5 Key Dos And Don'ts To Secure A Private Credit Role

Table of Contents

Do: Network Strategically within the Private Credit Industry

Networking is paramount in the private credit industry. Building relationships with key players can significantly boost your chances of finding and securing a private credit role.

Attend Industry Events

Actively participate in conferences, workshops, and networking events focused on private credit, leveraged finance, or alternative investments.

- Build relationships with professionals: Don't just attend; engage! Start conversations, exchange business cards, and follow up with meaningful connections after the event.

- Learn about emerging trends: Industry events provide invaluable insights into the latest trends and challenges in private credit, keeping you ahead of the curve. This knowledge will impress potential employers.

- Showcase your expertise: Prepare a concise and engaging elevator pitch highlighting your skills and experience relevant to private credit. Target events specifically related to your area of interest (e.g., real estate debt, mezzanine financing, distressed debt).

Leverage LinkedIn Effectively

LinkedIn is your professional online presence; optimize it to attract recruiters and hiring managers in the private credit space.

- Connect with recruiters and professionals: Identify recruiters specializing in private credit and connect with them. Similarly, connect with professionals working in roles you aspire to.

- Join relevant LinkedIn groups: Participate actively in discussions, share insightful comments, and establish yourself as a thought leader within the private credit community. This demonstrates your passion and knowledge.

- Use keywords strategically: Incorporate keywords throughout your profile, including terms like "private debt," "credit analysis," "alternative lending," "leveraged finance," "distressed debt," and "private equity," depending on your specialization.

Do: Develop In-Demand Skills for a Private Credit Role

Possessing the right skills is crucial for success in a private credit role. Focus on developing expertise in these key areas:

Master Financial Modeling

Proficiency in financial modeling is essential for analyzing potential investments and presenting compelling investment theses.

- Learn advanced Excel skills: Master discounted cash flow (DCF) analysis, leveraged buyout (LBO) modeling, and other valuation techniques. Practice building complex models and interpreting the results.

- Understand sensitivity analysis: Demonstrate your ability to assess the impact of different variables on financial projections. This showcases your critical thinking skills.

- Utilize specialized software: Familiarize yourself with industry-standard financial modeling software to enhance your efficiency and skills.

Hone Credit Analysis Skills

Strong credit analysis skills are fundamental to assessing risk and making sound investment decisions.

- Credit underwriting expertise: Gain expertise in credit underwriting principles, including analyzing financial statements, assessing creditworthiness, and structuring debt facilities.

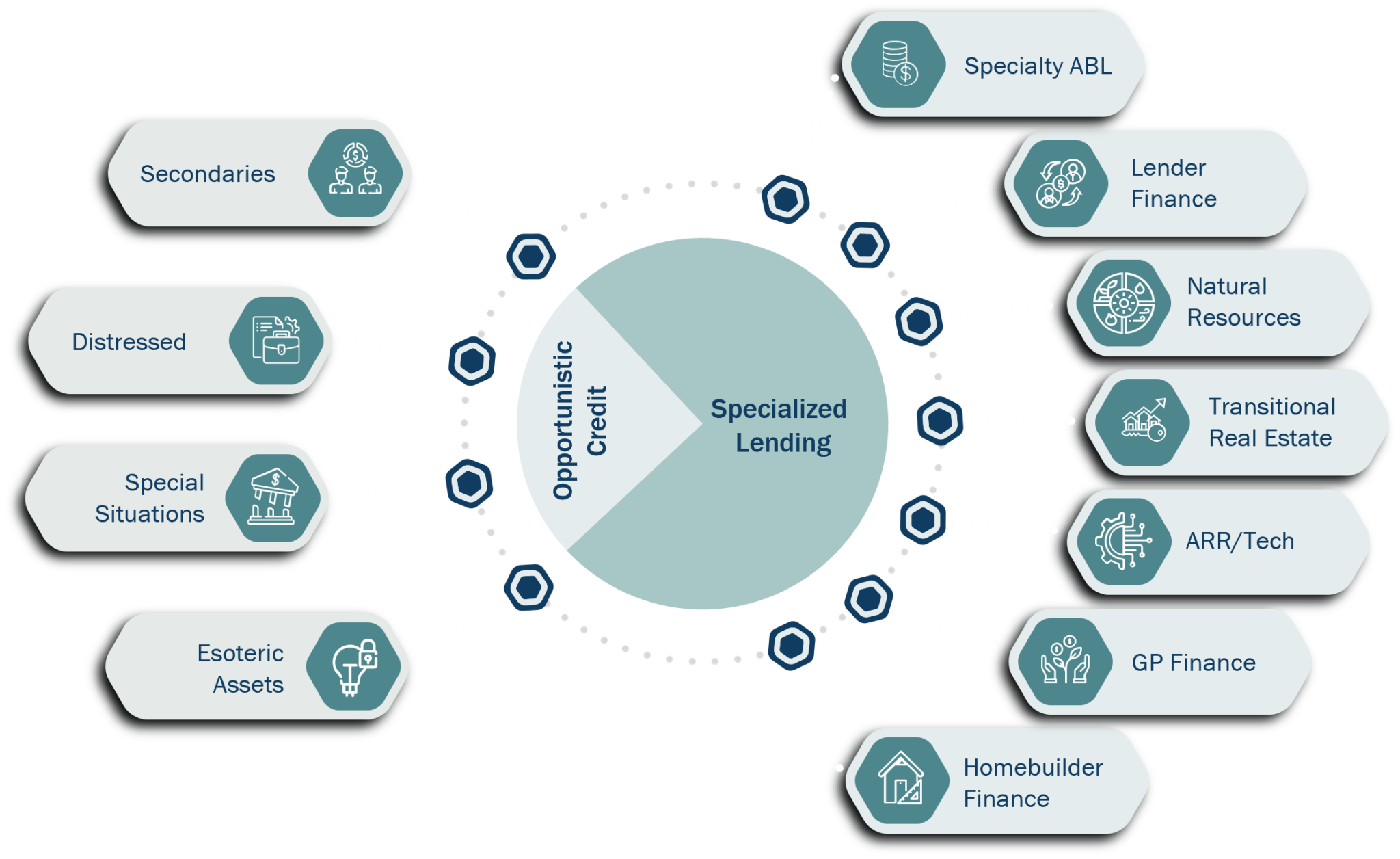

- Debt structuring knowledge: Understand the nuances of different types of credit facilities, such as senior secured loans, mezzanine financing, subordinated debt, and unitranche loans. Knowing the implications of each is critical.

- Covenant negotiation skills: Develop an understanding of covenant negotiation, ensuring the protection of investor interests.

Understand Legal and Regulatory Frameworks

Familiarity with the legal and regulatory landscape is vital for compliance and responsible investment practices.

- Study compliance requirements: Understand relevant regulations and best practices in private credit lending, particularly those related to due diligence and reporting.

- Legal document knowledge: Develop a strong understanding of legal documents, including credit agreements, loan agreements, and security documents.

Don't: Neglect the Importance of a Strong Resume and Cover Letter

Your resume and cover letter are your first impression; make them count.

Tailor Your Resume

Customize your resume to each specific private credit role you apply for. Highlight experiences and skills directly relevant to the job description.

- Use action verbs and quantifiable results: Instead of simply listing responsibilities, showcase your achievements using strong action verbs and quantifiable results (e.g., "Increased portfolio returns by 10%").

- Use keywords from the job description: Integrate keywords from the job description into your resume to improve your chances of getting past Applicant Tracking Systems (ATS).

Write a Compelling Cover Letter

A personalized cover letter demonstrates your understanding of the firm and your genuine interest in the private credit role.

- Showcase your research: Demonstrate you've researched the firm's investment strategy, portfolio companies, and recent transactions.

- Explain your career aspirations: Articulate your career goals within the private credit sector and how this specific role aligns with your aspirations.

Don't: Underestimate the Importance of the Interview Process

The interview process is your opportunity to showcase your skills and personality.

Prepare Thoroughly for Behavioral Questions

Practice answering common behavioral interview questions using the STAR method (Situation, Task, Action, Result).

- Highlight problem-solving skills: Provide specific examples of how you solved complex problems and overcame challenges in previous roles.

- Showcase teamwork and leadership abilities: Demonstrate your ability to work effectively in a team and lead projects successfully.

Showcase Your Technical Skills

Be prepared to discuss your technical skills in detail and demonstrate your understanding of private credit concepts.

- Practice financial modeling questions: Practice case studies and be prepared to walk through your modeling assumptions and conclusions.

- Discuss credit risk assessment: Demonstrate your understanding of credit risk assessment, including qualitative and quantitative factors.

Ask Thoughtful Questions

Asking insightful questions shows your genuine interest and initiative.

- Focus on the firm's investment strategy: Ask questions about their investment strategy, target sectors, and recent investments.

- Show you've done your research: Your questions should reflect your research and understanding of the firm.

Don't: Undersell Your Achievements

Always present your accomplishments in the best possible light.

Quantify Your Accomplishments

Use metrics to demonstrate the impact you had in previous roles. Instead of saying "Improved team efficiency," say "Improved team efficiency by 15% through process optimization." This clearly showcases your value.

Highlight Your Soft Skills

In addition to technical skills, highlight soft skills like communication, teamwork, and problem-solving, providing specific examples of how you utilized these skills in past roles.

Conclusion

Securing a private credit role is a challenging but achievable goal. By following these dos and don'ts, focusing on developing in-demand skills, networking effectively, and mastering the interview process, you can significantly increase your chances of success. Remember to tailor your application materials, showcase your accomplishments, and ask thoughtful questions. Don't delay – start working towards your dream private credit role today!

Featured Posts

-

The Case For Jimmy Butler How He Differs From Durant And Fills The Warriors Needs

May 16, 2025

The Case For Jimmy Butler How He Differs From Durant And Fills The Warriors Needs

May 16, 2025 -

Hl Yjme Twm Krwz Wana Dy Armas Qst Hb Hqyqyt

May 16, 2025

Hl Yjme Twm Krwz Wana Dy Armas Qst Hb Hqyqyt

May 16, 2025 -

Venezia Vs Napoles Transmision En Directo

May 16, 2025

Venezia Vs Napoles Transmision En Directo

May 16, 2025 -

Bidding Opens For La Ligas Uk And Ireland Broadcasting Rights

May 16, 2025

Bidding Opens For La Ligas Uk And Ireland Broadcasting Rights

May 16, 2025 -

Penarol Vs Olimpia Resumen Del Partido Goles Y Resultado Final 0 2

May 16, 2025

Penarol Vs Olimpia Resumen Del Partido Goles Y Resultado Final 0 2

May 16, 2025

Latest Posts

-

The Padres Challenge To The Dodgers Dominance

May 16, 2025

The Padres Challenge To The Dodgers Dominance

May 16, 2025 -

Padres Vs Pirates Mlb Game Prediction Picks And Betting Odds

May 16, 2025

Padres Vs Pirates Mlb Game Prediction Picks And Betting Odds

May 16, 2025 -

Rockies Aim To Snap 7 Game Losing Streak Against Padres

May 16, 2025

Rockies Aim To Snap 7 Game Losing Streak Against Padres

May 16, 2025 -

Padres Vs Dodgers Will The Padres Thwart The Dodgers Strategy

May 16, 2025

Padres Vs Dodgers Will The Padres Thwart The Dodgers Strategy

May 16, 2025 -

Padres Resistance To Dodgers Master Plan A Season Of Rivalry

May 16, 2025

Padres Resistance To Dodgers Master Plan A Season Of Rivalry

May 16, 2025