Acquisition Sanofi : Dren Bio Et Son Anticorps

Table of Contents

Dren Bio's Innovative Antibody Technology

Dren Bio's success hinges on its proprietary antibody technology, a novel approach to targeting [Specific cancer type, e.g., triple-negative breast cancer]. This innovative approach offers the potential for improved efficacy and reduced side effects compared to existing therapies.

Mechanism of Action

Dren Bio's antibody, tentatively named [Antibody name, if available, otherwise use placeholder like "DB-Antibody X"], employs a unique mechanism of action. Unlike traditional antibodies that simply bind to cancer cells, DB-Antibody X [Explain the unique mechanism, e.g., targets a specific neoantigen expressed only on cancer cells, triggering a potent immune response via Antibody-Dependent Cellular Cytotoxicity (ADCC) and Complement-Dependent Cytotoxicity (CDC)].

- High Target Specificity: DB-Antibody X demonstrates exceptional selectivity for cancerous cells, minimizing off-target effects and reducing the risk of adverse reactions.

- Enhanced Efficacy: Pre-clinical data suggest a significantly improved therapeutic index compared to existing antibody-based therapies.

- Favorable Safety Profile: Early studies indicate a manageable safety profile with minimal toxicity.

This precise targeting mechanism, coupled with its potent cytotoxic effects, positions DB-Antibody X as a potential game-changer in oncology.

Pre-clinical and Clinical Data

Pre-clinical studies in animal models have shown remarkable results, demonstrating significant tumor regression and improved survival rates. These promising findings have led to the initiation of Phase I clinical trials in human patients. While full results are still pending, early data released in [Source: Cite press release or publication] indicate [mention specific positive results, e.g., tolerability and encouraging anti-tumor activity].

- Positive Phase I Results: [Specific details on efficacy and safety from Phase I trials].

- Ongoing Phase II Trials: Recruitment is currently underway for Phase II trials, which will evaluate the efficacy and safety of DB-Antibody X in a larger patient population.

- Future Development: Further studies are planned to explore potential combination therapies with existing chemotherapeutic agents or other targeted therapies.

Strategic Rationale Behind Sanofi's Acquisition

Sanofi's acquisition of Dren Bio reflects a strategic move to bolster its oncology portfolio and solidify its position in the rapidly evolving cancer therapeutics market.

Expanding Sanofi's Portfolio

Sanofi's existing oncology portfolio, while strong, lacks a therapy with the unique mechanism of action offered by DB-Antibody X. This acquisition fills a critical gap, enhancing their ability to offer a comprehensive range of treatment options to patients.

- Synergies with Existing Platforms: Sanofi's expertise in drug development and commercialization, combined with Dren Bio's cutting-edge technology, creates significant synergies, accelerating the path to market.

- Diversification of Therapeutic Approaches: The acquisition adds a novel modality to Sanofi's oncology pipeline, diversifying its therapeutic strategies and reducing dependence on any single approach.

Market Potential and Financial Implications

The market for [Specific cancer type] therapies is substantial and growing rapidly. Analysts project a market value of [Market size estimate] by [Year]. DB-Antibody X's unique properties position it for a significant market share.

- Projected Revenue Streams: Successful commercialization of DB-Antibody X could generate significant revenue streams for Sanofi, potentially exceeding [Revenue estimate].

- Return on Investment: While the acquisition cost remains undisclosed, the potential market size and DB-Antibody X's innovative nature suggest a high return on investment for Sanofi.

Future Prospects and Challenges

Despite the exciting prospects, the successful commercialization of DB-Antibody X faces several challenges.

Regulatory Pathway and Approval Timeline

Navigating the regulatory landscape is crucial. Sanofi will need to submit comprehensive data packages to regulatory bodies like the FDA and EMA to secure market approval.

- Regulatory Hurdles: Meeting stringent regulatory requirements, including demonstrating both efficacy and safety, will be critical.

- Anticipated Timeline: A realistic timeline for regulatory approval would likely span [Timeframe estimate], depending on the speed of ongoing clinical trials and regulatory review processes.

Competition and Market Landscape

The oncology market is fiercely competitive. Several established therapies and emerging competitors pose a significant challenge.

- Competitive Landscape: [Mention key competitors and their therapies].

- Market Share Potential: Sanofi will need a robust commercialization strategy to secure a significant market share.

- Strategic Partnerships: Collaborations with other pharmaceutical companies or biotech firms could help accelerate development and market penetration.

Conclusion

Sanofi's Acquisition Sanofi Dren Bio, centered around its innovative antibody technology, holds significant promise for oncology. This acquisition strengthens Sanofi's pipeline and positions the company for future growth in this competitive market. The success of this acquisition hinges on successfully navigating regulatory pathways and effectively competing against established therapies.

Call to Action: Stay informed about the progress of Sanofi's development and commercialization of Dren Bio's groundbreaking antibody. Follow our updates on future developments in the field of Acquisition Sanofi Dren Bio. Learn more about the latest advancements in antibody-based therapies by subscribing to our newsletter.

Featured Posts

-

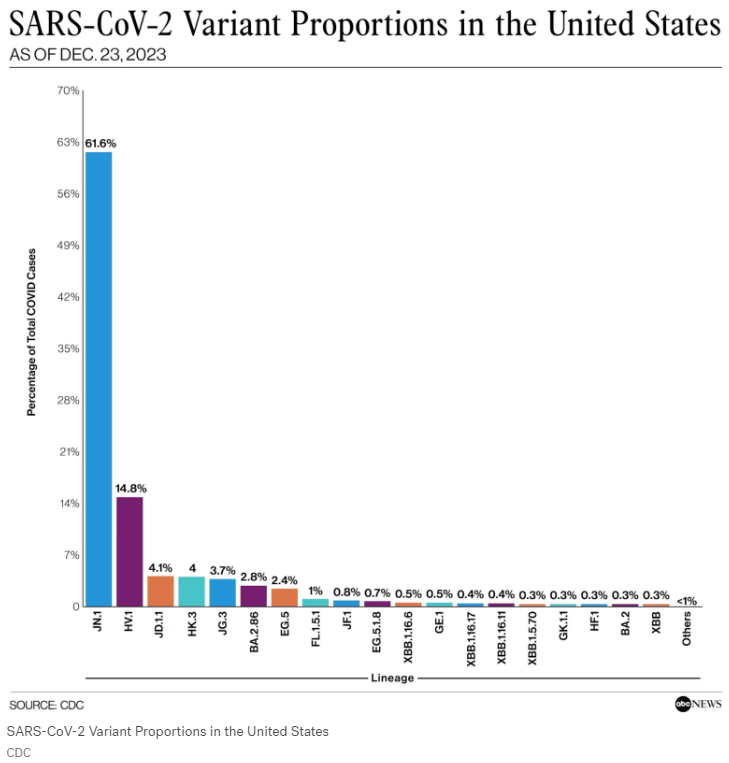

Covid 19s Jn 1 Variant What Are The Symptoms And How To Protect Yourself

May 31, 2025

Covid 19s Jn 1 Variant What Are The Symptoms And How To Protect Yourself

May 31, 2025 -

The Good Life And You Practical Tips For Everyday Living

May 31, 2025

The Good Life And You Practical Tips For Everyday Living

May 31, 2025 -

Receta Autentica De Carcamusas Descubre Este Plato Toledano

May 31, 2025

Receta Autentica De Carcamusas Descubre Este Plato Toledano

May 31, 2025 -

U Conns Academic Success Six Teams Post Perfect Apr Scores

May 31, 2025

U Conns Academic Success Six Teams Post Perfect Apr Scores

May 31, 2025 -

The Spanish Blackout Iberdrolas Accusation Shifts Focus To Grid Management

May 31, 2025

The Spanish Blackout Iberdrolas Accusation Shifts Focus To Grid Management

May 31, 2025