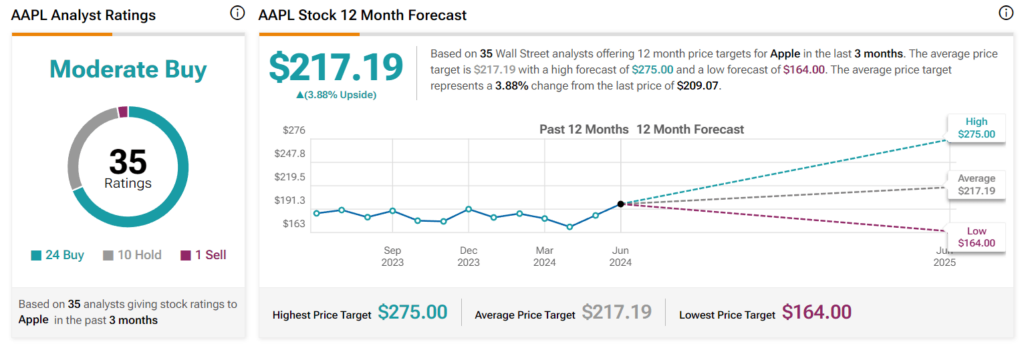

$254 Apple Stock Price Target: Should You Buy Now? Analyst's Perspective

Table of Contents

Analyst Predictions and Rationale Behind the $254 Apple Stock Price Target

The $254 Apple stock price target has been floated by several analysts, notably [Insert Analyst Name/Firm Here]. Their prediction is primarily driven by several key factors suggesting significant future growth potential:

-

Strong iPhone Sales and Future Growth: Apple consistently boasts impressive iPhone sales figures, a cornerstone of its revenue. Analysts project continued strong sales, particularly in emerging markets, fueling further growth. This expectation of continued iPhone dominance is a major factor in the $254 prediction.

-

Expansion into New Markets (AR/VR, Electric Vehicles): Apple's rumored foray into augmented reality/virtual reality (AR/VR) and the electric vehicle market represents substantial growth opportunities. Success in these sectors could significantly boost the company's valuation, contributing to the $254 target.

-

Innovative Service Offerings (Apple Music, iCloud): Apple's services sector continues to expand, with Apple Music and iCloud generating substantial recurring revenue. The increasing profitability of these services adds a layer of stability and future growth potential to Apple's overall financial picture, making the $254 price target more plausible.

-

Market Share Dominance and Brand Loyalty: Apple enjoys unparalleled brand loyalty and a significant market share in several key product categories. This strong brand recognition and customer base contribute to its resilience and long-term growth prospects, supporting the optimistic $254 price target.

-

Financial Strength and Consistent Profitability: Apple's consistently strong financial performance, characterized by high profitability and a robust balance sheet, is a key factor underpinning the analyst's prediction. This financial stability reduces risk and increases investor confidence.

[Insert Chart/Graph Here illustrating Apple's historical stock performance and projected growth based on the $254 target]

However, it's essential to acknowledge potential risks. Increased competition, global economic downturns, and supply chain disruptions could all negatively impact Apple's performance and threaten the $254 price target.

Analyzing Apple's Current Financial Performance and Future Prospects

Apple's recent earnings reports showcase [Insert Key Financial Metrics: Revenue, EPS, etc.]. Its market capitalization places it among the world's most valuable companies. The company's innovation pipeline is robust, with anticipated product launches likely to influence the stock price:

-

New iPhone Models and Features: New iPhone iterations with cutting-edge features are expected to maintain strong sales momentum.

-

Mac Upgrades and Software Updates: Continuous improvements to the Mac ecosystem and its software offerings further solidify Apple's position in the market.

-

Progress in AR/VR and Other Emerging Technologies: The success of Apple's ventures into AR/VR and other emerging technologies will be critical in determining whether the $254 price target is achievable.

[Insert Links to Reputable Sources supporting the points above]

Risk Assessment and Diversification Strategies for Apple Stock Investment

Investing in any stock, including Apple, carries inherent risks. Market fluctuations, unforeseen events, and company-specific challenges can all impact stock prices. Therefore, diversification is crucial for mitigating risk. Reaching for a specific price target like $254 should not be the sole driver of investment decisions. Consider:

- Sector Diversification: Don't put all your eggs in one basket. Diversify across different sectors to reduce overall portfolio risk.

- Investing in Other Tech Companies or Industries: Explore investment opportunities beyond Apple to balance your portfolio.

- Dollar-Cost Averaging: This strategy involves investing a fixed amount regularly, regardless of price fluctuations, mitigating the risk of buying high and selling low.

Comparing Apple to Competitors in the Tech Sector

Apple faces stiff competition from companies like [List Key Competitors, e.g., Samsung, Google, Microsoft]. While Apple maintains strengths in brand loyalty and ecosystem integration, its competitors are constantly innovating. The competitive landscape will significantly influence Apple's future growth and the likelihood of reaching the $254 price target. [Analyze specific competitive advantages and disadvantages].

Conclusion

The $254 Apple stock price target presents a compelling, yet uncertain, outlook. While strong fundamentals, innovative products, and a robust brand support the optimistic prediction, risks associated with market volatility and competition remain. Thorough research and consideration of your personal risk tolerance are paramount before investing. The potential upside of reaching the $254 Apple stock price target is significant, but so are the potential downsides. Conduct further research, consult with a financial advisor, and make informed decisions regarding your investment in the "$254 Apple Stock Price Target" or Apple stock generally. Remember that this analysis does not constitute financial advice.

Featured Posts

-

Sergey Yurskiy 90 Let So Dnya Rozhdeniya Velikogo Aktera

May 24, 2025

Sergey Yurskiy 90 Let So Dnya Rozhdeniya Velikogo Aktera

May 24, 2025 -

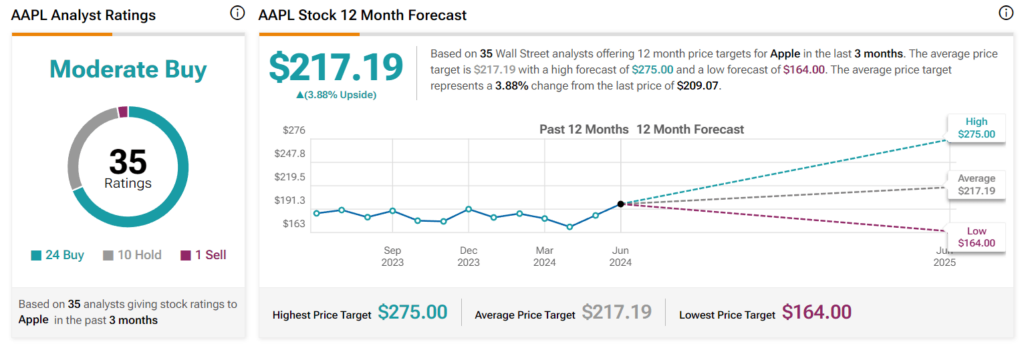

Amundi Msci World Ii Ucits Etf Usd Hedged Dist Nav Tracking And Analysis

May 24, 2025

Amundi Msci World Ii Ucits Etf Usd Hedged Dist Nav Tracking And Analysis

May 24, 2025 -

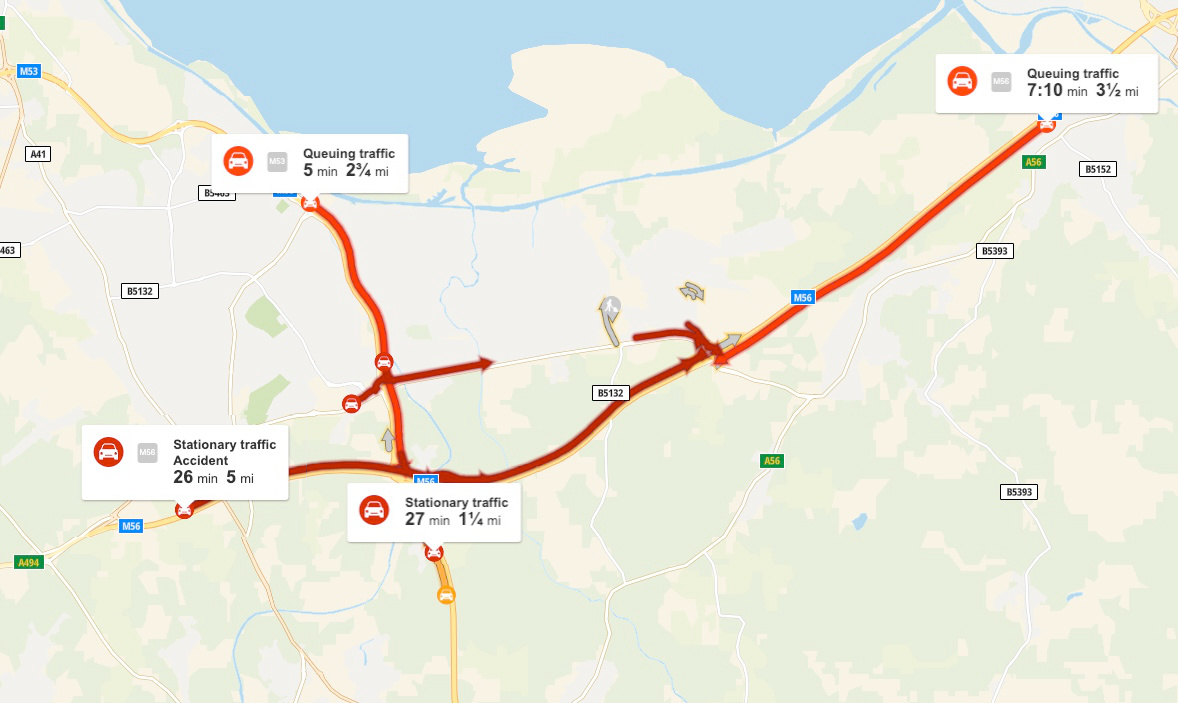

M56 Cheshire Deeside Traffic Update Following Collision

May 24, 2025

M56 Cheshire Deeside Traffic Update Following Collision

May 24, 2025 -

Escape To The Country Finding Your Perfect Countryside Home

May 24, 2025

Escape To The Country Finding Your Perfect Countryside Home

May 24, 2025 -

Borsa Europa Cauta Focus Sulla Fed Performance Italgas

May 24, 2025

Borsa Europa Cauta Focus Sulla Fed Performance Italgas

May 24, 2025

Latest Posts

-

Canadian Auto Execs Demand Stronger Action Against Trumps Threats

May 24, 2025

Canadian Auto Execs Demand Stronger Action Against Trumps Threats

May 24, 2025 -

Tva Group Restructuring Layoffs Highlight Challenges In The Media Landscape

May 24, 2025

Tva Group Restructuring Layoffs Highlight Challenges In The Media Landscape

May 24, 2025 -

The Posthaste Threat Unrest In The Global Bond Market And Its Worldwide Impact

May 24, 2025

The Posthaste Threat Unrest In The Global Bond Market And Its Worldwide Impact

May 24, 2025 -

Tva Group Job Cuts Impact Of Streaming And Regulation

May 24, 2025

Tva Group Job Cuts Impact Of Streaming And Regulation

May 24, 2025 -

Posthaste Risks And Implications Of The Worlds Largest Bond Markets Instability

May 24, 2025

Posthaste Risks And Implications Of The Worlds Largest Bond Markets Instability

May 24, 2025