3 Billion Pound Spending Reduction For SSE: Reasons And Consequences

Table of Contents

Reasons Behind SSE's £3 Billion Spending Reduction

Several interconnected factors have contributed to SSE's decision to slash its spending by £3 billion. This strategic move reflects a complex interplay of economic pressures, financial priorities, and a shift in investment focus.

Economic Headwinds and Market Volatility

The current economic climate is undeniably challenging. High inflation and interest rates are squeezing profitability across the board, forcing energy companies like SSE to reassess their investment strategies. The energy market itself is incredibly volatile, with fluctuating commodity prices and increasing regulatory uncertainty contributing to a more cautious approach to large-scale projects.

- Rising energy costs: The surge in energy prices has significantly impacted operational expenses.

- Fluctuating commodity prices: Unpredictable price swings for fuel sources make long-term investment planning more difficult.

- Potential for government intervention: Regulatory changes and potential government interventions add another layer of uncertainty.

Focus on Debt Reduction and Financial Stability

A key driver behind the £3 billion spending reduction is SSE's commitment to strengthening its balance sheet. By reducing its debt burden, the company aims to improve its financial stability and attract investor confidence. This prioritization of financial health over aggressive expansion represents a shift in the company's short-term strategy.

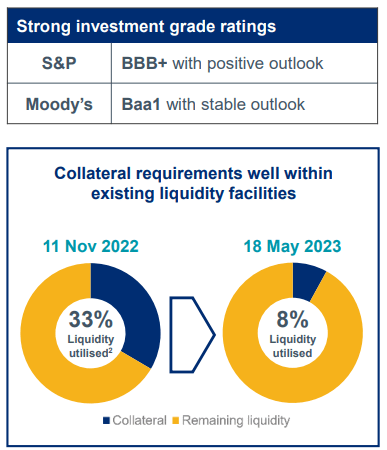

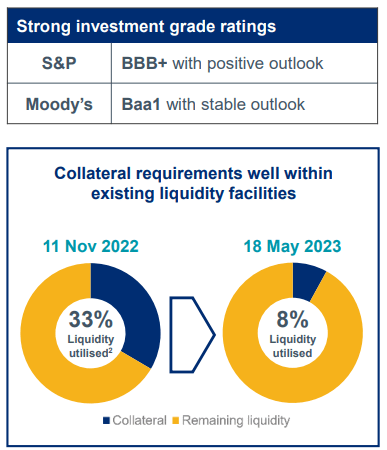

- Improved credit ratings: Lower debt levels will likely lead to improved credit ratings, making future borrowing cheaper.

- Reduced financial risk: A stronger balance sheet mitigates the risk of financial distress in times of economic downturn.

- Investor confidence: Demonstrating fiscal responsibility can enhance investor confidence and attract further investment.

Shifting Investment Priorities

SSE's spending cut is not simply about reducing expenditure; it’s also about reallocating resources. The company is likely prioritizing investments in renewable energy projects and other strategic initiatives aligned with long-term sustainability goals. This reflects a broader industry trend towards low-carbon energy sources and meeting net-zero targets.

- Renewable energy projects (wind, solar): Investing in renewable energy infrastructure is crucial for future growth and aligns with environmental targets.

- Grid infrastructure: Modernizing and expanding the electricity grid is essential to accommodate the influx of renewable energy.

- Digitalization of energy services: Investing in smart grid technologies and digital platforms improves efficiency and customer engagement.

Consequences of the £3 Billion Spending Reduction for SSE

The £3 billion spending reduction will undoubtedly have far-reaching consequences for SSE, its stakeholders, and the wider energy market. The impact will be felt across various aspects of the business and the UK energy landscape.

Impact on Investment Projects

The most immediate consequence is the potential delay or cancellation of planned infrastructure projects. This could have significant implications for the UK's energy supply and the overall energy transition. Furthermore, reduced investment in research and development might hinder innovation within the sector.

- Potential delays to renewable energy projects: Delays could slow the UK's progress towards its renewable energy targets.

- Job losses in related industries: Project cancellations could lead to job losses in construction and related sectors.

- Slower energy transition: Reduced investment might hinder the shift towards a cleaner, more sustainable energy system.

Effects on Shareholder Value

The spending reduction will likely have a short-term impact on SSE's share price as investors digest the news. The long-term effect, however, will depend on the success of the company's debt reduction strategy and its ability to execute its revised investment plan.

- Investor sentiment: The market's reaction will be crucial in determining the long-term impact on shareholder value.

- Share price volatility: Uncertainty surrounding the consequences of the spending cut could lead to share price fluctuations.

- Potential for long-term growth: Successful debt reduction and strategic realignment could pave the way for long-term growth.

Implications for Consumers

While the direct impact on consumers might not be immediate, there are potential consequences related to energy prices and the reliability of supply. The nature and scale of any delayed projects will play a critical role in determining the extent of these implications.

- Energy price fluctuations: Delays in renewable energy projects could indirectly impact energy prices in the long term.

- Potential for supply disruptions: Reduced investment in infrastructure could potentially increase the risk of supply disruptions.

- Public perception of the energy industry: The spending cuts and their consequences will shape public opinion on the energy sector.

Conclusion

SSE's £3 billion spending reduction is a significant strategic move driven by economic uncertainty, a need for financial stability, and a shift towards prioritizing specific investments. This decision carries potential consequences for the company's financial outlook, its investment projects, and the broader energy market. Understanding the reasons and consequences of SSE's £3 billion spending reduction is crucial for investors, consumers, and policymakers alike. Stay informed about further developments related to SSE's spending cuts and the impact on the UK energy sector. Follow our updates on major energy company spending decisions and the implications for the energy transition.

Featured Posts

-

Bangladesh Bow Down Zimbabwes Muzarabani Stars In Dominant Test Win

May 23, 2025

Bangladesh Bow Down Zimbabwes Muzarabani Stars In Dominant Test Win

May 23, 2025 -

Experience Weekend Events Combining Fashion Heritage And Ballet

May 23, 2025

Experience Weekend Events Combining Fashion Heritage And Ballet

May 23, 2025 -

Man United News Tagliafico Points Finger At Players For Ten Hags Underperformance

May 23, 2025

Man United News Tagliafico Points Finger At Players For Ten Hags Underperformance

May 23, 2025 -

Changes To Southwest Airlines Carry On Policy Regarding Portable Chargers

May 23, 2025

Changes To Southwest Airlines Carry On Policy Regarding Portable Chargers

May 23, 2025 -

The Official England And Wales Cricket Board Website

May 23, 2025

The Official England And Wales Cricket Board Website

May 23, 2025

Latest Posts

-

Memorial Day Weekend Gas Prices At Multi Decade Lows

May 23, 2025

Memorial Day Weekend Gas Prices At Multi Decade Lows

May 23, 2025 -

Memorial Day Gas Prices A Decade Low

May 23, 2025

Memorial Day Gas Prices A Decade Low

May 23, 2025 -

Actor Neal Mc Donough Tackles Pro Bull Riding In New Film

May 23, 2025

Actor Neal Mc Donough Tackles Pro Bull Riding In New Film

May 23, 2025 -

Exclusive Neal Mc Donough On Damien Darhk And Future Dc Roles

May 23, 2025

Exclusive Neal Mc Donough On Damien Darhk And Future Dc Roles

May 23, 2025 -

Master Chef Season Season Number Dallas Chef Tiffany Derry Joins The Judging Panel

May 23, 2025

Master Chef Season Season Number Dallas Chef Tiffany Derry Joins The Judging Panel

May 23, 2025