Amundi DJIA UCITS ETF (Dist): Factors Affecting Net Asset Value

Table of Contents

Net Asset Value (NAV) is simply the total value of an ETF's underlying assets, minus any liabilities, divided by the number of outstanding shares. This represents the intrinsic value of a single ETF share. While the ETF's share price might deviate slightly from the NAV due to market trading, the NAV remains the fundamental measure of its value.

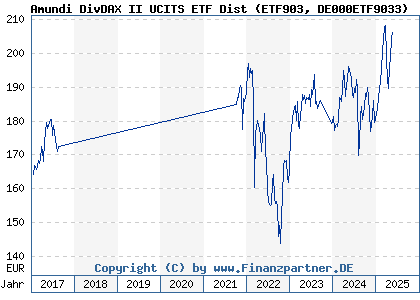

Market Performance of the Dow Jones Industrial Average (DJIA)

The most significant factor impacting the Amundi DJIA UCITS ETF (Dist) NAV is the performance of the Dow Jones Industrial Average itself. The ETF aims to track the DJIA's performance, meaning a rise in the DJIA index directly translates to an increase in the ETF's NAV, and vice versa. Individual stock movements within the DJIA also contribute to these fluctuations. A strong performance by one or more component stocks can significantly boost the overall NAV, while underperformance can have the opposite effect.

Several macroeconomic factors influence DJIA performance and subsequently the Amundi DJIA ETF NAV:

- Economic growth and recessionary periods: Strong economic growth usually leads to higher stock valuations and a rising DJIA, positively impacting the ETF NAV. Conversely, recessions often cause market downturns and lower NAVs.

- Interest rate changes and their impact on stock valuations: Interest rate hikes generally increase borrowing costs for companies, potentially affecting their profitability and share prices, thus influencing the DJIA and the ETF NAV.

- Geopolitical risks and their influence on market sentiment: Global events like wars, political instability, or trade disputes can create uncertainty in the market, impacting investor sentiment and leading to fluctuations in the DJIA and the ETF NAV.

- Sector-specific performance within the DJIA: The DJIA comprises companies across various sectors. Strong performance in specific sectors (e.g., technology) can disproportionately impact the overall index and the ETF NAV.

Currency Fluctuations and their Impact on NAV

For investors outside the United States, currency fluctuations play a significant role in determining the Amundi DJIA UCITS ETF (Dist) NAV in their local currency. Exchange rate movements between the US dollar (USD) and other currencies directly impact the value of the ETF for international investors.

- USD/EUR exchange rate fluctuations and their effect on the ETF NAV for European investors: If the EUR strengthens against the USD, the NAV in EUR will decrease, even if the underlying DJIA remains stable. Conversely, a weakening EUR will increase the NAV in EUR.

- Impact of other major currencies on NAV for investors in different regions: Similar effects are observed for investors using other major currencies like the GBP, JPY, or CHF.

- Hedging strategies and their effectiveness in mitigating currency risk: The ETF might employ currency hedging strategies to mitigate some of this risk, but these strategies are not always fully effective and can introduce their own complexities. Understanding the ETF's hedging policy is crucial. The base currency of the ETF is also important to note, as this is the currency in which the NAV is primarily calculated.

ETF Expenses and Management Fees

The Amundi DJIA UCITS ETF (Dist), like all ETFs, incurs expenses, including management fees and operational costs. These expenses are deducted from the ETF's assets, which directly impacts the NAV over time. A higher expense ratio will result in a lower NAV compared to a similar ETF with a lower expense ratio.

- Understanding the ETF's expense ratio and its impact on returns: The expense ratio is expressed as a percentage of the ETF's assets under management. Even small differences in expense ratios can accumulate significantly over the long term, affecting the overall returns.

- Comparing expense ratios of different DJIA ETFs: Investors should compare the expense ratio of the Amundi DJIA UCITS ETF (Dist) to other similar DJIA ETFs to ensure they are getting competitive fees.

- The long-term effect of small differences in expense ratios: Small percentage differences in expense ratios can make a substantial impact on your investment returns over several years.

Dividend Distributions and their Effect on NAV

The Amundi DJIA UCITS ETF (Dist) is a distributing ETF. This means that dividend payments received from the underlying DJIA stocks are distributed to the ETF's shareholders. These dividend distributions directly affect the NAV.

- Impact of dividend payments on the ETF NAV before and after the distribution: Before the ex-dividend date, the NAV reflects the accumulated dividends. On the ex-dividend date, the NAV is adjusted downwards to reflect the distribution of dividends.

- The ex-dividend date and its significance for investors: Investors who own the ETF before the ex-dividend date are entitled to receive the dividend.

- Comparison of distributing and accumulating ETFs: Accumulating ETFs reinvest the dividends back into the fund, leading to potential compounding growth but a different impact on NAV.

Conclusion: Making Informed Decisions about the Amundi DJIA UCITS ETF (Dist) NAV

Understanding the Amundi DJIA UCITS ETF (Dist) NAV requires considering several interwoven factors: the performance of the DJIA, currency fluctuations, the ETF's expense ratio, and dividend distributions. By carefully analyzing these elements, investors can make more informed decisions about when and how to invest in this ETF. Before investing in the Amundi DJIA UCITS ETF (Dist) or exploring other DJIA ETFs, thorough research into the current market conditions and a careful consideration of your own risk tolerance and investment goals are vital. Monitoring the Amundi DJIA ETF NAV and conducting regular DJIA ETF NAV analysis will help you track your investment's performance and react accordingly. Remember to consider your investment horizon and understand Amundi DJIA UCITS ETF implications fully before committing your capital.

Featured Posts

-

Jordan Bardella A Rising Star In French Politics

May 24, 2025

Jordan Bardella A Rising Star In French Politics

May 24, 2025 -

Porsche 911 80 Millio Forintos Extrafelszereltseg

May 24, 2025

Porsche 911 80 Millio Forintos Extrafelszereltseg

May 24, 2025 -

Investment Guide Amundi Dow Jones Industrial Average Ucits Etf Nav

May 24, 2025

Investment Guide Amundi Dow Jones Industrial Average Ucits Etf Nav

May 24, 2025 -

Glastonbury 2025 A Lineup Analysis Charli Xcx Neil Young And The Top Artists To Watch

May 24, 2025

Glastonbury 2025 A Lineup Analysis Charli Xcx Neil Young And The Top Artists To Watch

May 24, 2025 -

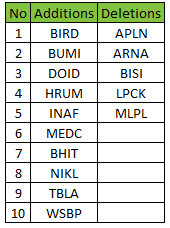

Apakah Mtel And Mbma Layak Dibeli Setelah Masuk Msci Small Cap Index

May 24, 2025

Apakah Mtel And Mbma Layak Dibeli Setelah Masuk Msci Small Cap Index

May 24, 2025

Latest Posts

-

Brest Urban Trail Benevoles Artistes Et Partenaires Au Coeur De L Evenement

May 24, 2025

Brest Urban Trail Benevoles Artistes Et Partenaires Au Coeur De L Evenement

May 24, 2025 -

Brest Urban Trail Les Visages De La Course Benevoles Artistes Et Partenaires

May 24, 2025

Brest Urban Trail Les Visages De La Course Benevoles Artistes Et Partenaires

May 24, 2025 -

Experience Local And Global Travel The Ae Xplore Campaign At England Airpark And Alexandria International Airport

May 24, 2025

Experience Local And Global Travel The Ae Xplore Campaign At England Airpark And Alexandria International Airport

May 24, 2025 -

New Ae Xplore Campaign Boosts Travel From England Airpark And Alexandria International Airport

May 24, 2025

New Ae Xplore Campaign Boosts Travel From England Airpark And Alexandria International Airport

May 24, 2025 -

England Airpark And Alexandria International Airports New Ae Xplore Campaign Fly Local Explore The World

May 24, 2025

England Airpark And Alexandria International Airports New Ae Xplore Campaign Fly Local Explore The World

May 24, 2025