5 Essential Tips For Success In The Private Credit Job Market

Table of Contents

Network Strategically within the Private Credit Industry

Building a strong network is paramount in the private credit job market. Direct connections can often lead to unadvertised opportunities.

Target Key Networking Events

Attending industry events provides invaluable opportunities to meet professionals and learn about new roles.

- Industry Conferences: Consider events like [List specific conferences relevant to private credit, e.g., SuperReturn, Private Debt Investor conferences].

- Local Chapter Meetings: Engage with local chapters of organizations such as the [List relevant professional organizations, e.g., CFA Institute, ACG].

- Effective Networking Tips: Prepare insightful questions, actively listen, follow up with connections promptly, and exchange business cards (or LinkedIn profiles).

Leverage LinkedIn for Private Credit Connections

LinkedIn is a powerful tool for connecting with professionals in the private credit industry.

- Keywords: Use relevant keywords in your headline and summary, such as "Private Debt," "Direct Lending," "Credit Analyst," "Fund Manager," and "Mezzanine Financing."

- Groups: Join relevant LinkedIn groups focused on private credit, alternative investments, and finance.

- Connections: Strategically connect with recruiters specializing in private credit and individuals working at target firms.

Master the Essential Skills for Private Credit Roles

Demonstrating technical expertise is crucial for securing a private credit role.

Develop Financial Modeling Expertise

Proficiency in financial modeling is a cornerstone of private credit.

- Software Skills: Master Excel (including advanced functions like VBA), Bloomberg Terminal, and potentially Argus.

- Certifications: Consider pursuing relevant certifications like the CFA (Chartered Financial Analyst) or CAIA (Chartered Alternative Investment Analyst).

Understand Credit Analysis and Underwriting

A deep understanding of credit analysis principles is essential.

- Key Concepts: Master credit risk assessment, covenant analysis, cash flow forecasting, and debt structure analysis.

- Credit Structures: Understand the nuances of various credit structures, including senior secured loans, mezzanine debt, and subordinated debt.

Tailor Your Resume and Cover Letter to Specific Private Credit Jobs

Generic applications rarely succeed in a competitive market like private credit.

Highlight Relevant Experience and Skills

Customize your resume and cover letter to reflect the specific requirements of each job description.

- Keywords: Incorporate relevant keywords from the job description throughout your resume and cover letter.

- Quantifiable Achievements: Showcase your accomplishments using quantifiable metrics (e.g., "Increased portfolio yield by 15%").

Use the Right Keywords for Private Credit ATS

Applicant Tracking Systems (ATS) screen resumes for keywords.

- Relevant Keywords: Use specific keywords like "private debt," "direct lending," "fund management," "credit underwriting," and "leveraged finance."

- ATS-Friendly Format: Use a clean, easily readable format and avoid fancy fonts or tables that might confuse ATS software.

Prepare for Private Credit Interviews with Confidence

Thorough preparation is key to a successful interview.

Practice Behavioral and Technical Interview Questions

Practice answering common interview questions.

- Behavioral Questions: Prepare answers to questions like "Tell me about a time you failed," "Describe your leadership style," and "How do you handle pressure?"

- Technical Questions: Practice questions related to financial modeling, credit analysis, and industry knowledge (e.g., "Walk me through a discounted cash flow analysis," "Explain the concept of leverage").

Research the Firm and Interviewers Thoroughly

Impress interviewers with your knowledge of their firm and their work.

- Research Sources: Consult the firm's website, LinkedIn profiles of interviewers, recent news articles, and industry publications.

- Questions to Ask: Prepare insightful questions to demonstrate your interest and engagement.

Continuously Learn and Stay Updated in the Private Credit Landscape

The private credit market is dynamic; continuous learning is crucial.

Follow Industry News and Trends

Stay informed about market trends, regulatory changes, and innovative deal structures.

- Publications & Websites: Follow reputable publications like [List relevant publications, e.g., Private Debt Investor, PEI Media] and websites specializing in private credit.

- Industry Events: Attend webinars and conferences to stay current on industry best practices.

Pursue Continuing Education and Certifications

Enhance your expertise through professional development.

- Relevant Certifications: Consider pursuing further certifications relevant to the private credit market.

- Regulatory Updates: Stay informed about evolving regulatory changes impacting the industry.

Conclusion

Landing a job in the competitive private credit job market requires a strategic approach. By implementing these five essential tips – building your network, mastering essential skills, tailoring your application materials, preparing thoroughly for interviews, and continuously learning – you can significantly improve your chances of securing your dream role. Don't wait – start implementing these strategies today and actively pursue opportunities within the dynamic and rewarding private credit job market!

Featured Posts

-

Blue Origins New Shepard Launch Cancelled Subsystem Issue Reported

Apr 29, 2025

Blue Origins New Shepard Launch Cancelled Subsystem Issue Reported

Apr 29, 2025 -

Brain Drain Fears International Race To Secure Us Researchers Following Funding Reductions

Apr 29, 2025

Brain Drain Fears International Race To Secure Us Researchers Following Funding Reductions

Apr 29, 2025 -

Malaysias Data Center Expansion Focus On Negeri Sembilan

Apr 29, 2025

Malaysias Data Center Expansion Focus On Negeri Sembilan

Apr 29, 2025 -

Understanding Chicagos Zombie Office Buildings And Their Implications

Apr 29, 2025

Understanding Chicagos Zombie Office Buildings And Their Implications

Apr 29, 2025 -

Mwaeyd Wamakn Fealyat Fn Abwzby Bdayt Mn 19 Nwfmbr

Apr 29, 2025

Mwaeyd Wamakn Fealyat Fn Abwzby Bdayt Mn 19 Nwfmbr

Apr 29, 2025

Latest Posts

-

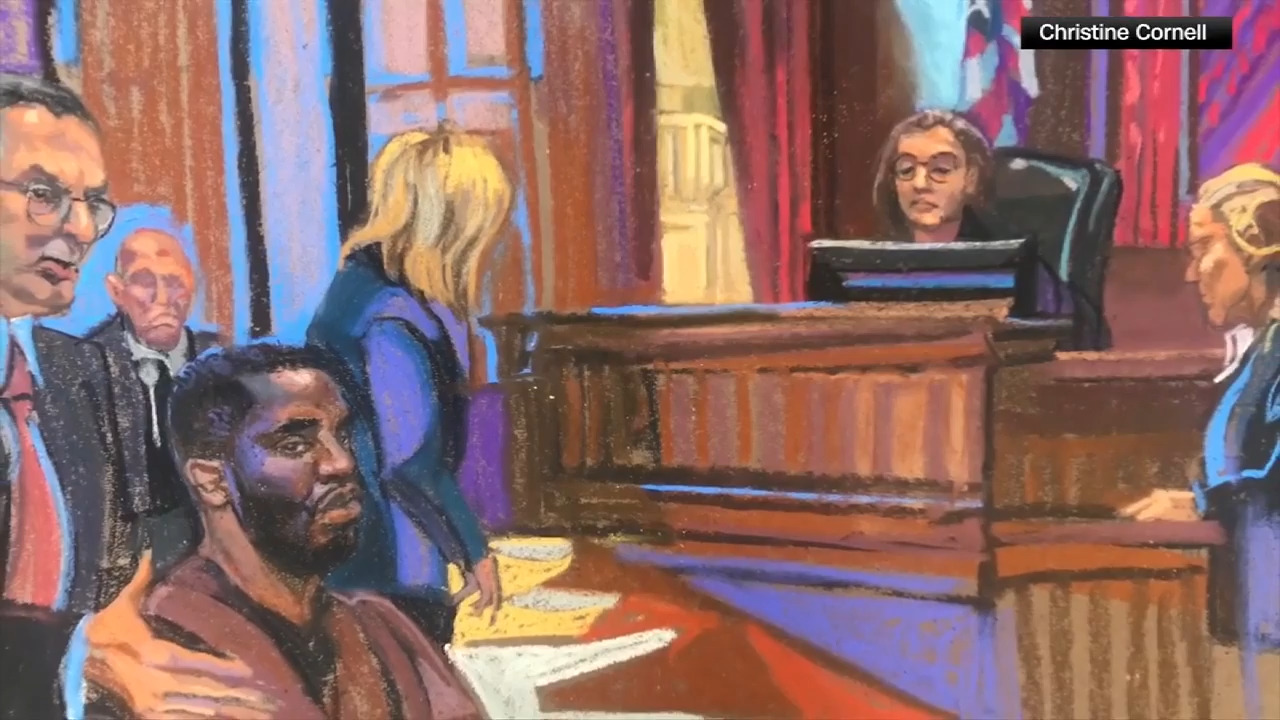

2016 Video Expected To Be Key In Sean Diddy Combs Trial

May 12, 2025

2016 Video Expected To Be Key In Sean Diddy Combs Trial

May 12, 2025 -

Bond Market Volatility Analyzing The Tariff Shock Impact

May 12, 2025

Bond Market Volatility Analyzing The Tariff Shock Impact

May 12, 2025 -

United Vs American The Fight For Chicago O Hare Airport Supremacy

May 12, 2025

United Vs American The Fight For Chicago O Hare Airport Supremacy

May 12, 2025 -

Zelensky Confirms Talks With Russia Following Trump Intervention

May 12, 2025

Zelensky Confirms Talks With Russia Following Trump Intervention

May 12, 2025 -

Sean Combs Trial 2016 Video Takes Center Stage

May 12, 2025

Sean Combs Trial 2016 Video Takes Center Stage

May 12, 2025