$5000 Personal Loans For Bad Credit: Direct Lender Options

Table of Contents

Understanding Your Credit Score and its Impact on Loan Approval

Your credit score is a crucial factor determining your eligibility for a loan, especially a $5000 personal loan for bad credit. A lower credit score signifies higher risk to lenders, leading to higher interest rates or even outright rejection. Understanding your score is the first step. Factors influencing your credit score include late payments, defaults on loans or credit cards, bankruptcies, and high credit utilization.

To check your credit report, you can utilize free resources like AnnualCreditReport.com. Reviewing your report for any errors is vital. Disputing inaccurate information can significantly improve your score.

- Importance of checking your credit report for errors: Incorrect information can dramatically lower your score, impacting your loan application.

- Strategies for improving your credit score before applying: Paying down existing debt, paying all bills on time, and maintaining low credit utilization are effective strategies.

- Realistic expectations regarding interest rates with bad credit: Expect higher interest rates compared to those with excellent credit. Shop around for the best rates possible.

Finding Reputable Direct Lenders for $5000 Personal Loans

When seeking $5000 personal loans for bad credit, choosing a direct lender offers several advantages. Direct lenders eliminate intermediaries, potentially speeding up the process and potentially offering more competitive terms. However, it's crucial to identify reputable lenders to avoid scams.

Avoid lenders who demand upfront fees – a red flag for fraudulent operations. Legitimate lenders will only charge fees after the loan is approved. Thoroughly research potential lenders.

- Look for lenders licensed in your state: This ensures they operate legally and are subject to regulatory oversight.

- Check online reviews and ratings: Explore multiple sources like the Better Business Bureau and Trustpilot for unbiased opinions from past customers.

- Beware of lenders asking for upfront fees: Legitimate lenders never require upfront payments.

- Read the terms and conditions carefully: Understand all fees, interest rates, and repayment schedules before signing any agreement.

The Application Process for $5000 Personal Loans with Bad Credit

Applying for a $5000 personal loan with bad credit typically involves an online application, where you'll provide personal and financial information. Lenders will conduct a credit check. Be prepared to submit documentation such as proof of income (pay stubs, tax returns), and a valid government-issued ID.

- Gather necessary documentation beforehand: This streamlines the application process and shows your preparedness.

- Be prepared to answer questions about your income and expenses: Transparency is key during the application process.

- Understand the loan repayment terms and interest rates: Don't commit to a loan you cannot comfortably repay.

Alternative Financing Options if $5000 Personal Loans are Unavailable

If securing a $5000 personal loan proves difficult, consider alternative options. Secured loans, using collateral like a car or savings account, can increase your chances of approval. Credit unions sometimes offer more flexible lending options for borrowers with bad credit. However, be wary of payday loans, as their high interest rates and short repayment terms can exacerbate financial problems.

- Secured loans: These loans mitigate risk for lenders, making approval more likely.

- Credit unions: Often more community-focused, they may offer more favorable terms than traditional banks.

- Debt consolidation loans: These can simplify your debt management, but ensure the new loan's interest rate is lower than your existing debts.

Conclusion: Securing Your $5000 Personal Loan for Bad Credit

Successfully navigating the process of obtaining $5000 personal loans for bad credit requires careful planning and research. Understanding your credit score, identifying reputable direct lenders, and carefully reviewing loan terms are crucial steps. Explore alternative options if necessary, but always prioritize responsible borrowing practices. Start your search for $5000 personal loans for bad credit today by comparing reputable direct lenders. Don't let bad credit hold you back from achieving your financial goals!

Featured Posts

-

Bianca Censori Reportedly Wants Divorce From Kanye West Controlling Behavior Alleged

May 28, 2025

Bianca Censori Reportedly Wants Divorce From Kanye West Controlling Behavior Alleged

May 28, 2025 -

Last Friday Movie Confirmed Ice Cubes Return As Writer And Star

May 28, 2025

Last Friday Movie Confirmed Ice Cubes Return As Writer And Star

May 28, 2025 -

Las Vegas To Host American Music Awards With Jennifer Lopez

May 28, 2025

Las Vegas To Host American Music Awards With Jennifer Lopez

May 28, 2025 -

The Future Of Family Planning Otc Birth Control In A Post Roe World

May 28, 2025

The Future Of Family Planning Otc Birth Control In A Post Roe World

May 28, 2025 -

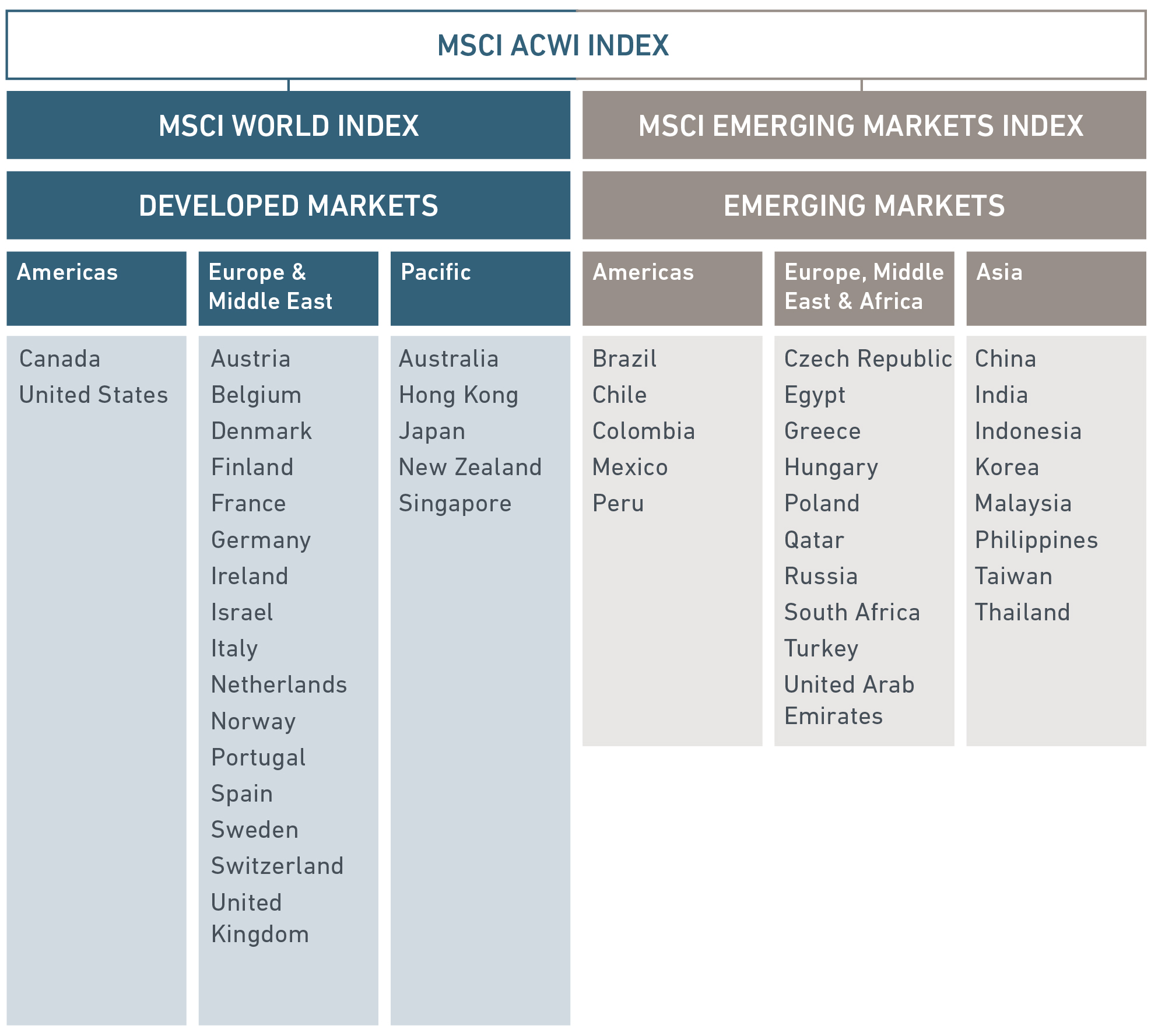

Business Opportunities By Region Mapping The Countrys Emerging Markets

May 28, 2025

Business Opportunities By Region Mapping The Countrys Emerging Markets

May 28, 2025

Latest Posts

-

Indian Wells 2024 Griekspoor Defeats Top Seeded Zverev

May 31, 2025

Indian Wells 2024 Griekspoor Defeats Top Seeded Zverev

May 31, 2025 -

Zverevs Indian Wells Campaign Ends Early Griekspoor Upsets Top Seed

May 31, 2025

Zverevs Indian Wells Campaign Ends Early Griekspoor Upsets Top Seed

May 31, 2025 -

The Factors Behind Thompsons Monte Carlo Failure

May 31, 2025

The Factors Behind Thompsons Monte Carlo Failure

May 31, 2025 -

New Covid 19 Variant What We Know About The Recent Case Surge

May 31, 2025

New Covid 19 Variant What We Know About The Recent Case Surge

May 31, 2025 -

A Look At Thompsons Losses In Monte Carlo

May 31, 2025

A Look At Thompsons Losses In Monte Carlo

May 31, 2025