5 Key Actions To Secure A Role In Today's Booming Private Credit Market

Table of Contents

Develop Specialized Private Credit Expertise

To stand out in the competitive private credit market, you need to demonstrate a deep understanding of its intricacies. This requires a multifaceted approach to skill development.

Master the Fundamentals

A strong foundation is crucial. Focus on acquiring expertise in these key areas:

- Credit Analysis: Learn to assess the creditworthiness of borrowers, understand financial statements, and build robust credit models. This includes mastering techniques like cash flow analysis, debt capacity modeling, and sensitivity analysis.

- Financial Modeling: Proficiency in building detailed financial models is paramount. You'll need to be adept at forecasting cash flows, valuing assets, and performing scenario analysis. Software skills like Excel and specialized financial modeling platforms are essential.

- Legal Aspects of Private Credit Transactions: Understand the legal framework governing private credit transactions, including loan agreements, security documents, and regulatory compliance. Familiarize yourself with concepts like covenants, collateral, and default procedures.

- Specific Private Credit Niches: Develop expertise in specific areas within private credit, such as leveraged finance, distressed debt investing, or direct lending. Each area has unique characteristics and requires specialized knowledge.

Utilize resources like online courses from platforms like Coursera and edX, pursue industry certifications such as the Chartered Financial Analyst (CFA) designation, and consider relevant academic programs, such as an MBA with a focus in finance.

Stay Updated on Market Trends

The private credit market is constantly evolving. Keeping abreast of the latest trends is essential for success:

- Follow Industry News: Subscribe to reputable financial news sources such as Bloomberg, Reuters, and The Wall Street Journal, paying close attention to articles related to private credit, private debt, and leveraged finance.

- Attend Industry Events: Participate in industry conferences, workshops, and networking events to learn from experts and connect with professionals. Look for events focused on private credit, direct lending, or alternative lending.

- Network Actively: Connect with industry professionals on LinkedIn and engage in online discussions related to private credit and alternative finance.

Understanding current market cycles, regulatory changes (like those impacting leveraged lending), and emerging trends will greatly enhance your credibility and marketability.

Network Strategically within the Private Credit Industry

Building a strong network is crucial in the private credit market. It's not just about knowing people; it's about building meaningful relationships.

Target Key Players

Focus your networking efforts on firms and individuals who are leaders in the private credit space.

- Research Firms: Identify firms specializing in private credit and research their investment strategies, recent transactions, and team members. This targeted approach will enable you to tailor your networking efforts effectively.

- Leverage LinkedIn: Use LinkedIn to connect with professionals working in private credit. Engage with their posts, participate in relevant groups, and send personalized connection requests.

- Attend Industry Events: Attend conferences and networking events specifically targeting private credit and alternative lending.

Cultivate Meaningful Relationships

Networking is not simply about collecting business cards; it’s about building genuine relationships.

- Informational Interviews: Seek informational interviews with professionals in the field to gain insights and learn about their career paths.

- Follow Up: Always follow up after networking events and informational interviews, demonstrating your genuine interest and commitment.

- Contribute to Industry Discussions: Share your insights and participate in online forums and discussions to build your reputation and establish yourself as a thought leader.

Craft a Compelling Resume and Cover Letter

Your resume and cover letter are your first impression. Make them count.

Highlight Relevant Skills and Experience

Your resume should clearly demonstrate your understanding of private credit concepts.

- Tailor Your Resume: Customize your resume for each job application, emphasizing the skills and experience most relevant to the specific role and firm.

- Quantify Your Achievements: Use quantifiable metrics to showcase your accomplishments and demonstrate your impact in previous roles. For example, instead of saying "Improved efficiency," say "Improved efficiency by 15%."

- Use Industry Terminology: Incorporate relevant private credit terminology throughout your resume, showing your familiarity with the industry’s language.

Showcase Your Passion for Private Credit

Your cover letter should convey your enthusiasm for the private credit market.

- Express Your Enthusiasm: Clearly express your interest in the specific firm and the private credit industry in your cover letter.

- Demonstrate Market Understanding: Showcase your understanding of current market trends and challenges within the private credit sector.

- Highlight Unique Skills: Emphasize your unique skills and experiences that make you a strong candidate.

Ace the Private Credit Interview Process

The interview process is your opportunity to shine and demonstrate your qualifications.

Prepare for Technical Questions

Private credit interviews often involve rigorous technical questioning.

- Practice Financial Modeling: Brush up on your financial modeling skills and be prepared to demonstrate your abilities through case studies or hypothetical scenarios.

- Research the Firm: Thoroughly research the firm's investment strategies, recent transactions, and portfolio companies.

- Discuss Market Trends: Be prepared to discuss current market trends and your perspective on the future of the private credit market. Show you’ve thought critically about the sector.

Showcase Your Soft Skills

Technical skills are essential, but soft skills are equally important.

- Communication Skills: Demonstrate strong communication skills by articulating your thoughts clearly and concisely.

- Teamwork: Highlight your ability to work effectively in a team environment.

- Problem-Solving: Showcase your analytical skills and ability to solve complex problems.

Consider Alternative Pathways into the Private Credit Market

If a direct entry into private credit is challenging, consider these alternative routes:

Explore Related Roles

Gain experience in related fields that can provide a solid foundation for a career in private credit.

- Investment Banking: Experience in leveraged finance or debt capital markets within an investment bank provides excellent preparation.

- Asset Management: Roles in credit analysis or portfolio management at larger asset management firms can offer valuable experience.

- Accounting: A strong accounting background can be highly valuable in understanding financial statements and performing credit analysis.

Pursue Further Education

Advanced education can significantly enhance your qualifications.

- MBA: An MBA, especially with a concentration in finance, can provide a comprehensive understanding of financial markets and business strategy.

- Specialized Master's Degrees: Consider a master's degree in finance, financial engineering, or a related field.

- Networking Opportunities: Look for programs that offer strong networking opportunities with private credit professionals.

Conclusion

Securing a position in the booming private credit market requires a multifaceted approach. By developing specialized expertise, networking effectively, crafting a compelling application, mastering the interview process, and exploring alternative pathways, you significantly increase your chances of success. Don't delay – take action today to launch your career in the dynamic world of the private credit market. Start by focusing on building your private credit knowledge and networking with professionals in the field. The opportunities are vast, and the rewards are significant.

Featured Posts

-

Wolves In The North State A Growing Problem

May 23, 2025

Wolves In The North State A Growing Problem

May 23, 2025 -

Why Middle Managers Are Valuable Benefits For Companies And Employees

May 23, 2025

Why Middle Managers Are Valuable Benefits For Companies And Employees

May 23, 2025 -

Space Crystals And Pharmaceutical Advancements A New Frontier

May 23, 2025

Space Crystals And Pharmaceutical Advancements A New Frontier

May 23, 2025 -

Emergency Airlift Saving Cows In A Remote Swiss Village

May 23, 2025

Emergency Airlift Saving Cows In A Remote Swiss Village

May 23, 2025 -

Sunrise On The Reaping Kieran Culkin Cast As Caesar Flickerman

May 23, 2025

Sunrise On The Reaping Kieran Culkin Cast As Caesar Flickerman

May 23, 2025

Latest Posts

-

Wwe Wrestle Mania 41 Golden Belts Memorial Day Weekend Ticket Sale

May 23, 2025

Wwe Wrestle Mania 41 Golden Belts Memorial Day Weekend Ticket Sale

May 23, 2025 -

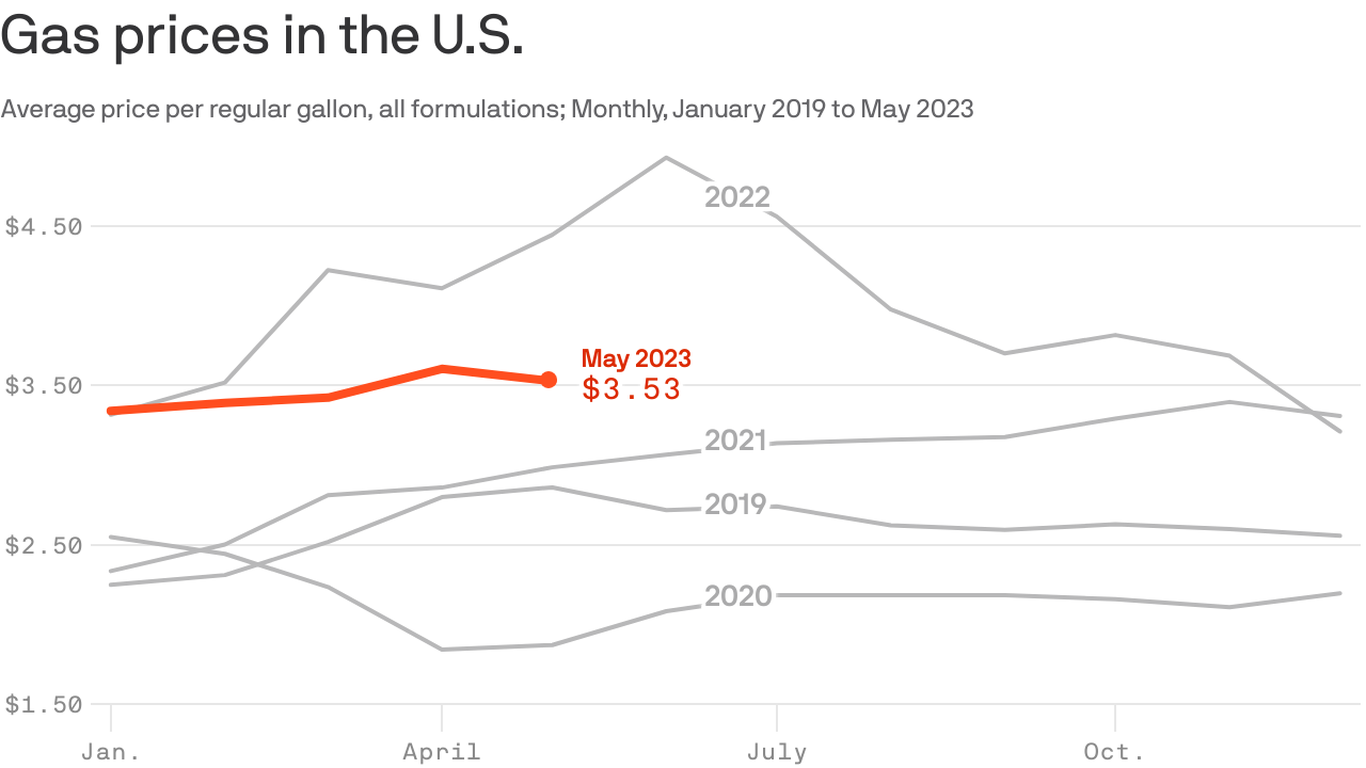

Memorial Day Gas Prices A Decade Low Forecast

May 23, 2025

Memorial Day Gas Prices A Decade Low Forecast

May 23, 2025 -

Record Low Gas Prices Predicted For Memorial Day Weekend

May 23, 2025

Record Low Gas Prices Predicted For Memorial Day Weekend

May 23, 2025 -

Memorial Day Weekend Gas Prices At Multi Decade Lows

May 23, 2025

Memorial Day Weekend Gas Prices At Multi Decade Lows

May 23, 2025 -

Memorial Day Gas Prices A Decade Low

May 23, 2025

Memorial Day Gas Prices A Decade Low

May 23, 2025