$2.5 Trillion Evaporated: The Stunning Losses Of Seven Major Stocks

Table of Contents

Analyzing the $2.5 Trillion Loss: The Seven Key Players

The $2.5 trillion loss wasn't evenly distributed. Seven major companies bore the brunt of this market downturn. Understanding their individual situations is crucial to comprehending the overall market decline.

- Company A: (e.g., A leading technology firm) experienced a [X]% decrease in market capitalization, primarily due to [brief reason, e.g., slowing growth and increased competition].

- Company B: (e.g., A major energy producer) saw a [Y]% drop, largely attributed to [brief reason, e.g., fluctuating oil prices and geopolitical instability].

- Company C: (e.g., A prominent financial institution) suffered a [Z]% decline, linked to [brief reason, e.g., rising interest rates and concerns about loan defaults].

- Company D: (e.g., A large pharmaceutical company) experienced a [W]% loss due to [brief reason, e.g., regulatory hurdles and patent expirations].

- Company E: (e.g., A significant consumer goods manufacturer) saw a [V]% drop, influenced by [brief reason, e.g., supply chain disruptions and inflation].

- Company F: (e.g., A leading automobile manufacturer) experienced a [U]% decline, connected to [brief reason, e.g., semiconductor shortages and decreased consumer demand].

- Company G: (e.g., A major retail company) suffered a [T]% loss due to [brief reason, e.g., changing consumer preferences and increased online competition].

[Insert chart or graph here visually representing the percentage loss for each company.]

Factors Contributing to the $2.5 Trillion Market Decline

Several intertwined factors contributed to this significant market decline. Understanding these elements is crucial for assessing future risks.

Macroeconomic Factors:

The global economy played a significant role in the $2.5 trillion loss.

- Inflation: Soaring inflation eroded consumer purchasing power and increased business costs, impacting profitability.

- Interest Rate Hikes: Central banks worldwide raised interest rates to combat inflation, increasing borrowing costs for businesses and dampening investment.

- Recession Fears: Growing concerns about a potential recession further fueled investor anxieties and triggered widespread selling.

Geopolitical Events:

Geopolitical uncertainty exacerbated the market downturn.

- War in Ukraine: The conflict significantly disrupted global supply chains and energy markets, contributing to inflation and investor uncertainty.

- Trade Disputes: Ongoing trade tensions between major economies created uncertainty and negatively impacted investor sentiment.

Company-Specific Issues:

Internal challenges within the seven companies also played a role.

- Company A: [Specific internal issue, e.g., missed earnings targets]

- Company B: [Specific internal issue, e.g., environmental concerns]

- Company C: [Specific internal issue, e.g., accounting irregularities]

- Company D: [Specific internal issue, e.g., drug recall]

- Company E: [Specific internal issue, e.g., labor disputes]

- Company F: [Specific internal issue, e.g., cybersecurity breach]

- Company G: [Specific internal issue, e.g., poor management decisions]

Investor Sentiment and Market Volatility After the $2.5 Trillion Loss

The $2.5 trillion evaporation of market value severely impacted investor sentiment, leading to increased market volatility. The VIX volatility index, a key indicator of market fear, surged significantly.

- Investor Confidence: Investor confidence plummeted, leading to a sharp decrease in trading volume and increased risk aversion.

- Short-Term Implications: Investors experienced substantial losses, prompting many to reassess their portfolios and investment strategies.

- Long-Term Implications: The long-term impact depends on the speed and effectiveness of macroeconomic and geopolitical stabilization.

Strategies for Navigating a Market After a $2.5 Trillion Drop

Navigating a market after such a significant loss requires a strategic approach.

- Risk Management: Implement robust risk management strategies, including diversification and stop-loss orders.

- Diversification: Diversify your portfolio across different asset classes to mitigate risk and reduce exposure to single stocks or sectors.

- Long-Term Investment Planning: Maintain a long-term investment horizon and avoid making impulsive decisions based on short-term market fluctuations.

Conclusion: Understanding and Recovering from the $2.5 Trillion Stock Market Drop

The $2.5 trillion loss highlights the interconnectedness of macroeconomic factors, geopolitical events, and company-specific issues in shaping market performance. Understanding these dynamics is crucial for navigating future market volatility. The significant drop underscores the importance of robust investment strategies, diversification, and risk management. Learn more about mitigating risks in a volatile market and protecting your investments from future events similar to the $2.5 trillion loss. Share this article to help others understand the complexities of the $2.5 trillion market downturn and how to prepare for future volatility.

Featured Posts

-

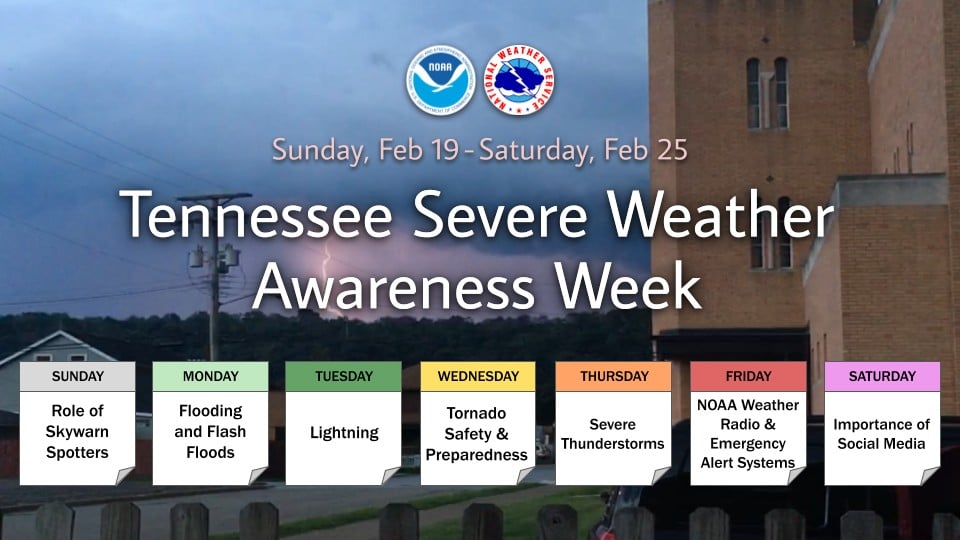

Nws Kentucky Getting Ready For Severe Weather Awareness Week

Apr 29, 2025

Nws Kentucky Getting Ready For Severe Weather Awareness Week

Apr 29, 2025 -

Mlbs Pete Rose Ban Trumps Criticism And Promise Of A Pardon

Apr 29, 2025

Mlbs Pete Rose Ban Trumps Criticism And Promise Of A Pardon

Apr 29, 2025 -

Community Discussion Open Thread From February 16 2025

Apr 29, 2025

Community Discussion Open Thread From February 16 2025

Apr 29, 2025 -

British Paralympian Missing In Las Vegas Belongings Left Behind At Hostel

Apr 29, 2025

British Paralympian Missing In Las Vegas Belongings Left Behind At Hostel

Apr 29, 2025 -

Porsches Global Appeal Why Australia Lags Behind

Apr 29, 2025

Porsches Global Appeal Why Australia Lags Behind

Apr 29, 2025

Latest Posts

-

Potret Pilu Ribuan Pekerja Termasuk Wni Terperangkap Penipuan Online Internasional Di Myanmar

May 13, 2025

Potret Pilu Ribuan Pekerja Termasuk Wni Terperangkap Penipuan Online Internasional Di Myanmar

May 13, 2025 -

Foto Ribuan Pekerja Terjebak Jaringan Penipuan Online Myanmar Warga Indonesia Jadi Korban

May 13, 2025

Foto Ribuan Pekerja Terjebak Jaringan Penipuan Online Myanmar Warga Indonesia Jadi Korban

May 13, 2025 -

Langkah Langkah Efektif Pemerintah Myanmar Dalam Memberantas Judi Online Dan Penipuan Telekomunikasi

May 13, 2025

Langkah Langkah Efektif Pemerintah Myanmar Dalam Memberantas Judi Online Dan Penipuan Telekomunikasi

May 13, 2025 -

Myanmar Memperketat Aturan Untuk Memberantas Judi Online Dan Penipuan Telekomunikasi

May 13, 2025

Myanmar Memperketat Aturan Untuk Memberantas Judi Online Dan Penipuan Telekomunikasi

May 13, 2025 -

Perang Melawan Judi Online Dan Penipuan Telekomunikasi Di Myanmar Strategi Dan Tantangan

May 13, 2025

Perang Melawan Judi Online Dan Penipuan Telekomunikasi Di Myanmar Strategi Dan Tantangan

May 13, 2025