Alterya Acquired By Chainalysis: Implications For The Future Of Blockchain Security

Table of Contents

Enhanced Blockchain Security Capabilities

The synergy between Chainalysis and Alterya promises a substantial enhancement of blockchain security capabilities. This isn't just about adding two companies together; it's about combining complementary expertise to create a far more powerful solution.

Combining Expertise

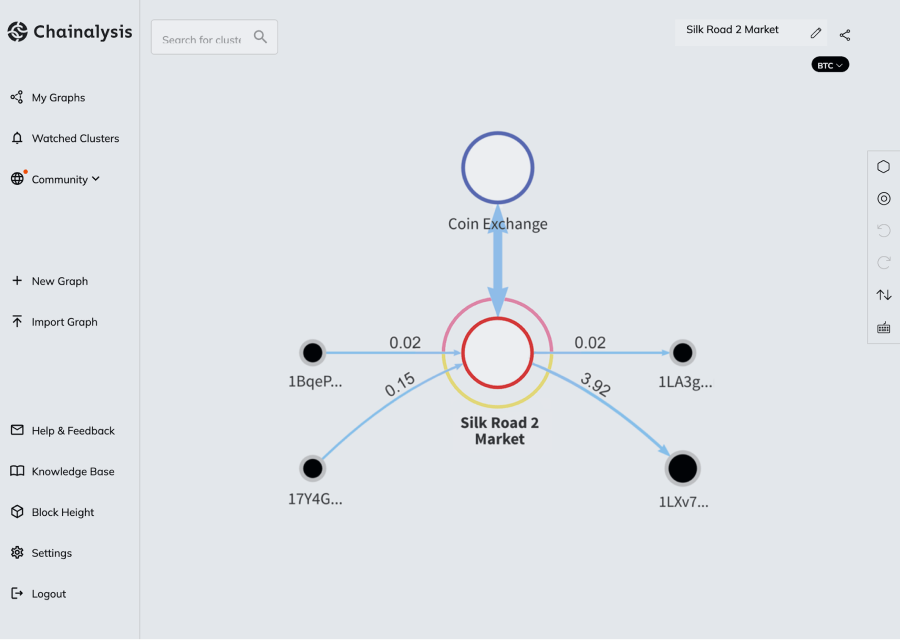

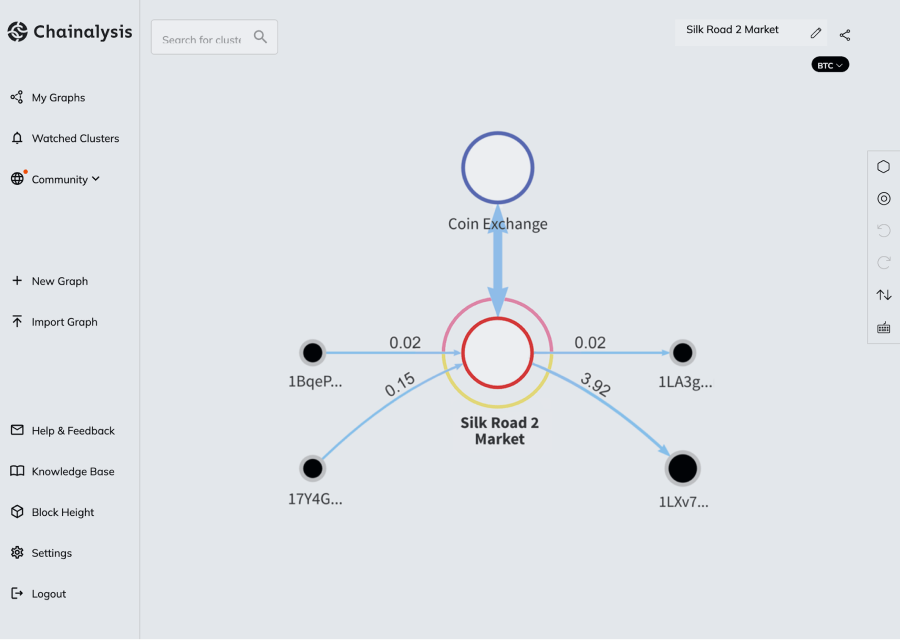

Chainalysis brings its renowned blockchain investigation capabilities, honed through years of experience tracking illicit cryptocurrency transactions and assisting law enforcement agencies worldwide. Alterya, on the other hand, contributes its advanced data analytics and risk management prowess. This combined expertise creates a powerful synergy.

- Improved AML/KYC capabilities: The integration of Alterya's risk scoring and data analysis tools will significantly enhance Chainalysis's already robust AML (Anti-Money Laundering) and KYC (Know Your Customer) capabilities, allowing for more accurate identification and flagging of suspicious activity.

- More sophisticated threat detection: By leveraging Alterya's data analysis engine, Chainalysis can develop more sophisticated threat detection models, proactively identifying emerging risks and vulnerabilities in the blockchain ecosystem.

- Enhanced investigation speed and efficiency: The combined resources will allow for faster and more efficient investigations, leading to quicker responses to security breaches and faster resolution of financial crimes.

Expanded Product Portfolio

The acquisition is likely to lead to the seamless integration of Alterya's technology into Chainalysis's existing product suite. This integration promises a more comprehensive and user-friendly blockchain security solution.

- New features and functionalities: We can expect new features and functionalities emerging from the combination of both company's technologies, offering customers a broader range of security tools and capabilities.

- Better user experience: The integration should result in a more streamlined and intuitive user experience, making blockchain security tools more accessible and easier to use for a wider range of users.

- Increased market reach: The combined entity will undoubtedly benefit from a broader market reach, allowing them to serve a wider range of clients across various industries and geographic locations.

Impact on Regulatory Compliance

The Alterya acquisition has significant implications for regulatory compliance within the blockchain space. The combined entity is better positioned to assist businesses in navigating the complex and evolving regulatory landscape.

Stronger Compliance Support

The enhanced data analysis and risk management capabilities resulting from the merger will provide stronger support to businesses striving to meet stringent regulatory requirements.

- Streamlined compliance processes: The combined platform will likely streamline compliance processes, reducing the administrative burden on businesses and making it easier to demonstrate compliance with AML/KYC regulations.

- Reduced regulatory risks: By providing more comprehensive risk assessments and improved transaction monitoring, the combined entity can help businesses mitigate regulatory risks and avoid costly penalties.

- Improved audit trails: Enhanced data analysis and record-keeping capabilities will facilitate the creation of more robust and transparent audit trails, simplifying compliance audits and strengthening accountability.

Implications for Global Regulations

This acquisition could exert a significant influence on the development of global regulations surrounding blockchain technology.

- Influence on future regulations: The combined market power of Chainalysis and Alterya could influence the direction of future regulations, potentially shaping the standards and expectations for blockchain security.

- Setting industry standards: The integrated entity is well-positioned to set industry standards for blockchain security and compliance, driving best practices across the industry.

- Increased transparency and accountability: The enhanced capabilities in monitoring and analyzing blockchain transactions will promote greater transparency and accountability within the cryptocurrency ecosystem.

Competitive Landscape and Market Share

The acquisition significantly alters the competitive landscape within the blockchain security market, positioning Chainalysis for increased market dominance.

Increased Market Dominance

By acquiring Alterya, Chainalysis consolidates its position as a leading provider of blockchain security solutions.

- Increased market share: The acquisition significantly increases Chainalysis's market share, potentially making it the dominant player in the industry.

- Stronger competitive advantage: The combined expertise and technology provide Chainalysis with a significant competitive advantage, making it harder for competitors to keep pace.

- Potential for consolidation in the industry: This acquisition could trigger further consolidation within the blockchain security market, as other companies seek to merge or acquire to remain competitive.

Future Innovation and Development

The combined resources and expertise of Chainalysis and Alterya are expected to accelerate innovation in blockchain security technology.

- Investment in R&D: The increased financial resources resulting from the merger will likely lead to significant investments in research and development, leading to breakthroughs in blockchain security.

- Development of new security solutions: The combined team of experts will be able to develop more innovative and sophisticated security solutions to address emerging threats and vulnerabilities.

- Faster adaptation to emerging threats: The combined entity will be better equipped to quickly adapt to emerging threats and vulnerabilities in the ever-evolving blockchain landscape.

Conclusion

The Alterya acquisition by Chainalysis represents a significant milestone for the future of blockchain security. The combined entity boasts significantly enhanced capabilities in threat detection, AML/KYC compliance, and regulatory support. This merger positions Chainalysis as a dominant player in the market, driving innovation and influencing the regulatory landscape. The implications are far-reaching, impacting not only the competitive landscape but also the overall security and maturity of the blockchain ecosystem. To strengthen your blockchain security, improve your AML/KYC compliance, and protect your cryptocurrency assets with advanced blockchain security solutions, learn more about Chainalysis's comprehensive offerings [link to Chainalysis website] and explore how these enhanced capabilities can benefit your organization.

Featured Posts

-

Nantes Et Ses Tours Opportunites Et Enjeux Pour Les Professionnels De La Corde

May 22, 2025

Nantes Et Ses Tours Opportunites Et Enjeux Pour Les Professionnels De La Corde

May 22, 2025 -

The Blake Lively Allegation What We Know So Far Bored Panda

May 22, 2025

The Blake Lively Allegation What We Know So Far Bored Panda

May 22, 2025 -

Core Weave Crwv Stock Surge Reasons Behind The Jump

May 22, 2025

Core Weave Crwv Stock Surge Reasons Behind The Jump

May 22, 2025 -

The Thames Water Executive Bonus Debate Facts And Figures

May 22, 2025

The Thames Water Executive Bonus Debate Facts And Figures

May 22, 2025 -

Cassis Blackcurrant The Ultimate Guide To Flavor And Uses

May 22, 2025

Cassis Blackcurrant The Ultimate Guide To Flavor And Uses

May 22, 2025

Latest Posts

-

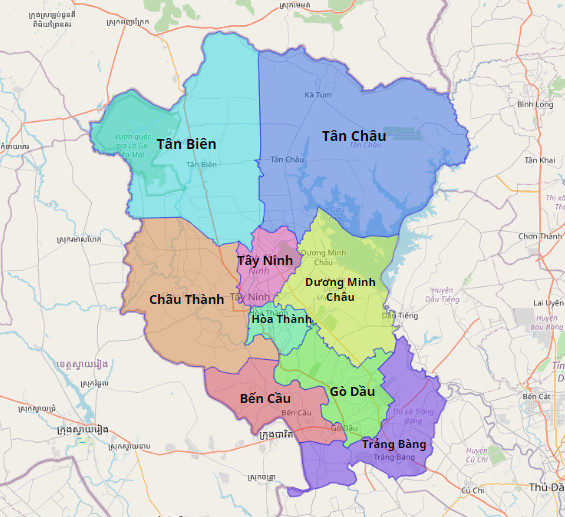

Duong Va Cau Ket Noi Binh Duong Tay Ninh Dia Diem And Huong Dan

May 22, 2025

Duong Va Cau Ket Noi Binh Duong Tay Ninh Dia Diem And Huong Dan

May 22, 2025 -

Khoi Cong Cau Ma Da Ket Noi Giao Thong Dong Nai Binh Phuoc Thuan Loi Hon

May 22, 2025

Khoi Cong Cau Ma Da Ket Noi Giao Thong Dong Nai Binh Phuoc Thuan Loi Hon

May 22, 2025 -

Duong Cao Toc Dong Nai Vung Tau Du Kien Thong Xe 2 9

May 22, 2025

Duong Cao Toc Dong Nai Vung Tau Du Kien Thong Xe 2 9

May 22, 2025 -

At Be X Ntt Multi Interconnect Ascii Jp

May 22, 2025

At Be X Ntt Multi Interconnect Ascii Jp

May 22, 2025 -

He Thong Giao Thong Lien Ket Binh Duong Va Tay Ninh

May 22, 2025

He Thong Giao Thong Lien Ket Binh Duong Va Tay Ninh

May 22, 2025