Ambani's Reliance: Q[Quarter] Earnings And Their Implications For Indian Large-Cap Stocks

![Ambani's Reliance: Q[Quarter] Earnings And Their Implications For Indian Large-Cap Stocks Ambani's Reliance: Q[Quarter] Earnings And Their Implications For Indian Large-Cap Stocks](https://wjuc2010.de/image/ambanis-reliance-q-quarter-earnings-and-their-implications-for-indian-large-cap-stocks.jpeg)

Table of Contents

Reliance Industries' Q3 Performance Overview

Reliance's Q3 results will be crucial in understanding the company's trajectory. Key metrics like revenue growth, net profit, and operating margins across its diverse segments – Jio, Retail, and Oil & Gas – will be under intense scrutiny. Comparing these figures to the previous quarter and the same period last year will be essential for a comprehensive assessment.

- Revenue Growth: Analysts predict [Insert Predicted Revenue Growth Percentage]% revenue growth compared to Q2 and [Insert Predicted Revenue Growth Percentage]% compared to Q3 of the previous year. Any deviation from these projections will significantly impact market sentiment.

- Profit Margin Analysis: Maintaining healthy profit margins across all segments is vital. A decline in margins, especially in the face of rising input costs, could signal challenges ahead. Close attention will be paid to the operational efficiency of each segment.

- Segment-wise Performance: Jio's subscriber additions and ARPU (Average Revenue Per User) will be closely watched. The Retail segment's expansion plans and sales figures will be key indicators of its growth momentum. The Oil & Gas segment's performance will be heavily influenced by global crude oil prices and refining margins.

- Strategic Initiatives: Any significant announcements regarding new ventures, acquisitions, or strategic partnerships made during the quarter will profoundly impact the overall assessment of Reliance's performance and future outlook.

Impact on Indian Large-Cap Stocks

Reliance Industries' performance is strongly correlated with the overall health of the Indian stock market. Its influence extends beyond its own stock price; it acts as a significant sentiment driver for the large-cap sector and major indices like the Nifty 50 and Sensex.

- Market Sentiment: Strong Q3 results will likely bolster investor confidence, potentially leading to a positive ripple effect across the large-cap space. Conversely, weaker-than-expected results could trigger a sell-off.

- Index Impact: A strong performance from Reliance could propel the Nifty 50 and Sensex upwards, while a poor showing could pull them down, given Reliance's significant weight in these indices.

- Sector-wise Impact: The performance of Reliance's various segments will have a knock-on effect on related sectors. For instance, strong Jio performance could positively influence other telecom stocks, while robust retail performance could benefit the consumer goods sector.

- Investor Reaction: Post-earnings announcements, investor reactions and trading volume will provide valuable insights into market sentiment and the overall impact of Reliance's Q3 performance.

Analyzing Key Performance Drivers

Several factors contribute to Reliance's overall performance. Understanding these drivers is crucial for a complete analysis.

- Jio Subscriber Growth: Sustained subscriber growth and ARPU improvement are crucial for Jio's continued success. Competition in the telecom sector remains fierce, and Jio's ability to retain and attract subscribers will be a key focus.

- Retail Expansion: The continued expansion of Reliance Retail and its penetration into new markets will be critical for its future growth. Sales figures and market share gains will be keenly observed.

- Oil Prices: The performance of Reliance's Oil & Gas business is heavily reliant on global crude oil prices and refining margins. Fluctuations in these factors could significantly impact the segment's profitability.

- Government Policies: Government regulations and policies relating to telecom, retail, and the energy sector can influence Reliance's operational environment and financial performance.

- Digital Initiatives: Reliance's investments in digital technologies and platforms will play a crucial role in its long-term growth strategy. The success of these initiatives will be reflected in the overall performance.

- Competitive Landscape: The competitive intensity in each of Reliance's operating segments will directly influence its performance. Analyzing the competitive pressures and market share trends is essential.

Investment Implications and Future Outlook

Based on the Q3 results, investors will need to adjust their investment strategies. However, it's crucial to remember that this analysis is for informational purposes only and does not constitute financial advice.

- Investment Strategies: Depending on Reliance's Q3 performance and future outlook, investors might consider various strategies, ranging from holding to buying or selling their Reliance shares.

- Short-term and Long-term Outlook: A comprehensive assessment of Reliance's Q3 performance should guide investors in formulating both short-term and long-term investment strategies for the company and related large-cap stocks.

- Risk Assessment: Investors must carefully assess the potential risks associated with investing in Reliance Industries and the Indian large-cap market. Geopolitical events, economic fluctuations, and regulatory changes all present potential challenges.

Conclusion:

Reliance Industries' Q3 earnings announcement holds immense significance for the Indian large-cap stock market. A thorough analysis of its performance, including key financial metrics and underlying drivers, is crucial for investors to make informed decisions. Understanding the impact of Reliance's results on market sentiment and related sectors is essential for navigating the Indian stock market effectively. Stay informed about future Reliance Industries earnings announcements and their implications for your investment strategy in Indian large-cap stocks. Consider subscribing for regular updates on market analysis to stay ahead of the curve.

![Ambani's Reliance: Q[Quarter] Earnings And Their Implications For Indian Large-Cap Stocks Ambani's Reliance: Q[Quarter] Earnings And Their Implications For Indian Large-Cap Stocks](https://wjuc2010.de/image/ambanis-reliance-q-quarter-earnings-and-their-implications-for-indian-large-cap-stocks.jpeg)

Featured Posts

-

New Porsche Cayenne Ev 2026 Analysis Of Recent Spy Photos

Apr 29, 2025

New Porsche Cayenne Ev 2026 Analysis Of Recent Spy Photos

Apr 29, 2025 -

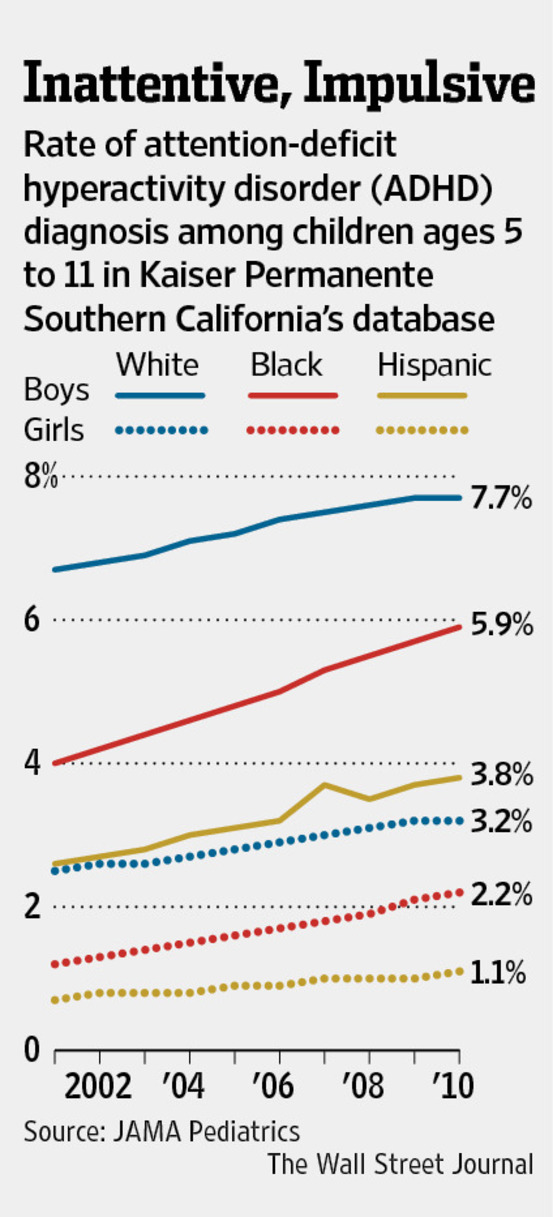

Study Reveals Increased Adhd Rates In Adults With Autism And Intellectual Disability

Apr 29, 2025

Study Reveals Increased Adhd Rates In Adults With Autism And Intellectual Disability

Apr 29, 2025 -

Pw C Exits Multiple Countries Accounting Giants Response To Scandals

Apr 29, 2025

Pw C Exits Multiple Countries Accounting Giants Response To Scandals

Apr 29, 2025 -

New Music Willie Nelson And Rodney Crowell Collaborate On Oh What A Beautiful World Album

Apr 29, 2025

New Music Willie Nelson And Rodney Crowell Collaborate On Oh What A Beautiful World Album

Apr 29, 2025 -

7 The Points Guide To Classic Movie Quotes And Election Statistics

Apr 29, 2025

7 The Points Guide To Classic Movie Quotes And Election Statistics

Apr 29, 2025

Latest Posts

-

Analyzing The 2025 Cubs Performance In Game 16 Heroes And Goats

May 13, 2025

Analyzing The 2025 Cubs Performance In Game 16 Heroes And Goats

May 13, 2025 -

Dodgers Defeat Cubs 3 0 Yamamotos Strong Pitching And Edmans Home Run Secure Win

May 13, 2025

Dodgers Defeat Cubs 3 0 Yamamotos Strong Pitching And Edmans Home Run Secure Win

May 13, 2025 -

2025 Cubs Heroes And Goats Game 25 Recap

May 13, 2025

2025 Cubs Heroes And Goats Game 25 Recap

May 13, 2025 -

Edmans 3 Run Blast Yamamotos Strong Pitching Power Dodgers Past Cubs

May 13, 2025

Edmans 3 Run Blast Yamamotos Strong Pitching Power Dodgers Past Cubs

May 13, 2025 -

2025 Chicago Cubs Deconstructing Game 16s Wins And Losses

May 13, 2025

2025 Chicago Cubs Deconstructing Game 16s Wins And Losses

May 13, 2025