Amundi DJIA UCITS ETF: A Deep Dive Into Net Asset Value

Table of Contents

What is Net Asset Value (NAV) and why is it important for Amundi DJIA UCITS ETF?

Net Asset Value (NAV) is simply the value of an ETF's underlying assets minus its liabilities, divided by the number of outstanding shares. For the Amundi DJIA UCITS ETF, this means the NAV represents the value of a single share based on the current market value of the holdings that track the Dow Jones Industrial Average. Understanding the NAV is crucial for several reasons:

-

It reflects the true value of your investment: The NAV provides a clear picture of your investment's worth based on the performance of the underlying DJIA.

-

It allows you to track performance: By monitoring the daily NAV fluctuations, you can easily assess the ETF's performance against its benchmark, the Dow Jones index.

-

It informs investment decisions: Changes in the NAV can inform your buy or sell decisions, helping you to optimize your portfolio.

-

It aids in portfolio management: Consistent monitoring of the NAV enables effective portfolio management and allows you to adapt to market changes.

-

NAV represents the value of the ETF's holdings per share.

-

Daily NAV calculation reflects market closing prices of the DJIA components.

-

Tracking NAV helps assess ETF performance against the benchmark index.

-

Understanding NAV aids in buy/sell decisions and portfolio management.

How is the Amundi DJIA UCITS ETF's NAV calculated?

The Amundi DJIA UCITS ETF's NAV is calculated daily, at the close of the market. The process involves several key steps:

-

Asset Valuation: The fund manager, working with the custodian bank, determines the market value of all the assets held by the ETF, which are designed to mirror the components of the Dow Jones Industrial Average.

-

Liability Deduction: Any liabilities, such as management fees and other expenses, are deducted from the total asset value.

-

Share Division: The resulting net asset value is then divided by the total number of outstanding shares of the Amundi DJIA UCITS ETF.

-

Daily Update: This calculation is performed at the end of each trading day, providing an up-to-date picture of the ETF's NAV.

-

Sum of the market value of all assets held by the ETF.

-

Less any liabilities (expenses, etc.).

-

Divided by the total number of outstanding shares.

-

Calculated at the end of each trading day.

Factors Affecting the Amundi DJIA UCITS ETF's NAV

Several factors influence the Amundi DJIA UCITS ETF's NAV:

-

Dow Jones Industrial Average Performance: The most significant factor is the performance of the Dow Jones Industrial Average itself. A rise in the DJIA generally leads to a rise in the ETF's NAV, and vice-versa.

-

Currency Fluctuations: While the DJIA is a US-based index, currency fluctuations could marginally impact the NAV if the ETF holds any international assets or incurs expenses in foreign currencies.

-

Dividends from Underlying Stocks: Dividend payments from the companies included in the DJIA increase the NAV of the ETF (although this is often offset by a corresponding reduction in the share price on the ex-dividend date).

-

Expense Ratio: The expense ratio, while a small percentage, indirectly affects the NAV as it represents an ongoing cost of holding the ETF.

-

Dow Jones performance directly impacts ETF NAV.

-

Currency exchange rates (if the ETF holds international assets).

-

Dividend payouts from DJIA companies increase NAV (ex-dividend date effects).

-

Expense ratio affects the NAV indirectly.

Understanding NAV and ETF Trading Price

It's important to distinguish between the NAV and the market price of the Amundi DJIA UCITS ETF. The market price is the price at which the ETF is currently trading on the exchange. While the NAV and market price usually track closely, there can be small premiums or discounts. Large deviations might present arbitrage opportunities for sophisticated investors.

- Market price is the price at which the ETF trades on the exchange.

- NAV and market price usually track closely but may deviate.

- Small premiums or discounts are typical; large deviations signal trading opportunities.

Accessing Amundi DJIA UCITS ETF NAV Information

Finding the daily NAV for the Amundi DJIA UCITS ETF is straightforward. You can access this information through several reliable sources:

-

Amundi's Official Website: The ETF provider's website is the most accurate and reliable source for the daily NAV.

-

Major Financial Data Providers: Reputable financial data providers such as Bloomberg, Refinitiv, and Yahoo Finance often display the NAV.

-

Brokerage Platforms: Most brokerage platforms will show the NAV of ETFs held in your portfolio.

-

Amundi's official website.

-

Major financial data providers (e.g., Bloomberg, Refinitiv).

-

Brokerage platforms.

Conclusion

Understanding the Net Asset Value (NAV) of the Amundi DJIA UCITS ETF is crucial for successful investing in this index-tracking fund. By understanding how the NAV is calculated, the factors that influence it, and how to access this crucial information, you can make well-informed decisions regarding your investment strategy. Regularly monitor the Amundi DJIA UCITS ETF's NAV to track your investment's performance and make necessary adjustments to your portfolio. Learn more about the Amundi DJIA UCITS ETF and its NAV today!

Featured Posts

-

Poor Glastonbury 2025 Headliners Leave Fans Disappointed

May 24, 2025

Poor Glastonbury 2025 Headliners Leave Fans Disappointed

May 24, 2025 -

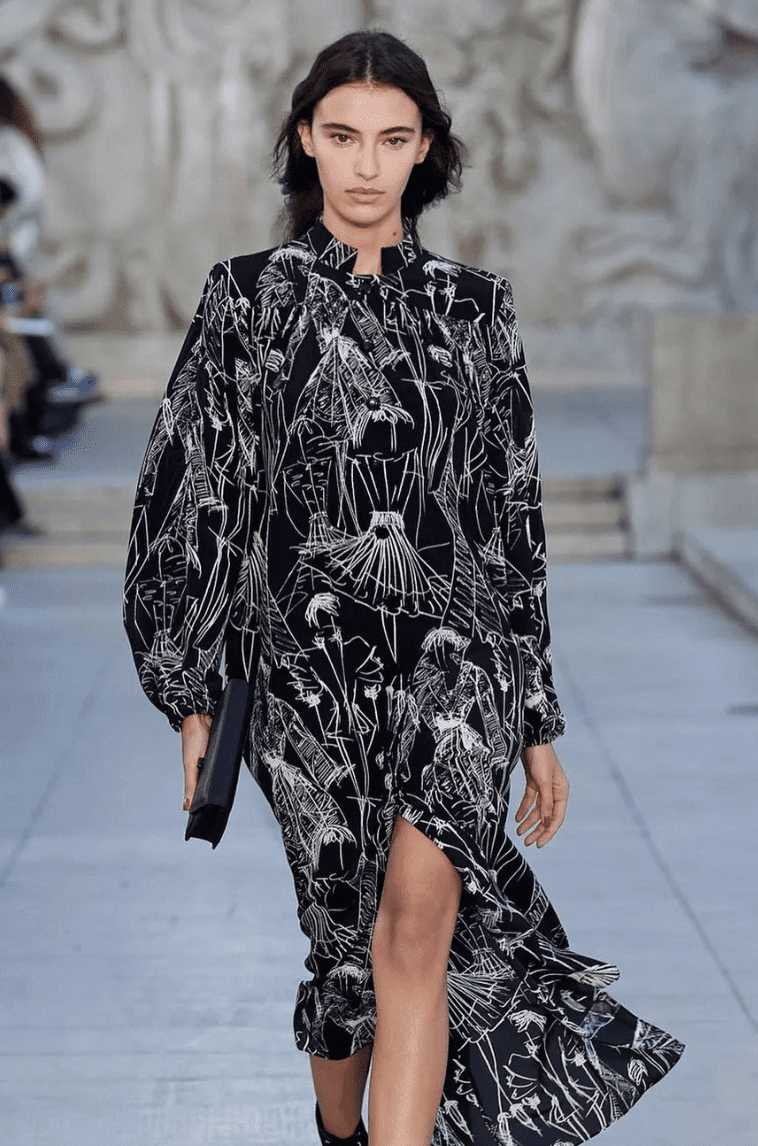

Amira Al Zuhair Models For Zimmermann In Paris Fashion Week

May 24, 2025

Amira Al Zuhair Models For Zimmermann In Paris Fashion Week

May 24, 2025 -

Escape To The Country Practical Considerations For Country Living

May 24, 2025

Escape To The Country Practical Considerations For Country Living

May 24, 2025 -

Nuori Kyky Ferrarille 13 Vuotias Taehti Nousemassa

May 24, 2025

Nuori Kyky Ferrarille 13 Vuotias Taehti Nousemassa

May 24, 2025 -

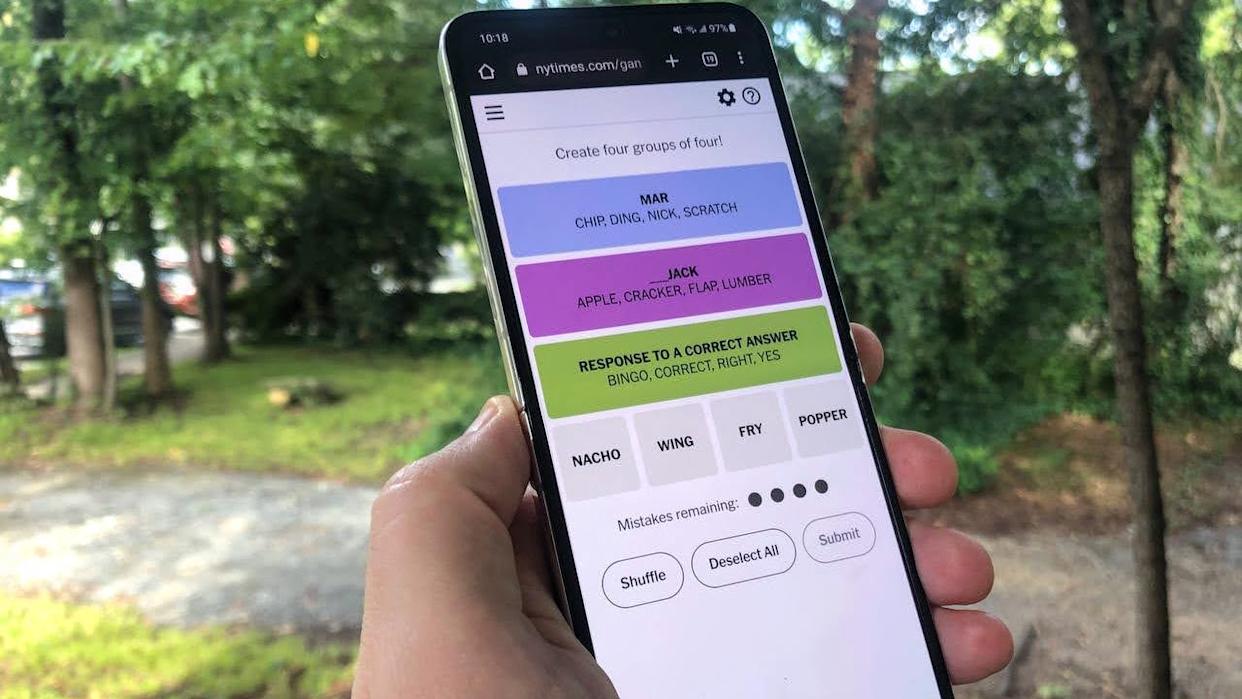

Solutions For Nyt Connections Puzzle 646 March 18 2025

May 24, 2025

Solutions For Nyt Connections Puzzle 646 March 18 2025

May 24, 2025

Latest Posts

-

Ae Xplore Campaign Takes Off Connecting Local Communities Through England Airpark And Alexandria International Airport

May 24, 2025

Ae Xplore Campaign Takes Off Connecting Local Communities Through England Airpark And Alexandria International Airport

May 24, 2025 -

Camunda Con 2025 Amsterdam How Orchestration Drives Ai And Automation Success

May 24, 2025

Camunda Con 2025 Amsterdam How Orchestration Drives Ai And Automation Success

May 24, 2025 -

Unlocking Ai And Automation Potential Orchestration At Camunda Con 2025 Amsterdam

May 24, 2025

Unlocking Ai And Automation Potential Orchestration At Camunda Con 2025 Amsterdam

May 24, 2025 -

England Airpark And Alexandria International Airport Fly Local Explore Global With Ae Xplore

May 24, 2025

England Airpark And Alexandria International Airport Fly Local Explore Global With Ae Xplore

May 24, 2025 -

Camunda Con 2025 Maximizing Ai And Automation Investments Through Orchestration In Amsterdam

May 24, 2025

Camunda Con 2025 Maximizing Ai And Automation Investments Through Orchestration In Amsterdam

May 24, 2025