7-Year Prison Sentence For David Gentile In GPB Capital Ponzi Case

Table of Contents

The GPB Capital Ponzi Scheme: A Detailed Overview

The GPB Capital Ponzi scheme operated through a complex web of deceit, preying on investors seeking high returns. The scheme's mechanics involved misrepresenting the nature and performance of investments in various sectors, primarily focusing on parking lots and other alternative assets. Gentile and his associates used sophisticated strategies to conceal the fraudulent activities, creating an illusion of profitability while diverting investor funds for their personal enrichment.

Key aspects of the GPB Capital Ponzi scheme include:

- Misrepresentation of investments: Investors were led to believe their funds were invested in lucrative, high-growth opportunities, when in reality, the returns were largely fabricated.

- Use of investor funds for personal gain: A significant portion of the money raised from investors was used to fund Gentile's lavish lifestyle and other personal expenses.

- Lack of transparency and disclosure: Crucial information about the investments and the financial health of GPB Capital was deliberately withheld from investors.

- Sophisticated strategies to hide fraudulent activity: The scheme involved complex financial transactions and shell companies to obscure the movement of funds and mask the fraudulent nature of the operation. This included the use of commingled funds and misleading financial statements. The use of these sophisticated techniques made it more difficult for regulators and investors to detect the fraud.

These actions constitute classic hallmarks of investment fraud, securities fraud, and financial fraud, leading to devastating consequences for countless victims.

David Gentile's Role and Conviction

David Gentile, as the principal of GPB Capital, played a central role in orchestrating the Ponzi scheme. He was directly involved in the misrepresentation of investments, the diversion of funds, and the concealment of fraudulent activities. The prosecution presented compelling evidence detailing his active participation in the scheme.

The charges against Gentile included securities fraud, conspiracy, and other related offenses. The evidence presented during the trial included emails, financial records, and testimony from former associates and investors. The judge, in delivering the sentence, highlighted the scale of the fraud, the significant losses suffered by victims, and Gentile's blatant disregard for the law.

Key aspects of David Gentile's conviction include:

- Specific charges: Securities fraud, conspiracy to commit securities fraud, and wire fraud.

- Evidence used in the prosecution: Emails, financial records, witness testimonies, and forensic accounting analysis.

- Judge's statement on sentencing: The judge emphasized the severity of the crime and the devastating impact on the victims.

- Potential fines and restitution: In addition to the prison sentence, Gentile faces substantial fines and may be ordered to make restitution to the defrauded investors. The amount of restitution will likely be a significant factor in the ongoing legal proceedings.

The conviction represents a significant step towards justice for the victims of this devastating fraud.

Impact of the 7-Year Prison Sentence on Victims and the Financial Industry

The 7-year prison sentence imposed on David Gentile carries significant weight for both the victims and the financial industry. For the victims, who suffered substantial financial losses, the sentence offers a measure of closure and accountability. While the sentence cannot fully compensate for their losses, it demonstrates that perpetrators of such crimes will face severe consequences. The possibility of restitution offers a glimmer of hope for recovering some of the lost funds.

The sentence also serves as a powerful deterrent against future fraudulent activities. It underscores the severity with which the justice system views large-scale Ponzi schemes and investment fraud. This strong deterrent effect could potentially prevent similar schemes from emerging in the future. The case also highlights the need for increased vigilance and stronger regulatory oversight within the financial industry to prevent and detect fraudulent activities.

The impact of the sentencing is multifaceted:

- Financial losses suffered by investors: Hundreds of millions of dollars were lost by investors due to the GPB Capital Ponzi scheme.

- Potential for recovery of funds through restitution: The court may order Gentile to make restitution to the victims, offering a pathway to partial financial recovery.

- Strengthening of regulatory oversight: The case underscores the need for enhanced regulatory scrutiny of investment firms and stricter enforcement of existing regulations.

- Increased awareness of investment fraud schemes: The high-profile nature of the case has brought increased public awareness of the risks associated with investment fraud and the importance of due diligence.

This increased awareness is crucial in empowering investors to protect themselves.

Legal Implications and Future Developments

The legal repercussions of the GPB Capital case extend far beyond David Gentile's sentencing. Ongoing investigations may uncover further individuals involved in the scheme, potentially leading to additional criminal charges and convictions. Civil lawsuits are likely to follow, targeting Gentile and other involved parties to seek further financial compensation for victims.

The sentence set in this case will undoubtedly serve as a precedent in future Ponzi scheme prosecutions. This precedent may influence sentencing in similar cases, demonstrating a firm stance against this type of financial crime.

Future legal aspects to consider include:

- Ongoing investigations: Authorities may continue to investigate the GPB Capital scheme to identify and prosecute other participants.

- Potential civil litigation: Victims are likely to file civil lawsuits against Gentile and other involved parties to recover their losses.

- Precedents set by the sentencing: The 7-year sentence will likely influence sentencing in future cases involving similar large-scale fraud.

- Impact on future prosecutions: The case may lead to stricter enforcement of laws related to investment fraud and Ponzi schemes.

The GPB Capital case has established a significant legal precedent, likely influencing future prosecutions and deterring similar fraudulent activities.

Conclusion: The 7-Year Prison Sentence for David Gentile in the GPB Capital Ponzi Case Sets a Precedent

The 7-year prison sentence handed down to David Gentile in the GPB Capital Ponzi case marks a significant victory in the fight against investment fraud. The severity of the sentence highlights the devastating consequences of such schemes and underscores the commitment of the legal system to holding perpetrators accountable. The impact extends beyond the victims, sending a powerful message to the financial industry and potentially preventing future fraudulent activities. The case serves as a stark reminder of the importance of investor due diligence and the need for robust regulatory oversight.

To protect yourself from investment fraud, thoroughly research any investment opportunity before committing your funds. Be wary of promises of unusually high returns and seek professional financial advice. If you suspect fraudulent activity, report it immediately to the appropriate authorities. Understanding the lessons of the GPB Capital case and implementing proactive measures is crucial in preventing similar tragedies from occurring. Remember to always protect your investments by being vigilant and informed about the risks involved. Report any suspicious activity related to investment fraud to the relevant authorities. Learning from the GPB Capital case is vital for the future of investor protection.

Featured Posts

-

City Name Michigan A Top Choice For College Students And Beyond

May 11, 2025

City Name Michigan A Top Choice For College Students And Beyond

May 11, 2025 -

L Euro Face Aux Tensions Analyse Du Dechiffrage

May 11, 2025

L Euro Face Aux Tensions Analyse Du Dechiffrage

May 11, 2025 -

Rochelle Humes Chic New Hairstyle At London Fashion Week

May 11, 2025

Rochelle Humes Chic New Hairstyle At London Fashion Week

May 11, 2025 -

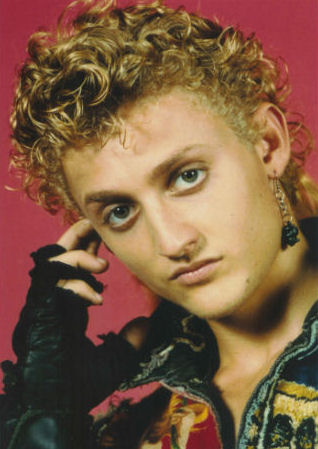

Alex Winters Pre Freaked Mtv Sketches A Look Back

May 11, 2025

Alex Winters Pre Freaked Mtv Sketches A Look Back

May 11, 2025 -

Introducing Tove Lily Collins And Charlie Mc Dowell Share Family Photos

May 11, 2025

Introducing Tove Lily Collins And Charlie Mc Dowell Share Family Photos

May 11, 2025