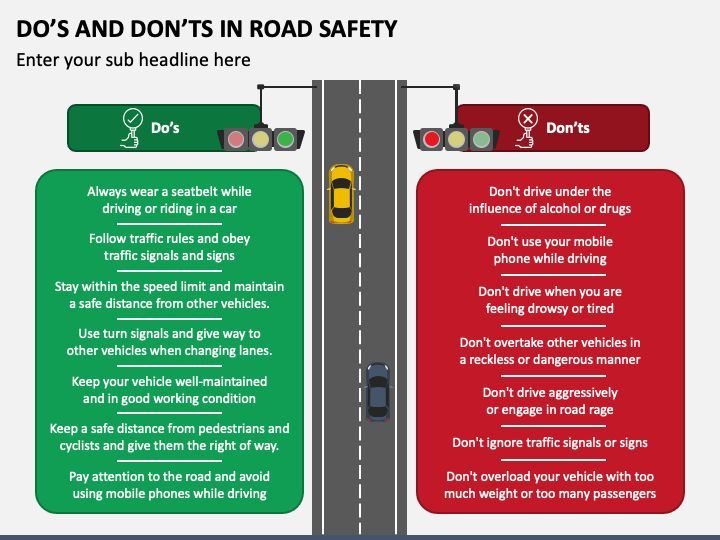

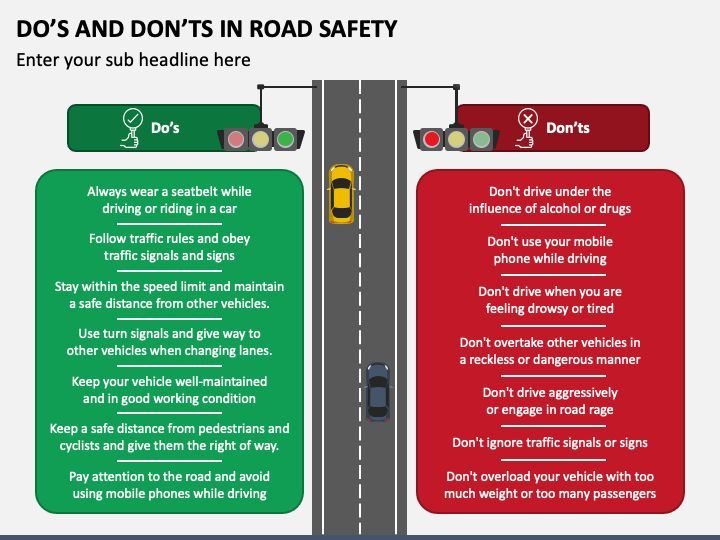

5 Key Do's & Don'ts: Securing A Private Credit Job

Table of Contents

Do's: Mastering the Essentials for Private Credit Success

Develop Specialized Skills & Knowledge

Possessing in-depth knowledge is crucial for private credit roles. You need a strong foundation in several key areas to stand out from the competition. Proficiency goes beyond theoretical understanding; you need practical application skills.

- Financial Modeling: Mastering advanced Excel skills and financial modeling techniques is paramount. You'll be building complex models to analyze investment opportunities.

- Credit Analysis: Develop expertise in evaluating creditworthiness, understanding credit risk, and assessing the financial health of borrowers.

- Due Diligence: Thorough due diligence is essential. This involves verifying information, identifying potential risks, and assessing the viability of investment opportunities.

- Leveraged Buyouts (LBOs) & LBO Modeling: Understanding the intricacies of leveraged buyouts and creating accurate LBO models is crucial for many private credit roles.

- Valuation Techniques: Proficiency in various valuation methods (DCF, precedent transactions, etc.) is vital for assessing the fair market value of assets.

- Portfolio Management: Understanding portfolio construction, risk management, and performance measurement is essential for managing a diverse portfolio of private credit investments.

- Debt Restructuring: Experience or knowledge in debt restructuring is highly valuable, particularly in distressed debt situations.

You'll also need to be proficient in specific software, such as Excel (including advanced functions like VBA), and potentially Bloomberg Terminal. Relevant certifications like the CFA (Chartered Financial Analyst) or CAIA (Chartered Alternative Investment Analyst) can significantly boost your credentials. Remember, the private credit industry is constantly evolving, so continuous learning is essential for staying ahead.

Network Strategically Within the Private Credit Industry

Networking is crucial for uncovering hidden job opportunities and building valuable relationships within the private credit industry. Don't underestimate the power of your connections.

- Attend Industry Events: Conferences, seminars, and workshops offer excellent opportunities to meet professionals and learn about new opportunities.

- Join Relevant Professional Organizations: The CFA Institute and the Association for Corporate Growth (ACG) are valuable resources for networking and professional development.

- Utilize LinkedIn Effectively: Optimize your LinkedIn profile, connect with professionals in the field, and engage in relevant discussions.

- Informational Interviews: Reach out to professionals for informational interviews to learn more about their careers and gain insights into the industry.

Remember that quality connections are more valuable than quantity. Focus on building genuine relationships with people you admire and respect. Always follow up after networking events and informational interviews to maintain those connections.

Craft a Compelling Resume and Cover Letter

Your resume and cover letter are your first impression. They need to showcase your relevant experience and skills effectively to secure an interview.

- Quantifiable Achievements: Instead of simply listing your responsibilities, highlight your accomplishments using quantifiable metrics (e.g., "Increased portfolio returns by 15%").

- Keywords Aligned with Job Descriptions: Use keywords from the job description to ensure your application gets noticed by Applicant Tracking Systems (ATS).

- Strong Action Verbs: Use strong action verbs to describe your responsibilities and accomplishments (e.g., "Managed," "Developed," "Implemented").

- Concise and Impactful Language: Keep your resume and cover letter concise and easy to read. Focus on the most relevant information.

- Highlight Private Credit-Specific Experience: Emphasize any experience you have in private credit, even if it's from internships or previous roles.

Tailor your resume and cover letter for each specific job application. Understanding how Applicant Tracking Systems (ATS) work is essential for maximizing your chances of getting noticed.

Don'ts: Common Mistakes to Avoid in Your Private Credit Job Search

Neglecting to Research the Firm and Role

Thorough research is critical before applying and interviewing. Demonstrating a lack of knowledge reflects poorly on your interest and preparedness.

- Understand the Firm's Investment Strategy: Research the firm's investment thesis, target sectors, and typical deal sizes.

- Analyze Recent Deals: Familiarize yourself with the firm's recent transactions and investment successes.

- Investigate Team Structure: Understand the team dynamics and the roles of different team members.

- Research the Interviewer's Background: Learn about the interviewer's experience and expertise to tailor your responses accordingly.

Failing to show sufficient knowledge of the firm and position demonstrates a lack of genuine interest and preparation, significantly harming your chances.

Underestimating the Importance of Behavioral Questions

Behavioral questions assess your past performance to predict your future behavior. Practice answering these questions effectively.

- STAR Method: Use the STAR method (Situation, Task, Action, Result) to structure your answers and provide concrete examples.

- Demonstrate Problem-Solving: Showcase your ability to analyze problems, develop solutions, and achieve positive outcomes.

- Highlight Teamwork and Collaboration: Provide examples of successful teamwork and collaboration experiences.

- Showcase Leadership Skills: Describe instances where you demonstrated leadership qualities and effectively managed teams or projects.

- Explain How You Handle Pressure: Share examples of how you've handled stressful situations and managed pressure effectively.

Prepare for common behavioral questions like "Tell me about a time you failed," "Describe a challenging project," or "How do you handle conflict?" Practice your answers to ensure you can deliver concise and impactful responses.

Failing to Ask Thoughtful Questions

Asking insightful questions demonstrates your engagement and understanding of the role and the firm.

- Demonstrate Your Interest: Show genuine interest in the role, the team, and the firm's culture.

- Show Strategic Thinking: Ask questions that reveal your understanding of the firm's investment strategy and the challenges it faces.

- Avoid Easily Researchable Questions: Avoid questions that can be easily answered through basic online research.

Prepare a list of strong questions that demonstrate your deep understanding and strategic thinking. Examples include questions about the firm's future investment plans, its approach to risk management, or its culture and employee development initiatives.

Conclusion

Securing a private credit job requires careful preparation and a strategic approach. By following these do's and don'ts—mastering essential skills, networking effectively, crafting compelling application materials, researching thoroughly, and preparing for insightful interviews—you significantly increase your chances of landing your dream private credit role. Remember, continuous learning and a proactive approach are key to success in this dynamic field. Start honing your skills and begin your journey to securing a rewarding private credit job today!

Featured Posts

-

Real Madrid De Klopp Olasi Bir Senaryo Ve Etkileri

May 22, 2025

Real Madrid De Klopp Olasi Bir Senaryo Ve Etkileri

May 22, 2025 -

The Versatile Uses Of Cassis Blackcurrant In Cocktails And Cuisine

May 22, 2025

The Versatile Uses Of Cassis Blackcurrant In Cocktails And Cuisine

May 22, 2025 -

Fans Discover Peppa Pigs Hidden Identity A New Sibling Arrives

May 22, 2025

Fans Discover Peppa Pigs Hidden Identity A New Sibling Arrives

May 22, 2025 -

Reduced Executive Pay At Bp A 31 Decrease

May 22, 2025

Reduced Executive Pay At Bp A 31 Decrease

May 22, 2025 -

Cassis Blackcurrant Cocktails A Mixologists Guide

May 22, 2025

Cassis Blackcurrant Cocktails A Mixologists Guide

May 22, 2025

Latest Posts

-

Casper Residents Shocking Boat Lift Discovery Thousands Of Zebra Mussels

May 22, 2025

Casper Residents Shocking Boat Lift Discovery Thousands Of Zebra Mussels

May 22, 2025 -

Colorado Gray Wolf Dies In Wyoming Second Loss For Reintroduction Program

May 22, 2025

Colorado Gray Wolf Dies In Wyoming Second Loss For Reintroduction Program

May 22, 2025 -

Wyoming Otter Conservation A Pivotal Moment In Management

May 22, 2025

Wyoming Otter Conservation A Pivotal Moment In Management

May 22, 2025 -

Death Of Second Translocated Colorado Gray Wolf In Wyoming

May 22, 2025

Death Of Second Translocated Colorado Gray Wolf In Wyoming

May 22, 2025 -

A Turning Point For Otter Management In Wyoming New Strategies And Conservation Efforts

May 22, 2025

A Turning Point For Otter Management In Wyoming New Strategies And Conservation Efforts

May 22, 2025