A Financial Planner's Advice For Student Loan Borrowers

Table of Contents

Understanding Your Student Loans

Before tackling student loan repayment, it's crucial to understand the specifics of your loans. This involves identifying the types of loans you have and locating all relevant information.

Types of Student Loans

Understanding the differences between federal and private student loans is paramount for effective repayment planning.

- Federal Student Loans: These loans are offered by the U.S. government and often come with more borrower protections and repayment options than private loans. They include subsidized and unsubsidized loans.

- Subsidized Loans: The government pays the interest while you're in school (under certain conditions) and during grace periods.

- Unsubsidized Loans: Interest accrues from the time the loan is disbursed, even while you're in school.

- Private Student Loans: These loans are offered by banks, credit unions, and other private lenders. They typically have higher interest rates and fewer repayment options than federal loans. Interest rates can be fixed or variable.

| Loan Type | Interest Rate | Repayment Options | Forgiveness Programs |

|---|---|---|---|

| Federal Subsidized | Variable/Fixed | Many options | Potential forgiveness |

| Federal Unsubsidized | Variable/Fixed | Many options | Potential forgiveness |

| Private Student Loan | Variable/Fixed | Fewer options | Limited forgiveness |

Locating Your Loan Information

Knowing where to find your loan information is the first step to managing your debt.

- National Student Loan Data System (NSLDS): This website provides a centralized location to view your federal student loan information.

- Your Loan Servicer(s): Your loan servicer is the company responsible for collecting your monthly payments. You'll need to contact them to understand your repayment options and make payments.

- Private Lender Websites: If you have private student loans, you'll need to access your loan details through the lender's website or online portal.

- Regular Account Monitoring: Check your loan accounts regularly to ensure accuracy and catch any potential problems early.

Choosing a Repayment Plan

Several repayment plans are available for federal student loans, each with its pros and cons. Choosing the right plan is crucial for long-term financial success.

Standard Repayment

The standard repayment plan involves fixed monthly payments over a 10-year period.

- Duration: 10 years

- Monthly Payments: Fixed and relatively high.

- Total Interest Paid: Generally lower than other plans due to the shorter repayment period.

- Pros: Predictable payments, faster debt payoff.

- Cons: Higher monthly payments may be difficult for some borrowers.

Income-Driven Repayment (IDR) Plans

IDR plans adjust your monthly payments based on your income and family size. These plans include IBR, PAYE, REPAYE, and ICR.

- How IDR Plans Work: Your monthly payment is calculated as a percentage of your discretionary income.

- Advantages: Lower monthly payments, making them more manageable for borrowers with lower incomes.

- Potential Long-Term Implications: Payments are lower, but the repayment period is longer, potentially leading to higher total interest paid over the life of the loan. Some plans offer loan forgiveness after 20 or 25 years.

Extended Repayment and Deferment/Forbearance

These are temporary options that can provide short-term relief, but they often come with drawbacks.

- Extended Repayment: Extends the repayment period beyond the standard 10 years, lowering monthly payments but increasing overall interest paid.

- Deferment: Temporarily postpones your payments, usually due to specific circumstances like returning to school or facing unemployment. Interest may or may not accrue during this period, depending on your loan type.

- Forbearance: Similar to deferment, but typically granted for shorter periods and for reasons such as financial hardship. Interest usually accrues during forbearance.

Strategies for Efficient Student Loan Repayment

Effective student loan repayment requires a multifaceted approach, including budgeting, exploring refinancing options, and seeking professional help.

Budgeting and Debt Management

Creating a realistic budget is crucial for prioritizing student loan repayment.

- Track Expenses: Use budgeting apps or spreadsheets to monitor your spending and identify areas where you can cut back.

- Prioritize Payments: Make student loan payments a top priority in your budget.

- Automate Payments: Set up automatic payments to avoid late fees and ensure consistent repayment.

Exploring Loan Refinancing Options

Refinancing can help you lower your interest rate and potentially save money over the life of your loans.

- When Refinancing Makes Sense: If you have a good credit score and can qualify for a lower interest rate.

- Factors to Consider: Interest rates, fees, loan terms, and whether you're refinancing federal or private loans.

- Compare Offers: Always compare offers from multiple lenders before making a decision.

Seeking Professional Help

A financial advisor can provide personalized guidance and support.

- Benefits of Working with a Financial Planner: They can help you create a comprehensive repayment plan, explore all available options, and stay on track.

- Finding Reputable Advisors: Seek referrals, check online reviews, and verify credentials.

- Potential Cost Savings: A financial advisor can help you save money in the long run by optimizing your repayment strategy.

Conclusion

Effectively managing your student loan debt requires careful planning and understanding of your options. By understanding the different types of student loans, choosing a suitable repayment plan, and implementing smart repayment strategies, you can significantly reduce your financial burden and achieve your financial goals. Remember, seeking professional advice from a financial planner specializing in student loan repayment can provide invaluable support and guidance throughout this process. Don't hesitate to reach out for help with your student loan repayment strategy; it's an investment in your future. Take control of your student loan debt today!

Featured Posts

-

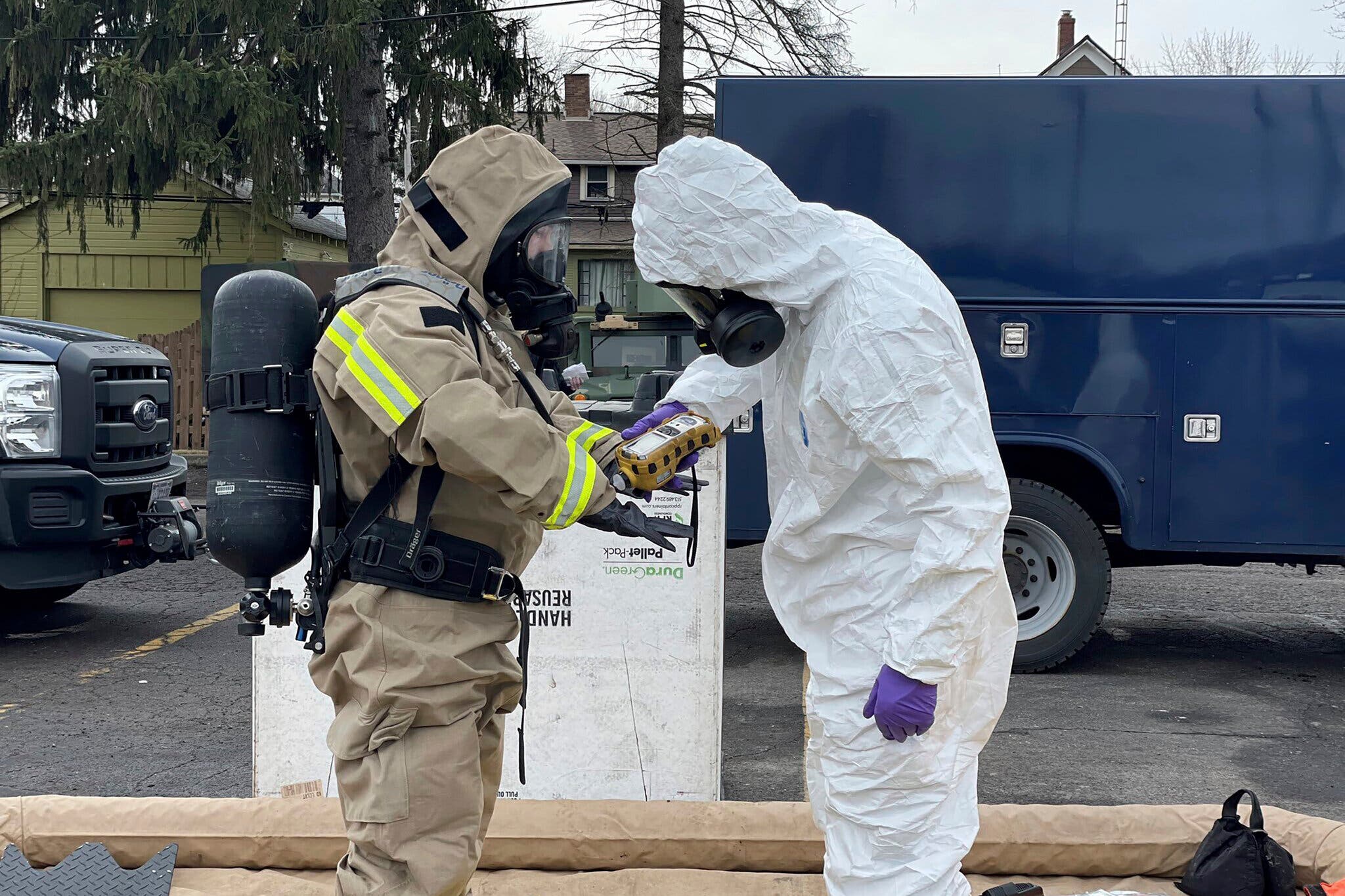

Investigation Into The Persistence Of Toxic Chemicals Following The Ohio Train Derailment

May 17, 2025

Investigation Into The Persistence Of Toxic Chemicals Following The Ohio Train Derailment

May 17, 2025 -

13 Analyst Assessments Of Principal Financial Group Pfg Key Insights For Investors

May 17, 2025

13 Analyst Assessments Of Principal Financial Group Pfg Key Insights For Investors

May 17, 2025 -

Is Creatine Safe And Effective A Comprehensive Review

May 17, 2025

Is Creatine Safe And Effective A Comprehensive Review

May 17, 2025 -

Thibodeaus Coaching Adjustments Key To The Knicks Improved Season

May 17, 2025

Thibodeaus Coaching Adjustments Key To The Knicks Improved Season

May 17, 2025 -

Lynas The First Heavy Rare Earths Producer Outside China

May 17, 2025

Lynas The First Heavy Rare Earths Producer Outside China

May 17, 2025

Latest Posts

-

Melania Trump Current Status And Relationship With Donald Trump

May 17, 2025

Melania Trump Current Status And Relationship With Donald Trump

May 17, 2025 -

Donald And Melania Trumps Relationship A Timeline And Analysis

May 17, 2025

Donald And Melania Trumps Relationship A Timeline And Analysis

May 17, 2025 -

Did Donald And Melania Trump Separate A Look At Their Marriage

May 17, 2025

Did Donald And Melania Trump Separate A Look At Their Marriage

May 17, 2025 -

Witness Trumps Humiliation A Defining Moment On The Lawrence O Donnell Show

May 17, 2025

Witness Trumps Humiliation A Defining Moment On The Lawrence O Donnell Show

May 17, 2025 -

Lawrence O Donnell Captures Trumps Humiliation On Live Television

May 17, 2025

Lawrence O Donnell Captures Trumps Humiliation On Live Television

May 17, 2025