2% Drop In Amsterdam Stock Exchange Following Trump's Latest Tariffs

Table of Contents

The Immediate Impact of Trump's Tariffs on the AEX Index

The immediate aftermath of the tariff announcement saw a rapid sell-off, pushing the AEX index down by 2%. This wasn't a uniform impact; certain sectors were hit harder than others.

Sector-Specific Analysis

-

Technology: Companies heavily reliant on exporting technology components or software experienced some of the steepest declines. For example, (Insert example of a Dutch tech company and its percentage drop, if available). This is because the tariffs increased the cost of their products in the target markets, reducing competitiveness and potentially harming sales.

-

Manufacturing: Dutch manufacturers exporting goods to the US (or countries affected by the ripple effects) also saw significant drops. The increased import costs make their products less attractive compared to domestically produced goods. (Insert example of a Dutch manufacturing company and its percentage drop, if available).

-

Export-Oriented Businesses: Businesses whose revenue is largely dependent on international trade were most vulnerable. The uncertainty surrounding future tariffs created a climate of fear, leading to immediate stock price reductions. (Insert example of a Dutch export company and its percentage drop, if available, mentioning specific products and target markets).

-

Resilience: Interestingly, some sectors, particularly those focused on domestic markets or offering essential services, showed greater resilience. (Insert example if data is available, explain their resilience).

Investor Sentiment and Market Psychology

The tariff announcement triggered panic selling, as investors reacted to the perceived increased risk. Trading volume surged immediately following the news, indicating a significant shift in market activity. Expert opinions varied; some analysts predicted a short-term correction, while others expressed concerns about a prolonged period of market volatility and the need for careful investment strategy adjustments.

Underlying Economic Factors Contributing to the AEX Decline

The 2% drop wasn't solely due to the immediate impact of tariffs. Several underlying economic factors contributed to the AEX decline.

Global Trade War Uncertainty

The Trump administration's tariffs are part of a broader trade war, creating significant uncertainty in the global economy. This uncertainty impacts investor confidence, making them hesitant to invest. The interconnectedness of global economies means that the effects of these tariffs ripple outwards, affecting even countries not directly targeted. Potential retaliatory measures from the EU could further destabilize the AEX and the global trade.

Dutch Economic Dependence on Global Trade

The Netherlands has a highly export-oriented economy, making it particularly vulnerable to trade wars. A significant portion of Dutch GDP is generated through exports, making it sensitive to changes in global trade patterns. The tariffs directly affect Dutch businesses and exports, leading to reduced profits and potentially job losses. The Dutch government may implement support measures, but their effectiveness in countering the impact of global trade war uncertainty remains to be seen.

Potential Future Scenarios and Investment Strategies

Predicting the future is always challenging, but analyzing potential scenarios helps investors formulate suitable strategies.

Short-Term Outlook

The short-term outlook suggests continued market volatility. Investors should expect further fluctuations in the AEX index in the coming weeks and months. Short-term trading strategies, such as hedging or short selling, might be considered, but they involve significant risk. A potential recovery scenario hinges on the outcome of ongoing trade negotiations and a reduction in global trade war uncertainty.

Long-Term Implications

The long-term implications depend on the resolution of the trade dispute and the broader adjustments in global trade patterns. The AEX and the Dutch economy could experience structural changes as businesses adapt to the new realities of global trade. Long-term investors should focus on portfolio diversification, minimizing exposure to sectors heavily affected by the Trump tariffs.

Conclusion

The 2% drop in the Amsterdam Stock Exchange following Trump's latest tariffs underscores the significant impact of trade wars on global markets, and particularly on export-oriented economies like the Netherlands. The immediate impact was felt across various sectors, driven by investor uncertainty and the interconnected nature of international trade. Understanding these factors is crucial for both short-term and long-term investment strategy.

Call to Action: Stay informed about the evolving global trade landscape and its impact on the Amsterdam Stock Exchange. Monitor the AEX index and relevant news for informed decisions regarding your investment portfolio and consider diversifying to mitigate risks associated with future Trump tariffs and global trade uncertainties. Understanding the implications of Trump tariffs on the AEX index is key for navigating the current market volatility.

Featured Posts

-

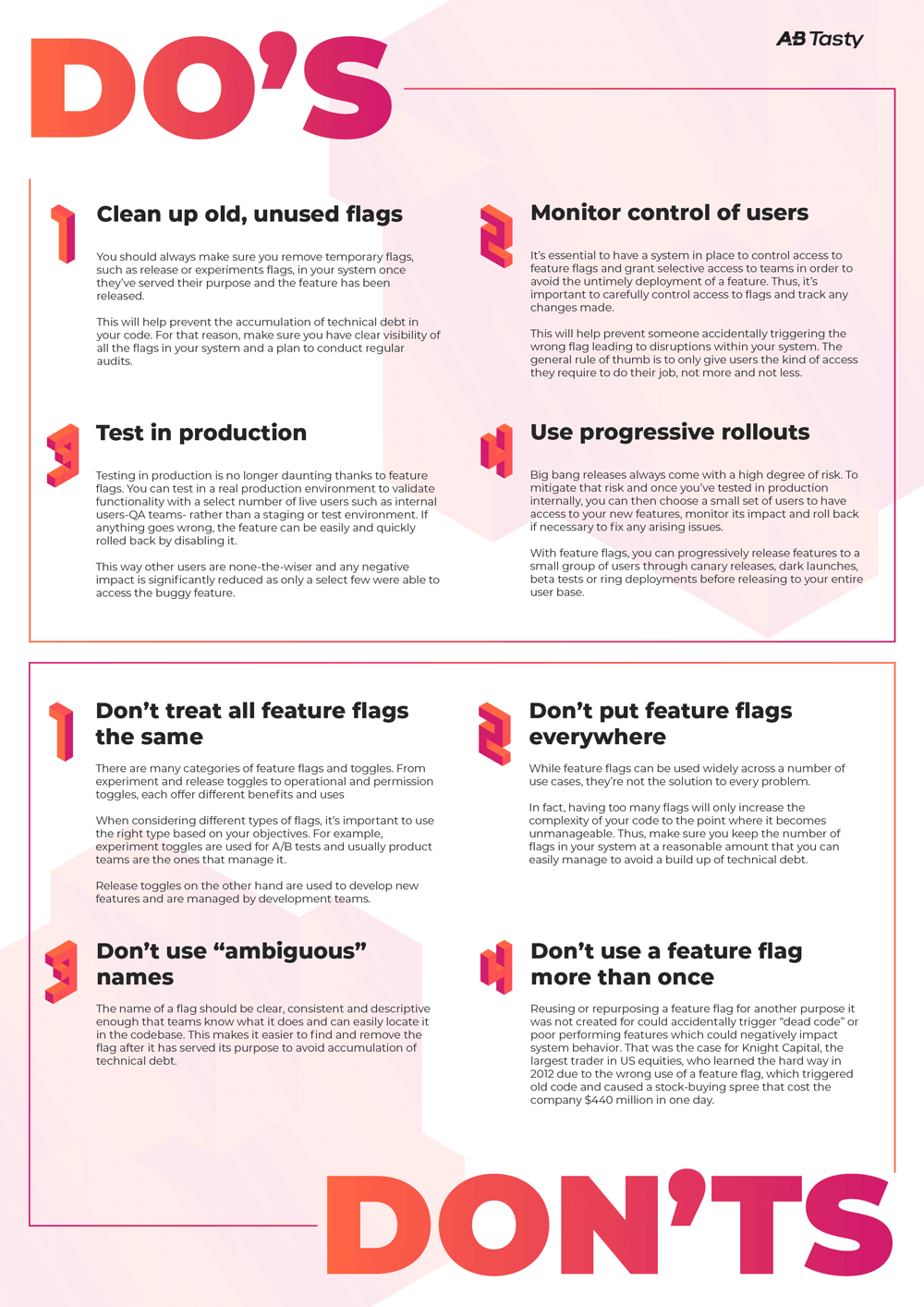

Land A Private Credit Job 5 Crucial Dos And Don Ts To Follow

May 25, 2025

Land A Private Credit Job 5 Crucial Dos And Don Ts To Follow

May 25, 2025 -

Monaco Vs Nice Le Groupe Convoque Pour La Reception

May 25, 2025

Monaco Vs Nice Le Groupe Convoque Pour La Reception

May 25, 2025 -

M56 Traffic Live Updates Following Major Crash Causing Delays

May 25, 2025

M56 Traffic Live Updates Following Major Crash Causing Delays

May 25, 2025 -

55 Rokiv Naomi Kempbell Divitsya Naykraschi Foto

May 25, 2025

55 Rokiv Naomi Kempbell Divitsya Naykraschi Foto

May 25, 2025 -

Skolko Let Geroyam Filma O Bednom Gusare Zamolvite Slovo Vozrast Akterov I Personazhey

May 25, 2025

Skolko Let Geroyam Filma O Bednom Gusare Zamolvite Slovo Vozrast Akterov I Personazhey

May 25, 2025