Amundi Dow Jones Industrial Average UCITS ETF: A Guide To Net Asset Value (NAV)

Table of Contents

What is Net Asset Value (NAV)?

Net Asset Value (NAV) represents the current market value of an ETF's underlying assets minus its liabilities, all divided by the number of outstanding shares. Essentially, it's the net worth of the ETF per share. Understanding NAV is paramount because it reflects the intrinsic value of your investment.

- Importance of NAV: NAV serves as a benchmark for determining the fair market value of the ETF. It provides a clear picture of the underlying assets and their performance, offering a more accurate reflection of the ETF's worth than the fluctuating share price alone.

- NAV Calculation: The calculation involves determining the total market value of all assets held by the ETF (e.g., stocks, bonds, etc.). This is then reduced by the ETF's liabilities (e.g., management fees, expenses). The resulting net asset value is then divided by the total number of outstanding shares to arrive at the NAV per share.

- Example: Let's say an ETF has total assets of $10 million and liabilities of $100,000. If there are 1 million shares outstanding, the NAV per share would be ($10,000,000 - $100,000) / 1,000,000 = $9.90.

How is the Amundi Dow Jones Industrial Average UCITS ETF NAV Calculated?

The Amundi Dow Jones Industrial Average UCITS ETF tracks the performance of the Dow Jones Industrial Average. Therefore, its NAV is directly influenced by the performance of the 30 constituent companies.

- Specific Assets: The ETF's assets primarily consist of holdings in the 30 companies that make up the Dow Jones Industrial Average, proportionally weighted to reflect the index's composition.

- Daily Calculation: The NAV is calculated daily, reflecting the closing prices of the underlying stocks. Fluctuations in the market values of these 30 companies directly impact the ETF's NAV.

- Currency Considerations: While the Dow Jones Industrial Average is denominated in USD, currency exchange rates can play a role if the ETF holds assets in other currencies. Any currency conversions are factored into the daily NAV calculation.

- Transparency: Amundi, as the ETF provider, ensures transparency in NAV reporting. The daily NAV is readily available on their website and through most brokerage platforms.

The Relationship Between NAV and Share Price

Ideally, the Amundi Dow Jones Industrial Average UCITS ETF's share price should closely track its NAV. However, market forces can sometimes create temporary discrepancies.

- Ideal Scenario: In a perfectly efficient market, the share price would always equal the NAV. This is because investors would buy or sell shares to maintain this equilibrium.

- Market Factors: Supply and demand, trading volume, and market sentiment can cause short-term deviations. High demand might push the share price above the NAV (creating a premium), while low demand might drive it below (creating a discount).

- Premium/Discount: A premium occurs when the share price trades above the NAV, while a discount happens when it trades below. These discrepancies are usually temporary and tend to correct themselves over time.

- Tracking Error: Tracking error measures the difference between the ETF's performance and the performance of its underlying index (the Dow Jones Industrial Average). A higher tracking error might indicate a larger potential divergence between the NAV and the share price.

Monitoring NAV Changes in your Amundi Dow Jones Industrial Average UCITS ETF Portfolio

Regularly monitoring your ETF's NAV is crucial for effective portfolio management.

- Regular Checking: Check the NAV at least once a week to observe your investment's performance. More frequent checks might be beneficial for active trading strategies.

- Online Resources: Access real-time or historical NAV data via the Amundi website or your brokerage account. Many platforms offer charts and graphs for easy visualization.

- Chart Analysis: Analyze NAV charts to identify trends, patterns, and potential turning points in the ETF's performance. This aids in long-term investment strategy.

- Comparison to Benchmark: Compare the ETF's NAV performance to the Dow Jones Industrial Average itself to assess how effectively the ETF is tracking its benchmark.

Conclusion

Understanding the Net Asset Value (NAV) is fundamental to successfully investing in the Amundi Dow Jones Industrial Average UCITS ETF. We've explored how NAV is calculated, its relationship with the share price, and the importance of regular monitoring. By utilizing the readily available resources and regularly reviewing your ETF's NAV, you can make informed decisions about your investment in this Dow Jones Industrial Average tracking ETF and optimize your portfolio's performance. Learn more about Amundi Dow Jones Industrial Average UCITS ETF NAV today!

Featured Posts

-

Heineken Revenue Results Above Expectations Outlook Remains Strong

May 24, 2025

Heineken Revenue Results Above Expectations Outlook Remains Strong

May 24, 2025 -

Essen Uniklinikum Aktuelle Ereignisse Und Ihre Auswirkungen

May 24, 2025

Essen Uniklinikum Aktuelle Ereignisse Und Ihre Auswirkungen

May 24, 2025 -

South Florida Hosts Electrifying Ferrari Challenge Racing Days

May 24, 2025

South Florida Hosts Electrifying Ferrari Challenge Racing Days

May 24, 2025 -

Import Dazi Usa Quanto Costa Importare Abbigliamento

May 24, 2025

Import Dazi Usa Quanto Costa Importare Abbigliamento

May 24, 2025 -

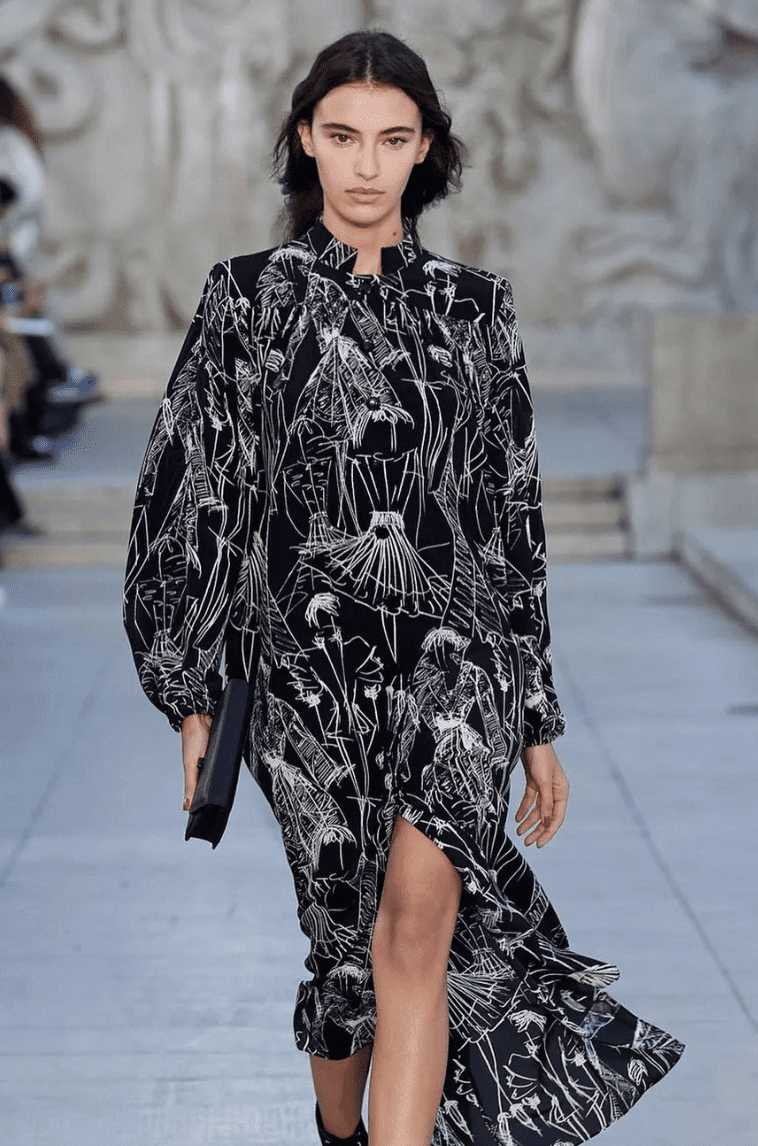

Amira Al Zuhair Models For Zimmermann In Paris Fashion Week

May 24, 2025

Amira Al Zuhair Models For Zimmermann In Paris Fashion Week

May 24, 2025

Latest Posts

-

Best Of Bangladesh In Europe 2nd Edition Focuses On Collaboration And Growth

May 24, 2025

Best Of Bangladesh In Europe 2nd Edition Focuses On Collaboration And Growth

May 24, 2025 -

Portrait Des Acteurs Du Brest Urban Trail De L Artiste Au Partenaire

May 24, 2025

Portrait Des Acteurs Du Brest Urban Trail De L Artiste Au Partenaire

May 24, 2025 -

Bangladesh Event In Netherlands To Draw 1 500 Visitors Including European Investors

May 24, 2025

Bangladesh Event In Netherlands To Draw 1 500 Visitors Including European Investors

May 24, 2025 -

Brest Urban Trail L Importance Des Benevoles Artistes Et Partenaires

May 24, 2025

Brest Urban Trail L Importance Des Benevoles Artistes Et Partenaires

May 24, 2025 -

Best Of Bangladesh Event In Netherlands Over 1 500 Expected

May 24, 2025

Best Of Bangladesh Event In Netherlands Over 1 500 Expected

May 24, 2025