Addressing High Stock Market Valuations: BofA's Analysis For Investors

Table of Contents

BofA's Key Concerns Regarding High Valuations

BofA highlights several factors contributing to these elevated valuations. Low interest rates, sustained quantitative easing policies, and robust corporate earnings have all played a significant role in driving market growth. However, BofA expresses valid concerns about the long-term sustainability of these factors and the potential for a market correction. The current market situation presents a complex interplay of economic forces that require careful consideration.

-

Elevated Price-to-Earnings (P/E) Ratios: Across numerous sectors, P/E ratios are significantly higher than historical averages, indicating potentially overvalued stocks. This high valuation signals a risk of future price declines.

-

Inflationary Pressures: Rising inflation poses a considerable threat to corporate profitability. Increased production costs can erode profit margins, impacting stock prices negatively. The current inflationary environment demands careful monitoring and a reassessment of investment portfolios.

-

Rising Interest Rates: The Federal Reserve's moves to increase interest rates aim to combat inflation, but these hikes increase borrowing costs for businesses and potentially slow economic growth. This, in turn, can negatively affect corporate earnings and stock market valuations. Understanding the impact of interest rate hikes on the market is crucial for effective investment management.

-

Geopolitical Uncertainty: Global geopolitical instability introduces further volatility into the market. Unforeseen events can quickly impact investor sentiment and lead to sharp market fluctuations.

BofA's Recommended Investment Strategies for High Valuation Environments

In light of these concerns, BofA recommends a cautious approach emphasizing diversification and robust risk management strategies. The current market environment necessitates a prudent approach to investment, prioritizing risk mitigation.

-

Diversify Across Asset Classes: Spreading investments across various asset classes, including stocks, bonds, and real estate, helps reduce overall portfolio risk. Diversification is a cornerstone of effective risk management.

-

Increase Allocation to Defensive Sectors: Shifting some investment towards defensive sectors like consumer staples and utilities, which tend to be less sensitive to economic downturns, can help protect against market volatility. These sectors offer stability and resilience during periods of economic uncertainty.

-

Value Investing Strategies: Focusing on undervalued companies, those trading below their intrinsic value, offers the potential for higher returns while mitigating some risks associated with overvalued growth stocks. Value investing represents a more conservative approach during high valuation periods.

-

Regular Portfolio Rebalancing: Periodically adjusting your portfolio to maintain your desired asset allocation is crucial for managing risk and staying aligned with your long-term goals. Regular rebalancing ensures the portfolio remains consistent with the investor's risk tolerance.

-

Alternative Investments: Exploring alternative investments like precious metals can act as a hedge against inflation, protecting purchasing power. Alternative investments can provide diversification and protection during periods of high inflation and market volatility.

Analyzing BofA's Predictions and Their Implications for Investors

BofA's market forecast (while specific numbers aren't publicly available here, one should consult BofA's official reports for precise figures) suggests a potential range of outcomes. Understanding these predictions is vital for making informed investment decisions. The impact on different investment styles will vary, with growth stocks potentially more vulnerable to a market correction than value stocks.

-

Market Growth Forecast: BofA's prediction should be considered (find and insert specific numbers from their reports). This forecast needs to be interpreted in the context of the overall economic climate and associated risks.

-

Growth vs. Value Stocks: The impact on different stock categories will vary. Growth stocks, often characterized by high valuations, are more susceptible to correction than value stocks, which are generally cheaper relative to their earnings.

-

Long-Term Investment Horizon: Maintaining a long-term investment strategy is critical during periods of market uncertainty. Short-term market fluctuations should not influence long-term investment objectives.

-

Navigating a Market Downturn: Having a plan in place to manage potential losses during a market correction is essential. This includes having emergency funds readily available and a strategy for managing investment losses.

Understanding the Role of Inflation and Interest Rates

Inflation and interest rates are inextricably linked to stock market valuations. BofA's analysis heavily incorporates these macroeconomic factors, emphasizing their crucial role in shaping market performance.

-

Inflation, Interest Rates, and Stock Valuations: Rising inflation often leads to interest rate hikes, potentially slowing economic growth and impacting corporate earnings. This affects stock valuations, as higher interest rates increase borrowing costs for companies, impacting profitability.

-

BofA's Predictions: Consult BofA's reports for specific predictions on future inflation and interest rate movements. These predictions should guide investment strategy adjustments.

-

Adjusting Investment Strategies Based on Inflation: Strategies must be adjusted based on expected inflation. Investments in assets that typically outperform during inflationary periods, such as real estate and commodities, might be considered.

Conclusion

BofA's analysis of high stock market valuations emphasizes the necessity of a cautious and diversified investment approach. Understanding potential risks and employing effective risk management techniques is crucial for navigating these uncertain times. Their recommendations underscore the importance of diversification, value investing, and a long-term perspective. Don't let high stock market valuations deter you from investing. Utilize BofA's insights and develop a robust investment strategy to address high stock market valuations and achieve your financial goals. Consult with a financial advisor to create a personalized plan tailored to your risk tolerance and investment objectives. Remember, a well-diversified portfolio, incorporating strategies for managing risk in high-valuation environments, can help you navigate uncertainty and work towards your long-term financial success.

Featured Posts

-

Harvard Vs Trump The Legal Battle Shaping Higher Education

Apr 23, 2025

Harvard Vs Trump The Legal Battle Shaping Higher Education

Apr 23, 2025 -

Historic Night For Yankees 9 Home Runs Judge Leads With 3

Apr 23, 2025

Historic Night For Yankees 9 Home Runs Judge Leads With 3

Apr 23, 2025 -

Mahmoud Khalil Denied Release Wife Gives Birth Alone

Apr 23, 2025

Mahmoud Khalil Denied Release Wife Gives Birth Alone

Apr 23, 2025 -

Cory Provus Reflects On The Legacy Of Bob Uecker

Apr 23, 2025

Cory Provus Reflects On The Legacy Of Bob Uecker

Apr 23, 2025 -

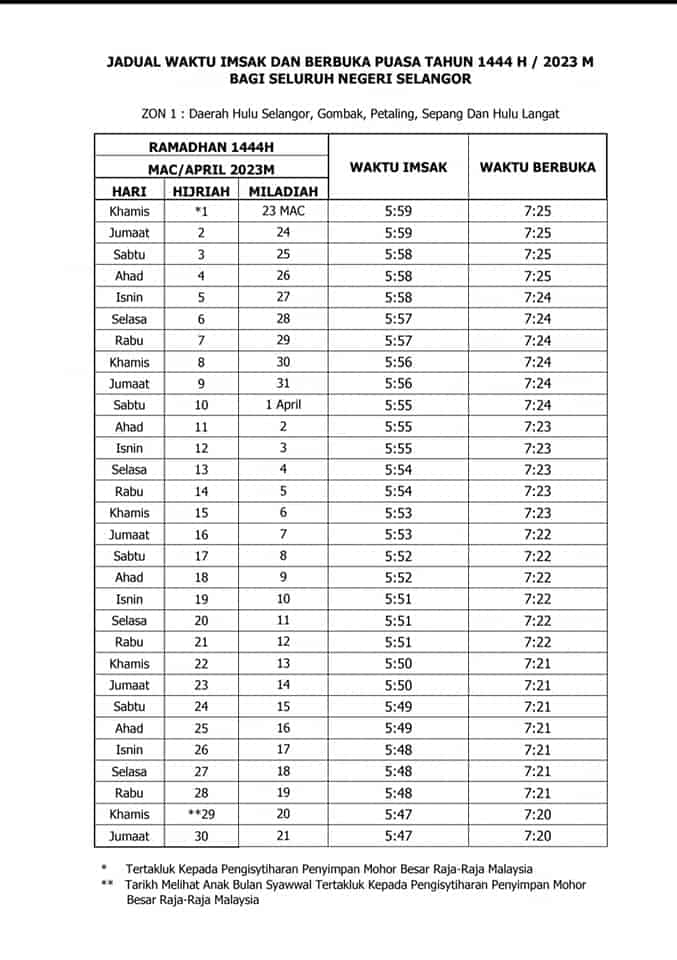

Ramadan 2025 Daftar Lengkap Acara Tv Untuk Menemani Waktu Berbuka Dan Sahur Anda

Apr 23, 2025

Ramadan 2025 Daftar Lengkap Acara Tv Untuk Menemani Waktu Berbuka Dan Sahur Anda

Apr 23, 2025

Latest Posts

-

Solve Nyt Strands Puzzle 366 Tuesday March 4 Hints And Answers

May 10, 2025

Solve Nyt Strands Puzzle 366 Tuesday March 4 Hints And Answers

May 10, 2025 -

Nyt Strands Game 366 Hints And Solutions For Tuesday March 4

May 10, 2025

Nyt Strands Game 366 Hints And Solutions For Tuesday March 4

May 10, 2025 -

Unlocking The Nyt Strands Crossword April 6 2025

May 10, 2025

Unlocking The Nyt Strands Crossword April 6 2025

May 10, 2025 -

Wednesday March 12 Nyt Strands Solutions Game 374

May 10, 2025

Wednesday March 12 Nyt Strands Solutions Game 374

May 10, 2025 -

Nyt Crossword Strands April 6th 2025 Hints And Answers

May 10, 2025

Nyt Crossword Strands April 6th 2025 Hints And Answers

May 10, 2025