7% Drop In Amsterdam Stock Market: Trade War Impact

Table of Contents

Understanding the 7% Drop: A Deep Dive into the Amsterdam Stock Market's Performance

A 7% drop in the Amsterdam Stock Exchange (AEX) index represents a significant event, signifying considerable investor anxiety and a loss of confidence in the market. To understand the gravity of the situation, we need to analyze the AEX's performance during this period. Comparing this decline to historical downturns within the Amsterdam market and contrasting it with the performance of other European and global markets provides valuable context.

-

Data on AEX Index Performance: The AEX index plummeted 7% within [Insert specific timeframe, e.g., 24 hours, a week]. This followed a period of already heightened volatility. [Insert specific data points, e.g., closing prices before and after the drop, percentage change].

-

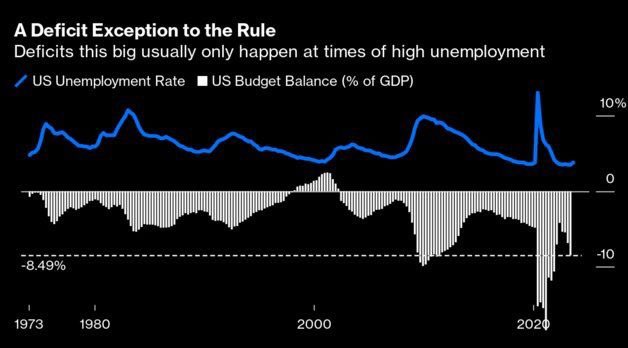

Comparison to Other Markets: [Compare the AEX's performance to other major European indices like the FTSE 100, DAX, and CAC 40. Also compare it to global indices like the Dow Jones and S&P 500, noting any similarities or differences in their responses to the trade war]. [Include relevant charts and graphs visualizing this comparison].

-

Sectors Most Affected: The decline wasn't uniform across all sectors. [Identify and explain which sectors, such as technology, financials, or energy, were hit hardest. Provide data to support these claims].

-

Comparison to Previous Downturns: [Compare the 7% drop to previous significant downturns in the AEX index, noting the causes and recovery times of those past events. This provides historical perspective and allows for better prediction of potential recovery].

The Trade War's Role: How Global Trade Tensions Triggered the Amsterdam Stock Market Decline

The ongoing trade war is a significant contributor to the Amsterdam stock market's decline. The Netherlands, being a highly export-oriented economy, is particularly vulnerable to disruptions in global trade.

-

Direct and Indirect Impacts: Tariffs and trade barriers imposed by various countries directly impact Dutch businesses involved in international trade. Indirectly, the uncertainty surrounding trade policy discourages investment and hinders economic growth.

-

Impact on Key Sectors: Sectors heavily reliant on exports, such as agriculture, manufacturing, and technology, have been especially affected. [Provide specific examples of Dutch companies suffering losses due to tariffs or trade restrictions].

-

Investor Sentiment and Uncertainty: The trade war has created a climate of uncertainty, leading to decreased investor confidence. This uncertainty fuels volatility and prompts investors to pull back from riskier assets, contributing to the market downturn.

-

Examples: [Provide concrete examples. For instance, a Dutch technology company experiencing reduced sales due to tariffs imposed by a major trading partner or a Dutch agricultural exporter facing decreased demand due to trade disputes]. [Include quotes from economic experts or industry analysts weighing in on the situation].

Beyond the Trade War: Other Contributing Factors to the Amsterdam Stock Market's Fall

While the trade war plays a significant role, other factors contributed to the Amsterdam market's fall. These include macroeconomic trends and geopolitical events.

-

Rising Interest Rates and Inflation: [Explain how rising interest rates affect investor behavior and investment decisions. Discuss the impact of inflation on consumer spending and business profitability].

-

Geopolitical Risks: [Analyze the impact of events like Brexit and other geopolitical uncertainties on market sentiment. Explain how these factors affect investor confidence and risk appetite].

Navigating the Volatility: Strategies for Investors in the Amsterdam Stock Market

Navigating a volatile market requires careful planning and risk management. Long-term investment strategies are often preferred over short-term trading during periods of uncertainty.

-

Diversification: Spreading investments across different asset classes and sectors reduces exposure to any single risk. [Offer examples of diversified portfolios suited for the current market conditions].

-

Long-Term Investment Planning: Focusing on long-term goals helps mitigate the impact of short-term market fluctuations.

-

Risk Management: Employing stop-loss orders and other risk management techniques can limit potential losses. [Explain these strategies in detail, providing actionable advice].

Conclusion: Understanding the 7% Drop and Preparing for Future Volatility in the Amsterdam Stock Market

The 7% drop in the Amsterdam stock market serves as a stark reminder of the interconnectedness of global markets and the significant impact of trade wars on national economies. Understanding the interplay of trade tensions, macroeconomic factors, and geopolitical risks is crucial for navigating future volatility. Staying informed about trade developments and economic indicators is paramount. To further your understanding, research "Amsterdam stock market analysis," explore the "trade war impact on investments," and learn about "managing Amsterdam stock market risk." By actively engaging with these resources, you can better equip yourself to navigate the complexities of the Amsterdam stock market and make informed investment decisions.

Featured Posts

-

Artfae Daks Alalmany Ila 24 Alf Nqtt Bed Atfaq Jmrky Amryky Syny

May 24, 2025

Artfae Daks Alalmany Ila 24 Alf Nqtt Bed Atfaq Jmrky Amryky Syny

May 24, 2025 -

England Airpark And Alexandria International Airport Fly Local Explore Global With Ae Xplore

May 24, 2025

England Airpark And Alexandria International Airport Fly Local Explore Global With Ae Xplore

May 24, 2025 -

Tuukka Taponen Ja F1 Unelma Saavuttaako Haen Sen Taenae Vuonna

May 24, 2025

Tuukka Taponen Ja F1 Unelma Saavuttaako Haen Sen Taenae Vuonna

May 24, 2025 -

Almanya Alshrtt Tshn Hmlt Mdahmat Ela Mshjeyn

May 24, 2025

Almanya Alshrtt Tshn Hmlt Mdahmat Ela Mshjeyn

May 24, 2025 -

Marks And Spencer Cyber Attack 300 Million Cost Revealed

May 24, 2025

Marks And Spencer Cyber Attack 300 Million Cost Revealed

May 24, 2025

Latest Posts

-

Israeli Embassy Staffers Killed In Washington Museum Shooting

May 24, 2025

Israeli Embassy Staffers Killed In Washington Museum Shooting

May 24, 2025 -

Nfls Tush Push Controversy A Victory For Tradition

May 24, 2025

Nfls Tush Push Controversy A Victory For Tradition

May 24, 2025 -

The End Of The Nfls Butt Ban The Tush Push Persists

May 24, 2025

The End Of The Nfls Butt Ban The Tush Push Persists

May 24, 2025 -

Understanding High Stock Market Valuations Bof As Investor Guidance

May 24, 2025

Understanding High Stock Market Valuations Bof As Investor Guidance

May 24, 2025 -

The Thames Water Case Executive Bonuses And The Water Crisis

May 24, 2025

The Thames Water Case Executive Bonuses And The Water Crisis

May 24, 2025