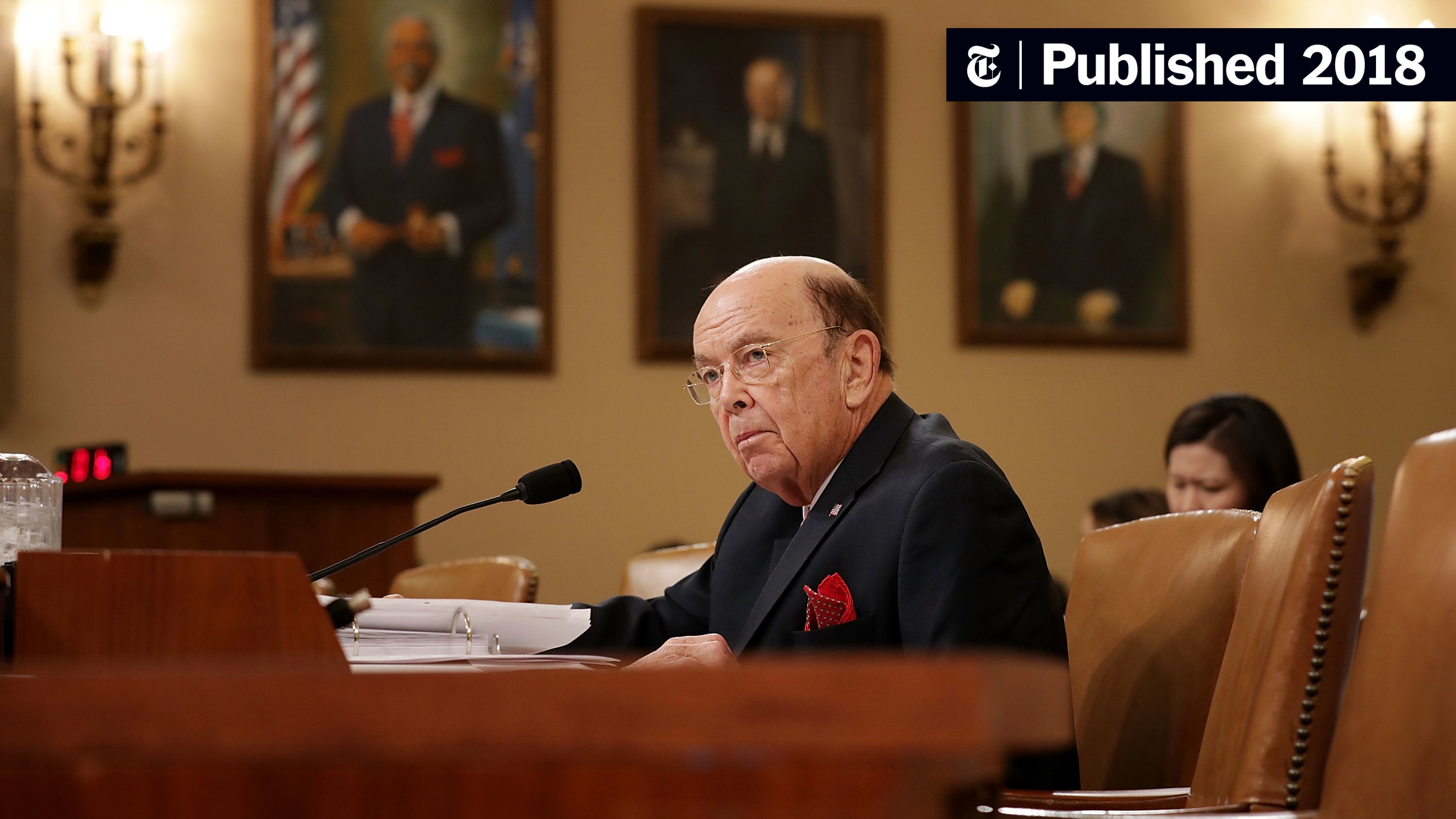

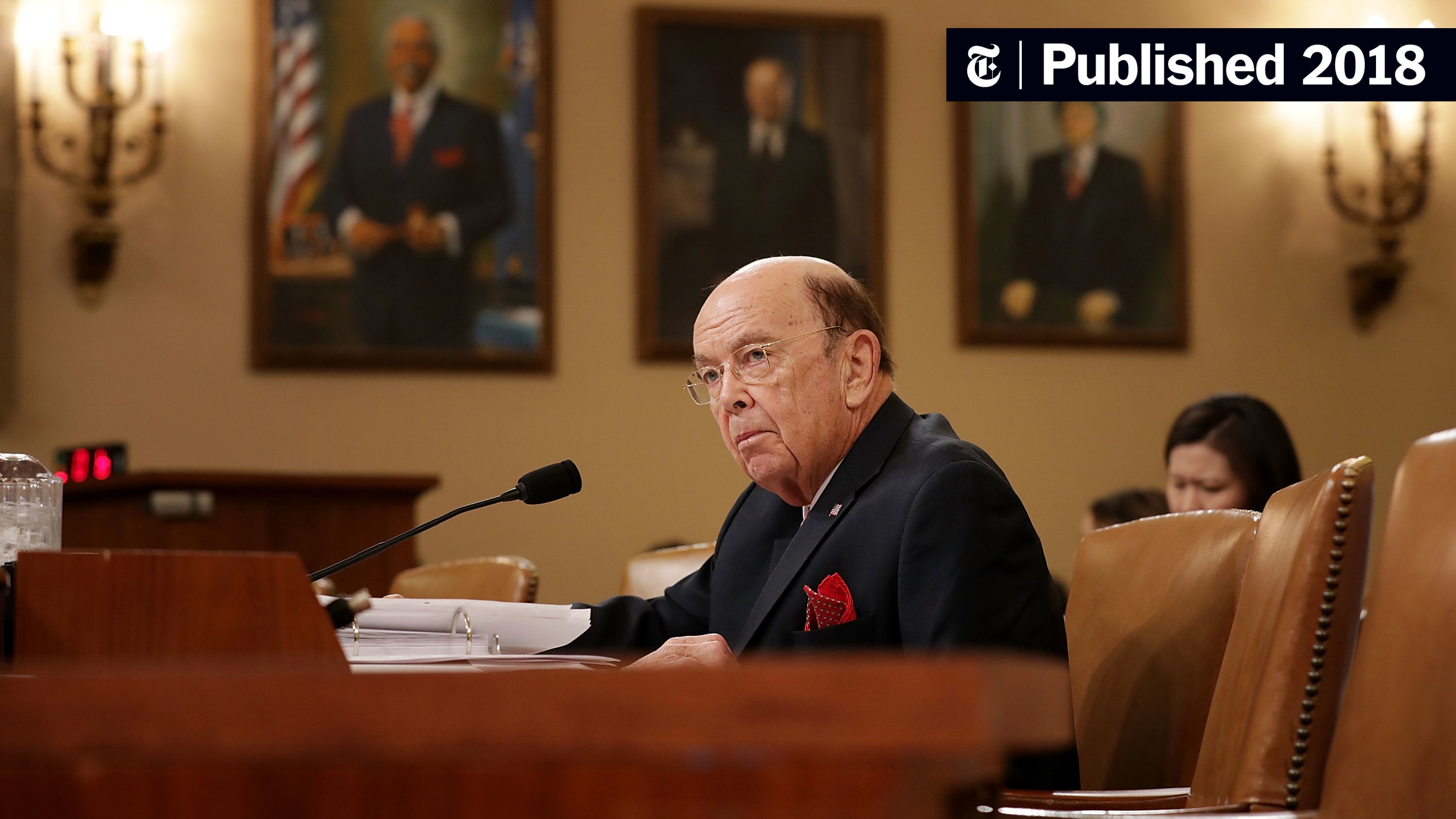

Amsterdam Exchange Falls 2% On Trump's New Tariffs

Table of Contents

Impact of Trump's New Tariffs on the Amsterdam Exchange

The newly announced tariffs target several key sectors, creating a domino effect across the Amsterdam Exchange. These tariffs primarily focus on [ Specify the targeted sectors, e.g., agricultural products, technology components, and certain manufactured goods ], impacting a significant portion of companies listed on the exchange.

-

Specific industries impacted: The technology sector, heavily reliant on international trade, has suffered the most significant losses. Agricultural companies exporting to the US also experienced considerable drops. The automotive industry, while not directly targeted, faces indirect consequences due to supply chain disruptions.

-

Quantifiable data on the drop in specific stocks: [ Insert real or hypothetical data, e.g., ASML Holding, a major semiconductor equipment manufacturer, saw its share price fall by 3.5%, while several agricultural companies experienced declines ranging from 1% to 5%. ] These drops reflect the immediate market reaction to the uncertainty created by the new tariffs.

-

Comparison to previous market reactions to Trump's trade policies: This latest drop mirrors previous market reactions to similar trade policy announcements from the Trump administration. However, the scale of this decline suggests a growing sensitivity to trade uncertainties among investors on the Amsterdam Exchange. The cumulative effect of previous tariffs has likely contributed to the amplified response this time.

The direct effect of the tariffs is felt by companies directly involved in importing or exporting goods subject to the new duties. Indirectly, however, the ripple effect extends to related businesses within the supply chain. For instance, logistics companies and supporting services are experiencing a decreased demand as a result of reduced trade activity.

Investor Sentiment and Market Volatility Following the News

The immediate reaction of investors to the news was a widespread sell-off, clearly demonstrated by a surge in trading volume. The increased trading activity, far beyond typical daily levels, underscores the heightened anxiety and uncertainty surrounding the new tariffs.

-

Analysis of trading volume and its relation to the price drop: [ Insert data showing increased trading volume compared to previous days. E.g., Trading volume on the Amsterdam Exchange increased by 25% compared to the previous day's average, coinciding with the sharp price decline. ]

-

Mention of any significant sell-offs or buying activity: While the predominant trend was a sell-off, there was limited evidence of opportunistic buying, suggesting a prevailing cautious sentiment among investors.

-

Quotes from financial analysts commenting on investor behavior: "[ Insert quotes from financial analysts summarizing investor behavior, emphasizing the increased risk aversion and uncertainty in the market. ]"

The tariff announcement has injected significant volatility into the Amsterdam Exchange, creating short-term uncertainty for investors. The long-term implications depend largely on the duration and extent of the tariffs and how effectively companies can adapt to the new trade environment.

Global Economic Implications and Predictions for the Amsterdam Exchange

The new tariffs have broad global economic implications, potentially impacting international trade and supply chains worldwide. The Amsterdam Exchange, as a significant European market, is particularly vulnerable to disruptions in global trade flows.

-

Potential impact on international trade and supply chains: Disruptions to global supply chains are anticipated, leading to increased costs and reduced availability of certain goods. This could trigger further price increases and economic slowdown.

-

Predictions from economic experts on the future of the Amsterdam Exchange: [ Include predictions from reputable financial sources and economic experts regarding the future outlook for the Amsterdam exchange. E.g., Some analysts predict a gradual recovery in the coming months, while others foresee prolonged uncertainty depending on further developments in trade relations. ]

-

Comparison to similar economic downturns in the past: The current situation bears some resemblance to [ Mention similar past economic downturns and their impact, making a comparison to the current situation and offering historical context. ]

Potential recovery strategies for the Amsterdam Exchange include government intervention to mitigate the impact on affected businesses, as well as diversification strategies by individual companies to reduce reliance on specific export markets. However, the likelihood of a rapid market rebound remains uncertain, largely dependent on the unfolding of future trade negotiations.

Alternative Investment Strategies During Market Uncertainty

Navigating the current volatile market requires a cautious yet proactive approach.

-

Diversification strategies to reduce risk: Diversifying investments across different asset classes and geographical regions is crucial to mitigate risk during periods of market uncertainty.

-

Safe haven assets to consider: Investors might consider shifting a portion of their portfolio to safe-haven assets such as government bonds or precious metals to protect against potential further market declines.

-

Long-term investment perspectives: Maintaining a long-term investment perspective is vital. While short-term market fluctuations are inevitable, focusing on long-term growth strategies can help weather market volatility.

Conclusion

The Amsterdam Exchange experienced a significant 2% drop today following the announcement of Trump's new tariffs. This decline impacted various sectors, triggering investor anxieties and increased market volatility. The broader global economic implications are considerable, with potential disruptions to international trade and supply chains. The uncertainty surrounding future trade relations adds to the challenges faced by investors in the Amsterdam Exchange. Understanding the complexities of global trade and its effects on the Amsterdam Exchange is crucial for effective investment decisions.

Call to Action: Stay informed about the evolving situation affecting the Amsterdam Exchange and its response to global trade policies. Continue monitoring the market for further updates and consider consulting with financial advisors to develop resilient investment strategies that effectively navigate market volatility. Understanding the impacts of events like these on the Amsterdam Exchange and its related markets is key to making well-informed investment decisions.

Featured Posts

-

Exploring The Tensions Between Michael Schumacher And Other Drivers

May 25, 2025

Exploring The Tensions Between Michael Schumacher And Other Drivers

May 25, 2025 -

A Successful Escape To The Country Tips For A Smooth Transition

May 25, 2025

A Successful Escape To The Country Tips For A Smooth Transition

May 25, 2025 -

I Dazi Stati Uniti E Il Futuro Dei Prezzi Moda

May 25, 2025

I Dazi Stati Uniti E Il Futuro Dei Prezzi Moda

May 25, 2025 -

Experience The Ferrari Difference Bengalurus New Official Service Centre

May 25, 2025

Experience The Ferrari Difference Bengalurus New Official Service Centre

May 25, 2025 -

Pariss Economic Slowdown Luxury Sector Downturn Impacts City Finances March 7 2025

May 25, 2025

Pariss Economic Slowdown Luxury Sector Downturn Impacts City Finances March 7 2025

May 25, 2025