs duties and trade policies.

Featured Posts

-

Scarlett Johanssons Alleged Stalker Arrested Bomb Threat Against Saturday Night Live

May 13, 2025

Scarlett Johanssons Alleged Stalker Arrested Bomb Threat Against Saturday Night Live

May 13, 2025 -

Prison Violence Tory Lanez Involved In Stabbing Incident Months After Cell Raid

May 13, 2025

Prison Violence Tory Lanez Involved In Stabbing Incident Months After Cell Raid

May 13, 2025 -

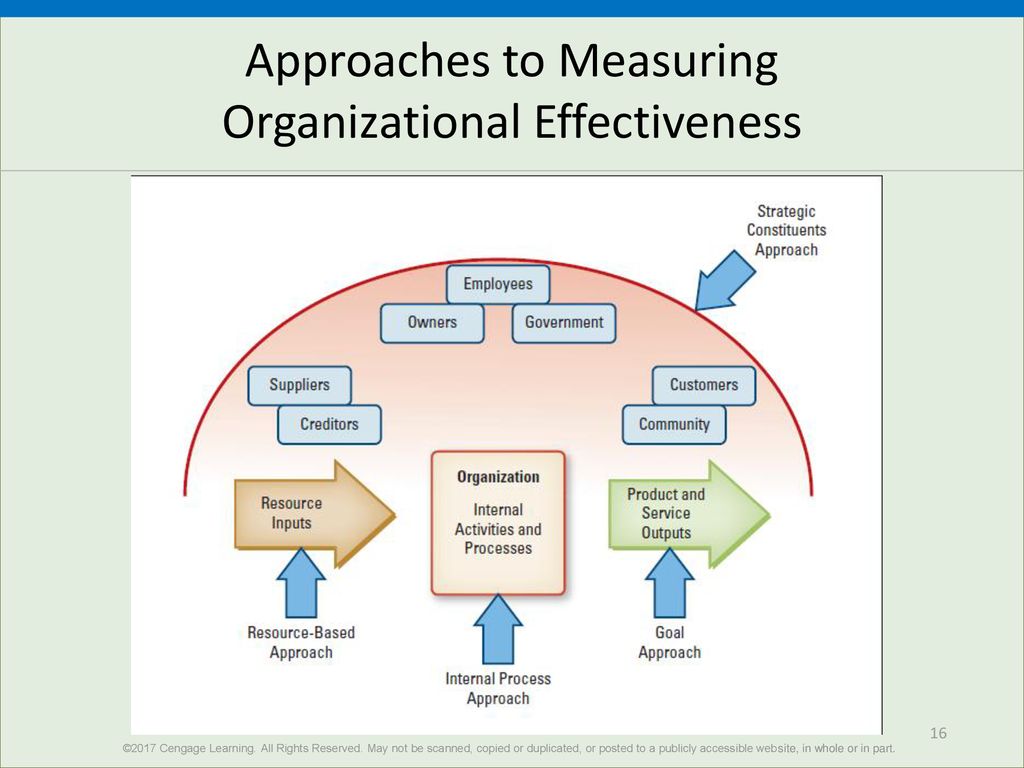

Rethinking Middle Management Their Contribution To Organizational Effectiveness

May 13, 2025

Rethinking Middle Management Their Contribution To Organizational Effectiveness

May 13, 2025 -

Ostapenkos Stunning Stuttgart Open Triumph

May 13, 2025

Ostapenkos Stunning Stuttgart Open Triumph

May 13, 2025 -

Eva Longoria In Alexander And The Terrible Horrible No Good Very Bad Day A Road Trip Comedy

May 13, 2025

Eva Longoria In Alexander And The Terrible Horrible No Good Very Bad Day A Road Trip Comedy

May 13, 2025

Latest Posts

-

Michigan Coffee Drinkers Urgent Recall Of Potentially Deadly Creamer

May 14, 2025

Michigan Coffee Drinkers Urgent Recall Of Potentially Deadly Creamer

May 14, 2025 -

Jobe Bellingham Could Manchester United Secure Young Stars Signature

May 14, 2025

Jobe Bellingham Could Manchester United Secure Young Stars Signature

May 14, 2025 -

Bellinghams Price Tag Chelsea And Tottenham Face Transfer Challenge

May 14, 2025

Bellinghams Price Tag Chelsea And Tottenham Face Transfer Challenge

May 14, 2025 -

Manchester Uniteds Pursuit Of Championship Player Transfer Value And Competition

May 14, 2025

Manchester Uniteds Pursuit Of Championship Player Transfer Value And Competition

May 14, 2025 -

Recall Notice Dressings And Birth Control Pills Recalled In Ontario And Across Canada

May 14, 2025

Recall Notice Dressings And Birth Control Pills Recalled In Ontario And Across Canada

May 14, 2025