Amundi DJIA UCITS ETF Distribution: NAV And Performance

Table of Contents

Decoding Amundi DJIA UCITS ETF Distributions

Understanding ETF distributions is vital for accurately assessing your investment returns. Let's break down the key aspects.

What are ETF Distributions?

ETFs distribute accumulated income to their shareholders periodically. These distributions typically comprise dividends generated from the underlying assets (in this case, the companies within the Dow Jones Industrial Average) and capital gains realized from the sale of securities within the ETF's portfolio. Receiving a distribution doesn't inherently mean your investment has grown; it simply means the fund is passing along profits.

- Dividends: These represent a share of the companies' profits within the DJIA.

- Capital Gains: These arise when the ETF sells assets at a profit.

- Ex-Dividend Date: This is the crucial date before the distribution. If you buy shares after the ex-dividend date, you won't receive the upcoming distribution. Buying before the ex-dividend date makes you eligible.

- Reinvestment Options: Most ETFs offer the possibility of automatically reinvesting distributions, buying more shares at the prevailing market price. This strategy can potentially boost your overall returns over time by compounding your earnings.

Frequency and Timing of Amundi DJIA UCITS ETF Distributions

The Amundi DJIA UCITS ETF typically distributes income annually or semi-annually. The exact frequency and specific dates are announced in advance and published on the Amundi website, within their fund fact sheets, and often reported by major financial news outlets. It's crucial to check these sources regularly for the most up-to-date information on distribution frequency and distribution dates. Accessing historical data on distributions provides insight into the past patterns, although future distributions may vary.

Amundi DJIA UCITS ETF NAV and its Relation to Distributions

The Net Asset Value (NAV) represents the value of the ETF's underlying assets per share. Understanding its relationship with distributions is key.

Understanding NAV and its Fluctuations

NAV is calculated daily by summing the market value of all assets held by the ETF, subtracting liabilities, and dividing by the total number of outstanding shares. On the ex-dividend date, the NAV usually drops by the amount of the distribution per share, reflecting the immediate payout. However, this drop is not a loss in investment value; it simply adjusts the NAV to reflect the distribution. The subsequent performance of the ETF will determine whether the NAV recovers and surpasses its pre-distribution level.

- NAV Calculation: A precise calculation reflecting the daily market value of underlying assets.

- Net Asset Value: The value of the ETF after subtracting liabilities.

- Gross NAV: The total value of assets before subtracting liabilities.

- NAV Fluctuation: Daily changes in NAV based on market movements of the underlying assets.

Analyzing NAV Performance Before and After Distributions

Analyzing the NAV before and after distributions is vital. Looking solely at the post-distribution NAV without considering the distribution itself can give a misleading impression of performance. It's crucial to compare pre-distribution NAV with the post-distribution NAV plus the amount of the distribution received to assess the true return. Use NAV chart analysis tools to easily visualize this relationship over time and interpret performance correctly.

Assessing Amundi DJIA UCITS ETF Performance: Beyond the Distribution

While distributions are an important aspect, the overall performance of the Amundi DJIA UCITS ETF depends on several factors.

Factors Influencing ETF Performance

The ETF's performance closely tracks the Dow Jones Industrial Average (DJIA). However, factors like overall market conditions, the specific performance of the DJIA index itself, and the ETF's expense ratio (annual fees) all play a role. Distributions are part of the overall investment return, but they don't represent the sole measure of success. Understanding the relationship between distributions and overall investment returns requires a holistic view of these factors.

Comparing Performance with Benchmarks

Benchmarking against the DJIA is essential. A well-performing ETF will show a minimal tracking error, meaning its performance closely mirrors that of the index. Monitoring the DJIA tracking error of the Amundi DJIA UCITS ETF allows investors to gauge the effectiveness of the fund's management in replicating the benchmark index.

Conclusion: Making Informed Decisions about Amundi DJIA UCITS ETF

Understanding Amundi DJIA UCITS ETF distributions, their impact on NAV, and how to assess overall performance requires a nuanced approach. While distributions are a component of total return, they shouldn't be the sole focus. Careful analysis of NAV performance, benchmarking against the DJIA, and consideration of market factors offer a clearer picture of the investment's overall success. Conduct thorough research before investing, and consult a financial advisor for personalized investment advice related to the Amundi DJIA UCITS ETF. Stay updated on Amundi DJIA UCITS ETF NAV and performance to make the most informed decisions for your portfolio.

Featured Posts

-

Kering Sales Decline As Demna Prepares First Gucci Collection

May 24, 2025

Kering Sales Decline As Demna Prepares First Gucci Collection

May 24, 2025 -

Kyle Walker And Annie Kilner The Story Behind The Poisoning Allegations

May 24, 2025

Kyle Walker And Annie Kilner The Story Behind The Poisoning Allegations

May 24, 2025 -

Important Updates Regarding Royal Philips 2025 Annual General Meeting

May 24, 2025

Important Updates Regarding Royal Philips 2025 Annual General Meeting

May 24, 2025 -

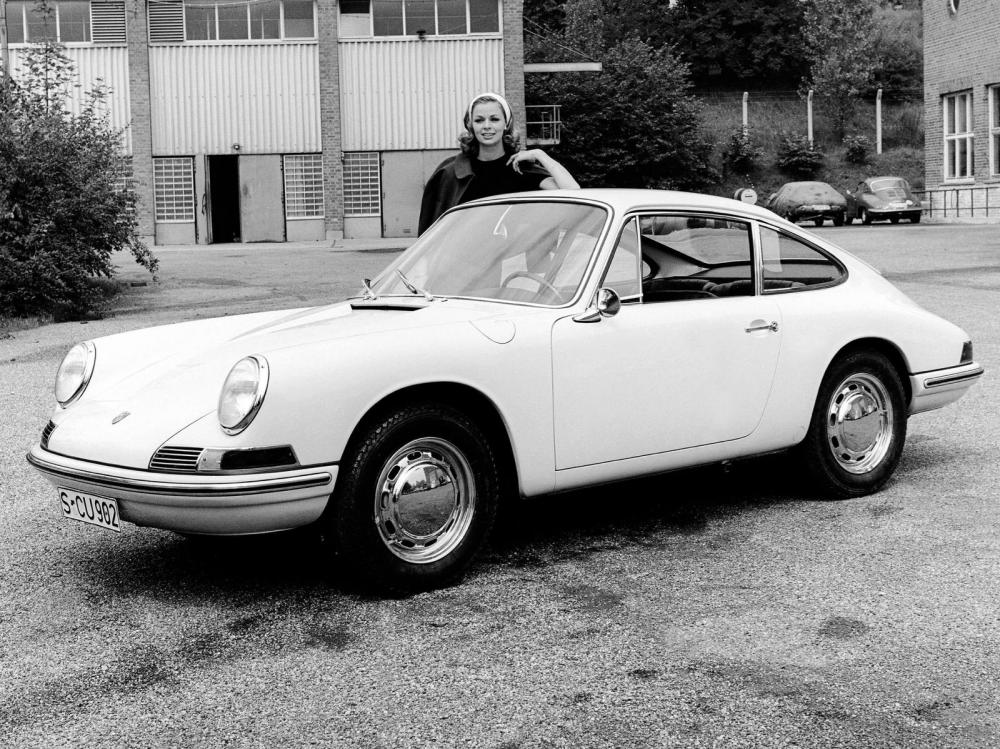

Pabrik Zuffenhausen Dan Lahirnya Mobil Sport Ikonik Sejarah Porsche 356

May 24, 2025

Pabrik Zuffenhausen Dan Lahirnya Mobil Sport Ikonik Sejarah Porsche 356

May 24, 2025 -

Smart Travel Tips Navigating Memorial Day Flights In 2025

May 24, 2025

Smart Travel Tips Navigating Memorial Day Flights In 2025

May 24, 2025

Latest Posts

-

Ces Unveiled Europe Les Innovations Qui Faconneront Le Futur

May 24, 2025

Ces Unveiled Europe Les Innovations Qui Faconneront Le Futur

May 24, 2025 -

Retour Du Ces Unveiled A Amsterdam Les Technologies De Demain Devoilees

May 24, 2025

Retour Du Ces Unveiled A Amsterdam Les Technologies De Demain Devoilees

May 24, 2025 -

Nouveautes Technologiques A Decouvrir Au Ces Unveiled Europe A Amsterdam

May 24, 2025

Nouveautes Technologiques A Decouvrir Au Ces Unveiled Europe A Amsterdam

May 24, 2025 -

Ces Unveiled Europe 2024 Date Lieu Et Nouveautes Attendues

May 24, 2025

Ces Unveiled Europe 2024 Date Lieu Et Nouveautes Attendues

May 24, 2025 -

Mathieu Avanzi Moderniser L Enseignement Du Francais

May 24, 2025

Mathieu Avanzi Moderniser L Enseignement Du Francais

May 24, 2025