$500 Million IPO: EToro's Renewed Pursuit Of Capital

Table of Contents

Why eToro Needs a $500 Million IPO

eToro's planned $500 million IPO is not merely about raising capital; it's a strategic maneuver designed to fuel significant growth and solidify its market leadership. The substantial investment is crucial for several key reasons:

-

Fueling international expansion into new markets: eToro aims to expand its reach globally, tapping into new user bases and diversifying its revenue streams. This requires significant investment in localized marketing, regulatory compliance, and infrastructure. This eToro expansion strategy is vital in a competitive market.

-

Investing in technology upgrades and platform enhancements: The competitive landscape demands continuous innovation. A significant portion of the $500 million IPO funding will likely be allocated to enhancing the eToro platform through AI integration, improving the user experience (UX), and enhancing security features. This investment in technology is key to attracting and retaining users.

-

Increasing marketing and brand awareness campaigns: To attract new users, eToro needs robust marketing campaigns targeting diverse demographics and regions. The IPO funding will enable larger-scale advertising efforts, boosting brand awareness and user acquisition. This increased visibility is crucial in a crowded fintech market.

-

Enhancing its product offerings: eToro aims to broaden its appeal by expanding its offerings. This could involve adding new asset classes, improving existing investment tools, and introducing innovative trading features. The eToro growth strategy hinges on providing a comprehensive and competitive platform.

-

Strengthening its financial position: The fintech industry is inherently volatile. A larger capitalization, resulting from the eToro funding, allows the company to withstand market fluctuations and competitive pressures more effectively, ensuring financial stability.

This substantial investment is a strategic response to the intensifying competition within the online trading sector. The eToro capitalization boost will be crucial in maintaining its leading edge.

Potential Challenges and Risks Associated with the eToro IPO

While the potential benefits of a $500 million IPO are substantial, eToro faces several significant challenges and risks:

-

Market volatility and investor uncertainty impacting the IPO valuation: The overall market climate and investor sentiment will significantly influence the valuation eToro receives. Economic downturns or shifts in investor confidence could negatively impact the IPO's success.

-

Regulatory scrutiny and compliance challenges in different jurisdictions: Navigating the complexities of financial regulations across various international markets is a significant hurdle. Non-compliance can result in hefty fines and reputational damage.

-

Competition from other established brokerage firms and innovative fintech platforms: The online trading industry is highly competitive. Established players and innovative startups pose constant challenges, necessitating continuous innovation and adaptation by eToro.

-

Maintaining profitability and demonstrating sustainable growth to attract long-term investors: Sustained profitability and demonstrable growth are essential for attracting long-term investors. eToro must prove its business model's viability and its ability to deliver consistent returns.

-

Successfully navigating the complexities of the IPO process itself: The IPO process itself is demanding, involving numerous legal, financial, and logistical complexities. Effective management of this process is crucial for a successful outcome.

eToro needs to effectively address these concerns to secure a successful IPO and maintain investor confidence. The eToro valuation will heavily depend on its ability to convincingly showcase a strong future.

Impact of the $500 Million IPO on eToro's Future

A successful $500 million IPO could dramatically alter eToro's trajectory, unlocking significant opportunities:

-

Accelerated growth and expansion into new geographical markets: The increased capital will enable more aggressive expansion into untapped markets, significantly broadening eToro's user base.

-

Enhanced product innovation and technological advancements: Investment in technology will lead to innovative features and a superior user experience, further solidifying eToro's competitive advantage.

-

Increased brand visibility and market share: Larger-scale marketing campaigns will significantly enhance brand awareness, attracting new users and increasing market share.

-

Potential for higher valuations and increased investor confidence: A successful IPO will likely lead to a higher valuation and increased investor confidence in eToro's long-term prospects.

-

Opportunities for strategic acquisitions and partnerships: The increased capital will provide opportunities for strategic acquisitions of complementary businesses or technologies, accelerating growth and innovation.

The eToro future hinges on the successful execution of this IPO, enabling the company to execute its ambitious vision for growth and global expansion within the social trading space.

Conclusion

eToro's pursuit of a $500 million IPO marks a critical juncture in its journey. While challenges and risks exist, the potential benefits – including substantial capital infusion, accelerated growth, and enhanced market positioning – are substantial. The success of this eToro investment hinges on skillful navigation of market conditions, regulatory hurdles, and sustained investor confidence.

Call to Action: Stay informed about the unfolding events surrounding the eToro IPO and the platform's future. Follow reputable financial news sources for updates on this potentially transformative event. Learn more about the implications of the eToro IPO and its impact on the broader fintech landscape. Understanding the eToro funding and its potential effects is crucial for investors and those interested in the future of social trading.

Featured Posts

-

Aldi Cheese Recall Possible Steel Fragments Found In Shredded Cheese Packets

May 14, 2025

Aldi Cheese Recall Possible Steel Fragments Found In Shredded Cheese Packets

May 14, 2025 -

Spanish Television Ignites Debate Should Israel Be In Eurovision

May 14, 2025

Spanish Television Ignites Debate Should Israel Be In Eurovision

May 14, 2025 -

Debate Erupts Spanish Broadcaster Questions Israels Eurovision Participation

May 14, 2025

Debate Erupts Spanish Broadcaster Questions Israels Eurovision Participation

May 14, 2025 -

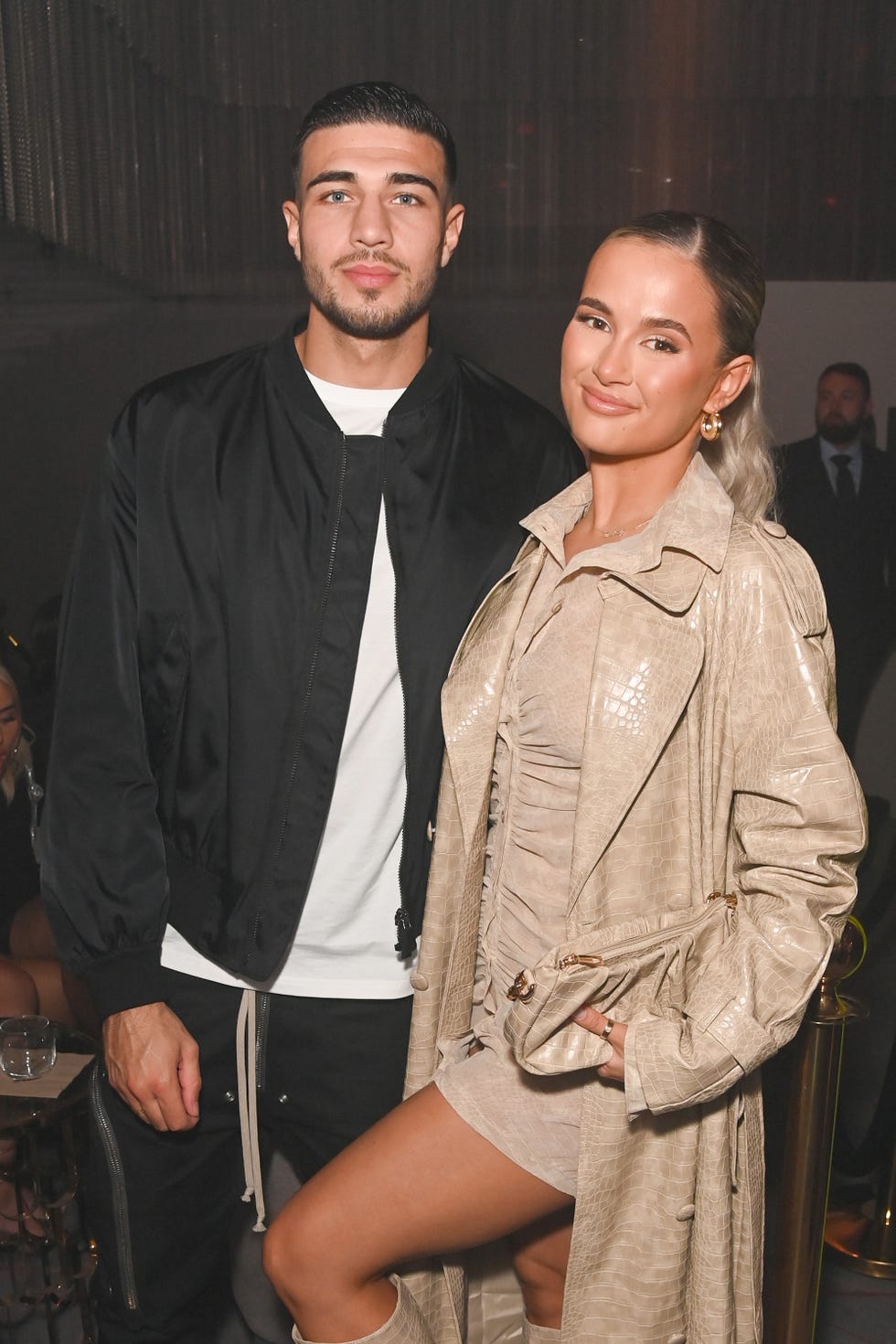

Tommy Furys Revelation Molly Mae Hague Fan Reaction Explodes

May 14, 2025

Tommy Furys Revelation Molly Mae Hague Fan Reaction Explodes

May 14, 2025 -

Seven Players On Amorims Man United Transfer Wishlist

May 14, 2025

Seven Players On Amorims Man United Transfer Wishlist

May 14, 2025

Latest Posts

-

Tommy Fury Challenges Jake Paul To A Rematch A Sudden Change Of Heart

May 14, 2025

Tommy Fury Challenges Jake Paul To A Rematch A Sudden Change Of Heart

May 14, 2025 -

Eurovision Director Rejects Boycott Calls Regarding Israel

May 14, 2025

Eurovision Director Rejects Boycott Calls Regarding Israel

May 14, 2025 -

Tommy Fury Hit With Driving Fine Following Molly Mae Split

May 14, 2025

Tommy Fury Hit With Driving Fine Following Molly Mae Split

May 14, 2025 -

Eurovision 2024 Yuval Raphaels Path Through Nova Festival

May 14, 2025

Eurovision 2024 Yuval Raphaels Path Through Nova Festival

May 14, 2025 -

Full Eurovision 2025 Lineup Dates Uk Representative And Competition Schedule

May 14, 2025

Full Eurovision 2025 Lineup Dates Uk Representative And Competition Schedule

May 14, 2025