£3 Billion Spending Cut By SSE: Analysis And Implications For Investors

Table of Contents

Reasons Behind SSE's £3 Billion Spending Reduction

SSE's decision to slash its capital expenditure by £3 billion is a multifaceted issue, driven by a confluence of macroeconomic factors, strategic realignment, and the prevailing regulatory and political landscape.

Macroeconomic Factors

The current economic climate significantly impacts SSE's investment choices. Rising inflation, coupled with aggressive interest rate hikes by the Bank of England, has dramatically increased borrowing costs. This makes financing large-scale energy projects considerably more expensive. Furthermore, a potential recession looms, dampening consumer demand for energy and impacting the overall profitability of new investments.

- Increased borrowing costs: Interest rates have risen sharply, making debt financing for capital-intensive projects significantly more expensive.

- Reduced consumer demand: Economic uncertainty may lead to reduced energy consumption, impacting the return on investment in new generation capacity.

- Government policies impacting energy investment: Changes in government subsidies or tax incentives for renewable energy projects can affect investment decisions. For instance, a reduction in renewable energy subsidies could make certain projects less attractive. The current inflation rate of X% (insert actual data) directly impacts project viability.

Strategic Realignment

The £3 billion spending cut might also reflect a strategic shift within SSE. The company may be prioritizing investments in specific areas while divesting from others. This could involve a renewed focus on renewable energy sources, such as wind and solar power, while scaling back investments in less profitable or less sustainable energy assets.

- Focus on renewable energy: SSE may be shifting its resources towards renewable energy projects, aligning with global decarbonization goals and potentially securing long-term growth.

- Divestment from certain assets: The company might be selling off less profitable or outdated assets to free up capital for more promising ventures. Specific examples of projects impacted by the cuts would need to be named here (cite news sources if available).

- Prioritization of profitable projects: SSE might be focusing its investments on projects with a higher probability of success and stronger returns, leading to a more efficient allocation of capital.

Regulatory and Political Landscape

The regulatory and political environment plays a crucial role in shaping SSE's investment strategy. Changes in energy policy, environmental regulations, and potential subsidies or tax incentives can significantly influence investment decisions.

- Changes in energy policy: Government policies regarding energy generation and distribution can create uncertainty and impact investment plans.

- Environmental regulations: Stringent environmental regulations might increase the cost of new projects, leading to a more cautious approach to investment.

- Potential subsidies or tax incentives: Government support for renewable energy projects can influence investment priorities, encouraging investment in specific technologies.

Implications for Investors

The £3 billion spending cut has significant implications for SSE's investors, impacting the share price, dividend payouts, and future growth prospects.

Impact on Share Price

The announcement of the spending cut has caused immediate volatility in SSE's share price. While short-term fluctuations are expected, the long-term impact depends on how investors perceive the strategic rationale behind the decision. A well-communicated strategy focusing on long-term sustainability and profitability could mitigate negative investor sentiment.

- Short-term volatility: The immediate reaction in the stock market is likely to be negative, with a potential drop in the share price. (Include a chart or graph illustrating share price movements if available)

- Investor sentiment: Investor confidence will be affected by how the company communicates its revised strategy and future plans. Transparency is key.

- Potential for long-term growth: Despite the cut, if the strategy leads to improved profitability and a stronger long-term outlook, the share price could recover and potentially experience further growth.

Dividend Implications

The spending reduction could impact SSE's ability to maintain its current dividend payouts to shareholders. A reduced capital expenditure program may free up cash flow, potentially offsetting any negative impact, but a dividend reduction or freeze remains a possibility.

- Potential for dividend reductions or freezes: Investors should be prepared for the possibility of lower dividend payments in the short to medium term.

- Impact on investor returns: A lower dividend will reduce the overall return on investment for shareholders.

Future Growth Prospects

While the spending cut might seem initially negative, it could pave the way for future growth if it leads to a more focused and efficient allocation of capital. Opportunities exist in the rapidly expanding renewable energy sector.

- Opportunities in renewable energy: SSE can leverage the cut to strategically invest in high-growth areas within the renewable energy sector, generating long-term returns.

- Potential for new investments in other areas: The released capital could be reinvested in other profitable areas, diversifying SSE's portfolio.

- Long-term sustainability: The shift towards sustainable energy sources improves long-term sustainability and resilience to market fluctuations.

Comparison with Competitors

To gain perspective, it's crucial to compare SSE's decision with the strategies of its competitors in the energy sector. (This section would require a comparative analysis of the investment strategies of other major energy companies. Include specific examples and data to support the comparison.) For example, how does SSE’s strategy compare to that of British Gas or EDF Energy? Are they also reducing capital expenditure? What are their justifications? This comparative analysis will provide a valuable context for understanding SSE's choices.

Conclusion: Navigating the Aftermath of SSE's £3 Billion Spending Cut

SSE's £3 billion spending cut is a significant event with far-reaching consequences for investors. The decision is multifaceted, driven by macroeconomic pressures, strategic realignment, and the regulatory environment. While short-term impacts on share price and dividends are likely, the long-term implications will depend on the success of SSE's revised strategy. The company's ability to effectively communicate its new direction and demonstrate sustainable growth in its chosen areas will be key to regaining investor confidence. Understanding this £3 billion spending cut is crucial for informed investment decisions in the energy sector. Stay informed about SSE's future announcements and the implications for your portfolio. Careful monitoring of SSE's performance and a reassessment of your investment strategy in light of this significant development are highly recommended.

Featured Posts

-

Antalya Da Nato Parlamenter Asamblesi Teroerizm Ve Deniz Guevenligi Odak Noktasi

May 22, 2025

Antalya Da Nato Parlamenter Asamblesi Teroerizm Ve Deniz Guevenligi Odak Noktasi

May 22, 2025 -

Understanding Google Searchs Ai Mode Benefits And Challenges

May 22, 2025

Understanding Google Searchs Ai Mode Benefits And Challenges

May 22, 2025 -

Googles Ai Ambitions Convincing Investors Of Its Mastery

May 22, 2025

Googles Ai Ambitions Convincing Investors Of Its Mastery

May 22, 2025 -

Real Madrid In Yeni Teknik Direktoerue Klopp Guendemde

May 22, 2025

Real Madrid In Yeni Teknik Direktoerue Klopp Guendemde

May 22, 2025 -

Brutal Confrontation Pub Landladys Irate Reaction To Employees Notice

May 22, 2025

Brutal Confrontation Pub Landladys Irate Reaction To Employees Notice

May 22, 2025

Latest Posts

-

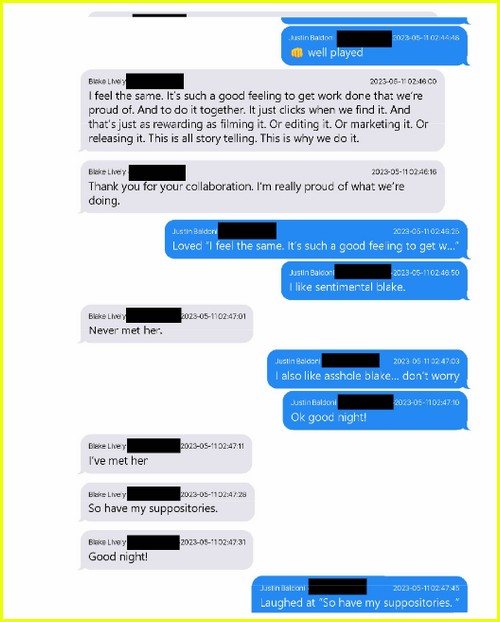

Selena Gomezs Wake Up Call To Taylor Swift The Blake Lively Claim And Justin Baldoni Lawsuit

May 22, 2025

Selena Gomezs Wake Up Call To Taylor Swift The Blake Lively Claim And Justin Baldoni Lawsuit

May 22, 2025 -

Chi Sprostit Vidmova Ukrayini U Vstupi Do Nato Plani Rosiyi Schodo Podalshoyi Agresiyi

May 22, 2025

Chi Sprostit Vidmova Ukrayini U Vstupi Do Nato Plani Rosiyi Schodo Podalshoyi Agresiyi

May 22, 2025 -

Enerji Guevenligi Nato Genel Sekreteri Rutte Ile Ispanyol Basbakan Sanchez In Goeruesmesi

May 22, 2025

Enerji Guevenligi Nato Genel Sekreteri Rutte Ile Ispanyol Basbakan Sanchez In Goeruesmesi

May 22, 2025 -

Vidmova Nato Priynyati Ukrayinu Shlyakh Do Podalshoyi Rosiyskoyi Agresiyi

May 22, 2025

Vidmova Nato Priynyati Ukrayinu Shlyakh Do Podalshoyi Rosiyskoyi Agresiyi

May 22, 2025 -

Tuerkiye Nin Nato Daki Artan Etkisi Ittifakin Yeni Denge Noktasi

May 22, 2025

Tuerkiye Nin Nato Daki Artan Etkisi Ittifakin Yeni Denge Noktasi

May 22, 2025