ABN Amro Bonus Practices Under Scrutiny: Potential Fine From Dutch Regulator

Table of Contents

The Dutch Regulator's Investigation

ABN Amro is currently under investigation by the Dutch regulator for potential breaches of regulations concerning its bonus schemes. This investigation into ABN Amro bonus practices is far-reaching and could have significant consequences.

Allegations of Non-Compliance

The allegations against ABN Amro center around several key areas of non-compliance with bonus regulations:

- Insufficient oversight of bonus structures: Concerns exist that the bank lacked adequate mechanisms to monitor and control the allocation of bonuses, potentially leading to unfair or inappropriate payouts.

- Lack of transparency regarding bonus calculations: The complexity and lack of transparency in the bonus calculation methods are being questioned, raising concerns about potential manipulation or bias.

- Potential conflicts of interest influencing bonus payouts: The investigation is examining whether conflicts of interest, either perceived or real, influenced the awarding of bonuses to specific individuals or departments. This includes analyzing the relationship between risk-taking and bonus payouts.

The Scope of the Investigation

The investigation is not limited to a single department. The Dutch regulator is conducting a comprehensive review of ABN Amro bonus practices across various divisions, including:

- Investment banking: Bonuses awarded in this high-risk sector are under intense scrutiny.

- Retail banking: Even in seemingly less risky areas, the regulator is examining the fairness and transparency of bonus structures.

- Asset management: This area is also under investigation for potential irregularities in bonus allocation.

Potential Penalties

The potential penalties facing ABN Amro are substantial and could significantly impact the bank's financial health and reputation:

- Large fines: The Dutch regulator has the power to impose significant financial penalties if violations are proven.

- Reputational damage: Even if fines are relatively small, the reputational damage from this investigation could be long-lasting and impact investor confidence.

- Changes to executive compensation structures: The regulator may demand significant changes to ABN Amro's executive compensation structure to ensure greater fairness and transparency.

ABN Amro's Response and Public Statement

ABN Amro has responded to the investigation with a carefully crafted public statement.

ABN Amro's Official Position

The bank has publicly acknowledged the investigation and affirmed its commitment to full cooperation with the Dutch regulator. In their statement, ABN Amro may highlight several key points:

- Internal reviews undertaken to improve compliance: They may describe internal reviews and audits undertaken to identify and rectify any shortcomings in their bonus practices.

- Strengthened internal controls regarding bonus allocation: The bank will likely emphasize efforts to strengthen internal controls and ensure greater transparency in bonus calculations.

- Commitment to ethical and responsible banking practices: ABN Amro will undoubtedly reiterate its commitment to ethical and responsible banking practices, emphasizing its intention to maintain the highest standards of corporate governance.

Shareholder Reactions

The investigation is closely watched by shareholders and investors. The impact on ABN Amro's share price and investor confidence is a key concern.

- Market reactions to news of the investigation: The initial market reaction to news of the investigation likely involved a drop in the share price, reflecting investor uncertainty.

- Analyst predictions concerning future performance: Financial analysts will be closely monitoring developments and issuing revised performance predictions for ABN Amro.

- Potential long-term impact on investor sentiment: The ultimate impact on investor sentiment will depend on the outcome of the investigation and the bank's response.

Implications for the Broader Banking Sector

The ABN Amro case has significant implications for the wider banking sector, both in the Netherlands and across Europe.

Increased Regulatory Scrutiny

This investigation underscores a trend of increased regulatory scrutiny of bonus practices within the banking industry:

- A greater emphasis on ethical conduct within financial institutions: Regulators are increasingly focused on promoting ethical conduct and preventing excessive risk-taking within financial institutions.

- Concerns about excessive risk-taking driven by bonus incentives: The concern is that bonus structures can incentivize excessive risk-taking, potentially jeopardizing the stability of the financial system.

- Increased regulatory pressure to promote responsible banking practices: This trend is likely to continue as regulators worldwide seek to prevent future financial crises.

Potential for Industry-Wide Changes

The outcome of the ABN Amro investigation could significantly impact banking practices across the sector:

- Stricter regulations on bonus calculations and payouts: Expect tighter regulatory oversight of bonus schemes, with stricter rules on calculation methods and maximum payouts.

- Increased transparency in bonus schemes: Greater transparency in bonus structures will likely become mandatory, allowing better scrutiny and accountability.

- Greater emphasis on long-term performance metrics over short-term gains: Regulators are pushing for bonus schemes that reward long-term sustainable performance, rather than short-term gains that may mask underlying risks.

Conclusion

The scrutiny of ABN Amro's bonus practices highlights the growing importance of ethical and compliant compensation schemes within the banking industry. The potential for substantial fines and reputational damage underscores the risks associated with insufficient oversight and a lack of transparency. This case serves as a cautionary tale for other financial institutions, emphasizing the need for robust internal controls and a clear commitment to responsible bonus practices. Stay informed about developments in this ongoing investigation into ABN Amro bonus practices and the potential implications for the wider financial landscape. Understanding the intricacies of ABN Amro bonus schemes and their regulatory implications is critical for investors and stakeholders alike.

Featured Posts

-

Understanding Cassis Blackcurrant Production

May 22, 2025

Understanding Cassis Blackcurrant Production

May 22, 2025 -

Juergen Klopp Transferi En Son Gelismeler Ve Tahminler

May 22, 2025

Juergen Klopp Transferi En Son Gelismeler Ve Tahminler

May 22, 2025 -

Klopp Real Madrid In Yeni Teknik Direktoerue Olabilir Mi

May 22, 2025

Klopp Real Madrid In Yeni Teknik Direktoerue Olabilir Mi

May 22, 2025 -

Betalbaarheid Nederlandse Huizenmarkt Analyse Van Abn Amro En Geen Stijl

May 22, 2025

Betalbaarheid Nederlandse Huizenmarkt Analyse Van Abn Amro En Geen Stijl

May 22, 2025 -

Coldplay Concert Review Music Lights And Powerful Messages Of Love Captivate Top Audience

May 22, 2025

Coldplay Concert Review Music Lights And Powerful Messages Of Love Captivate Top Audience

May 22, 2025

Latest Posts

-

Understanding The Thames Water Executive Bonus Structure

May 22, 2025

Understanding The Thames Water Executive Bonus Structure

May 22, 2025 -

Thames Water Public Outrage Over Executive Bonuses

May 22, 2025

Thames Water Public Outrage Over Executive Bonuses

May 22, 2025 -

Are Thames Water Executive Bonuses Excessive A Critical Analysis

May 22, 2025

Are Thames Water Executive Bonuses Excessive A Critical Analysis

May 22, 2025 -

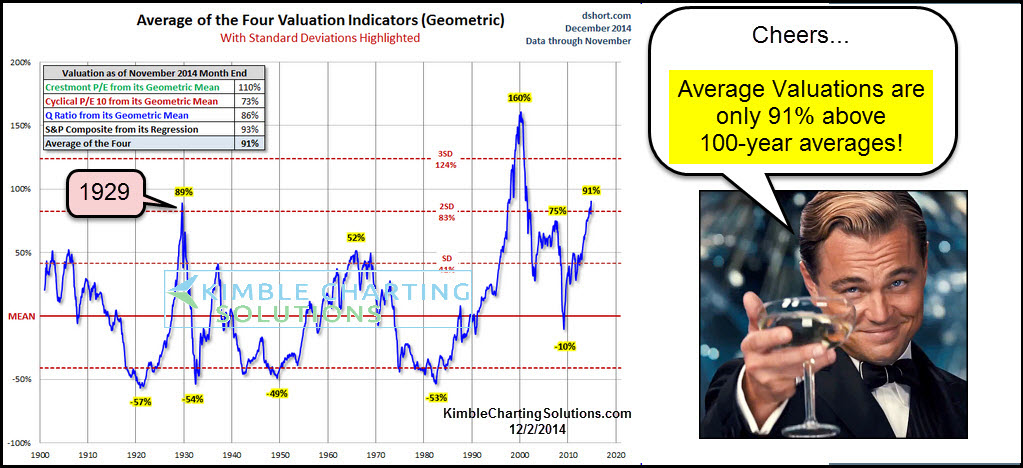

High Stock Market Valuations A Bof A Analysis And Why You Shouldnt Worry

May 22, 2025

High Stock Market Valuations A Bof A Analysis And Why You Shouldnt Worry

May 22, 2025 -

The Thames Water Executive Bonus Debate Facts And Figures

May 22, 2025

The Thames Water Executive Bonus Debate Facts And Figures

May 22, 2025