Amsterdam Stocks Open 7% Lower: Intensifying Trade War Impacts Markets

Table of Contents

The Impact of the Intensifying Trade War on Amsterdam's Stock Market

The ongoing trade war is significantly impacting Amsterdam's stock market, creating volatility and uncertainty for investors. Several factors contribute to this decline, impacting various sectors differently.

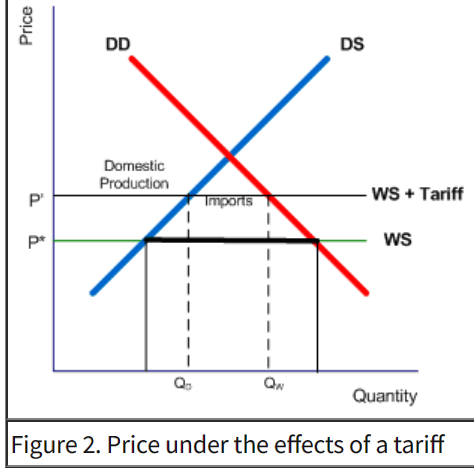

Escalating Tariffs and Retaliatory Measures

New tariffs and retaliatory measures imposed by major global players directly affect Dutch businesses and the Amsterdam stock exchange. This has a knock-on effect on investor confidence and market stability.

- Technology Sector: The technology sector, a significant component of the Amsterdam stock exchange, is particularly vulnerable to trade restrictions and increased input costs. Companies reliant on global supply chains are facing significant disruptions.

- Agricultural and Export-Oriented Industries: The Netherlands, a major exporter of agricultural products and flowers, is heavily impacted by trade disputes. Tariffs on Dutch exports lead to reduced demand and lower revenue.

- Manufacturing: Companies involved in manufacturing, relying on global supply chains and international trade, are facing increased costs and reduced competitiveness.

Specific companies heavily reliant on export markets are experiencing double-digit percentage drops in their stock prices. The impact on specific sectors is measurable through their import/export dependence: For example, the agricultural sector, accounting for X% of Dutch GDP, shows a Y% decrease in export volume since the initiation of the trade war.

Investor Sentiment and Market Volatility

The uncertainty surrounding the trade war is significantly impacting investor confidence, leading to increased market volatility in Amsterdam. This "risk-off" sentiment prompts investors to move their money into safer assets, decreasing demand for stocks and pushing prices down.

- Trading volume on the Amsterdam exchange has increased significantly, reflecting the heightened uncertainty and increased trading activity as investors react to news and events.

- Price swings are becoming more pronounced, indicating greater market volatility and increased risk for investors.

- Financial analysts are predicting continued volatility in the short term, with the potential for further declines if the trade war escalates. "The current situation is creating a climate of fear," says leading economist [Expert Name], "and that's directly impacting investor behavior."

The Global Spillover Effect

The trade war's impact on global markets indirectly affects Amsterdam's stock market due to the interconnectedness of global financial markets. The downturn in Amsterdam mirrors similar trends seen in other major stock exchanges.

- The performance of the Amsterdam exchange is closely correlated with major markets such as New York, London, and Frankfurt. A decline in these markets often triggers a similar reaction in Amsterdam.

- Disruptions to international trade and supply chains directly impact Dutch companies involved in global commerce, further exacerbating the downward pressure on Amsterdam stocks.

Analyzing the Amsterdam Stock Market Decline: Key Sectors Affected

A deeper look into specific sectors reveals the varied impact of the trade war on Amsterdam's stock market.

Technology Sector Vulnerability

Dutch technology companies face specific challenges due to the trade war, including potential export restrictions and increased input costs for components sourced from affected countries. [Company Name], a leading technology firm listed on the Amsterdam exchange, has seen its stock price decline by Z% since the start of the trade war.

Agricultural and Export-Oriented Industries

The trade war significantly impacts Dutch agricultural exports, a cornerstone of the Dutch economy. Tariffs and retaliatory measures have reduced demand for key exports like flowers and food products, leading to revenue losses and impacting the profitability of related companies. Statistical data showing decreased export volumes and revenue changes would illustrate this effect.

The Role of the Euro and Currency Fluctuations

Fluctuations in the Euro's value against other major currencies further exacerbate the situation for Amsterdam-listed companies. A weakening Euro can make Dutch exports more expensive in other markets and reduce the value of foreign earnings when converted back to Euros. Charts illustrating currency movements would offer a visual representation of this influence.

Potential Outcomes and Future Predictions for Amsterdam Stocks

The future of Amsterdam stocks hinges on the resolution of the trade war and the resulting economic climate.

Scenarios for Trade War Resolution

Several scenarios are possible: a negotiated settlement, a prolonged conflict, or an escalation of tensions. Each scenario would have a different impact on Amsterdam stocks. A negotiated settlement could lead to a rapid market recovery, while a prolonged conflict could cause continued uncertainty and further declines. Market analysts' predictions for different scenarios provide valuable insights.

Strategies for Investors

Navigating the current market uncertainty requires careful consideration of risk management strategies.

- Diversification of investments across different asset classes can mitigate losses.

- Hedging strategies can help protect against further declines in specific sectors or the overall market.

- Staying informed about the trade war's development through reputable financial news sources is crucial. Seeking professional financial advice before making investment decisions related to Amsterdam stocks is also highly recommended.

Conclusion

The 7% drop in Amsterdam stocks represents a significant reaction to the intensifying global trade war, highlighting the interconnectedness of global markets and the resulting volatility. Key sectors, including technology, agriculture, and export-oriented industries, are feeling the brunt of this economic pressure. The uncertainty surrounding the trade war’s resolution underscores the need for investors to closely monitor the situation and consider suitable risk management strategies when investing in Amsterdam stocks. Stay informed about developments through reputable financial news sources and consider seeking professional financial advice before making any investment decisions related to Amsterdam stocks or the broader Amsterdam stock market outlook.

Featured Posts

-

G 7 Nations Debate Lowering Tariffs On Chinese Imports

May 24, 2025

G 7 Nations Debate Lowering Tariffs On Chinese Imports

May 24, 2025 -

Istoriya Lyubvi Ili Ilicha Publikatsiya V Gazete Trud

May 24, 2025

Istoriya Lyubvi Ili Ilicha Publikatsiya V Gazete Trud

May 24, 2025 -

Amundi Msci World Catholic Principles Ucits Etf Acc Understanding Net Asset Value Nav

May 24, 2025

Amundi Msci World Catholic Principles Ucits Etf Acc Understanding Net Asset Value Nav

May 24, 2025 -

Major Crash Closes Road One Person Hospitalized

May 24, 2025

Major Crash Closes Road One Person Hospitalized

May 24, 2025 -

Kyle Walker And The Serbian Models The Milan Party Following Wife Annie Kilners Return To The Uk

May 24, 2025

Kyle Walker And The Serbian Models The Milan Party Following Wife Annie Kilners Return To The Uk

May 24, 2025

Latest Posts

-

The Countrys Top New Business Locations Growth Opportunities Revealed

May 24, 2025

The Countrys Top New Business Locations Growth Opportunities Revealed

May 24, 2025 -

The Rising Tide Of Wildfires Driving Record Global Forest Loss

May 24, 2025

The Rising Tide Of Wildfires Driving Record Global Forest Loss

May 24, 2025 -

Chinas Automotive Landscape A Shifting Market For International Brands

May 24, 2025

Chinas Automotive Landscape A Shifting Market For International Brands

May 24, 2025 -

Wildfires Intensify Global Forest Loss Hits Unprecedented Levels

May 24, 2025

Wildfires Intensify Global Forest Loss Hits Unprecedented Levels

May 24, 2025 -

Why Are Bmw And Porsche Facing Difficulties In China A Deep Dive

May 24, 2025

Why Are Bmw And Porsche Facing Difficulties In China A Deep Dive

May 24, 2025