Amundi Dow Jones Industrial Average UCITS ETF: How Net Asset Value Impacts Your Investment

Table of Contents

What is Net Asset Value (NAV) and How is it Calculated?

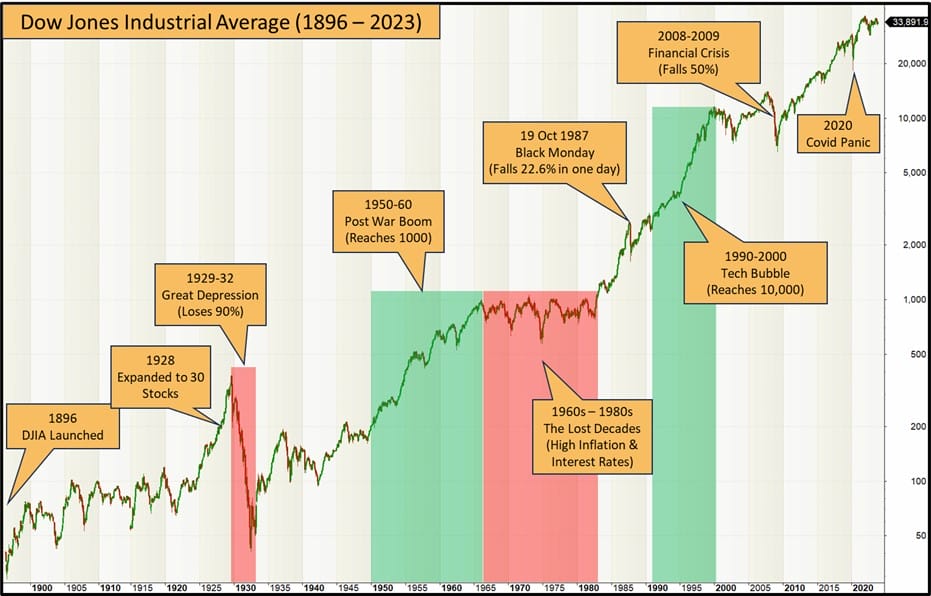

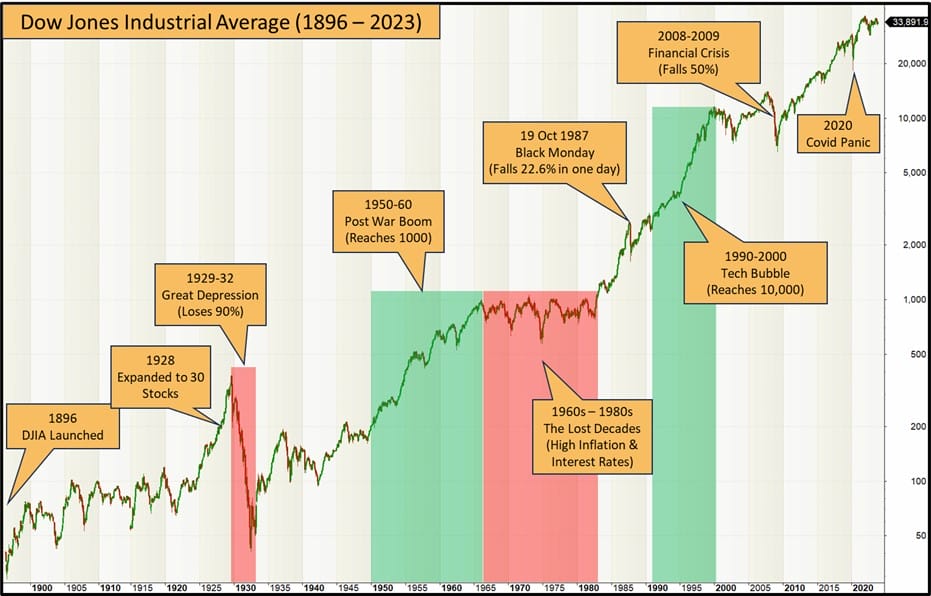

Net Asset Value (NAV) represents the net value of an ETF's underlying assets per share. For the Amundi Dow Jones Industrial Average UCITS ETF, this means the total value of the 30 constituent stocks of the Dow Jones Industrial Average, minus any liabilities, divided by the total number of outstanding ETF shares. Understanding NAV calculation is crucial for interpreting ETF pricing and assessing your investment's asset valuation.

The process involves valuing each of the underlying stocks at their respective closing market prices. This market value is then aggregated, and any expenses or liabilities of the ETF are subtracted. The resulting figure is then divided by the total number of outstanding shares to arrive at the NAV per share.

- Formula: NAV = (Total Market Value of Assets - Liabilities) / Number of Outstanding Shares

- Factors Affecting Daily NAV Calculation: Daily fluctuations in the market prices of the underlying Dow Jones Industrial Average stocks are the primary driver of NAV changes. Other factors include dividend payments received from the underlying companies, and any ETF-related expenses.

- NAV vs. Market Price: While the NAV is the intrinsic value of the ETF, the market price can deviate slightly due to supply and demand dynamics. However, these deviations are usually minimal, especially for actively traded ETFs like the Amundi Dow Jones Industrial Average UCITS ETF.

How NAV Impacts Your Amundi Dow Jones Industrial Average UCITS ETF Returns

The NAV of your Amundi Dow Jones Industrial Average UCITS ETF directly impacts your investment returns. An increase in NAV translates to capital appreciation, increasing the value of your investment. Conversely, a decrease in NAV signifies a loss. Your profit or loss is determined by the difference between the NAV at the time of purchase and the NAV at the time of sale.

- Example: If you bought 100 shares at a NAV of $100 and the NAV rises to $110, your investment has increased by $10 per share, or $1000 in total, excluding any fees.

- Long-Term NAV Growth: Consistent long-term growth in the NAV is crucial for achieving significant investment returns. This is particularly true for buy-and-hold investment strategies.

- Impact of Dividends: Dividend payments from the underlying Dow Jones Industrial Average companies are usually reinvested into the ETF, affecting the NAV positively. This contributes to overall returns.

Monitoring NAV and Making Informed Investment Decisions

Regularly monitoring the NAV of your Amundi Dow Jones Industrial Average UCITS ETF is critical for making informed investment decisions. This data allows you to assess the performance of your investment against your expectations. Tracking NAV changes helps you gauge the effectiveness of your investment strategy and adapt your approach as needed.

- Tips for Tracking NAV: Most brokerage platforms provide real-time or daily NAV updates for your ETFs. You can also find this information on the Amundi website.

- Using NAV to Time Purchases and Sales: While timing the market is challenging, monitoring NAV fluctuations can help in identifying potential buying opportunities (lower NAV) or selling points (higher NAV) depending on your investment goals and risk tolerance.

- Consider Other Factors: Don't solely rely on NAV. Consider broader market trends, economic indicators, and your individual financial goals when making investment decisions.

- Accessing NAV Information: Access updated NAV information regularly via your brokerage account, the Amundi website, or financial news sources.

Comparing NAV with Other Investment Metrics

While NAV is a primary indicator of ETF performance, it's essential to consider other investment metrics for a comprehensive assessment of the Amundi Dow Jones Industrial Average UCITS ETF's performance.

- Expense Ratio: This metric indicates the annual cost of managing the ETF. A lower expense ratio generally means better returns for the investor.

- Tracking Error: This measures how closely the ETF's performance tracks the underlying index (Dow Jones Industrial Average). A lower tracking error is desirable.

- Using Metrics Together: Combining NAV analysis with expense ratio and tracking error provides a more holistic view of the ETF's performance, allowing for a more informed investment decision.

Conclusion

Understanding Net Asset Value is key to successful investment in the Amundi Dow Jones Industrial Average UCITS ETF. Regularly monitoring NAV fluctuations, in conjunction with other relevant investment metrics like the expense ratio and tracking error, enables you to make informed decisions about buying, selling, or holding your investment. By actively tracking your Amundi Dow Jones Industrial Average UCITS ETF's NAV and understanding its implications, you can improve your investment strategy and work towards achieving your financial goals. Learn more about NAV and actively monitor your investment to make informed decisions for your portfolio.

Featured Posts

-

Thierry Ardisson Et Laurent Baffie Une Brouille Definitive

May 25, 2025

Thierry Ardisson Et Laurent Baffie Une Brouille Definitive

May 25, 2025 -

Amsterdam Stock Market Slump Aex Index At 12 Month Low

May 25, 2025

Amsterdam Stock Market Slump Aex Index At 12 Month Low

May 25, 2025 -

Apple Stock Forecast One Analyst Predicts 254 Should You Invest Now

May 25, 2025

Apple Stock Forecast One Analyst Predicts 254 Should You Invest Now

May 25, 2025 -

Albert De Monaco Viatge Amb Actriu Distancia Amb Charlene

May 25, 2025

Albert De Monaco Viatge Amb Actriu Distancia Amb Charlene

May 25, 2025 -

Hells Angels Pay Respects South Shields Biker Remembered As A Legend In Motion

May 25, 2025

Hells Angels Pay Respects South Shields Biker Remembered As A Legend In Motion

May 25, 2025