5 Key Dos And Don'ts To Succeed In The Private Credit Market

Table of Contents

Do Your Due Diligence: Thoroughly Investigate Potential Investments

Thorough due diligence is paramount in the private credit market. Skipping this crucial step can lead to significant losses. This involves a comprehensive investigation of both the borrower and the collateral offered.

Understanding the Borrower

Before committing capital, you must thoroughly understand the borrower's financial health and operational capabilities. This includes:

- Conducting comprehensive background checks: Investigate the borrower's financial history, creditworthiness, and management team's experience. Look for red flags such as past bankruptcies or significant legal issues.

- Analyzing their business model: Scrutinize the borrower's business model, industry position, and competitive landscape. Identify potential risks and opportunities associated with their operations. Understanding market trends and industry dynamics is essential.

- Utilizing credit reports and financial statements: Leverage credit reports, financial statements (including income statements, balance sheets, and cash flow statements), and industry benchmarks to inform your assessment. Compare the borrower's performance to industry averages and identify potential areas of concern.

Assessing the Collateral

The collateral offered secures the loan and mitigates potential losses in case of default. Therefore, a rigorous assessment is vital:

- Evaluating the quality and value: Thoroughly evaluate the quality and market value of any collateral offered as security. Consider the type of collateral (real estate, equipment, accounts receivable, etc.) and its potential for depreciation.

- Considering market fluctuations and liquidity: Account for market fluctuations and the liquidity of the collateral. Can the collateral be easily sold in case of default? What is the potential for price depreciation?

- Engaging independent appraisers: For complex assets, engaging independent appraisers to provide unbiased valuations is crucial to ensure an accurate assessment of the collateral's worth. This adds an extra layer of protection against overvaluation.

Don't Neglect Risk Management: Mitigate Potential Losses

Risk management is critical in the private credit market. Unforeseen events can significantly impact returns. Proactive measures are essential to mitigate potential losses.

Diversify Your Portfolio

Diversification is a cornerstone of effective risk management:

- Spread your investments: Spread your investments across multiple borrowers and industries to reduce the impact of individual defaults. Don't put all your eggs in one basket.

- Consider geographic diversification: Diversify geographically to mitigate regional economic risks. Economic downturns can impact specific regions disproportionately.

- Maintain a healthy balance: Maintain a healthy balance of risk tolerance and return expectations. Higher returns typically come with higher risks.

Implement Robust Monitoring Systems

Continuous monitoring of borrowers and market conditions is crucial:

- Regular monitoring: Regularly monitor the financial performance of your borrowers and the overall market conditions. This enables early detection of potential problems.

- Establish clear covenants: Establish clear covenants and reporting requirements to track key performance indicators (KPIs) such as debt service coverage ratio and leverage ratios.

- Address financial distress promptly: Address any signs of financial distress promptly and proactively. Early intervention can often prevent more significant losses.

Do Build Strong Relationships: Network and Collaborate

Building strong relationships is vital for success in the private credit market. Collaboration and networking can open doors to new opportunities and reduce risks.

Cultivate Relationships with Sponsors

Networking is key to accessing promising investment opportunities:

- Build strong relationships: Build strong relationships with experienced private equity sponsors and other key players in the private credit market.

- Attend industry events: Attending industry conferences and networking events can provide valuable connections and insights.

- Seek co-investment opportunities: Seek out opportunities for co-investment to expand your reach and mitigate risks by sharing the investment burden.

Leverage Legal and Financial Expertise

Seek expert advice to navigate the complexities of private credit transactions:

- Engage legal counsel: Engage experienced legal counsel specializing in private credit transactions to ensure compliance and protect your interests.

- Consult financial advisors: Consult with financial advisors to optimize portfolio allocation and risk management strategies.

- Partner with reputable service providers: Partner with reputable service providers for due diligence, valuation, and other critical functions.

Don't Underestimate Market Timing: Adapt to Shifting Conditions

Market conditions are constantly changing. Ignoring these shifts can lead to significant losses. Adaptability is key to navigating market volatility.

Stay Informed on Market Trends

Staying informed about market conditions is crucial:

- Monitor economic indicators: Continuously monitor economic indicators, interest rate changes, and regulatory developments that may impact the private credit market.

- Analyze market cycles: Analyze market cycles and adjust your investment strategy accordingly. Understanding economic cycles and their impact on different asset classes is vital.

- Stay updated on industry news: Stay updated on industry news and research to identify emerging opportunities and risks.

Be Prepared for Market Volatility

Prepare for unexpected market downturns:

- Develop contingency plans: Develop contingency plans to address unexpected market downturns. Having a plan B is crucial during periods of stress.

- Maintain sufficient liquidity: Have sufficient liquidity to withstand periods of stress and capitalize on distressed opportunities.

- Assess your risk appetite: Assess your risk appetite and adjust your investment approach to market conditions.

Do Focus on Long-Term Value Creation: Seek Sustainable Returns

While short-term gains may be tempting, focusing on long-term value creation leads to more sustainable returns in the private credit market.

Prioritize Sustainable Growth

Invest in companies with a clear path to sustainable growth:

- Invest in strong growth potential: Invest in companies with strong growth potential and a clear path to profitability. Focus on companies with a sustainable business model.

- Consider ESG factors: Consider ESG (Environmental, Social, and Governance) factors when assessing investment opportunities. ESG considerations are increasingly important for investors.

- Focus on long-term value: Look beyond short-term gains and focus on building long-term value. Patience is often rewarded in the private credit market.

Build a Reputation for Excellence

A strong reputation is invaluable in the private credit market:

- Maintain high ethical standards: Maintain high ethical standards and transparency in all your dealings. Trust is essential in this market.

- Deliver on commitments: Deliver on your commitments to borrowers and investors. Building a reputation for reliability is crucial.

- Earn a reputation for expertise: Earn a reputation for reliability and expertise in the private credit market. This will attract more opportunities.

Conclusion

Successfully navigating the private credit market demands meticulous planning, proactive risk management, and a long-term perspective. By adhering to these five key dos and don'ts – conducting thorough due diligence, actively managing risk, fostering strong relationships, adapting to market shifts, and prioritizing long-term value – you can significantly enhance your chances of achieving success in this competitive field. Don't delay in implementing these strategies to unlock the significant potential of the private credit market. Begin your journey towards success in the private credit market today!

Featured Posts

-

Jeanine Pirros Biography Exploring Her Education Career And Net Worth

May 10, 2025

Jeanine Pirros Biography Exploring Her Education Career And Net Worth

May 10, 2025 -

Investigation Into Police Conduct Nottingham Attacks

May 10, 2025

Investigation Into Police Conduct Nottingham Attacks

May 10, 2025 -

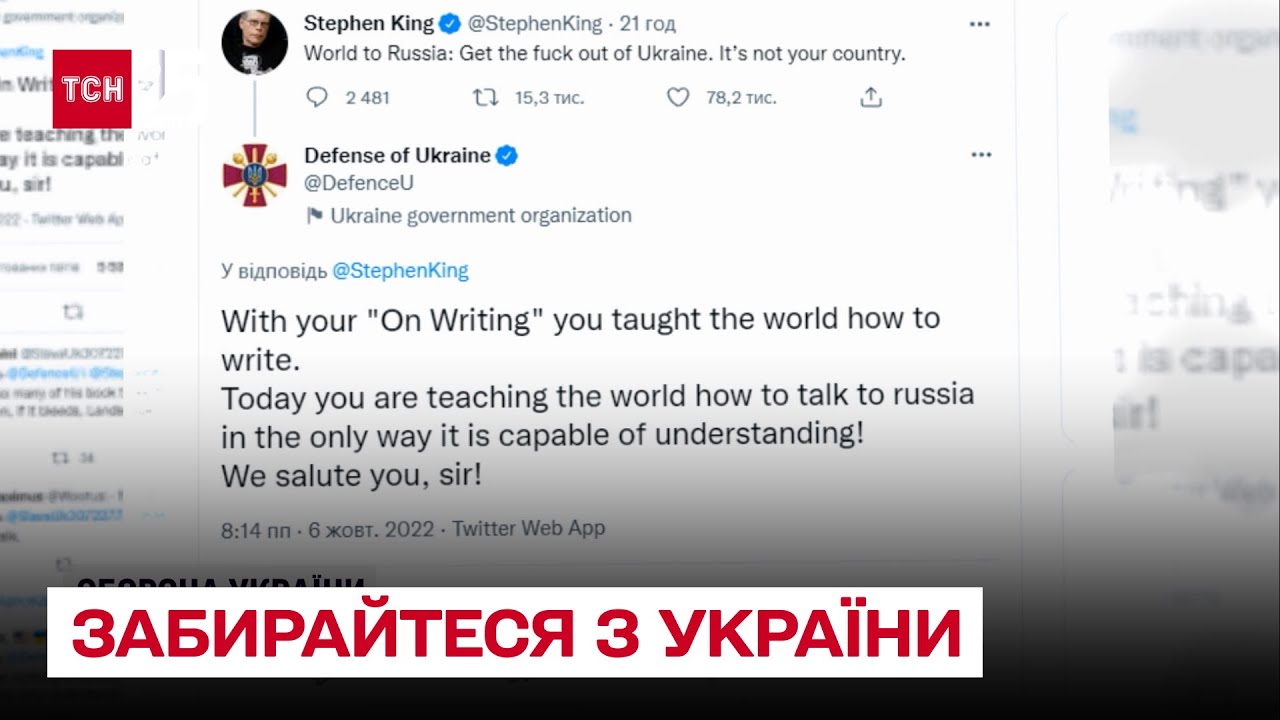

Stiven King Mask I Tramp Posibniki Putina

May 10, 2025

Stiven King Mask I Tramp Posibniki Putina

May 10, 2025 -

Nuclear Energy Collaboration A French Ministers Proposal For Europe

May 10, 2025

Nuclear Energy Collaboration A French Ministers Proposal For Europe

May 10, 2025 -

Derecho A Usar El Bano El Arresto De Una Universitaria Transgenero Desata Polemica

May 10, 2025

Derecho A Usar El Bano El Arresto De Una Universitaria Transgenero Desata Polemica

May 10, 2025