Amsterdam Stock Index Plunges Over 4%, Hits Year-Low

Table of Contents

Causes of the Amsterdam Stock Index Decline

The sharp decline in the Amsterdam Stock Index is a multifaceted issue stemming from a confluence of global and regional factors. Understanding these contributing elements is crucial for investors seeking to navigate this turbulent period.

Global Economic Uncertainty

Global economic headwinds are significantly impacting the AEX. Rising inflation rates across the globe, coupled with aggressive interest rate hikes by central banks, are dampening economic growth and investor confidence. Geopolitical instability, including the ongoing war in Ukraine and escalating tensions in other regions, further exacerbates this uncertainty.

- Weakening Euro: The weakening Euro against the US dollar reduces the purchasing power of Dutch businesses and increases the cost of imports.

- US Recession Fears: Concerns about a potential recession in the United States, a major trading partner for the Netherlands, are casting a long shadow over investor sentiment. The ripple effect of a US downturn would significantly impact Dutch exports and overall economic growth.

- Energy Crisis Impact on Dutch Businesses: The ongoing energy crisis in Europe is disproportionately affecting energy-intensive industries in the Netherlands, adding to the economic strain and impacting business profitability. Inflation in the Eurozone reached 10% in October 2022, contributing significantly to investor anxieties and impacting the AEX.

Sector-Specific Weakness

The decline in the Amsterdam Stock Index is not uniform across all sectors. Certain sectors are experiencing more pronounced weakness than others.

- Energy Sector Underperformance: The energy sector, while initially benefiting from high prices, is now facing challenges due to price volatility and regulatory uncertainty.

- Technology Sector Downturn: The technology sector, a significant component of the AEX, has been particularly hard hit, reflecting a broader global tech slowdown and investor concerns about valuations. ASML Holding, a key player in the semiconductor industry and a major component of the AEX, saw its share price drop by 6% on the day of the plunge.

- Financial Sector Volatility: The financial sector is also experiencing volatility due to rising interest rates and concerns about potential loan defaults.

Investor Sentiment and Market Volatility

Negative investor sentiment and increased market volatility are key drivers of the sell-off. Fear and uncertainty are prompting investors to liquidate their holdings, leading to a downward spiral in the AEX.

- Increased Market Volatility: The AEX is experiencing significantly increased volatility, making it challenging for investors to predict market movements.

- Decreased Investor Confidence: The combination of global economic uncertainty and sector-specific weaknesses has eroded investor confidence in the Dutch market.

- Potential for Further Declines: Financial analysts warn that further declines are possible until global economic conditions stabilize and investor sentiment improves. "We expect further volatility in the short term," commented leading financial analyst Jan Willem de Vries.

Impact on Dutch Economy and Investors

The decline in the Amsterdam Stock Index has far-reaching implications for the Dutch economy and investors.

Short-Term Implications

The immediate effects of the AEX's fall are already being felt.

- Potential Job Losses: Reduced business activity and investment could lead to job losses across various sectors.

- Reduced Investment: Businesses may postpone or cancel investment plans in response to the economic uncertainty.

- Decreased Consumer Spending: Falling consumer confidence could result in decreased spending, further impacting economic growth.

Long-Term Outlook

While the short-term outlook is uncertain, the long-term consequences will depend on several factors.

- Opportunities for Long-Term Investors: The current downturn may present opportunities for long-term investors seeking to buy assets at discounted prices.

- Need for Diversification: The current market volatility underscores the importance of diversifying investment portfolios to mitigate risk.

- Government Response: Government policies and interventions will play a significant role in shaping the long-term economic recovery.

Advice for Investors

Investors need to adopt a cautious approach and take proactive steps to protect their investments.

- Review Investment Portfolios: Carefully review your investment portfolio and assess your risk tolerance.

- Consider Risk Tolerance: Adjust your investment strategy based on your risk appetite and long-term financial goals.

- Seek Professional Financial Advice: Consult with a qualified financial advisor to develop a suitable investment strategy for the current market conditions.

Conclusion

The Amsterdam Stock Index's significant drop represents a considerable challenge for the Dutch economy and investors. Global economic uncertainty, sector-specific weaknesses, and negative investor sentiment all contributed to this year's low. Understanding the factors driving the decline of the Amsterdam Stock Index is crucial for navigating the current market volatility. Stay informed about developments in the AEX and consider diversifying your investment portfolio to mitigate risk. Monitor the Amsterdam Stock Index closely for further updates and strategic planning. Careful analysis of the AEX and its constituent companies is essential for informed investment decisions in this volatile market.

Featured Posts

-

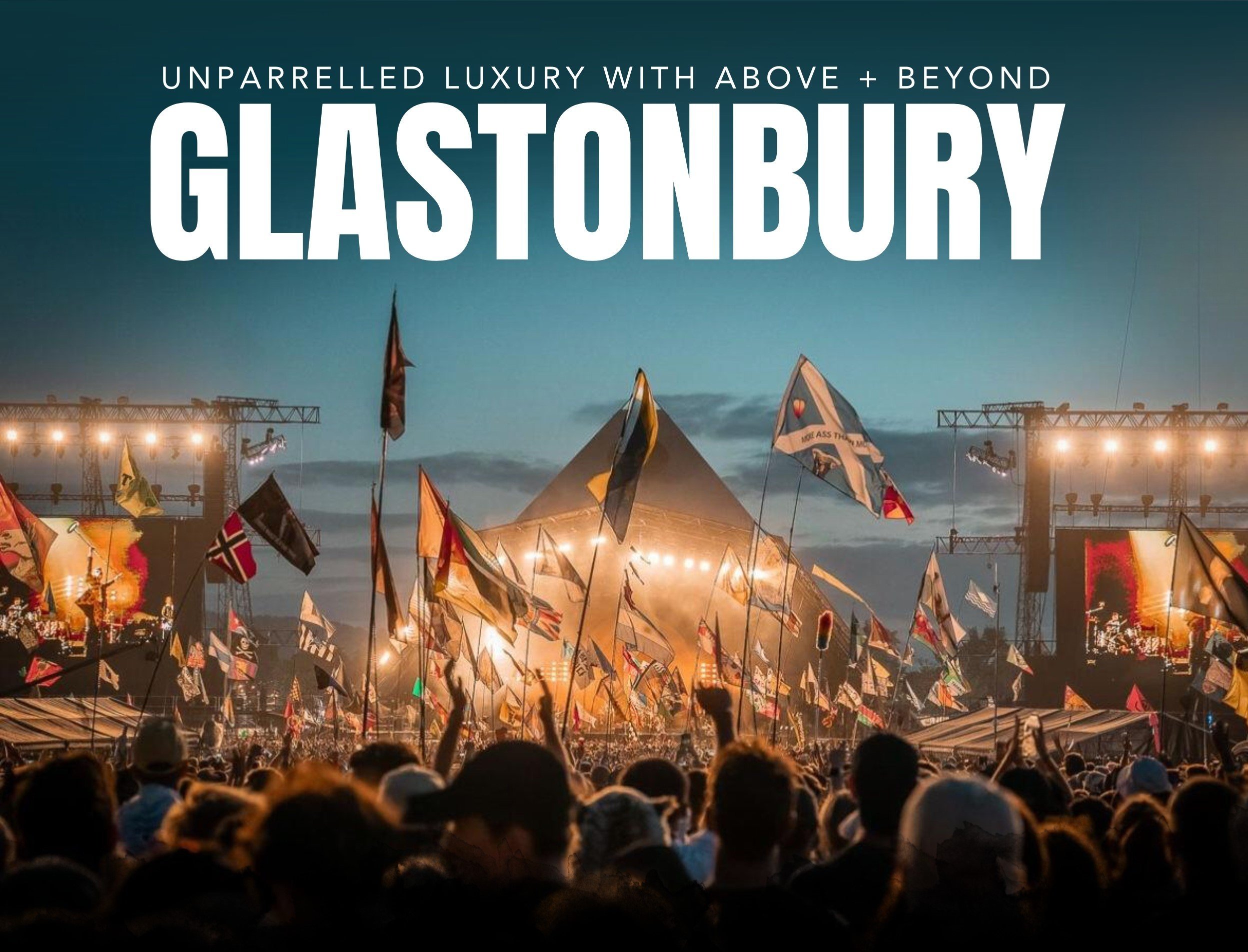

The Glastonbury 2025 Lineup A Comprehensive Guide To The Top Performers

May 25, 2025

The Glastonbury 2025 Lineup A Comprehensive Guide To The Top Performers

May 25, 2025 -

Escape To The Countryside Top Destinations And Hidden Gems

May 25, 2025

Escape To The Countryside Top Destinations And Hidden Gems

May 25, 2025 -

Cassidy Hutchinson Plans Memoir Detailing Her Jan 6 Testimony

May 25, 2025

Cassidy Hutchinson Plans Memoir Detailing Her Jan 6 Testimony

May 25, 2025 -

Boosting Regional And International Travel The Launch Of The Ae Xplore Global Campaign At England Airpark And Alexandria International Airport

May 25, 2025

Boosting Regional And International Travel The Launch Of The Ae Xplore Global Campaign At England Airpark And Alexandria International Airport

May 25, 2025 -

Jacques Y Gabriella De Monaco Asi Fue Su Primera Comunion

May 25, 2025

Jacques Y Gabriella De Monaco Asi Fue Su Primera Comunion

May 25, 2025