ABN Amro: Potential Fine From Dutch Central Bank Over Bonuses

Table of Contents

DNB's Concerns Regarding ABN Amro's Bonus System

The Dutch banking sector operates under a strict regulatory framework governing bonuses, designed to prevent excessive risk-taking and promote responsible lending. The DNB's concerns regarding ABN Amro's bonus system appear to center on several key areas:

Potential breaches of responsible lending guidelines:

ABN Amro's bonus structure may have inadvertently incentivized risky lending practices. The DNB's investigation likely focuses on whether the bonus system encouraged employees to prioritize short-term gains over long-term financial stability and responsible risk assessment. This could involve:

- High-pressure sales targets: Were unrealistic sales targets implemented that pushed employees to approve loans with higher risk profiles?

- Insufficient due diligence: Did the bonus system adequately incentivize thorough due diligence on loan applications, potentially leading to poor lending decisions?

- Ignoring risk indicators: Did the bonus structure encourage overlooking warning signs of potential defaults or financial distress in borrowers?

Lack of transparency and accountability:

The DNB's investigation may also involve a scrutiny of the transparency and accountability within ABN Amro's bonus scheme. Key questions may include:

- Clarity of bonus criteria: Were the criteria for bonus payouts clearly defined and easily understood by all employees?

- Oversight and monitoring: Were there sufficient internal controls and oversight mechanisms to ensure the bonus system operated within regulatory guidelines?

- Disclosure to stakeholders: Was the bonus scheme adequately disclosed to shareholders and other stakeholders?

Disproportionate bonus payouts:

The DNB may be investigating whether bonus payouts were excessively high in relation to ABN Amro's overall performance and the level of risk undertaken. This might involve comparing ABN Amro's bonus payments to those of its competitors and examining the relationship between bonuses and risk-weighted assets.

Potential Impact of the Fine on ABN Amro

A substantial fine from the DNB could have significant repercussions for ABN Amro. The potential financial penalties could negatively impact the bank's financial performance, impacting profitability and potentially reducing shareholder dividends. Beyond the direct financial cost, the fine would likely cause reputational damage, potentially affecting ABN Amro's standing with customers, investors, and other stakeholders. Loss of shareholder confidence could lead to a decline in the bank's share price. Moreover, the incident could force ABN Amro to reassess its risk management practices and potentially overhaul its bonus structure, leading to increased compliance costs and adjustments to its business strategies.

Wider Implications for the Dutch Banking Sector

The potential ABN Amro fine carries broader implications for the Dutch banking sector. Other Dutch banks may review and potentially revise their own bonus structures to ensure full compliance with DNB regulations. The situation may prompt increased scrutiny of bonus practices across the sector, leading to more stringent regulatory oversight. This could result in changes to industry standards and potentially impact the overall financial stability of the Dutch banking system. The potential for increased regulatory changes and stricter enforcement could ripple through the wider financial landscape in the Netherlands, influencing lending practices and the overall cost of capital.

Conclusion: The ABN Amro Fine and the Future of Bonus Practices

The DNB's investigation into ABN Amro's bonus practices highlights the critical importance of responsible banking and adherence to regulatory guidelines. The potential fine's impact on ABN Amro – both financially and reputationally – underscores the severe consequences of non-compliance. The outcome of this case will undoubtedly influence the future of bonus structures within ABN Amro and likely set a precedent for other banks within the Dutch banking sector, prompting a wider reassessment of risk management and bonus schemes. Stay informed about developments in the ABN Amro fine case and the ongoing debate on responsible bonus practices within the Dutch banking sector. Further reading on topics such as responsible lending guidelines and banking regulations can help stakeholders understand the complexities of the situation. Understanding these implications is crucial for all involved in the Dutch banking sector and beyond.

Featured Posts

-

Sharath Kamal Loses To Snehit Suravajjula Bids Farewell At Wtt Chennai 2025

May 21, 2025

Sharath Kamal Loses To Snehit Suravajjula Bids Farewell At Wtt Chennai 2025

May 21, 2025 -

Sold Out Brooklyn Concerts Vybz Kartels Reign Continues

May 21, 2025

Sold Out Brooklyn Concerts Vybz Kartels Reign Continues

May 21, 2025 -

Sterke Kwartaalcijfers Tillen Abn Amro Aex Koers

May 21, 2025

Sterke Kwartaalcijfers Tillen Abn Amro Aex Koers

May 21, 2025 -

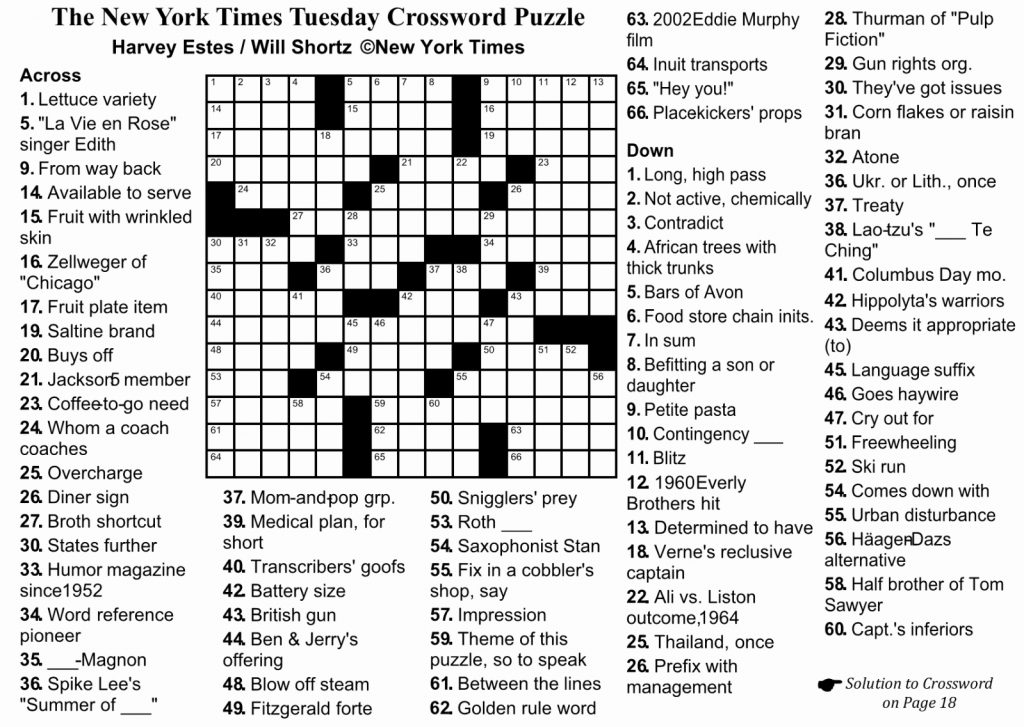

Nyt Mini Crossword Solution March 24 2025

May 21, 2025

Nyt Mini Crossword Solution March 24 2025

May 21, 2025 -

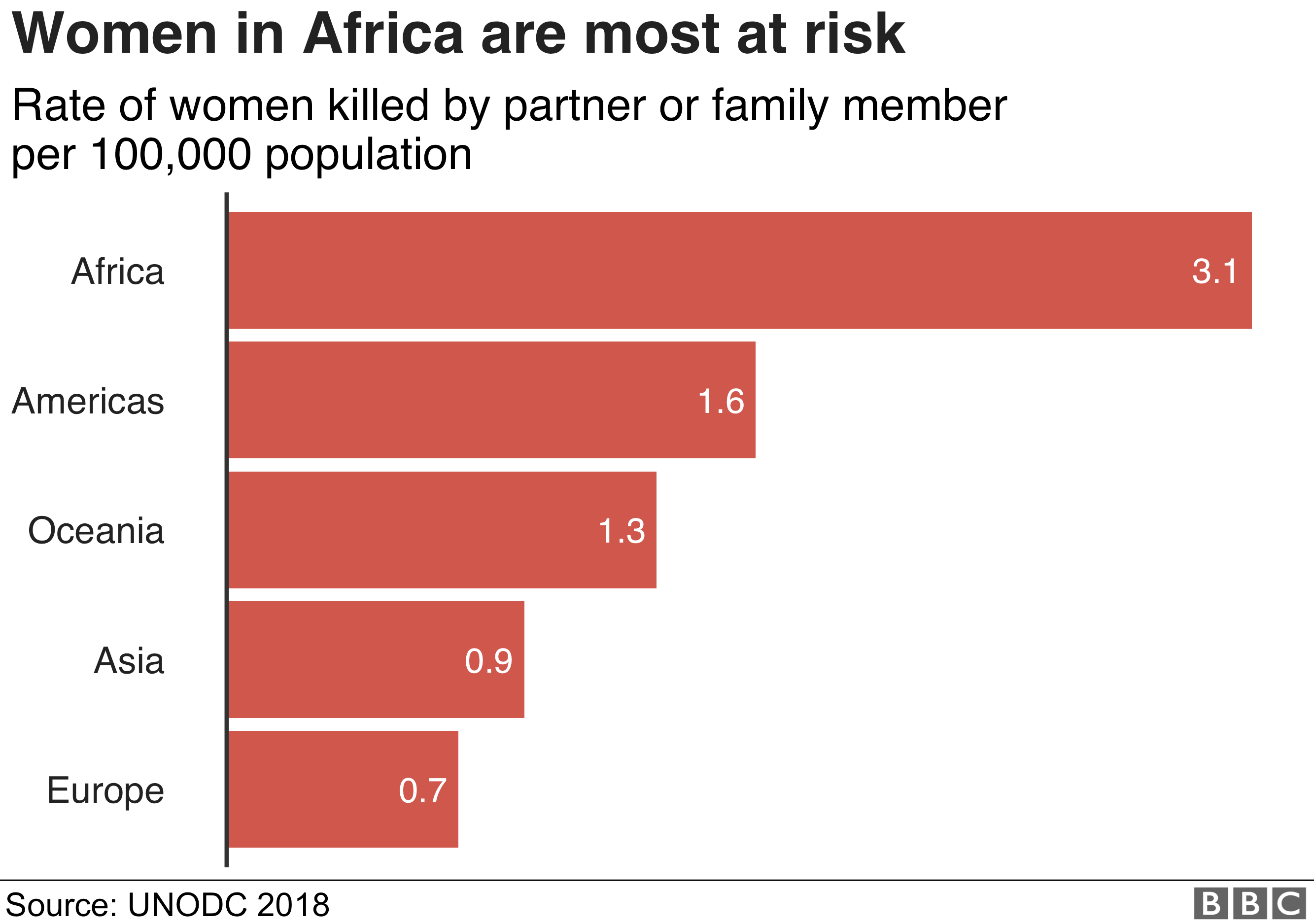

Mexican And Colombian Femicides Influencer And Model Murders Reignite Debate On Violence Against Women

May 21, 2025

Mexican And Colombian Femicides Influencer And Model Murders Reignite Debate On Violence Against Women

May 21, 2025

Latest Posts

-

Madrid Open Sabalenka And Zverev Progress To Later Stages

May 21, 2025

Madrid Open Sabalenka And Zverev Progress To Later Stages

May 21, 2025 -

Top Seeds Sabalenka And Zverev Advance To Next Round In Madrid

May 21, 2025

Top Seeds Sabalenka And Zverev Advance To Next Round In Madrid

May 21, 2025 -

Susan Lucci Splashes Water On Michael Strahan A Hilarious Moment

May 21, 2025

Susan Lucci Splashes Water On Michael Strahan A Hilarious Moment

May 21, 2025 -

Aryna Sabalenkas Commanding Victory Propels Her To Madrid Open Last 16

May 21, 2025

Aryna Sabalenkas Commanding Victory Propels Her To Madrid Open Last 16

May 21, 2025 -

Full Solutions Nyt Crossword Puzzle April 25 2025

May 21, 2025

Full Solutions Nyt Crossword Puzzle April 25 2025

May 21, 2025