5 Key Actions To Secure A Private Credit Job During The Boom

Table of Contents

Master the Fundamentals of Private Credit Investing

To succeed in the private credit industry, a strong foundational understanding is paramount. This involves more than just theoretical knowledge; it requires practical application and a deep understanding of the intricacies of private credit investments.

Understand Deal Structuring and Due Diligence

Successful private credit professionals possess a comprehensive understanding of various debt instruments and the due diligence process. This involves:

- Understanding Debt Instruments: Familiarity with senior secured loans, mezzanine debt, unitranche loans, and other private debt structures is crucial. You need to understand their relative risk and return profiles.

- Due Diligence Process: Mastering the due diligence process, from initial screening to final investment decision, is essential. This includes financial statement analysis, legal reviews, and operational assessments.

- Financial Modeling: Proficiency in financial modeling is indispensable for analyzing potential investments, forecasting cash flows, and assessing risk.

Grasp the Intricacies of Credit Analysis and Risk Assessment

Credit analysis and risk assessment are the cornerstones of successful private credit investing. This requires:

- Credit Scoring and Analysis: Understanding different credit scoring methodologies and applying them to assess the creditworthiness of borrowers.

- Covenant Analysis: The ability to analyze loan covenants to understand the protections afforded to lenders and identify potential risks.

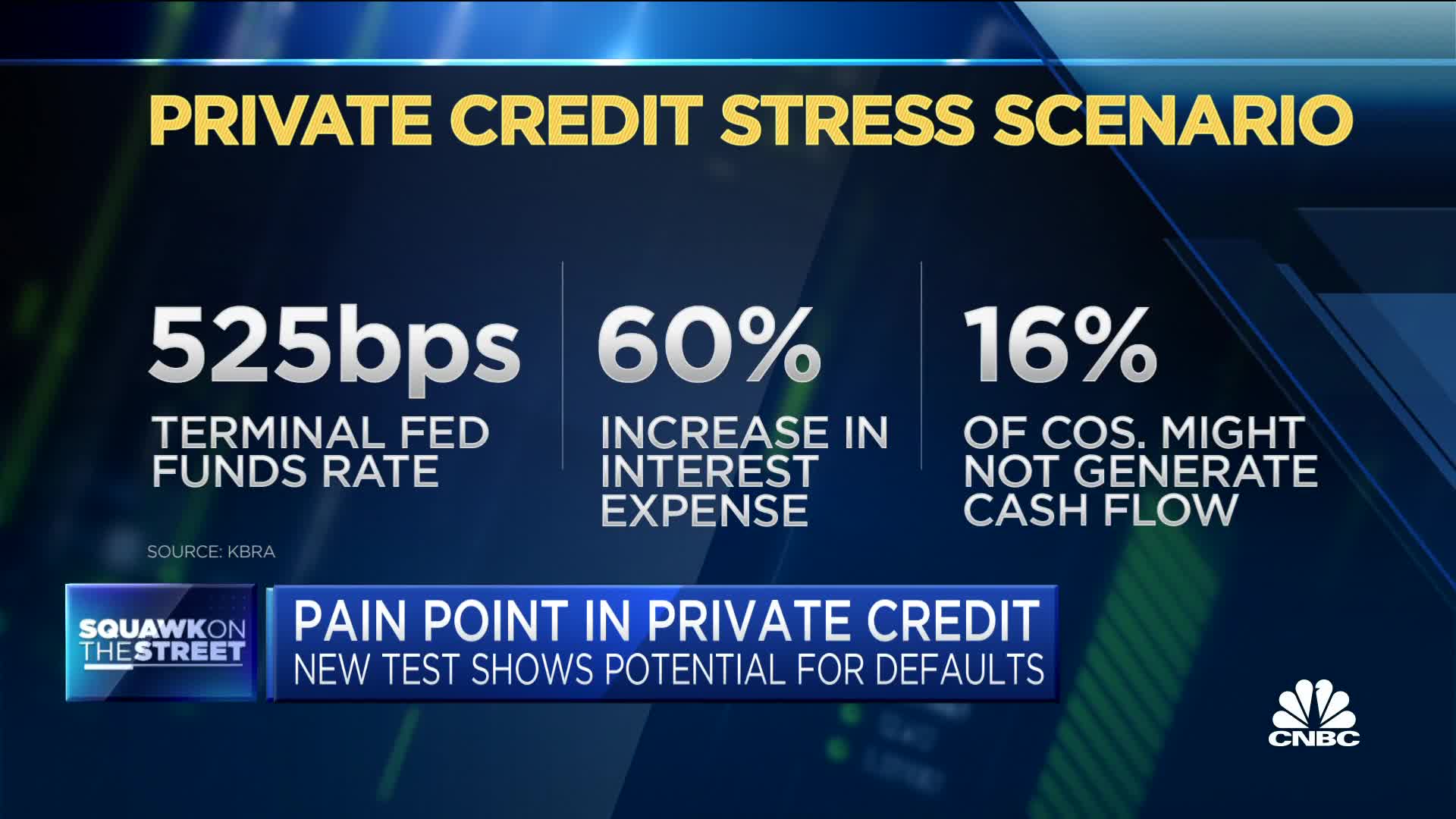

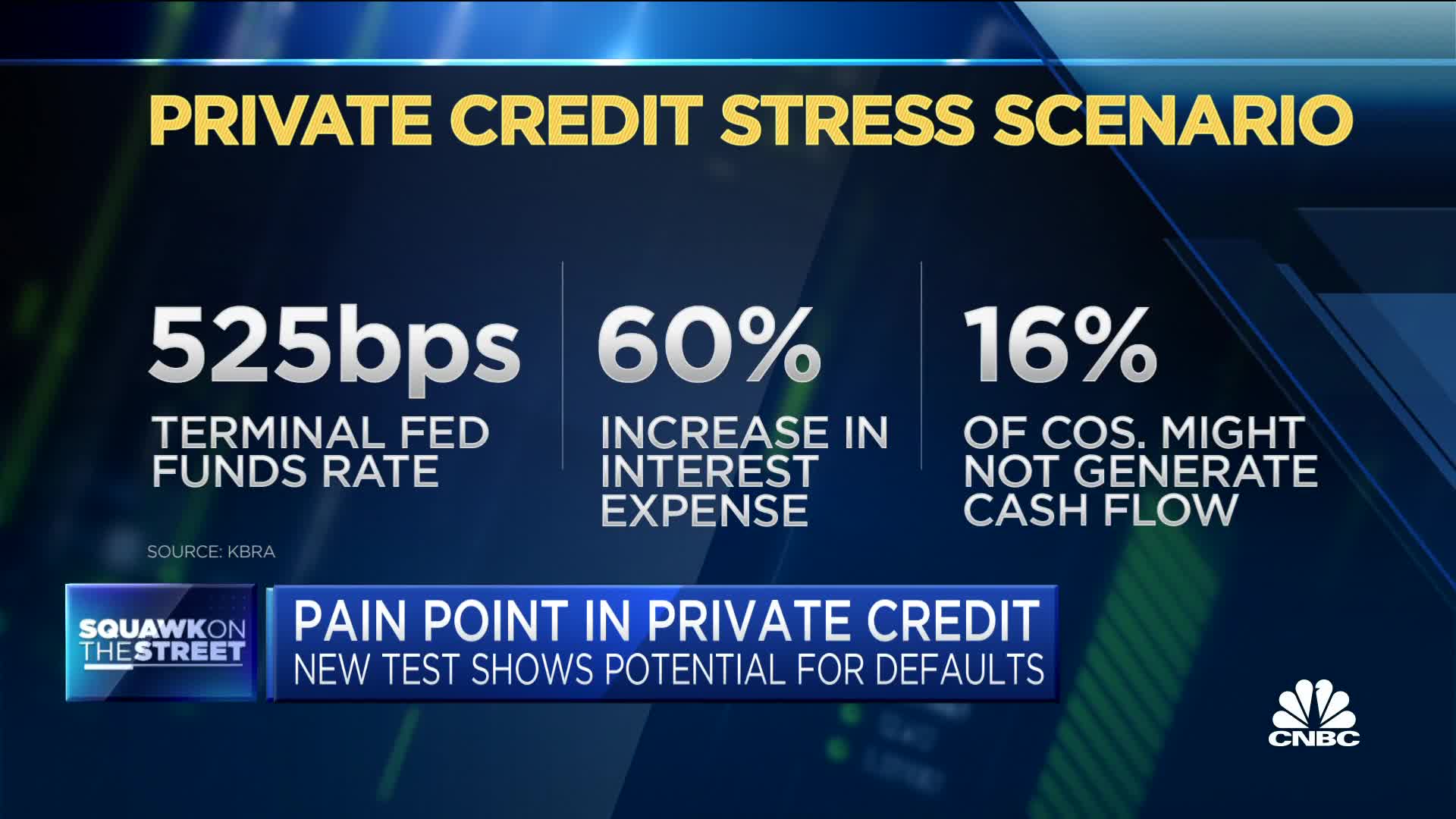

- Risk Management: A strong understanding of various risk factors, including interest rate risk, credit risk, and market risk, and the strategies to mitigate them. Strong analytical and problem-solving skills are crucial for identifying and addressing these risks in private credit underwriting.

Network Strategically within the Private Credit Industry

Networking is crucial for landing a private credit job. Building relationships within the industry opens doors to opportunities you might not otherwise find.

Attend Industry Conferences and Events

Actively participate in relevant industry events to expand your network.

- Relevant Conferences: Attend conferences like the SuperReturn, PEI, and other private credit focused events.

- Active Engagement: Don't just attend; actively engage with speakers and attendees, exchanging business cards and following up afterward.

Leverage LinkedIn and other Professional Platforms

Utilize online platforms to connect with professionals in the field.

- Professional LinkedIn Profile: Ensure your LinkedIn profile is up-to-date, professional, and highlights your relevant skills and experience.

- Engage in Relevant Groups: Join and actively participate in private credit-related LinkedIn groups and online forums.

Craft a Compelling Resume and Cover Letter Tailored to Private Credit Roles

Your resume and cover letter are your first impression. They must showcase your qualifications effectively to secure an interview for a private credit job.

Highlight Relevant Skills and Experience

Tailor your resume to emphasize skills and experience highly valued in private credit.

- Key Skills: Highlight your proficiency in financial modeling, credit analysis, due diligence, legal experience (if applicable), and any relevant software (e.g., Bloomberg Terminal).

- Experience: Showcase your experience in areas such as debt structuring, portfolio management, or credit risk assessment.

Quantify Achievements and Results

Use numbers to demonstrate the impact you've made in previous roles.

- Quantifiable Metrics: Instead of saying "improved efficiency," say "improved efficiency by 15% resulting in $X savings."

- Strong Verbs: Use strong action verbs to describe your accomplishments.

Prepare for Behavioral and Technical Interviews

Interview preparation is critical. Practice answering common questions and showcasing your knowledge of private credit market trends.

Practice Answering Common Interview Questions

Prepare for both behavioral and technical questions.

- Behavioral Questions: Practice answering questions about your strengths, weaknesses, teamwork experiences, and how you handle pressure.

- Technical Questions: Prepare for questions on financial modeling, credit analysis, and your understanding of different debt instruments.

Showcase your understanding of Private Credit Market Trends

Demonstrate your knowledge of current market conditions.

- Market Trends: Stay updated on interest rate changes, regulatory developments (e.g., Dodd-Frank), and overall market sentiment in the private debt market.

- Industry Publications: Read industry publications and follow key players in the private credit space.

Consider Further Education or Certifications

Enhance your credentials to stand out from the competition.

Relevant Certifications and Advanced Degrees

Consider pursuing certifications or advanced degrees to boost your qualifications.

- Relevant Certifications: The CFA charter, CAIA charter, and other relevant financial certifications can significantly enhance your profile.

- Advanced Degrees: An MBA or a specialized Master's degree in finance can improve your chances of securing a private credit job.

Securing Your Dream Private Credit Job

By mastering the fundamentals of private credit investing, networking effectively, crafting a compelling application, preparing thoroughly for interviews, and considering further education, you’ll significantly increase your chances of landing your dream private credit job during this boom. Start implementing these strategies today! Your dream private credit job awaits—take action now to secure your place in this rapidly growing industry.

Featured Posts

-

Open Ai And Chat Gpt Under The Ftcs Microscope

May 26, 2025

Open Ai And Chat Gpt Under The Ftcs Microscope

May 26, 2025 -

Andrew Forrest And Rio Tinto Clash Over Pilbaras Environmental Future

May 26, 2025

Andrew Forrest And Rio Tinto Clash Over Pilbaras Environmental Future

May 26, 2025 -

La Charentaise Histoire D Un Succes A Saint Brieuc

May 26, 2025

La Charentaise Histoire D Un Succes A Saint Brieuc

May 26, 2025 -

Elon Musks Dogecoin Exit Fact Or Fiction

May 26, 2025

Elon Musks Dogecoin Exit Fact Or Fiction

May 26, 2025 -

Beloved South Shields Biker Remembered By Hundreds At Funeral

May 26, 2025

Beloved South Shields Biker Remembered By Hundreds At Funeral

May 26, 2025

Latest Posts

-

The La Wildfire Betting Trend A Reflection Of Our Times

May 29, 2025

The La Wildfire Betting Trend A Reflection Of Our Times

May 29, 2025 -

French Consumer Spending Underwhelms In April Details And Analysis

May 29, 2025

French Consumer Spending Underwhelms In April Details And Analysis

May 29, 2025 -

Activision Blizzard Acquisition Ftc Appeals Court Decision

May 29, 2025

Activision Blizzard Acquisition Ftc Appeals Court Decision

May 29, 2025 -

French Consumer Spending Slows In April Lower Than Projected Growth

May 29, 2025

French Consumer Spending Slows In April Lower Than Projected Growth

May 29, 2025 -

Microsoft Activision Merger Ftc Launches Appeal

May 29, 2025

Microsoft Activision Merger Ftc Launches Appeal

May 29, 2025