Amundi DJIA UCITS ETF: A Deep Dive Into Net Asset Value (NAV)

Table of Contents

What is Net Asset Value (NAV) and why is it important for the Amundi DJIA UCITS ETF?

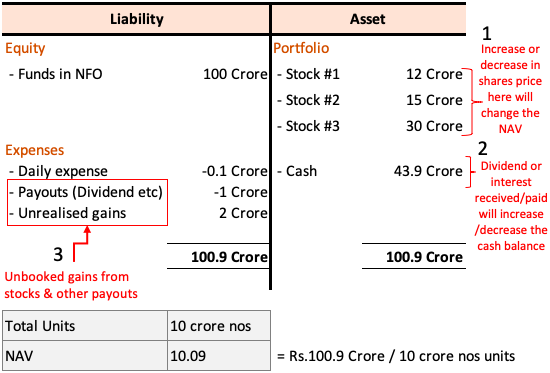

Net Asset Value (NAV) represents the underlying value of each share in an ETF. Simply put, it's the total value of all the assets held within the ETF, minus any liabilities, divided by the number of outstanding shares. This differs significantly from the market price, which is the price at which the ETF is currently trading on the exchange. While the market price can fluctuate throughout the trading day based on supply and demand, the NAV provides a more accurate reflection of the ETF's intrinsic worth.

Why is NAV so important for the Amundi DJIA UCITS ETF?

- NAV reflects the true underlying value of the ETF's holdings. It accurately represents the value of your investment in the DJIA components.

- Daily NAV calculation ensures transparency and fair pricing. This daily calculation provides investors with a clear picture of their investment's value.

- Comparing NAV to market price helps identify potential arbitrage opportunities. Although less frequent with a liquid ETF like the Amundi DJIA UCITS ETF, significant deviations can present opportunities.

- Tracking NAV changes helps monitor investment performance over time. Monitoring NAV trends allows you to assess the ETF's performance against the DJIA and your investment goals.

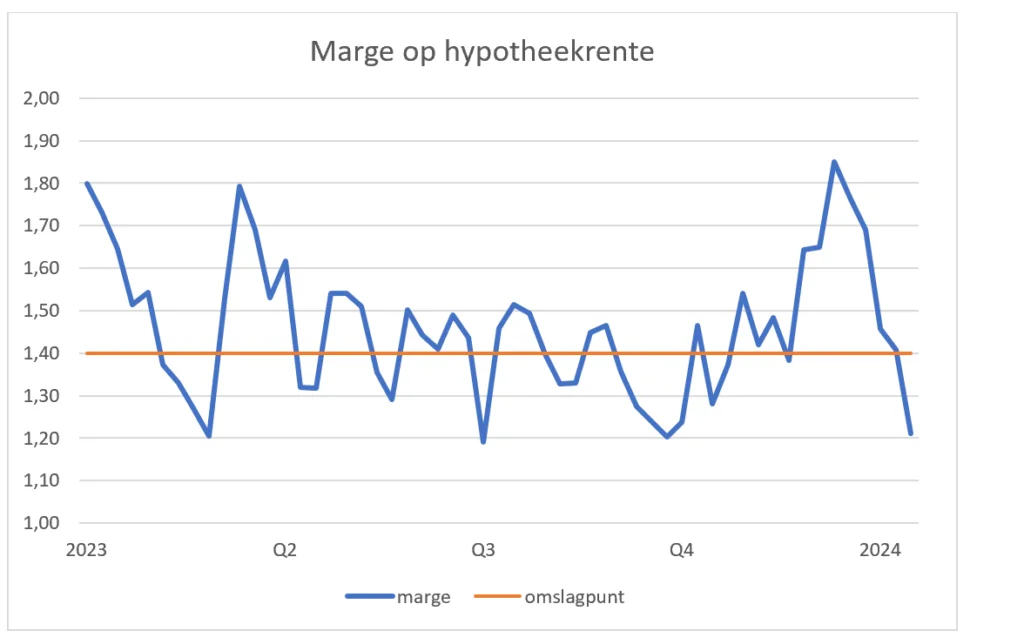

How is the Amundi DJIA UCITS ETF's NAV Calculated?

The Amundi DJIA UCITS ETF's NAV is calculated daily, typically at the close of the market. The process involves several key steps:

- Determining the market prices of each DJIA component stock. The closing prices of the 30 companies that make up the DJIA are the foundation of the calculation.

- Calculating the total value of the ETF's holdings. This involves multiplying the number of shares of each DJIA component held by the ETF by its closing price.

- Considering currency exchange rates. If any DJIA components are listed on foreign exchanges, applicable currency exchange rates are factored in to arrive at a USD equivalent.

- Including accrued income. Any dividends received from the DJIA companies are added to the total value before other deductions.

- Deducting management fees and other expenses. The ETF's management fees and any other operating expenses are subtracted from the total asset value.

- Dividing by the number of outstanding shares. The resulting figure represents the NAV per share.

This meticulous process ensures the NAV accurately reflects the current value of the Amundi DJIA UCITS ETF.

Interpreting Amundi DJIA UCITS ETF NAV Data

Accessing NAV data is straightforward. You can usually find the daily NAV on the Amundi website, major financial news websites, and through your brokerage account. Understanding and interpreting this data is key to successful investment management.

- Regular monitoring of NAV changes provides insights into investment growth. Track the NAV over time to see how your investment is performing relative to the DJIA.

- Comparing NAV with previous periods helps determine performance trends. This longitudinal view helps identify upward or downward trends and inform your investment strategy.

- Understanding the difference between NAV and market price indicates trading efficiency. A small difference suggests a highly liquid and efficiently priced ETF.

- Use charts and graphs to visualize NAV trends for easier interpretation. Visualizing the data makes it easier to identify patterns and make informed decisions.

Factors Influencing Amundi DJIA UCITS ETF NAV

Several factors influence the Amundi DJIA UCITS ETF's NAV, impacting your investment's value:

- The underlying DJIA performance: The most significant factor is the overall performance of the Dow Jones Industrial Average. Strong DJIA performance typically translates to a higher NAV.

- Currency fluctuations: For international investors, currency exchange rate fluctuations between the USD and their local currency can significantly impact the NAV.

- Dividend payouts from DJIA companies: Dividend payments from the constituent companies increase the ETF's assets, leading to a higher NAV before reinvestment or distribution to shareholders.

Conclusion

Understanding the Net Asset Value (NAV) of the Amundi DJIA UCITS ETF is paramount for investors aiming for transparency and effective portfolio management. This guide has provided a comprehensive overview of NAV calculation, interpretation, and influencing factors. By diligently monitoring NAV alongside the market price, investors can gain a deeper understanding of their investment's performance and make well-informed buy and sell decisions.

Call to Action: Ready to optimize your Amundi DJIA UCITS ETF investment strategy? Regularly check the Amundi website and other reliable financial sources for updated NAV data and detailed analysis of this valuable investment tool. Stay informed about your Amundi DJIA UCITS ETF NAV for superior investment management.

Featured Posts

-

130 Years On Renewed Effort To Honor Alfred Dreyfus

May 24, 2025

130 Years On Renewed Effort To Honor Alfred Dreyfus

May 24, 2025 -

Tracking The Net Asset Value Nav Of Amundi Msci All Country World Ucits Etf Usd Acc

May 24, 2025

Tracking The Net Asset Value Nav Of Amundi Msci All Country World Ucits Etf Usd Acc

May 24, 2025 -

Inside The New Ferrari Service Centre Bengalurus Automotive Landmark

May 24, 2025

Inside The New Ferrari Service Centre Bengalurus Automotive Landmark

May 24, 2025 -

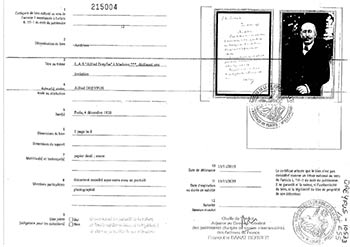

Kapitaalmarkt Euros Sterke Stijging Tegen De Dollar

May 24, 2025

Kapitaalmarkt Euros Sterke Stijging Tegen De Dollar

May 24, 2025 -

Crystal Palace Eye Free Transfer For Kyle Walker Peters

May 24, 2025

Crystal Palace Eye Free Transfer For Kyle Walker Peters

May 24, 2025

Latest Posts

-

Ae Xplore Campaign Takes Off Connecting Local Communities Through England Airpark And Alexandria International Airport

May 24, 2025

Ae Xplore Campaign Takes Off Connecting Local Communities Through England Airpark And Alexandria International Airport

May 24, 2025 -

Camunda Con 2025 Amsterdam How Orchestration Drives Ai And Automation Success

May 24, 2025

Camunda Con 2025 Amsterdam How Orchestration Drives Ai And Automation Success

May 24, 2025 -

Unlocking Ai And Automation Potential Orchestration At Camunda Con 2025 Amsterdam

May 24, 2025

Unlocking Ai And Automation Potential Orchestration At Camunda Con 2025 Amsterdam

May 24, 2025 -

England Airpark And Alexandria International Airport Fly Local Explore Global With Ae Xplore

May 24, 2025

England Airpark And Alexandria International Airport Fly Local Explore Global With Ae Xplore

May 24, 2025 -

Camunda Con 2025 Maximizing Ai And Automation Investments Through Orchestration In Amsterdam

May 24, 2025

Camunda Con 2025 Maximizing Ai And Automation Investments Through Orchestration In Amsterdam

May 24, 2025