5 Key Actions To Secure A Private Credit Role

Table of Contents

Mastering the Fundamentals of Private Credit

To excel in a private credit role, a strong foundation in the field is paramount. This involves understanding various structures, mastering financial modeling techniques, and grasping the legal and regulatory landscape.

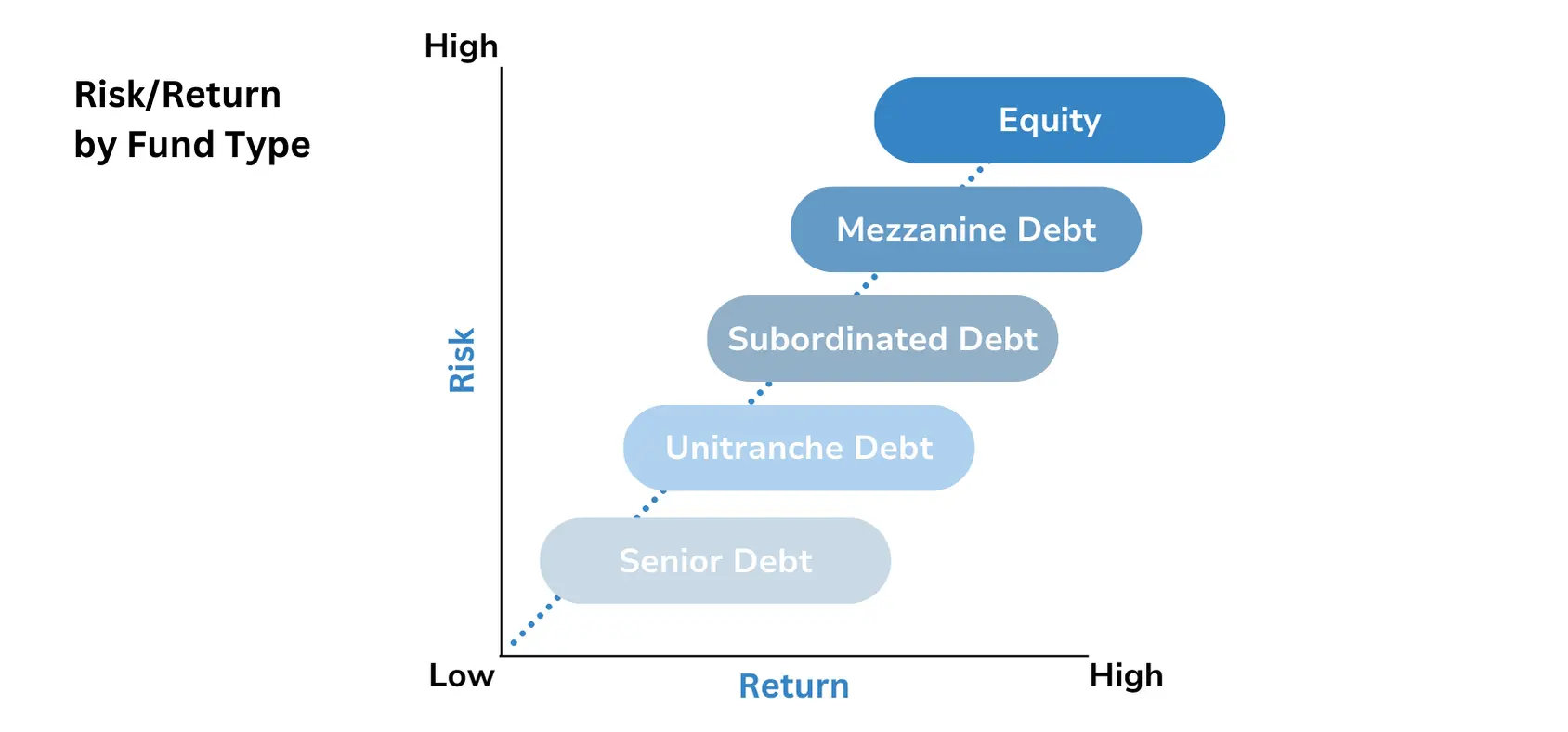

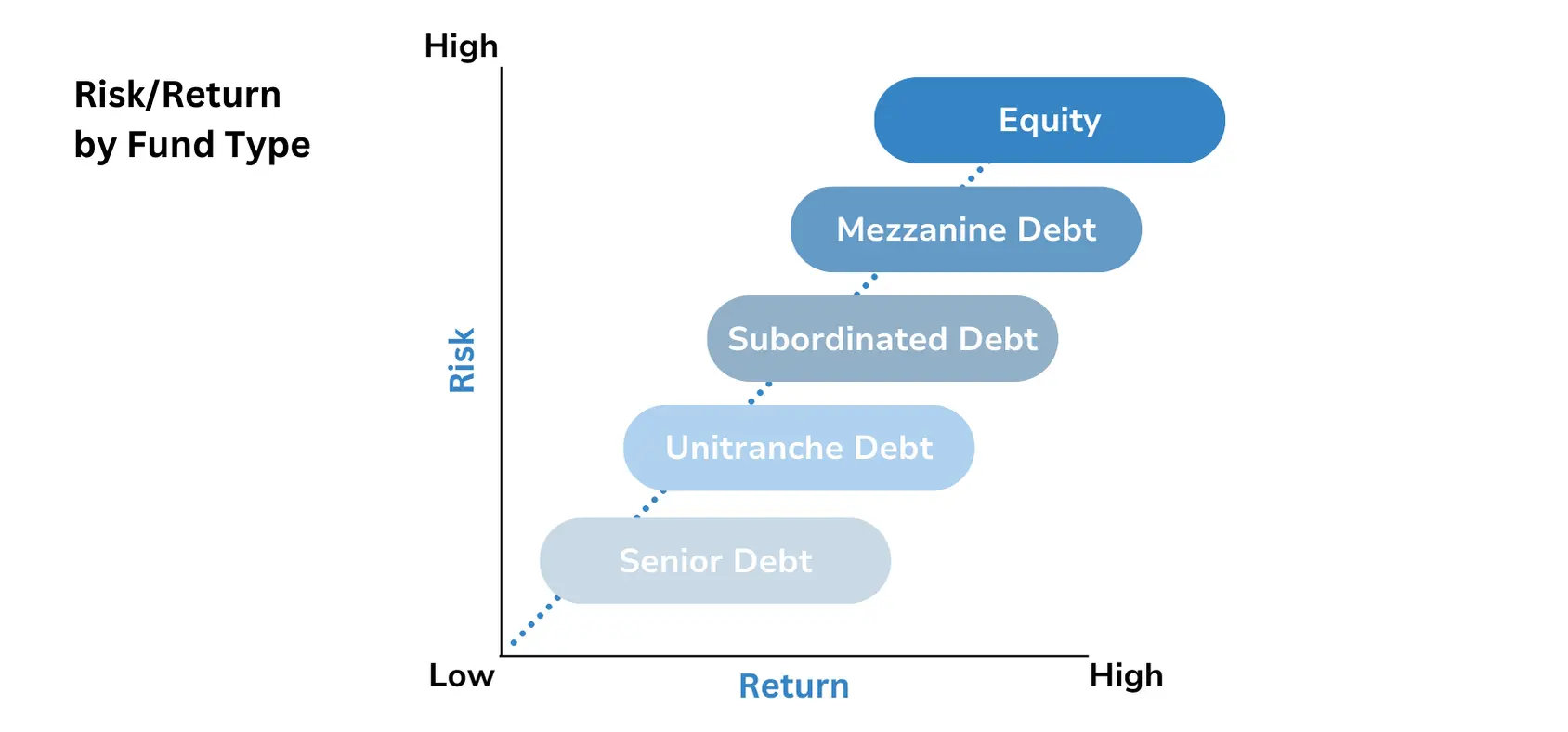

Understanding Private Credit Structures

Private credit encompasses diverse structures, each with unique characteristics. Understanding these differences is crucial.

- Direct Lending: Involves providing loans directly to borrowers, often bypassing traditional financial institutions. This requires strong credit analysis skills and an understanding of collateral valuation.

- Fund Investing: Involves investing in private credit funds, which pool capital from multiple investors to provide loans to various borrowers. This requires an understanding of fund structures, performance metrics, and risk management.

- Special Situations Investing: This focuses on distressed debt or companies undergoing restructuring. This requires a deep understanding of financial distress and turnaround strategies.

Demonstrating expertise through relevant certifications such as the Chartered Financial Analyst (CFA) charter or coursework in private equity and venture capital will significantly enhance your application.

Developing Financial Modeling Skills

Advanced financial modeling is the cornerstone of private credit analysis. Proficiency in the following is essential:

- Essential Software: Excel (including advanced functions like VBA), Bloomberg Terminal, Argus.

- Key Techniques: Discounted Cash Flow (DCF) analysis, Leveraged Buyout (LBO) modeling, sensitivity analysis, waterfall modeling.

Your ability to build robust financial models, forecast cash flows, and assess risk will be crucial in securing a private credit role.

Grasping Legal and Regulatory Aspects

Navigating the legal and regulatory frameworks governing private credit is vital. A strong understanding of:

- Credit Agreements: Thorough knowledge of loan terms, covenants, and security packages is essential.

- Loan Documentation: Familiarity with the intricacies of loan agreements, security documents, and other legal paperwork is crucial for successful due diligence.

- Regulatory Compliance: Understanding relevant regulations such as KYC/AML compliance is vital for ethical and legal operations.

This knowledge demonstrates your commitment to responsible and compliant practices.

Building a Strong Network in Private Credit

Networking is crucial in securing a private credit role. Building relationships within the industry can open doors to unadvertised opportunities and provide valuable insights.

Networking Events and Conferences

Attending industry events allows you to connect directly with professionals. Consider events like:

- Industry Conferences: Search for private equity and credit-focused conferences.

- Networking Groups: Join professional organizations related to finance, private equity, and credit.

- Informational Interviews: Reach out to professionals for informational interviews to gain insights and build relationships.

Leveraging Online Platforms

LinkedIn is an invaluable tool.

- Optimize Your Profile: Use keywords like "private credit," "credit analysis," "due diligence," and "portfolio management." Highlight your skills and experience.

- Join Relevant Groups: Engage in discussions and connect with professionals in private credit.

Cultivating Mentorship Relationships

Seeking guidance from experienced professionals can offer invaluable insights and support.

- Identify Potential Mentors: Reach out to individuals who work in private credit roles that you admire.

- Build Long-Term Relationships: Nurture these relationships for ongoing support and guidance.

Crafting a Compelling Resume and Cover Letter for Private Credit

Your resume and cover letter are your first impression. They must effectively highlight your qualifications for a private credit role.

Highlighting Relevant Experience

Tailor your resume to showcase relevant skills and experience using keywords like:

- Keywords: "credit analysis," "due diligence," "portfolio management," "loan structuring," "financial modeling," "risk assessment."

- Quantifiable Achievements: Focus on results – quantify your accomplishments whenever possible.

Showcasing Technical Skills

Demonstrate your proficiency in:

- Software: List software proficiency: Excel, Bloomberg Terminal, Argus, etc.

- Analytical Techniques: Highlight expertise in DCF analysis, LBO modeling, and other relevant techniques.

Writing a Persuasive Cover Letter

Your cover letter should express your enthusiasm for private credit.

- Strong Opening: Clearly state your interest in the specific role and company.

- Compelling Closing: Reiterate your qualifications and enthusiasm.

- Specific Examples: Provide concrete examples of how your skills align with the job requirements.

Acing the Private Credit Interview Process

The interview process is critical. Preparation and confident presentation are essential.

Preparing for Behavioral Questions

Practice answering common behavioral questions using the STAR method (Situation, Task, Action, Result).

- Example Questions: "Tell me about a time you failed," "Describe a challenging project," "How do you handle pressure?"

Demonstrating Technical Proficiency

Be ready to showcase your technical skills.

- Prepare Examples: Have specific examples prepared to illustrate your expertise.

- Explain Clearly: Be able to explain complex concepts simply and concisely.

Asking Thoughtful Questions

Asking insightful questions demonstrates your interest and knowledge.

- Example Questions: "What are the firm's investment strategies?" "What are the biggest challenges facing the team?"

Negotiating Your Private Credit Offer

Once you receive an offer, be prepared to negotiate effectively.

Researching Market Rates

Understand market salary ranges for private credit roles using resources like Glassdoor and Payscale.

Preparing Your Negotiation Strategy

Develop a clear and confident negotiation strategy.

- Tactics: Know your worth and be prepared to justify your desired compensation.

- Professionalism: Maintain a respectful and professional demeanor throughout the negotiation process.

Understanding the Total Compensation Package

Consider the entire compensation package, including:

- Benefits: Health insurance, retirement plans, paid time off.

- Bonuses: Performance-based bonuses and other incentives.

- Perks: Company car, professional development opportunities.

Securing Your Dream Private Credit Role

By mastering these five key actions – mastering the fundamentals, building a strong network, crafting a compelling application, acing the interview, and negotiating effectively – you'll significantly enhance your chances of securing a rewarding and challenging private credit role. Start building your network and honing your skills today!

Featured Posts

-

Why Jeff Goldblum Wanted A Different Ending For The Fly

Apr 29, 2025

Why Jeff Goldblum Wanted A Different Ending For The Fly

Apr 29, 2025 -

Willie Nelson Announces New Album Oh What A Beautiful World

Apr 29, 2025

Willie Nelson Announces New Album Oh What A Beautiful World

Apr 29, 2025 -

Grim Retail Sales Figures Fuel Speculation Of Looming Rate Cuts

Apr 29, 2025

Grim Retail Sales Figures Fuel Speculation Of Looming Rate Cuts

Apr 29, 2025 -

How To Get Capital Summertime Ball 2025 Tickets Official And Resale Options

Apr 29, 2025

How To Get Capital Summertime Ball 2025 Tickets Official And Resale Options

Apr 29, 2025 -

How U S Companies Are Responding To Tariff Uncertainty A Focus On Cost Reduction

Apr 29, 2025

How U S Companies Are Responding To Tariff Uncertainty A Focus On Cost Reduction

Apr 29, 2025

Latest Posts

-

Nba Playoffs Magic Johnson Weighs In On Knicks Pistons Series

May 12, 2025

Nba Playoffs Magic Johnson Weighs In On Knicks Pistons Series

May 12, 2025 -

Knicks Vs Pistons Magic Johnsons Bold Playoff Prediction

May 12, 2025

Knicks Vs Pistons Magic Johnsons Bold Playoff Prediction

May 12, 2025 -

Zeygaria Kai Imerominies Agonon Nba Playoffs 2024

May 12, 2025

Zeygaria Kai Imerominies Agonon Nba Playoffs 2024

May 12, 2025 -

Magic Johnson Predicts The Winner Knicks Vs Pistons Playoffs

May 12, 2025

Magic Johnson Predicts The Winner Knicks Vs Pistons Playoffs

May 12, 2025 -

Nba Playoffs Pliris Enimerosi Gia Zeygaria Kai Agones

May 12, 2025

Nba Playoffs Pliris Enimerosi Gia Zeygaria Kai Agones

May 12, 2025