Addressing Investor Concerns: BofA On Elevated Stock Market Valuations

Table of Contents

BofA's Assessment of Current Market Conditions

BofA's recent report paints a nuanced picture of the current equity market. While acknowledging the undeniably high stock market valuations, they don't necessarily view them as a harbinger of imminent collapse. Their assessment considers a multitude of factors, going beyond simplistic metrics like Price-to-Earnings (P/E) ratios. They incorporate broader economic indicators, interest rate projections, and sector-specific analyses to form a comprehensive view.

-

Key findings from BofA's research: BofA highlights the influence of low interest rates and sustained corporate earnings growth in supporting current valuations. However, they also caution that these factors may not be sustainable in the long term.

-

Comparison of current valuations to historical averages: The report compares current P/E ratios and other valuation metrics to historical averages, noting that while valuations are elevated, they aren't unprecedented. This historical context helps to temper immediate panic, emphasizing the need for a long-term perspective.

-

Specific sectors highlighted: BofA's analysis pinpoints specific sectors, such as technology and consumer discretionary, as potentially overvalued, while others, such as energy and certain segments of the healthcare industry, may present more attractive opportunities relative to their valuations. This granular approach provides investors with sector-specific insights to better manage their portfolio.

Identifying Potential Risks and Opportunities

While BofA doesn't predict an immediate market crash, they do identify potential risks associated with these high stock market valuations. Understanding these risks is crucial for informed investment decisions.

-

Risk factors BofA highlights:

- Increased market vulnerability: High valuations mean the market is more sensitive to negative news and economic shocks. A sudden shift in sentiment could trigger a significant correction.

- Potential for a correction: BofA acknowledges the potential for a market correction, emphasizing the importance of risk management strategies.

- Interest rate hikes impact: Rising interest rates could impact corporate profitability and investor appetite for equities, potentially leading to lower valuations.

-

Potential scenarios BofA considers: The report outlines several potential scenarios, ranging from a relatively soft landing to a more pronounced correction. This probabilistic approach helps investors prepare for a range of outcomes.

-

Mitigation strategies: BofA suggests mitigating risk through diversification, focusing on high-quality companies with strong fundamentals, and maintaining a disciplined approach to investing.

Despite the risks, BofA also identifies opportunities within the current market environment.

-

Attractive sectors: While some sectors are seen as overvalued, BofA highlights others with potentially strong long-term growth prospects, even at current valuations.

-

Long-term growth potential: BofA emphasizes the importance of considering long-term growth potential when assessing valuations. Short-term market fluctuations should not overshadow the potential for long-term returns.

-

Strategies for managing risk: The report stresses the importance of a well-diversified portfolio, a long-term investment horizon, and a clear understanding of one's own risk tolerance.

BofA's Recommendations for Investors

Based on their analysis, BofA offers several key recommendations for investors navigating these elevated stock market valuations:

-

Specific actionable steps: The advice includes diversifying across asset classes, sectors, and geographies.

-

Portfolio adjustments: BofA suggests re-evaluating portfolio allocations, potentially shifting away from sectors deemed overvalued and toward those presenting better risk-reward profiles.

-

Importance of risk tolerance and long-term goals: The report underscores the critical importance of aligning investment strategies with individual risk tolerance and long-term financial goals. A long-term perspective is crucial to weathering market fluctuations.

Conclusion: Navigating Elevated Stock Market Valuations with BofA's Guidance

BofA's analysis offers a balanced perspective on current high stock market valuations. While acknowledging the elevated valuations and inherent risks, they also highlight opportunities for long-term growth. Their recommendations emphasize the importance of diversification, a long-term investment horizon, and a thorough understanding of one's own risk tolerance. By carefully considering BofA's insights, investors can develop a more robust and informed strategy to navigate the complexities of the current market. Stay informed about market fluctuations by following BofA's research and develop a robust investment strategy by considering BofA's insights on high stock market valuations.

Featured Posts

-

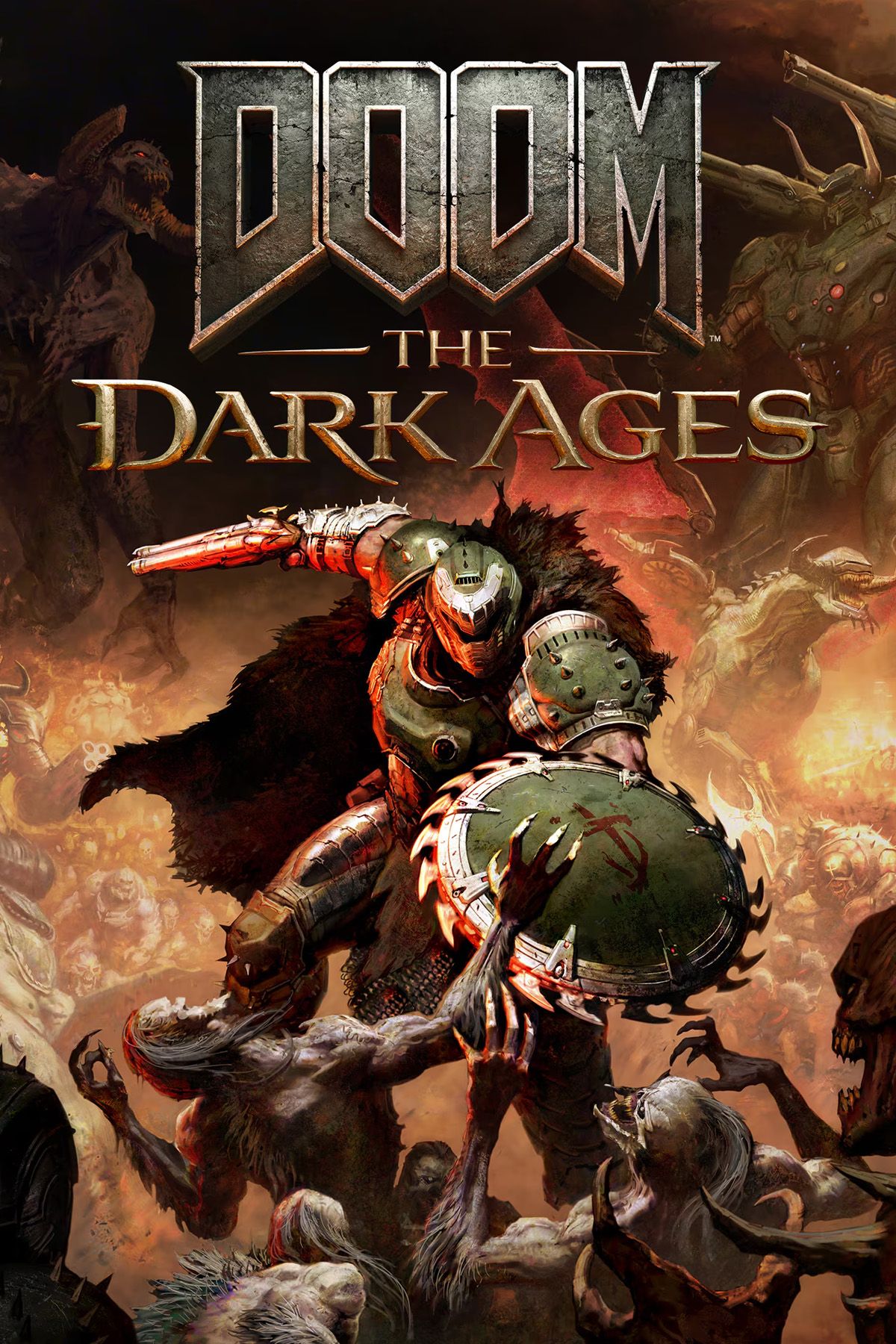

Doom The Dark Ages A Comprehensive Guide To The Release And Trailers

May 13, 2025

Doom The Dark Ages A Comprehensive Guide To The Release And Trailers

May 13, 2025 -

Save 17 On Doom The Dark Ages Best Deal Available

May 13, 2025

Save 17 On Doom The Dark Ages Best Deal Available

May 13, 2025 -

Gibraltars Brexit Future Ongoing Negotiations And Unresolved Issues

May 13, 2025

Gibraltars Brexit Future Ongoing Negotiations And Unresolved Issues

May 13, 2025 -

Eva Longoria 50 Evesen Is Toekeletes Alak

May 13, 2025

Eva Longoria 50 Evesen Is Toekeletes Alak

May 13, 2025 -

Cnn Reports Three Vehicles Crash Into Same Townhouse Over Two Years

May 13, 2025

Cnn Reports Three Vehicles Crash Into Same Townhouse Over Two Years

May 13, 2025

Latest Posts

-

Shohei Ohtanis 6 Run 9th Inning Powers Wild Dodgers Comeback

May 14, 2025

Shohei Ohtanis 6 Run 9th Inning Powers Wild Dodgers Comeback

May 14, 2025 -

Dodgers Defeat Diamondbacks In 14 11 Slugfest Ohtanis Late Power

May 14, 2025

Dodgers Defeat Diamondbacks In 14 11 Slugfest Ohtanis Late Power

May 14, 2025 -

14 11 Thriller Ohtanis Heroics Secure Dodgers Win Against Diamondbacks

May 14, 2025

14 11 Thriller Ohtanis Heroics Secure Dodgers Win Against Diamondbacks

May 14, 2025 -

Dodgers Rally Past Diamondbacks Ohtanis Late Homer The Key

May 14, 2025

Dodgers Rally Past Diamondbacks Ohtanis Late Homer The Key

May 14, 2025 -

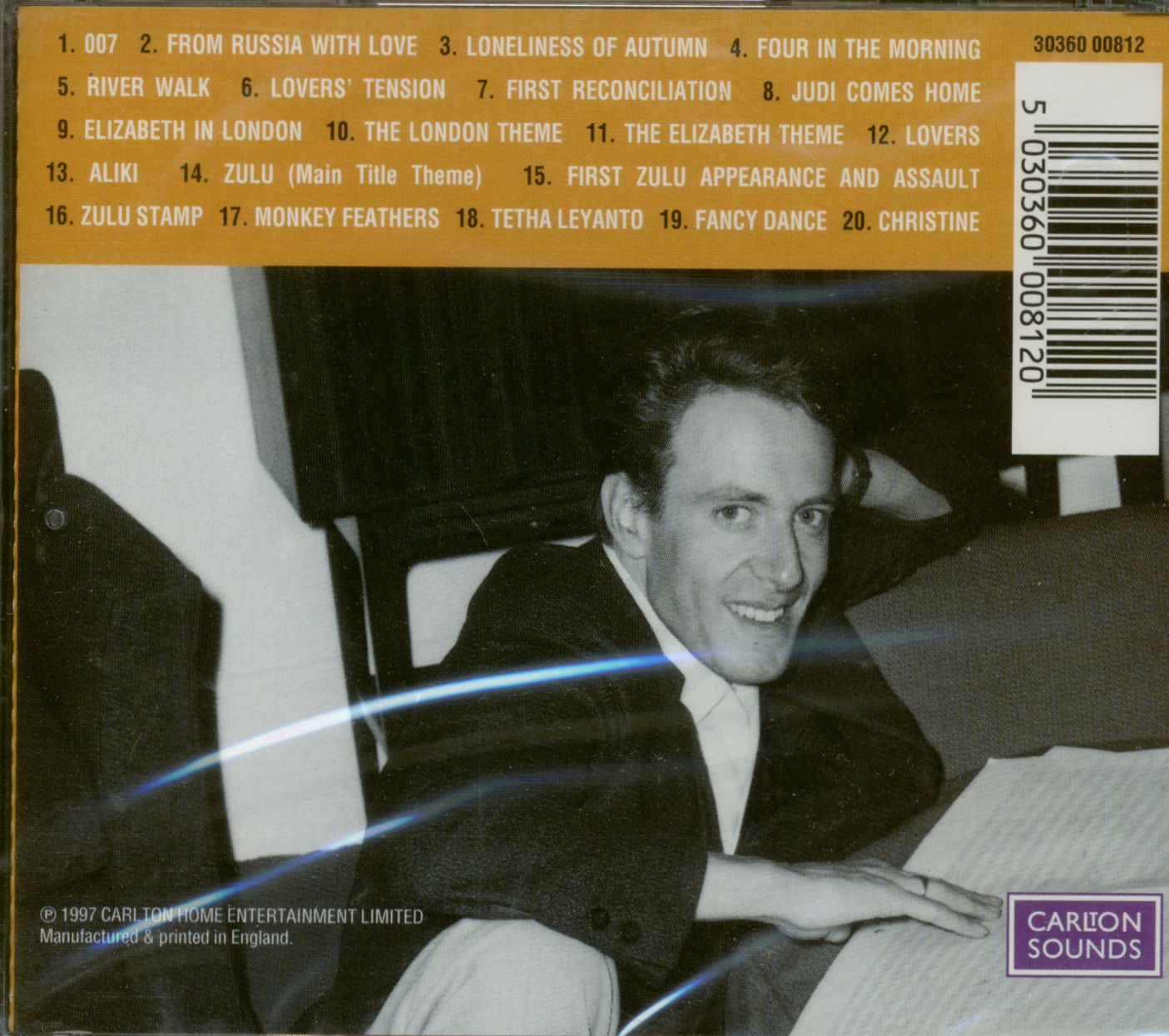

Experience John Barrys From York With Love At Your Local Everyman

May 14, 2025

Experience John Barrys From York With Love At Your Local Everyman

May 14, 2025