ABN Amro Under Scrutiny For Bonus Practices

Table of Contents

Criticisms of ABN Amro's Bonus Structure

ABN Amro's bonus structure has drawn significant criticism on several fronts. Concerns range from the sheer size of payouts to a lack of transparency and potential conflicts of interest in the allocation process.

Excessive Bonuses Amidst Economic Uncertainty

One of the primary criticisms centers around the perceived excessiveness of bonuses awarded during periods of economic uncertainty or declining profits. This raises questions about fairness and corporate responsibility.

- Example: Reports suggest that certain senior executives received bonuses exceeding €[Insert Hypothetical Amount], a figure significantly higher than comparable roles at competitor banks like ING or Rabobank during a similar period.

- Comparison: A comparison of ABN Amro's bonus-to-profit ratios with industry averages reveals a disproportionately high figure, sparking debate about the justification for such payouts.

- Argument: Critics argue that awarding substantial bonuses while employees face job insecurity or shareholders experience reduced returns is morally questionable and potentially damaging to the bank's long-term sustainability.

Lack of Transparency in Bonus Calculations

Another major point of contention is the lack of transparency surrounding ABN Amro's bonus calculations. The opacity of the system makes it difficult to understand how bonuses are determined, fueling suspicion and mistrust.

- Criticism: Critics point to the absence of clearly defined metrics and performance indicators, suggesting that bonus allocations may be arbitrary or influenced by subjective factors.

- Bias Concerns: There are concerns about potential biases in the system, favoring certain departments or individuals over others, irrespective of their overall contribution to the bank's success.

- Whistleblower Accounts: [Mention any reported whistleblower accounts or leaked documents that shed light on the opacity of the bonus system, citing appropriate sources].

Potential Conflicts of Interest in Bonus Allocation

Concerns exist regarding potential conflicts of interest in the bonus allocation process. Rewarding employees for actions that may not be in the best interest of the bank or its shareholders raises serious ethical questions.

- Conflict Example: [Provide a hypothetical example of a potential conflict of interest, such as rewarding employees for risky investments that ultimately resulted in losses].

- Expert Opinion: [Quote a financial analyst or ethicist commenting on the potential for conflicts of interest within ABN Amro’s bonus system and the need for stricter guidelines].

Regulatory Scrutiny and Potential Consequences

The controversy surrounding ABN Amro's bonus practices has attracted the attention of regulatory bodies, leading to investigations and the potential for significant consequences.

Investigations and Audits

Several regulatory bodies are reportedly investigating ABN Amro's bonus practices. These investigations could result in significant penalties if violations are found.

- Regulatory Bodies: [List the names of the involved regulatory bodies, e.g., De Nederlandsche Bank (DNB), European Central Bank (ECB)].

- Potential Penalties: Potential penalties could include hefty fines, restrictions on future bonus payments, and even the removal of key personnel.

- Investigation Timeline: [Mention the timeline of the investigations, if known, and cite relevant news sources].

Potential Legal Ramifications

The ongoing scrutiny could lead to legal ramifications for ABN Amro and individual employees involved in the bonus allocation process.

- Lawsuits: Shareholders or other stakeholders may file lawsuits against ABN Amro alleging mismanagement or breach of fiduciary duty.

- Fines: Significant fines could be levied against the bank, impacting its profitability and financial stability.

- Reputational Damage: The legal battles themselves, irrespective of the outcome, can inflict severe reputational damage.

Impact on Shareholder Value

The controversy surrounding ABN Amro's bonus practices has had a tangible impact on its share price and investor confidence.

- Stock Price Fluctuations: [Report on any observed fluctuations in ABN Amro's stock price since the bonus controversy began].

- Investor Sentiment: [Describe the overall investor sentiment towards ABN Amro, citing any analyst reports or news articles].

- Investment Strategies: Investors may adjust their investment strategies in response to the controversy, potentially leading to reduced investment in the bank.

Public and Stakeholder Reaction to ABN Amro's Bonus Practices

The public and stakeholder reaction to ABN Amro's bonus practices has been largely negative, generating significant media coverage and social media discussions.

Public Outrage and Media Coverage

The news surrounding ABN Amro's bonus practices has fueled public outrage and widespread media criticism.

- News Articles: [Link to relevant news articles and reports covering public outrage].

- Social Media: [Summarize social media sentiment, noting the prevalence of negative comments and criticism].

- Public Protests: [Mention any public protests or demonstrations related to the issue].

Employee Morale and Retention

The controversy has likely impacted employee morale and could affect the bank's ability to retain talent.

- Employee Satisfaction: [Discuss potential effects on employee satisfaction and job security].

- Recruitment Difficulties: The negative publicity may make it harder for ABN Amro to attract and retain skilled employees.

- Loss of Experienced Staff: Experienced employees may seek opportunities elsewhere, impacting the bank's institutional knowledge.

Reputational Damage to ABN Amro

The long-term reputational consequences for ABN Amro could be significant, potentially affecting customer trust and business opportunities.

- Loss of Customers: Customers may lose confidence in the bank and switch to competitors.

- Impact on Future Business: The negative publicity could hinder ABN Amro's ability to secure new business deals and partnerships.

- Branding Expert Opinion: [Include opinions from branding experts on the extent of the reputational damage and strategies for recovery].

Conclusion: The Future of ABN Amro's Bonus Practices

The scrutiny surrounding ABN Amro's bonus practices highlights significant concerns about fairness, transparency, and corporate responsibility. The controversy has triggered regulatory investigations, negative public reaction, and potential damage to the bank's reputation and financial performance. To regain trust and address these concerns, ABN Amro may need to implement substantial changes to its bonus structure, enhancing transparency and aligning compensation more closely with long-term value creation. Stay updated on the ongoing developments concerning ABN Amro's bonus practices and share your perspective on the future of responsible compensation in the banking industry.

Featured Posts

-

Live Tv Chaos Bbc Breakfast Guest Interrupts Broadcast

May 22, 2025

Live Tv Chaos Bbc Breakfast Guest Interrupts Broadcast

May 22, 2025 -

Southport Migrant Rant Tory Politicians Wife To Stay In Jail

May 22, 2025

Southport Migrant Rant Tory Politicians Wife To Stay In Jail

May 22, 2025 -

El Superalimento Que Combate Las Enfermedades Cronicas Y Promueve El Envejecimiento Saludable

May 22, 2025

El Superalimento Que Combate Las Enfermedades Cronicas Y Promueve El Envejecimiento Saludable

May 22, 2025 -

Javier Baez Enfocandose En La Salud Y La Productividad Para La Temporada

May 22, 2025

Javier Baez Enfocandose En La Salud Y La Productividad Para La Temporada

May 22, 2025 -

Marks And Spencer Cyber Attack 300 Million Loss Projected

May 22, 2025

Marks And Spencer Cyber Attack 300 Million Loss Projected

May 22, 2025

Latest Posts

-

Understanding The Thames Water Executive Bonus Structure

May 22, 2025

Understanding The Thames Water Executive Bonus Structure

May 22, 2025 -

Thames Water Public Outrage Over Executive Bonuses

May 22, 2025

Thames Water Public Outrage Over Executive Bonuses

May 22, 2025 -

Are Thames Water Executive Bonuses Excessive A Critical Analysis

May 22, 2025

Are Thames Water Executive Bonuses Excessive A Critical Analysis

May 22, 2025 -

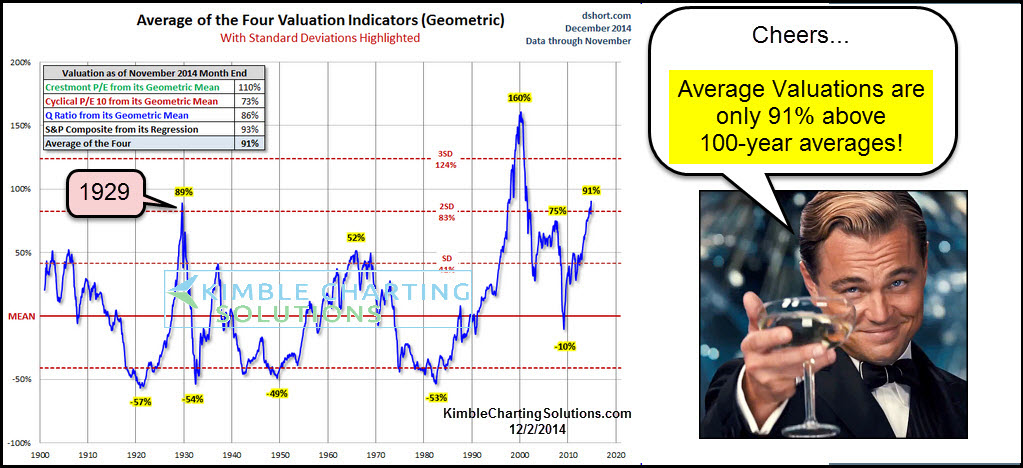

High Stock Market Valuations A Bof A Analysis And Why You Shouldnt Worry

May 22, 2025

High Stock Market Valuations A Bof A Analysis And Why You Shouldnt Worry

May 22, 2025 -

The Thames Water Executive Bonus Debate Facts And Figures

May 22, 2025

The Thames Water Executive Bonus Debate Facts And Figures

May 22, 2025