Addressing Stock Market Valuation Concerns: Insights From BofA

Table of Contents

BofA's Current Assessment of Stock Market Valuation

BofA's recent reports offer a nuanced perspective on stock market valuation, avoiding overly simplistic bullish or bearish pronouncements. Instead, they present a detailed analysis incorporating various valuation metrics and macroeconomic factors. Their stance tends to be cautiously optimistic, acknowledging elevated valuations in certain sectors while identifying pockets of undervaluation elsewhere. Their analysis isn't about predicting short-term market movements but rather about assessing long-term value and potential risk.

- Key Valuation Metrics: BofA utilizes a range of metrics, including the Price-to-Earnings ratio (P/E), the cyclically adjusted price-to-earnings ratio (Shiller PE), and various sector-specific valuation ratios, to assess market valuation. They carefully analyze these metrics in conjunction with macroeconomic indicators.

- Sector-Specific Analysis: Recent BofA reports have highlighted the technology sector as potentially overvalued in certain segments, while expressing more positive sentiment toward undervalued sectors such as energy or financials (specific examples should be referenced from current BofA reports for accuracy).

- Quantitative Data: BofA often provides quantitative data to support their assessment. For example, they might highlight a specific percentage increase in the Shiller PE ratio compared to historical averages or project specific target price ranges for major indices. (Insert specific data points from recent BofA reports here, citing the source).

Factors Influencing BofA's Valuation Analysis

BofA's valuation analysis is not conducted in a vacuum. Their assessment is deeply informed by a range of macroeconomic factors and market trends. Understanding these influences is crucial to interpreting their overall outlook.

- Interest Rate Hikes: The impact of interest rate hikes by central banks, like the Federal Reserve, is a central theme in BofA's analysis. Higher interest rates increase borrowing costs for companies, potentially impacting earnings and reducing the present value of future cash flows, thus affecting stock valuations.

- Inflationary Pressures: Persistent inflation erodes corporate profit margins and can lead to higher discount rates used in valuation models, negatively impacting equity valuations. BofA closely monitors inflation data and its potential impact on corporate earnings.

- Geopolitical Events and Investor Sentiment: Geopolitical instability and shifts in investor sentiment can significantly influence market valuations, often creating volatility and impacting risk appetite. BofA incorporates these factors into their analysis.

- Key Economic Indicators: BofA analyzes various economic indicators such as GDP growth, consumer confidence, unemployment rates, and manufacturing PMI to gauge the overall economic health and its impact on corporate profitability and stock valuations.

BofA's Investment Recommendations Based on Valuation Analysis

Based on their comprehensive valuation analysis, BofA provides investment recommendations designed to help investors navigate the current market environment. These recommendations often emphasize a balanced approach, acknowledging both opportunities and risks.

- Sector Allocation: BofA might suggest overweighting certain sectors deemed undervalued by their analysis while advocating for a more cautious approach to potentially overvalued sectors. (Again, specific recommendations from current BofA reports should be included).

- Risk Management Strategies: Given the current market uncertainties, BofA often emphasizes the importance of robust risk management strategies, such as diversification and careful position sizing.

- Stock Picking (with disclaimer): While BofA may mention specific stocks in their reports, it's crucial to remember that these are suggestions based on their analysis and not financial advice. Investors should always conduct their own thorough due diligence before making any investment decisions. (Mention any specific examples with appropriate disclaimers).

Navigating Uncertainty and Volatility

The stock market is inherently volatile, and navigating uncertainty requires a strategic approach. BofA's insights underscore the importance of long-term planning and risk mitigation.

- Diversification: Diversifying across different asset classes and sectors is crucial to mitigate portfolio risk and reduce the impact of market downturns.

- Portfolio Volatility Management: Employing strategies like dollar-cost averaging or employing stop-loss orders can help manage portfolio volatility and protect against significant losses.

- Long-Term Investment Perspective: Maintaining a long-term investment horizon allows investors to weather short-term market fluctuations and benefit from the long-term growth potential of equities.

Conclusion

BofA's analysis of stock market valuation provides valuable insights into the current market environment. Their assessment considers a range of factors, including macroeconomic indicators, interest rate changes, and investor sentiment. While acknowledging elevated valuations in certain sectors, they identify opportunities in others, emphasizing the importance of diversification and robust risk management strategies. Understanding stock market valuation is crucial for making informed investment decisions. Stay updated on BofA's insights and analysis to effectively address your stock market valuation concerns and develop a robust investment strategy. Learn more about BofA Global Research's market perspectives to effectively navigate the complexities of stock market valuation and make sound investment choices.

Featured Posts

-

Unexpected Guest Interrupts Bbc Breakfast Live Show

May 21, 2025

Unexpected Guest Interrupts Bbc Breakfast Live Show

May 21, 2025 -

Sterke Kwartaalcijfers Tillen Abn Amro Aex Koers

May 21, 2025

Sterke Kwartaalcijfers Tillen Abn Amro Aex Koers

May 21, 2025 -

Trumps Tariffs Statehood Remarks Ignite Debate Wayne Gretzkys Canadian Loyalty Questioned

May 21, 2025

Trumps Tariffs Statehood Remarks Ignite Debate Wayne Gretzkys Canadian Loyalty Questioned

May 21, 2025 -

Reyting Providnikh Finansovikh Kompaniy Ukrayini Za 2024 Rik Credit Kasa Finako Ukrfinzhitlo Atlana Ta Credit Plus

May 21, 2025

Reyting Providnikh Finansovikh Kompaniy Ukrayini Za 2024 Rik Credit Kasa Finako Ukrfinzhitlo Atlana Ta Credit Plus

May 21, 2025 -

Robin Roberts Getting Fancy Remark Amid Gma Layoffs What It Means

May 21, 2025

Robin Roberts Getting Fancy Remark Amid Gma Layoffs What It Means

May 21, 2025

Latest Posts

-

Breezy And Mild Destinations Where To Find The Perfect Climate

May 21, 2025

Breezy And Mild Destinations Where To Find The Perfect Climate

May 21, 2025 -

From Ragbrai To Workplace Scott Savilles Passion For Biking

May 21, 2025

From Ragbrai To Workplace Scott Savilles Passion For Biking

May 21, 2025 -

Enjoying Breezy And Mild Conditions A Comprehensive Guide

May 21, 2025

Enjoying Breezy And Mild Conditions A Comprehensive Guide

May 21, 2025 -

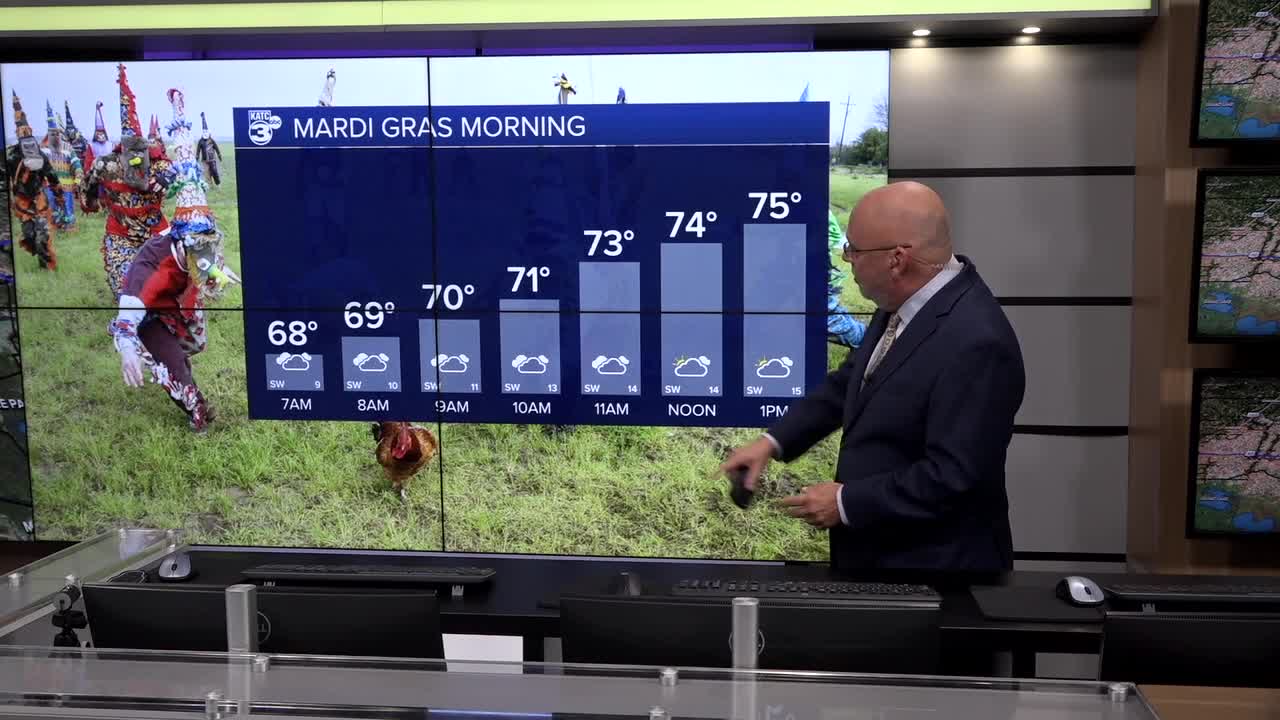

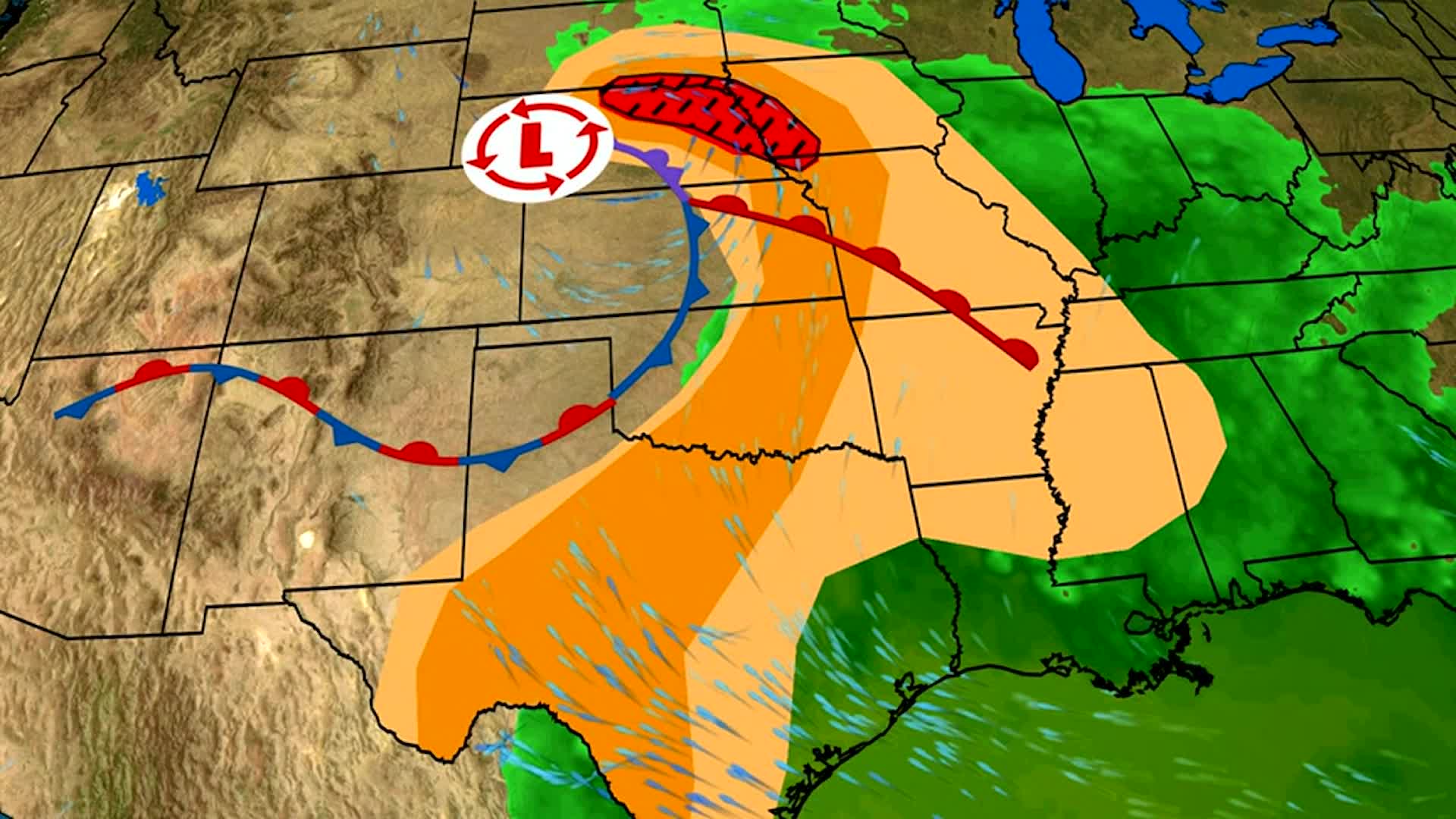

Increased Storm Chance Overnight Severe Potential Monday

May 21, 2025

Increased Storm Chance Overnight Severe Potential Monday

May 21, 2025 -

Monday Severe Weather Overnight Storm Chances And Impacts

May 21, 2025

Monday Severe Weather Overnight Storm Chances And Impacts

May 21, 2025