A Simple Path To High Dividend Returns: The Most Profitable Strategy

Table of Contents

Understanding Dividend Investing Basics

Before diving into strategies, it's crucial to grasp fundamental concepts. Understanding key metrics is the first step towards achieving high dividend returns.

Defining Dividend Yields and Payout Ratios

Dividend yield and payout ratio are two crucial metrics for evaluating dividend stocks. The dividend yield represents the annual dividend per share relative to the stock's price, expressed as a percentage. A higher yield suggests a larger dividend payment compared to the investment cost. The formula is: (Annual Dividend per Share / Stock Price) * 100.

The payout ratio, on the other hand, indicates the percentage of a company's earnings paid out as dividends. It's calculated as: (Dividends Paid / Net Income) * 100. A high payout ratio might seem appealing, but it could indicate unsustainable dividend payments if the company's earnings decline.

- High dividend yield doesn't always equate to high return; consider payout ratio. A company might offer a high yield, but if its payout ratio is unsustainable, the dividend could be cut, resulting in losses.

- Illustrate with examples of high-yield vs. sustainable yield. Company A might boast a 10% yield but has a payout ratio of 90%, indicating potential risks. Company B, with a 5% yield and a 40% payout ratio, presents a more sustainable picture.

- Explain the importance of analyzing a company's financial health before investing. Examine factors like debt levels, revenue growth, and profitability to gauge the company's ability to consistently pay dividends. Look for companies with a history of increasing dividends – a sign of financial strength.

Identifying Reliable Dividend-Paying Companies

Finding stable and consistent dividend payers is key to a successful high-dividend-return strategy.

- Screening stocks based on dividend history (consistency and growth). Look for companies with a long history of paying dividends and a track record of increasing those dividends over time. This demonstrates financial stability and a commitment to shareholder returns.

- Utilizing financial screening tools and resources. Online brokerage platforms and financial websites offer screening tools that allow you to filter stocks based on dividend yield, payout ratio, and other financial metrics.

- Analyzing company financials (debt levels, profitability). Before investing, thoroughly analyze a company's financial statements. Low debt levels and strong profitability are signs of a healthy company capable of sustaining its dividend payments. Look for consistent earnings growth, as this underpins dividend sustainability.

Building a High-Yield Dividend Portfolio

Once you've identified promising dividend stocks, the next step is building a well-diversified portfolio.

Diversification: The Key to Managing Risk

Diversification is paramount in mitigating risk and maximizing returns in any investment strategy, including dividend investing. Don't put all your eggs in one basket.

- Explain the benefits of diversifying your dividend portfolio. Spreading your investments across various sectors and companies reduces the impact of poor performance by a single company.

- Suggest diversifying across different market caps (large, mid, small). Large-cap companies offer stability, while mid-cap and small-cap stocks might provide higher growth potential.

- Highlight the advantages of geographic diversification (international stocks). Expanding your portfolio beyond your domestic market reduces exposure to country-specific risks.

Reinvesting Dividends for Compounding Growth

Reinvesting your dividends is a powerful strategy to accelerate wealth accumulation.

- Illustrate the impact of compounding with a real-world example. Show how reinvesting dividends over time can significantly increase the overall value of your portfolio through the snowball effect of compounding returns.

- Discuss the tax implications of reinvesting dividends. Understand the tax consequences of dividend reinvestment in your specific jurisdiction.

- Explain the benefits of automatic reinvestment plans. Many brokerage firms offer automatic dividend reinvestment plans (DRIPs), simplifying the process and maximizing the power of compounding.

Monitoring and Adjusting Your Dividend Portfolio

Building a portfolio is just the beginning. Continuous monitoring and adaptation are essential.

Regularly Reviewing Performance

Regularly tracking your portfolio's performance is crucial for identifying areas needing adjustment.

- Explain how to track dividend income and overall portfolio growth. Use spreadsheets, financial software, or brokerage account tools to monitor your dividend income and the overall growth of your investments.

- Discuss the importance of rebalancing your portfolio periodically. Rebalancing involves adjusting your portfolio allocations to maintain your desired asset allocation. This helps to capitalize on market fluctuations and manage risk.

- Explain when to sell underperforming dividend stocks. If a company's fundamentals deteriorate or its dividend is cut, it might be time to reassess your investment and consider selling.

Adapting to Market Changes

The market is dynamic. Flexibility is essential for long-term success.

- Highlight the importance of researching economic forecasts. Staying informed about economic trends and industry-specific news helps you anticipate potential challenges and opportunities.

- Discuss strategies to navigate market downturns. During market corrections, consider dollar-cost averaging to mitigate losses and take advantage of lower prices.

- Emphasize the long-term perspective in dividend investing. Dividend investing is a long-term strategy. Short-term market fluctuations should not deter you from your long-term goals.

Conclusion

Achieving high dividend returns requires a well-defined strategy combining careful stock selection, diversification, and consistent monitoring. By understanding dividend yields, payout ratios, and the power of reinvestment, you can build a portfolio designed for long-term growth and substantial income generation. Remember, while high dividend returns are attractive, thorough research and risk management are crucial. Start building your path to high dividend returns today! Explore our resources (link to relevant resources if any) to learn more about profitable dividend investing strategies.

Featured Posts

-

Chantal Ladesou Spectacles Films Et Theatre

May 11, 2025

Chantal Ladesou Spectacles Films Et Theatre

May 11, 2025 -

Adam Sandlers Net Worth A Look At The Success Of A Comedy Icon

May 11, 2025

Adam Sandlers Net Worth A Look At The Success Of A Comedy Icon

May 11, 2025 -

Is Sylvester Stallones Appearance In Jason Stathams Movie A Calculated Move

May 11, 2025

Is Sylvester Stallones Appearance In Jason Stathams Movie A Calculated Move

May 11, 2025 -

The Conor Mc Gregor Fox News Saga A Timeline Of Events

May 11, 2025

The Conor Mc Gregor Fox News Saga A Timeline Of Events

May 11, 2025 -

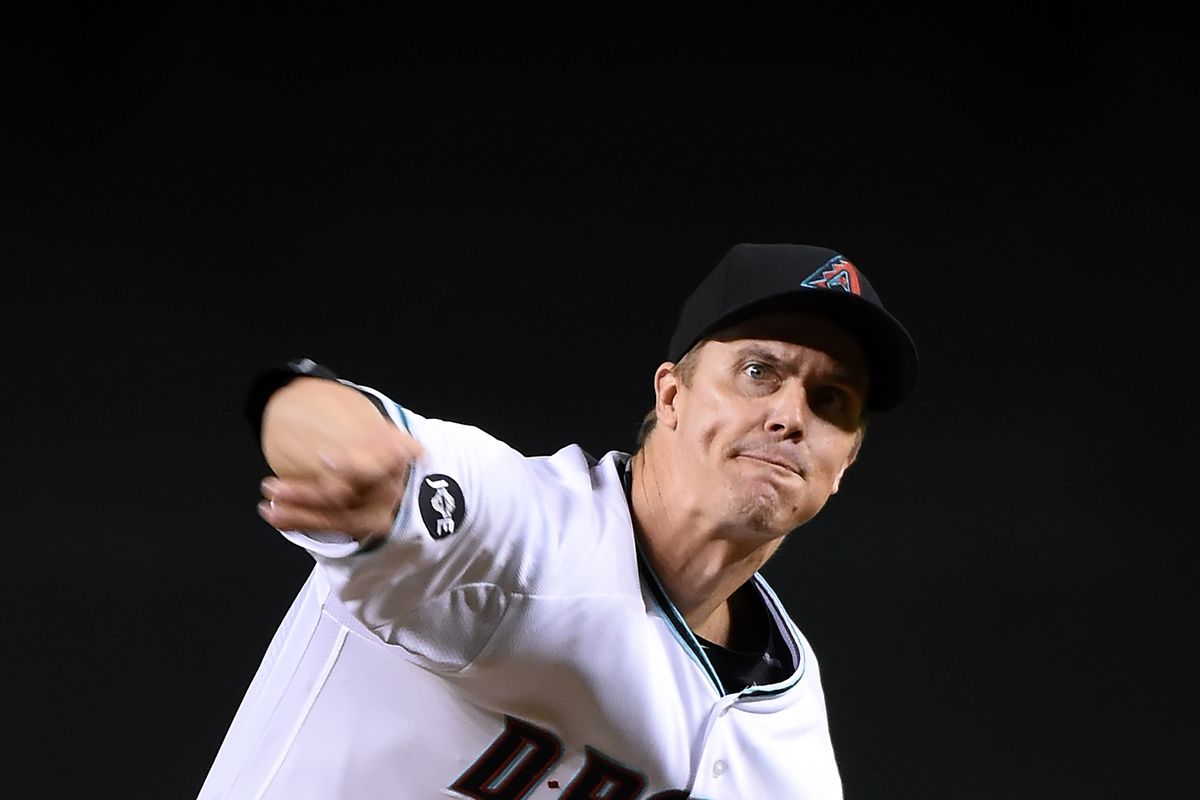

Yankees Vs Diamondbacks Injury Concerns For The April 1 3 Series

May 11, 2025

Yankees Vs Diamondbacks Injury Concerns For The April 1 3 Series

May 11, 2025