Amsterdam Stock Exchange Plunges: Three Days Of Heavy Losses

Table of Contents

Factors Contributing to the Amsterdam Stock Exchange Plunge

Several intertwined factors contributed to the sharp decline in the Amsterdam Stock Exchange. Understanding these factors is crucial for navigating future market uncertainty.

Global Economic Uncertainty

The current global economic climate played a significant role in the AEX plunge. Increased global inflation and aggressive interest rate hikes by central banks worldwide have dampened investor sentiment, leading to a risk-off attitude. This translates to investors pulling back from riskier assets, including stocks.

- Rising energy prices: The ongoing energy crisis, exacerbated by geopolitical instability, has fueled inflation and impacted the profitability of numerous Dutch companies.

- Geopolitical instability: The war in Ukraine continues to create uncertainty in global supply chains and energy markets, contributing to market volatility.

- Supply chain disruptions: Persistent supply chain bottlenecks continue to constrain economic growth and impact corporate earnings, further eroding investor confidence.

- Recessionary fears: Growing concerns about a potential global recession are adding to the overall sense of uncertainty and prompting investors to seek safer havens.

Specific Sectoral Weakness within the AEX

The AEX plunge wasn't uniform across all sectors. Certain sectors experienced disproportionately large losses.

- Technology Sector: The technology sector, particularly companies reliant on consumer spending, suffered significant declines due to concerns about slowing economic growth and reduced consumer demand. Companies heavily exposed to the US market also felt the impact of a weakening dollar.

- Energy Sector: Although energy prices remain high, concerns about future demand and potential government regulations led to a downturn in some energy stocks listed on the AEX. Volatility in oil and gas prices further contributed to market instability.

(Insert chart/graph illustrating the performance of specific stocks and sectors)

Investor Sentiment and Market Psychology

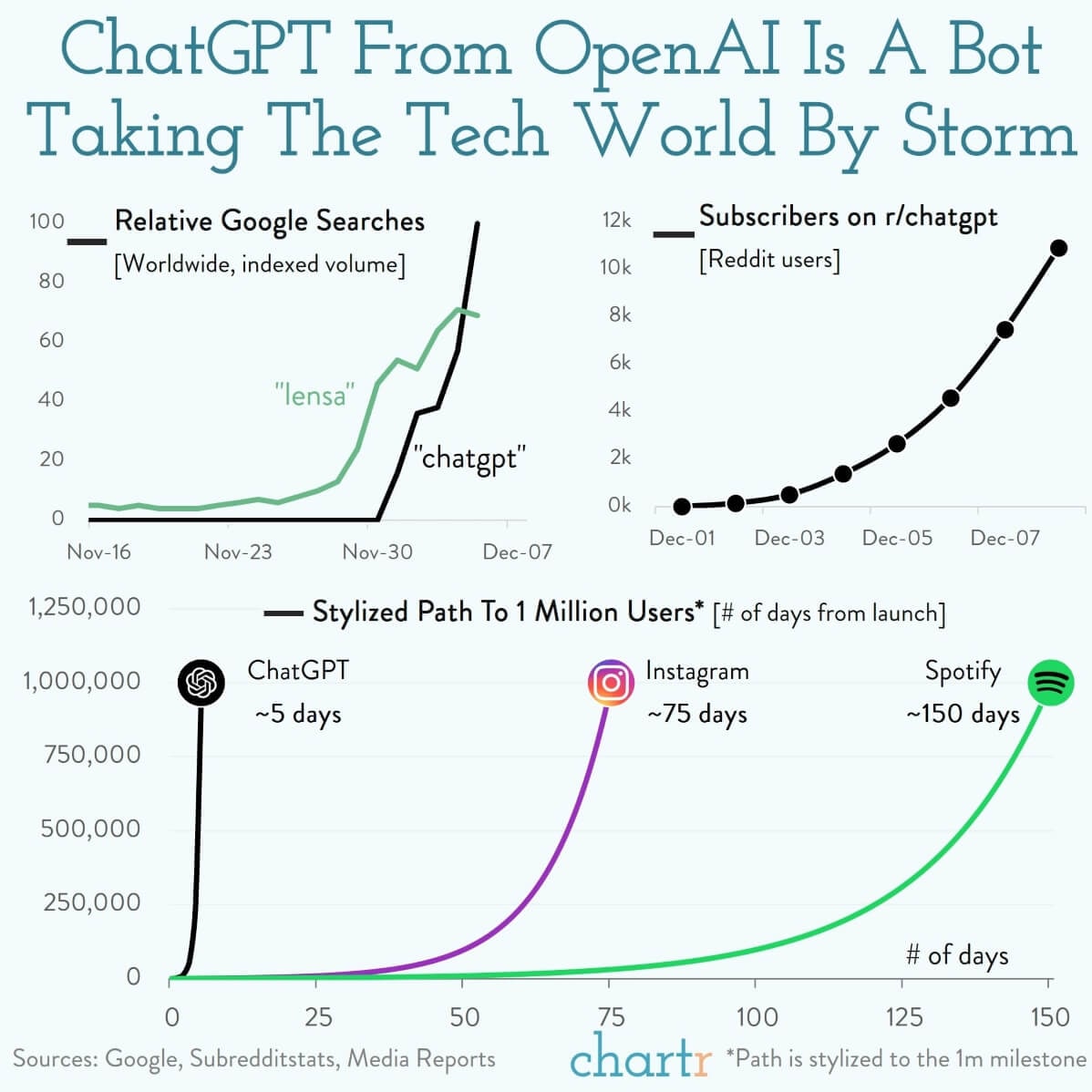

Fear and panic selling played a significant role in exacerbating the market decline. Negative news coverage, fueled by social media discussions, created a self-reinforcing cycle of selling pressure.

- Fear and Panic Selling: As the AEX began to fall, many investors reacted by selling their holdings, further driving down prices in a classic example of a stock market crash.

- Algorithmic Trading: High-frequency algorithmic trading can amplify market fluctuations, potentially contributing to the speed and intensity of the decline. These automated trading systems can trigger rapid sell-offs based on pre-programmed algorithms, exacerbating downward pressure.

- News Media Impact: Negative news coverage focusing on the AEX plunge can further fuel panic and encourage more selling.

Impact of the Plunge on the Dutch Economy

The AEX plunge has significant implications for the Dutch economy, extending beyond the immediate impact on investors.

Consequences for Dutch Companies

The stock market decline directly impacts the valuations of Dutch companies listed on the AEX. Reduced valuations can hinder access to capital for expansion and investment. This could also lead to:

- Reduced profitability: Lower stock prices and decreased investor confidence can lead to reduced investment and slower economic growth.

- Potential job losses: Companies facing financial difficulties may resort to cost-cutting measures, including layoffs.

- Government intervention: The Dutch government may implement measures to support the economy, such as fiscal stimulus or targeted support for specific sectors.

Implications for Dutch Investors

The AEX plunge has resulted in significant losses for both individual and institutional investors in the Netherlands.

- Retirement savings: Many Dutch citizens rely on investments for their retirement savings, leaving them vulnerable to market volatility.

- Investment portfolios: The decline has impacted the value of investment portfolios, potentially impacting long-term financial goals.

- Risk management: The event highlights the importance of diversifying investments and implementing appropriate risk management strategies.

Potential Recovery and Future Outlook for the Amsterdam Stock Exchange

Predicting the future of the AEX is challenging, but analyzing potential scenarios is crucial.

Short-Term Predictions

The short-term outlook depends on several factors:

- Central bank actions: Further interest rate hikes could dampen economic growth but potentially stabilize inflation.

- Geopolitical developments: A de-escalation of geopolitical tensions could boost investor confidence.

- Corporate earnings: Strong corporate earnings reports could help to reverse the downward trend.

Long-Term Implications

The long-term implications for the AEX will depend on the pace of economic recovery and the adaptation of Dutch companies to the evolving global landscape. This could include:

- Structural changes: The AEX may undergo structural changes, with some sectors experiencing greater growth than others.

- Increased volatility: The experience underscores the inherent volatility of stock markets and the need for robust risk management strategies.

- Investor behavior: Investors may become more cautious, demanding higher returns to compensate for increased risk.

Conclusion:

The three-day plunge in the Amsterdam Stock Exchange highlights the inherent volatility of global markets and the interconnectedness of national economies. Factors such as global economic uncertainty, sector-specific weakness, and investor sentiment all played significant roles in this dramatic downturn. Understanding these factors is crucial for both investors and policymakers in navigating future market challenges. Stay informed about the evolving situation on the Amsterdam Stock Exchange and monitor market trends closely to make informed investment decisions. Understanding the factors contributing to the Amsterdam Stock Exchange plunge is crucial for mitigating risk and capitalizing on future opportunities. Learn more about effective investment strategies during periods of market volatility to better manage your portfolio in the face of future stock market crashes and plunges.

Featured Posts

-

Amundi Msci World Ii Ucits Etf Usd Hedged Dist A Guide To Its Net Asset Value

May 24, 2025

Amundi Msci World Ii Ucits Etf Usd Hedged Dist A Guide To Its Net Asset Value

May 24, 2025 -

Bolshe 600 Svadeb Na Kharkovschine Prichiny Rosta Populyarnosti Brakosochetaniy

May 24, 2025

Bolshe 600 Svadeb Na Kharkovschine Prichiny Rosta Populyarnosti Brakosochetaniy

May 24, 2025 -

Mdahmat Alshrtt Alalmanyt Lmshjey Krt Alqdm

May 24, 2025

Mdahmat Alshrtt Alalmanyt Lmshjey Krt Alqdm

May 24, 2025 -

Amsterdam Stock Index Plunges Over 4 Drop To Year Low

May 24, 2025

Amsterdam Stock Index Plunges Over 4 Drop To Year Low

May 24, 2025 -

Glastonbury Festival Us Bands Potential Appearance Creates Buzz

May 24, 2025

Glastonbury Festival Us Bands Potential Appearance Creates Buzz

May 24, 2025

Latest Posts

-

The Countrys Top New Business Locations Growth Opportunities Revealed

May 24, 2025

The Countrys Top New Business Locations Growth Opportunities Revealed

May 24, 2025 -

The Rising Tide Of Wildfires Driving Record Global Forest Loss

May 24, 2025

The Rising Tide Of Wildfires Driving Record Global Forest Loss

May 24, 2025 -

Chinas Automotive Landscape A Shifting Market For International Brands

May 24, 2025

Chinas Automotive Landscape A Shifting Market For International Brands

May 24, 2025 -

Wildfires Intensify Global Forest Loss Hits Unprecedented Levels

May 24, 2025

Wildfires Intensify Global Forest Loss Hits Unprecedented Levels

May 24, 2025 -

Why Are Bmw And Porsche Facing Difficulties In China A Deep Dive

May 24, 2025

Why Are Bmw And Porsche Facing Difficulties In China A Deep Dive

May 24, 2025