3% Mortgage Rates And The Canadian Housing Market: A Realistic Outlook

Table of Contents

H2: Affordability and 3% Mortgage Rates in Canada

The prospect of 3% mortgage rates significantly alters the affordability landscape for Canadian homebuyers.

H3: The Impact of Lower Interest Rates on Monthly Payments:

A reduction in interest rates from, say, 5% to 3%, translates to substantially lower monthly mortgage payments. For example:

- A $500,000 mortgage amortized over 25 years would see a monthly payment reduction of approximately $300-$400 depending on the specific terms.

- For a $750,000 mortgage, the savings could exceed $500 per month.

This increased affordability opens doors for potential homebuyers previously priced out of the market. However, it's crucial to remember that these calculations are based on the interest rate alone, and other costs must be factored in. Statistics Canada data on housing affordability regularly highlights the persistent gap between income and housing costs, even with potentially lower mortgage rates.

H3: Challenges Despite Lower Rates:

While lower rates improve affordability, several challenges persist:

- High Home Prices: Even with reduced monthly payments, the initial cost of purchasing a home remains significantly high in many Canadian cities.

- Limited Inventory: The persistent shortage of homes for sale creates intense competition, pushing prices upward.

- Increased Competition: Lower rates attract more buyers, intensifying competition and potentially leading to bidding wars.

- Additional Costs: Property taxes, insurance premiums, and maintenance costs add to the overall burden of homeownership, even with 3% mortgage rates.

- First-Time Homebuyers: The dream of homeownership is still a considerable hurdle for many first-time homebuyers, particularly in expensive urban centers, despite lower rates.

H2: Buyer Behaviour in a 3% Mortgage Rate Environment

Lower mortgage rates have a considerable impact on buyer behavior.

H3: Increased Demand and Market Competition:

The allure of lower monthly payments stimulates demand, leading to heightened competition:

- Bidding Wars: Expect more frequent and intense bidding wars, particularly for desirable properties.

- Strong Offers: Buyers need to present strong, competitive offers to succeed in this market.

- Shifting Demographics: Lower rates might attract more first-time homebuyers and those who previously felt priced out of the market, further increasing competition.

H3: Shift in Buyer Strategies:

Buyers may adjust their strategies in response to market conditions:

- Compromising on Location or Size: Some buyers may need to compromise on location or property size to stay within their budget.

- Pre-Approval is Crucial: Securing pre-approval for a mortgage becomes essential to demonstrate financial readiness to sellers.

- Speed is Key: Acting swiftly and decisively is crucial to winning in a competitive market fueled by 3% mortgage rates.

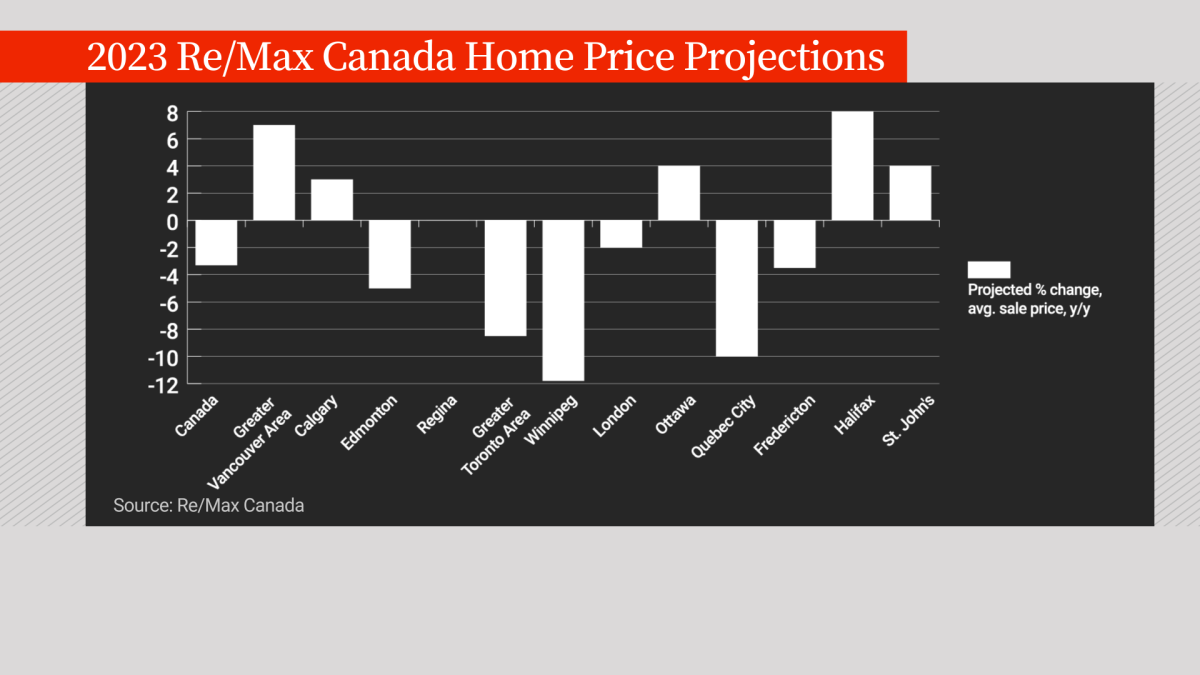

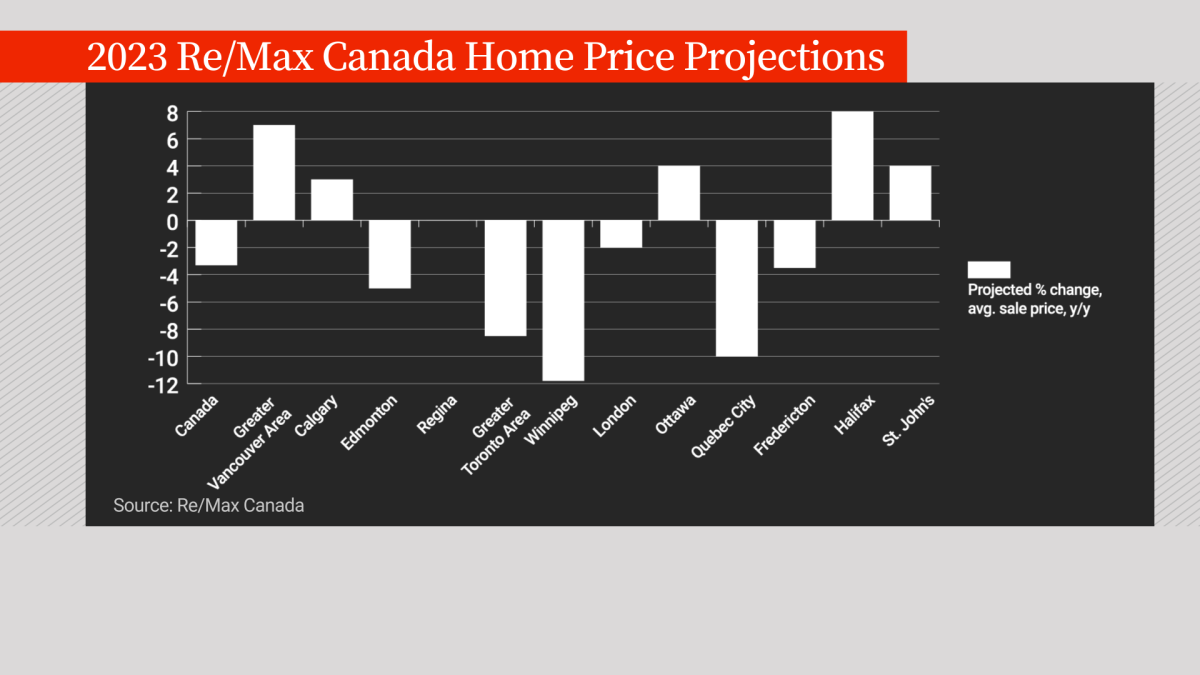

H2: Market Predictions and Future Trends

Predicting the future of the Canadian housing market with 3% mortgage rates requires careful consideration.

H3: Potential Impact on Home Prices:

The short-term impact of 3% mortgage rates on home prices is likely to be an increase in demand and therefore prices. However, the long-term effect is less certain. Several factors play a role:

- Increased Demand: Lower rates boost buyer activity, potentially driving prices higher in the short term.

- Economic Conditions: Overall economic health, including inflation and employment rates, greatly influences housing market trends.

- Government Intervention: Government policies, such as changes to stress tests or incentives for first-time homebuyers, can significantly affect the market.

H3: The Role of the Bank of Canada and Government Interventions:

The Bank of Canada's monetary policy and government interventions play crucial roles:

- Bank of Canada Interest Rate Adjustments: The Bank of Canada's decisions on interest rates directly impact mortgage rates. Further rate cuts or increases would significantly influence market conditions.

- Government Regulations: Government policies, including stress tests and regulations targeting foreign buyers, influence market stability and affordability.

- Policy Changes: Future policy changes, like adjustments to the first-time home buyer incentive program, could dramatically affect home prices and buyer behaviour.

3. Conclusion:

3% mortgage rates offer a potential path to improved affordability in the Canadian housing market. However, the reality is far more nuanced. High home prices, limited inventory, and intense competition continue to pose significant hurdles for many buyers. While lower rates undoubtedly stimulate demand and influence buyer behavior, external economic factors and government interventions play an equally crucial role in shaping market trends. Ultimately, navigating this complex landscape requires careful consideration of your financial situation and a realistic understanding of current market conditions. Consult with a financial advisor and a real estate professional to make informed decisions about buying a home in this dynamic market with potentially attractive 3% mortgage rates. Stay informed about the latest updates on Canadian mortgage rates and the housing market to make the best choices for your individual circumstances.

Featured Posts

-

From Social Media Influencer To Political Candidate A Gen Z Perspective

May 13, 2025

From Social Media Influencer To Political Candidate A Gen Z Perspective

May 13, 2025 -

Deja Kelly Undrafted Rookies Game Winning Shot Highlights Aces Preseason

May 13, 2025

Deja Kelly Undrafted Rookies Game Winning Shot Highlights Aces Preseason

May 13, 2025 -

Peninsula Hills Hike Urgent Search For Missing Elderly Person

May 13, 2025

Peninsula Hills Hike Urgent Search For Missing Elderly Person

May 13, 2025 -

Thursday February 20th Orange County Game Scores And Player Stats

May 13, 2025

Thursday February 20th Orange County Game Scores And Player Stats

May 13, 2025 -

Langkah Langkah Efektif Pemerintah Myanmar Dalam Memberantas Judi Online Dan Penipuan Telekomunikasi

May 13, 2025

Langkah Langkah Efektif Pemerintah Myanmar Dalam Memberantas Judi Online Dan Penipuan Telekomunikasi

May 13, 2025

Latest Posts

-

Langkah Langkah Efektif Pemerintah Myanmar Dalam Memberantas Judi Online Dan Penipuan Telekomunikasi

May 13, 2025

Langkah Langkah Efektif Pemerintah Myanmar Dalam Memberantas Judi Online Dan Penipuan Telekomunikasi

May 13, 2025 -

Myanmar Memperketat Aturan Untuk Memberantas Judi Online Dan Penipuan Telekomunikasi

May 13, 2025

Myanmar Memperketat Aturan Untuk Memberantas Judi Online Dan Penipuan Telekomunikasi

May 13, 2025 -

Perang Melawan Judi Online Dan Penipuan Telekomunikasi Di Myanmar Strategi Dan Tantangan

May 13, 2025

Perang Melawan Judi Online Dan Penipuan Telekomunikasi Di Myanmar Strategi Dan Tantangan

May 13, 2025 -

1

May 13, 2025

1

May 13, 2025 -

Tindak Tegas Judi Online Dan Penipuan Telekomunikasi Di Myanmar Langkah Langkah Terbaru

May 13, 2025

Tindak Tegas Judi Online Dan Penipuan Telekomunikasi Di Myanmar Langkah Langkah Terbaru

May 13, 2025