AEX Index Crashes: More Than 4% Loss, Lowest Point In 12 Months

Table of Contents

Causes of the AEX Index Crash

Several interconnected factors contributed to the recent AEX index crashes. Understanding these contributing elements is crucial for navigating the current market volatility.

Global Market Influences

Global economic uncertainty played a significant role in the AEX's decline. Rising inflation rates across the globe, coupled with persistent fears of a looming recession, have created a climate of apprehension among investors. Increased interest rates implemented by central banks worldwide to combat inflation further exacerbate the situation, impacting borrowing costs and dampening economic growth. Geopolitical risks, including the ongoing war in Ukraine and escalating tensions in other regions, also contribute to this heightened sense of uncertainty. Keywords: Global recession, inflation, interest rates, geopolitical risks, global market volatility.

- Inflationary pressures: High inflation erodes purchasing power and discourages investment.

- Recessionary fears: The possibility of a global recession dampens investor confidence, leading to sell-offs.

- Geopolitical instability: Uncertainty stemming from international conflicts negatively impacts market sentiment.

- Interest rate hikes: Increased interest rates make borrowing more expensive, impacting business investments and consumer spending.

Sector-Specific Impacts

The AEX index crash wasn't uniform across all sectors. Certain sectors within the AEX experienced disproportionately larger losses. The technology sector, often sensitive to shifts in interest rates and economic sentiment, saw significant declines. Similarly, the energy sector, influenced by fluctuating oil prices and global energy demand, faced considerable pressure. The financial sector also experienced losses, reflecting concerns about potential loan defaults and economic slowdowns. Keywords: Technology sector, energy sector, financial sector, AEX components, sector-specific performance.

- Technology sector downturn: Higher interest rates and reduced consumer spending directly impact tech valuations.

- Energy sector volatility: Fluctuating oil prices and geopolitical events create instability in the energy sector.

- Financial sector concerns: Economic slowdowns increase the risk of loan defaults, affecting financial institutions.

Domestic Factors

Besides global factors, several domestic factors contributed to the AEX index crashes. Changes in consumer confidence within the Netherlands, potentially influenced by inflation and rising living costs, might have reduced spending and negatively affected market sentiment. Government policies and regulations also play a role, influencing investor behavior and business activity. Keywords: Dutch economy, consumer confidence, government policies, AEX performance, domestic market conditions.

- Decreased consumer confidence: Inflation and economic uncertainty can lead to reduced consumer spending.

- Government regulations: New policies or regulatory changes can impact specific sectors within the AEX.

- Domestic economic indicators: Weak economic data from the Netherlands can further depress market sentiment.

Impact and Implications of the AEX Index Decline

The significant drop in the AEX index has far-reaching implications for investors and the Dutch economy.

Investor Sentiment

The AEX index crashes have severely impacted investor sentiment. We've seen increased market volatility and higher trading volumes as investors react to the downturn. Many investors are selling off assets, leading to further downward pressure on the index. Others are adopting a "wait-and-see" approach, while some are looking for opportunities to buy at lower prices. Keywords: Investor confidence, market volatility, trading volume, stock market sentiment, investor behavior.

- Increased selling pressure: Fear and uncertainty drive investors to sell their holdings.

- Reduced investment: The uncertainty discourages new investments into the Dutch market.

- Market volatility: Sharp price swings reflect the heightened uncertainty and nervousness.

Economic Consequences

The AEX index decline carries potential short-term and long-term economic consequences for the Netherlands. Reduced investor confidence can lead to decreased business investment, potentially impacting economic growth. Consumer spending might also be affected, creating a ripple effect throughout the economy. In the worst-case scenario, this could contribute to increased unemployment. Keywords: Dutch economy, economic growth, unemployment, consumer spending, economic impact.

- Reduced business investment: Uncertainty makes businesses hesitant to invest in expansion or new projects.

- Decreased consumer spending: Economic uncertainty often leads to reduced consumer confidence and spending.

- Potential for increased unemployment: Reduced economic activity can result in job losses.

Future Predictions and Analysis

Predicting the future of the AEX is challenging, but current market trends suggest continued volatility. A recovery is possible, particularly if global economic uncertainty eases and inflation subsides. However, further downside risks remain, especially if recessionary fears materialize. Expert opinions vary, but many analysts advocate for a cautious approach, suggesting diversification and risk management strategies for investors. Keywords: Market forecast, AEX recovery, market outlook, economic predictions, future market trends.

- Potential for recovery: A decrease in inflation and increased global stability could lead to a market rebound.

- Continued volatility: Uncertainty remains, suggesting the market will likely remain volatile in the near term.

- Need for cautious investment: Investors should consider diversification and risk management strategies.

Conclusion: Navigating the AEX Index Crash and Future Outlook

The recent AEX index crashes resulted from a combination of global economic headwinds, sector-specific challenges, and domestic factors. The impact on investor sentiment and the potential consequences for the Dutch economy are significant. While a recovery is possible, navigating this period of uncertainty requires vigilance. Stay informed about future AEX Index movements and learn how to mitigate risks associated with AEX index crashes by following reputable financial news sources and considering professional financial advice before making any investment decisions. Understanding these factors and adopting a well-informed investment strategy is crucial for successfully navigating the current market conditions.

Featured Posts

-

M6 Motorway Crash Current Traffic Conditions And Delays

May 24, 2025

M6 Motorway Crash Current Traffic Conditions And Delays

May 24, 2025 -

Debate Rages Macrons Party Pushes For Public Hijab Ban On Underage Girls

May 24, 2025

Debate Rages Macrons Party Pushes For Public Hijab Ban On Underage Girls

May 24, 2025 -

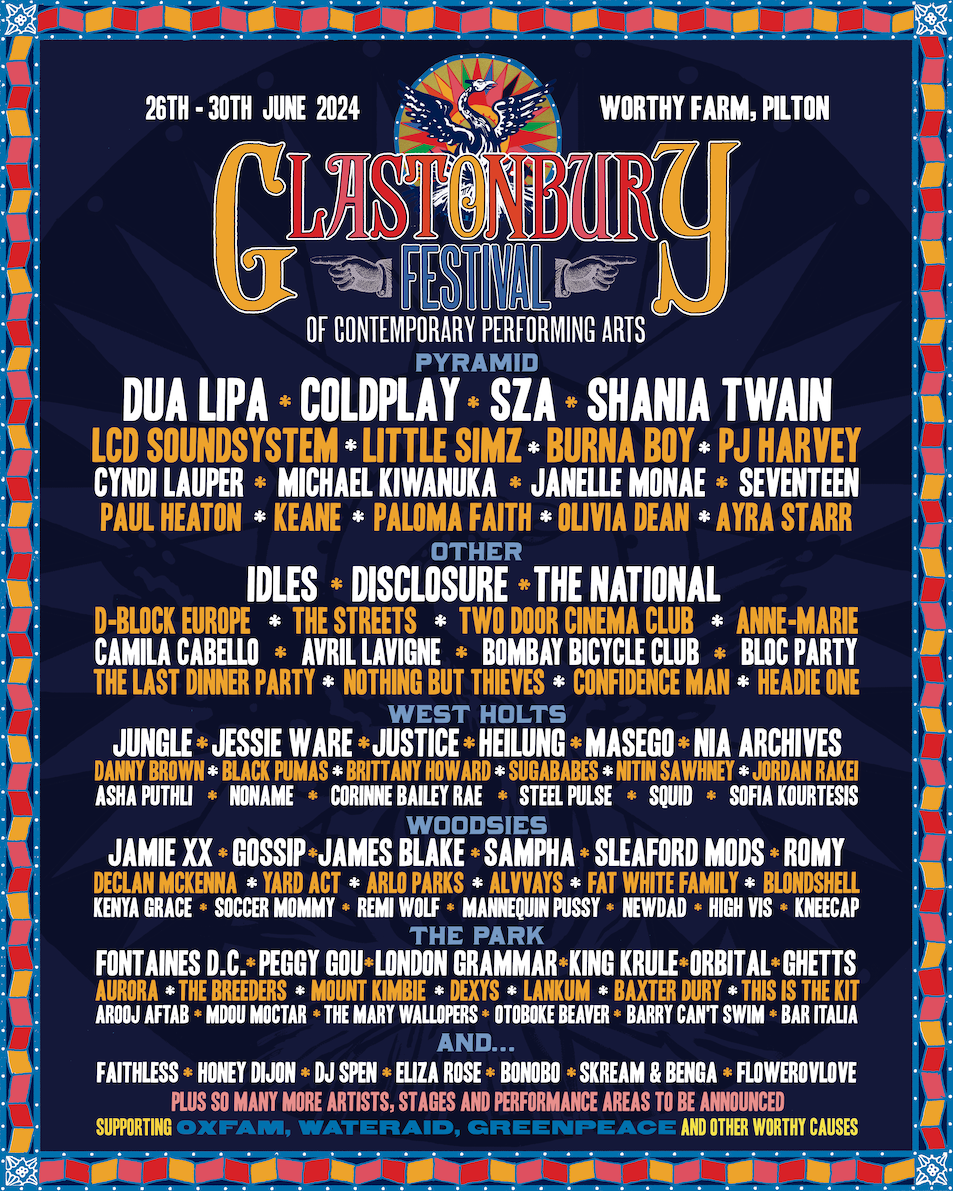

Leaked Glastonbury 2025 Lineup Confirmed Acts And Ticket Availability

May 24, 2025

Leaked Glastonbury 2025 Lineup Confirmed Acts And Ticket Availability

May 24, 2025 -

Kyle Walker And Annie Kilner The Story Behind The Poisoning Allegations

May 24, 2025

Kyle Walker And Annie Kilner The Story Behind The Poisoning Allegations

May 24, 2025 -

Planning Your Memorial Day Trip The Busiest Flight Days Of 2025

May 24, 2025

Planning Your Memorial Day Trip The Busiest Flight Days Of 2025

May 24, 2025

Latest Posts

-

Mia Farrow Calls For Trumps Arrest Over Venezuelan Deportations

May 24, 2025

Mia Farrow Calls For Trumps Arrest Over Venezuelan Deportations

May 24, 2025 -

Understanding Frank Sinatras Four Marriages Wives Love And Legacy

May 24, 2025

Understanding Frank Sinatras Four Marriages Wives Love And Legacy

May 24, 2025 -

The Four Women Who Married Frank Sinatra Their Stories And Impact

May 24, 2025

The Four Women Who Married Frank Sinatra Their Stories And Impact

May 24, 2025 -

Mia Farrow On Trump Deportations Of Venezuelan Gang Members Warrant Arrest

May 24, 2025

Mia Farrow On Trump Deportations Of Venezuelan Gang Members Warrant Arrest

May 24, 2025 -

Frank Sinatra And His Four Wives A Retrospective On His Marriages

May 24, 2025

Frank Sinatra And His Four Wives A Retrospective On His Marriages

May 24, 2025