AIMSCAP WTT: Strategies For Success In The World Trading Tournament

Table of Contents

Understanding the AIMSCAP WTT Rules and Regulations

Thoroughly understanding the AIMSCAP WTT rules and regulations is paramount. Ignoring even minor details can lead to disqualification or significant setbacks. Before even considering your trading strategy, dedicate time to fully grasp the tournament guidelines. This includes understanding the allowed trading instruments, leverage limits, and any prohibited strategies.

- Key AIMSCAP WTT Rules:

- Allowed trading instruments (e.g., forex pairs, indices, commodities). Check the official documentation for the most up-to-date list.

- Leverage limits: Understanding the maximum leverage allowed is crucial for effective risk management.

- Prohibited strategies: Familiarize yourself with any trading strategies explicitly banned by the AIMSCAP WTT regulations. This could include market manipulation techniques or the use of certain automated systems.

- Reporting requirements: Understand the specific reporting requirements for trades, profits, and losses.

Reading the official AIMSCAP WTT documentation is not optional; it's mandatory. Carefully review every section to ensure complete comprehension. Failing to adhere to the rules can result in penalties, including account suspension or disqualification from the tournament. Don't risk your hard work and preparation—understand the AIMSCAP WTT rules inside and out.

Developing a Winning Trading Strategy for the AIMSCAP WTT

A well-defined and rigorously tested trading strategy is the backbone of success in the AIMSCAP WTT. This strategy should be tailored to the specific conditions of the tournament, considering the timeframe, allowed instruments, and your risk tolerance.

-

Choosing Your Trading Style:

- Scalping: This high-frequency trading style might be less suitable due to the potential for high transaction costs and the need for extremely fast execution.

- Day Trading: This style, focusing on trades completed within a single day, can be effective if your strategy incorporates robust risk management.

- Swing Trading: Holding positions for several days or weeks might be a viable option, allowing for larger price movements but requiring patience and careful risk assessment.

-

Essential Elements of a Successful AIMSCAP WTT Strategy:

- Risk Management: A clearly defined risk management plan is crucial. This includes setting stop-loss orders and determining your maximum acceptable loss per trade.

- Position Sizing: Calculate the appropriate position size based on your risk tolerance and account balance. Never risk more than a small percentage of your capital on any single trade.

- Entry/Exit Points: Establish precise entry and exit points based on technical indicators or price action. Backtesting is critical for refining these points.

- Technical Indicators: Choose appropriate indicators (e.g., moving averages, RSI, MACD) and incorporate them into your strategy.

Backtesting your strategy using historical data is paramount. This allows you to identify potential weaknesses and optimize your approach before entering the actual AIMSCAP WTT. Ensure you backtest using data representative of the market conditions you expect during the tournament.

Mastering Risk Management in the AIMSCAP WTT

Risk management is not just important in the AIMSCAP WTT; it’s crucial for survival. Competitive trading involves high stakes, and uncontrolled risk can lead to rapid account depletion.

- Key Risk Management Techniques:

- Stop-Loss Orders: Always use stop-loss orders to limit potential losses on each trade. Set these orders at a level that aligns with your risk tolerance.

- Take-Profit Orders: Take-profit orders help lock in profits when your targets are met. This prevents you from giving back profits due to market reversals.

- Diversification: Spreading your trades across different instruments can mitigate overall risk. However, ensure this aligns with your chosen strategy.

Emotional control is another vital component of risk management. Avoid over-trading, which can stem from fear or greed. Stick to your trading plan and avoid impulsive decisions based on emotions. Calculate your position size based on your risk tolerance (e.g., risking only 1-2% of your account per trade).

Leveraging Technology and Tools for AIMSCAP WTT Success

The right tools can significantly enhance your performance in the AIMSCAP WTT. Selecting appropriate trading platforms and leveraging advanced technology are essential for success.

- Essential AIMSCAP WTT Tools:

- Trading Platform: Choose a reliable and fast trading platform that supports the instruments you'll be trading.

- Charting Software: Utilize charting software with advanced features for technical analysis.

- Technical Indicators: Integrate the relevant technical indicators into your trading platform to enhance your analysis.

- Automated Trading Systems (Optional): If allowed by the AIMSCAP WTT rules, consider using automated trading systems, but only if they are thoroughly backtested and understood.

A reliable internet connection is critical. Have a backup plan in place in case of internet outages, including a secondary internet connection or a mobile hotspot. Efficient data analysis and trade execution tools will provide you with a competitive edge.

Mental Preparation and Discipline for the AIMSCAP WTT

The AIMSCAP WTT is not only about technical skills; it's also about mental fortitude. Competitive trading can be stressful, and maintaining focus and discipline is essential.

- Mental Strategies for Success:

- Stress Management: Develop techniques to manage stress, such as meditation, deep breathing exercises, or mindfulness.

- Maintaining Focus: Practice maintaining focus during long trading sessions. Regular breaks and a comfortable trading environment can help.

- Positive Mindset: Cultivate a positive mindset and believe in your abilities. Resilience is critical to overcoming setbacks.

Develop a pre-tournament routine to optimize your mental state before the competition. This might include reviewing your strategy, practicing your trading plan, or engaging in relaxation exercises. Consistent practice, under pressure if possible, can build the mental resilience needed to succeed in the AIMSCAP WTT.

Conclusion

This article has provided key strategies to enhance your chances of success in the AIMSCAP WTT. By thoroughly understanding the AIMSCAP WTT rules, developing a winning trading strategy, mastering risk management, leveraging technology effectively, and focusing on your mental preparation, you'll significantly improve your performance. Remember that consistent practice, rigorous preparation, and unwavering discipline are the cornerstones of success in this demanding World Trading Tournament. Start planning your AIMSCAP WTT strategy today and conquer the competition!

Featured Posts

-

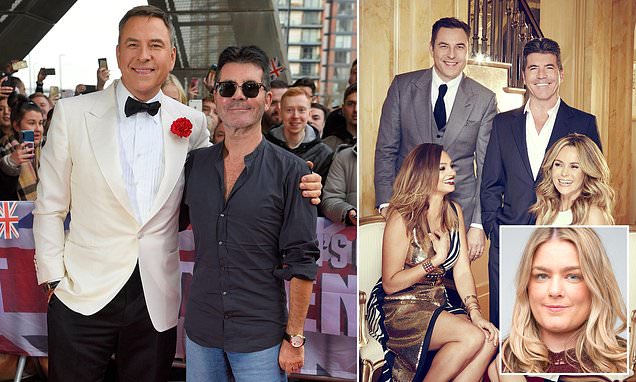

David Walliams What Happened On Britains Got Talent

May 22, 2025

David Walliams What Happened On Britains Got Talent

May 22, 2025 -

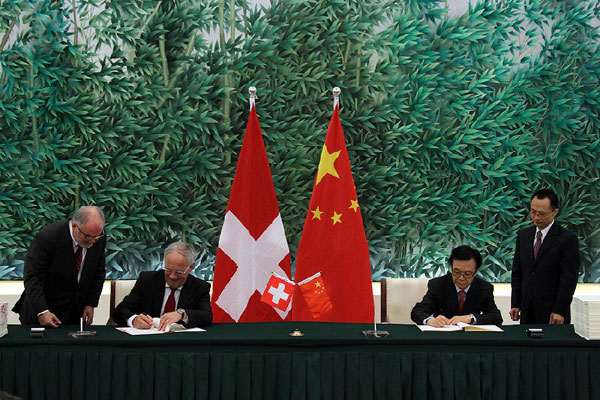

China And Switzerland Urge Dialogue To Resolve Tariff Disputes

May 22, 2025

China And Switzerland Urge Dialogue To Resolve Tariff Disputes

May 22, 2025 -

David Walliams And Simon Cowells Feud Are They No Longer Speaking

May 22, 2025

David Walliams And Simon Cowells Feud Are They No Longer Speaking

May 22, 2025 -

Within The Sound Perimeter Music And Social Cohesion

May 22, 2025

Within The Sound Perimeter Music And Social Cohesion

May 22, 2025 -

Alfa Romeo Junior 1 2 Turbo Speciale Avis Et Essai Par Le Matin Auto

May 22, 2025

Alfa Romeo Junior 1 2 Turbo Speciale Avis Et Essai Par Le Matin Auto

May 22, 2025

Latest Posts

-

Jaw Dropping Antiques Roadshow Find Results In Couples Arrest For Trafficking

May 22, 2025

Jaw Dropping Antiques Roadshow Find Results In Couples Arrest For Trafficking

May 22, 2025 -

National Treasure Trafficking Antiques Roadshow Episode Ends In Arrest

May 22, 2025

National Treasure Trafficking Antiques Roadshow Episode Ends In Arrest

May 22, 2025 -

Jail Time For Couple Following Antiques Roadshow Appraisal

May 22, 2025

Jail Time For Couple Following Antiques Roadshow Appraisal

May 22, 2025 -

Antiques Roadshow Couple Arrested After Jaw Dropping National Treasure Appraisal

May 22, 2025

Antiques Roadshow Couple Arrested After Jaw Dropping National Treasure Appraisal

May 22, 2025 -

Couples Antiques Roadshow Appearance Results In Prison Sentence

May 22, 2025

Couples Antiques Roadshow Appearance Results In Prison Sentence

May 22, 2025