2 Stocks Poised To Surpass Palantir's Value In 3 Years

Table of Contents

Stock #1: Snowflake – A Data Analytics Powerhouse

Snowflake (SNOW) is a cloud-based data warehousing and analytics service provider. Its unique architecture and scalability position it for explosive growth, making it a strong candidate to surpass Palantir's value. The company's success is fueled by several key factors:

Superior Technology and Innovation

Snowflake's architecture separates compute and storage, offering unparalleled scalability and flexibility. This translates into significant advantages:

- Near-unlimited scalability: Handles massive datasets with ease, catering to the growing needs of large enterprises.

- Pay-as-you-go pricing: Attractive to businesses of all sizes, promoting wider adoption.

- Seamless integration with major cloud providers: Facilitates easy deployment and integration into existing cloud infrastructures.

- Focus on ease of use and accessibility: Lowers the barrier to entry for data analytics, broadening its appeal across various industries.

Strong Market Position and Growth Potential

Snowflake's market share in the cloud data warehousing market is rapidly expanding:

- High year-over-year revenue growth: Consistently exceeding expectations, demonstrating strong market demand.

- Expanding client base across diverse sectors: From financial services to healthcare, Snowflake's versatility attracts a wide range of clients.

- Strategic partnerships and integrations: Collaborations with major technology companies enhance its capabilities and market reach.

Valuation and Investment Thesis

While Snowflake's current valuation is substantial, its future growth potential justifies the price. The company's superior technology, strong market position, and consistent revenue growth suggest significant long-term price appreciation, making it a compelling investment for those seeking high-growth potential, potentially even surpassing Palantir's current market cap.

Stock #2: CrowdStrike – Disrupting the Cybersecurity Sector

CrowdStrike (CRWD) is a leader in cloud-delivered endpoint protection, disrupting the traditional cybersecurity landscape with its innovative approach. Its rapid growth and strong financial performance make it another strong contender to surpass Palantir's value in the coming years.

Revolutionary Product/Service

CrowdStrike's Falcon platform provides comprehensive endpoint protection using artificial intelligence and machine learning:

- Patented technology with a significant competitive moat: Its unique approach provides superior threat detection and response capabilities.

- First-mover advantage in the cloud-based cybersecurity market: Capitalizes on the shift toward cloud-based infrastructure and applications.

- Cost-effective solution with superior performance: Offers a more efficient and effective alternative to legacy security solutions.

Strong Financial Performance and Future Projections

CrowdStrike's financial performance speaks for itself:

- Consistent profitability and strong cash flow: Demonstrates a sustainable business model and strong financial health.

- Positive analyst ratings and ambitious price targets: Reflects confidence in the company's future growth trajectory.

- High growth trajectory based on the expanding cybersecurity market: The increasing sophistication of cyber threats fuels the demand for CrowdStrike's services.

Investment Rationale and Expected Returns

CrowdStrike's innovative technology, strong financial performance, and position in the rapidly growing cybersecurity market make it an attractive investment. Its potential for substantial returns aligns with our prediction of surpassing Palantir's market value.

Conclusion

Both Snowflake and CrowdStrike demonstrate significant potential to surpass Palantir's value within three years. Their innovative technologies, strong financial performances, and promising growth trajectories in their respective markets form the basis of this prediction. While the stock market is inherently unpredictable, these companies exhibit characteristics often associated with high-growth, high-return investments. However, remember that this is not financial advice. Conduct your own thorough due diligence before making any investment decisions. Consider adding these high-growth stocks to your portfolio for potential long-term gains. Don't miss out on the opportunity to invest in companies poised to surpass Palantir's value.

Featured Posts

-

Pam Bondi Accused Of Hiding Epstein Records Senate Democrats Speak Out

May 10, 2025

Pam Bondi Accused Of Hiding Epstein Records Senate Democrats Speak Out

May 10, 2025 -

Cassidy Hutchinsons Memoir Key Witness To January 6th Details Plans For Fall Release

May 10, 2025

Cassidy Hutchinsons Memoir Key Witness To January 6th Details Plans For Fall Release

May 10, 2025 -

Unian Makron I Tusk Gotovyatsya K Podpisaniyu Vazhnogo Dogovora

May 10, 2025

Unian Makron I Tusk Gotovyatsya K Podpisaniyu Vazhnogo Dogovora

May 10, 2025 -

Debut D Incendie A La Mediatheque Champollion A Dijon Bilan Et Consequences

May 10, 2025

Debut D Incendie A La Mediatheque Champollion A Dijon Bilan Et Consequences

May 10, 2025 -

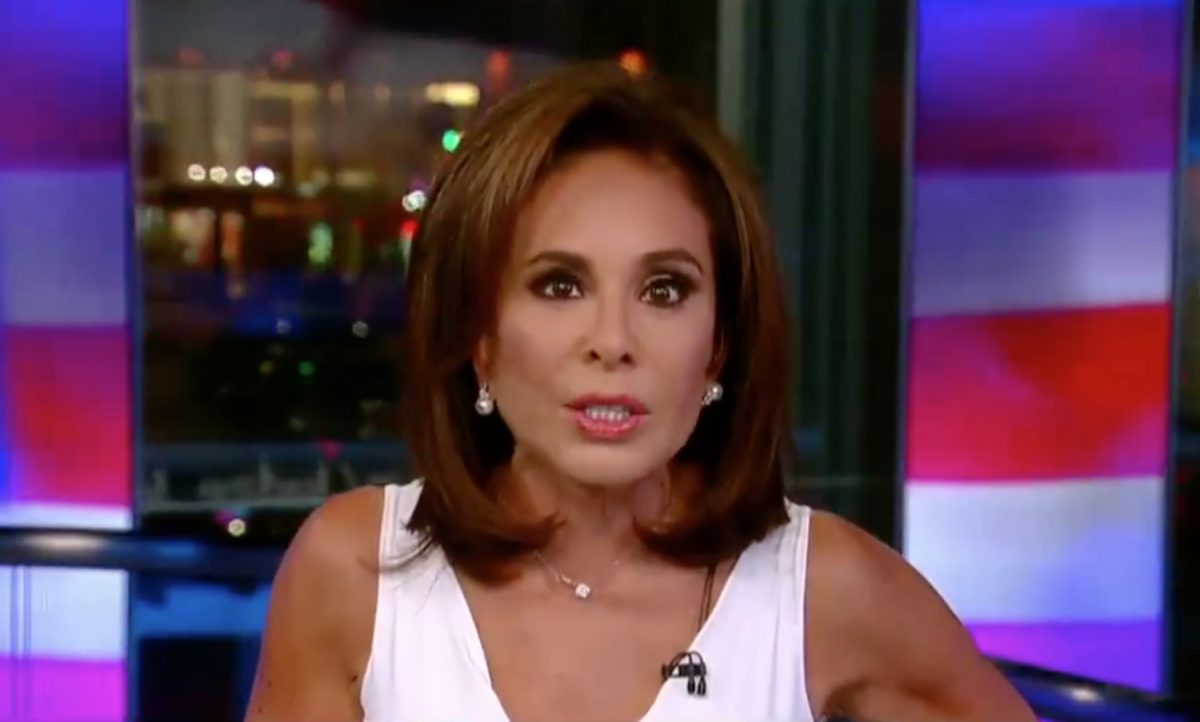

Exploring The Life And Career Of Fox News Jeanine Pirro

May 10, 2025

Exploring The Life And Career Of Fox News Jeanine Pirro

May 10, 2025