Amundi Dow Jones Industrial Average UCITS ETF: Understanding Net Asset Value (NAV)

Table of Contents

Keywords: Amundi Dow Jones Industrial Average UCITS ETF, Net Asset Value, NAV, ETF, Investment, Returns, Pricing, Fund Management, Portfolio, Index Tracking

Investing in exchange-traded funds (ETFs) like the Amundi Dow Jones Industrial Average UCITS ETF offers diversification and exposure to a specific market index. However, understanding key metrics like Net Asset Value (NAV) is crucial for maximizing your returns and managing your investment effectively. This article will demystify NAV, explaining its calculation, importance, and how it relates to your Amundi Dow Jones Industrial Average UCITS ETF holdings.

What is Net Asset Value (NAV) and Why is it Important?

Net Asset Value (NAV) represents the net value of an ETF's assets per share. For the Amundi Dow Jones Industrial Average UCITS ETF, this means the NAV reflects the total value of the underlying holdings (the 30 constituent companies of the Dow Jones Industrial Average), less any liabilities such as expenses and management fees, divided by the total number of outstanding ETF shares. Understanding NAV is paramount because:

- NAV reflects the ETF's underlying asset value: It provides a snapshot of the intrinsic worth of your investment.

- Daily NAV fluctuations indicate ETF performance: Changes in the NAV directly reflect the overall performance of the Dow Jones Industrial Average.

- NAV is used to calculate your ETF returns: Your profit or loss is determined by comparing the NAV at the time of purchase and sale.

- Understanding NAV helps informed investment decisions: It allows you to track your investment's progress and make informed decisions about buying, selling, or holding your shares.

How is the NAV of the Amundi Dow Jones Industrial Average UCITS ETF Calculated?

The NAV of the Amundi Dow Jones Industrial Average UCITS ETF is calculated daily, typically at the close of the market. The process involves:

- Daily calculation based on closing prices of the Dow Jones Industrial Average components: The value of each company in the index is weighted according to its representation in the Dow Jones Industrial Average.

- Consideration of expenses and other relevant fees: Management fees, administrative costs, and other expenses are deducted from the total asset value before calculating the NAV per share.

- Impact of currency fluctuations if held in a different currency: If you hold the ETF in a currency different from the base currency (likely USD), exchange rate fluctuations will affect the NAV you see in your account.

- Transparency in the calculation methodology: Amundi, as the fund manager, provides clear and accessible information about the NAV calculation methodology on their website and in fund documentation. This transparency is crucial for investor confidence.

NAV vs. Market Price: Understanding the Difference in the Amundi Dow Jones Industrial Average UCITS ETF

While NAV represents the intrinsic value of the ETF's assets, the market price reflects the price at which the ETF shares are currently trading on the exchange. These two values might differ slightly due to:

- Market price reflects supply and demand: Short-term market fluctuations, investor sentiment, and trading volume can cause the market price to deviate slightly from the NAV.

- NAV represents the intrinsic value of the ETF assets: This value is less susceptible to short-term market noise.

- Small discrepancies are common, but large differences warrant investigation: Significant deviations may signal market inefficiencies or other factors requiring further analysis.

- Arbitrage opportunities may exist due to price differences: Sophisticated investors may exploit price discrepancies between NAV and market price for short-term gains.

Tracking the NAV of your Amundi Dow Jones Industrial Average UCITS ETF Investment

You can find the daily NAV of the Amundi Dow Jones Industrial Average UCITS ETF on Amundi's official website, major financial news websites (like Yahoo Finance or Google Finance), and through your brokerage account. The NAV is typically updated daily, reflecting the closing prices of the Dow Jones Industrial Average components. Many brokerage platforms also provide charting tools and portfolio tracking features that allow you to easily monitor the NAV of your ETF holdings over time.

Conclusion

Understanding Net Asset Value (NAV) is vital for anyone investing in the Amundi Dow Jones Industrial Average UCITS ETF. NAV provides a clear indication of the underlying value of your investment, allowing you to track its performance and make informed decisions. While the market price may fluctuate, the NAV provides a stable benchmark for assessing your returns. Regularly monitoring the NAV of your Amundi Dow Jones Industrial Average UCITS ETF holdings, combined with an understanding of its calculation, will contribute significantly to effective investment management. Learn more about the Amundi Dow Jones Industrial Average UCITS ETF and its Net Asset Value (NAV) to optimize your investment strategy. Regularly monitor the NAV of your Amundi Dow Jones Industrial Average UCITS ETF holdings for better investment management.

Featured Posts

-

Police Helicopter Pursuit Dramatic Mid Chase Refueling

May 24, 2025

Police Helicopter Pursuit Dramatic Mid Chase Refueling

May 24, 2025 -

Find Housing Finance Solutions And Family Fun At The Iam Expat Fair

May 24, 2025

Find Housing Finance Solutions And Family Fun At The Iam Expat Fair

May 24, 2025 -

Analisi Dei Dazi Stati Uniti Previsioni Prezzi Moda

May 24, 2025

Analisi Dei Dazi Stati Uniti Previsioni Prezzi Moda

May 24, 2025 -

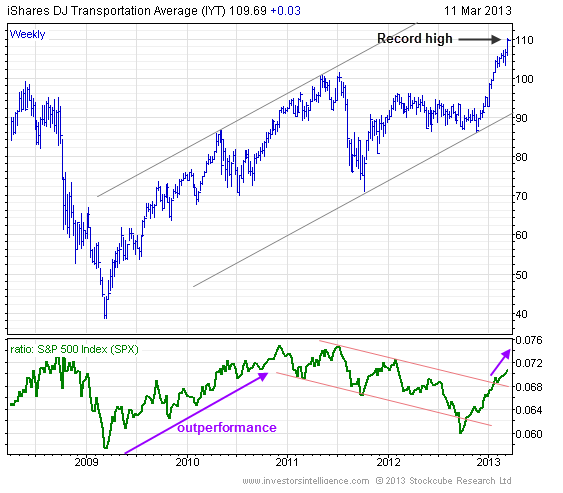

Avrupa Borsalari Ecb Faiz Kararindan Sonra Nasil Etkilendi

May 24, 2025

Avrupa Borsalari Ecb Faiz Kararindan Sonra Nasil Etkilendi

May 24, 2025 -

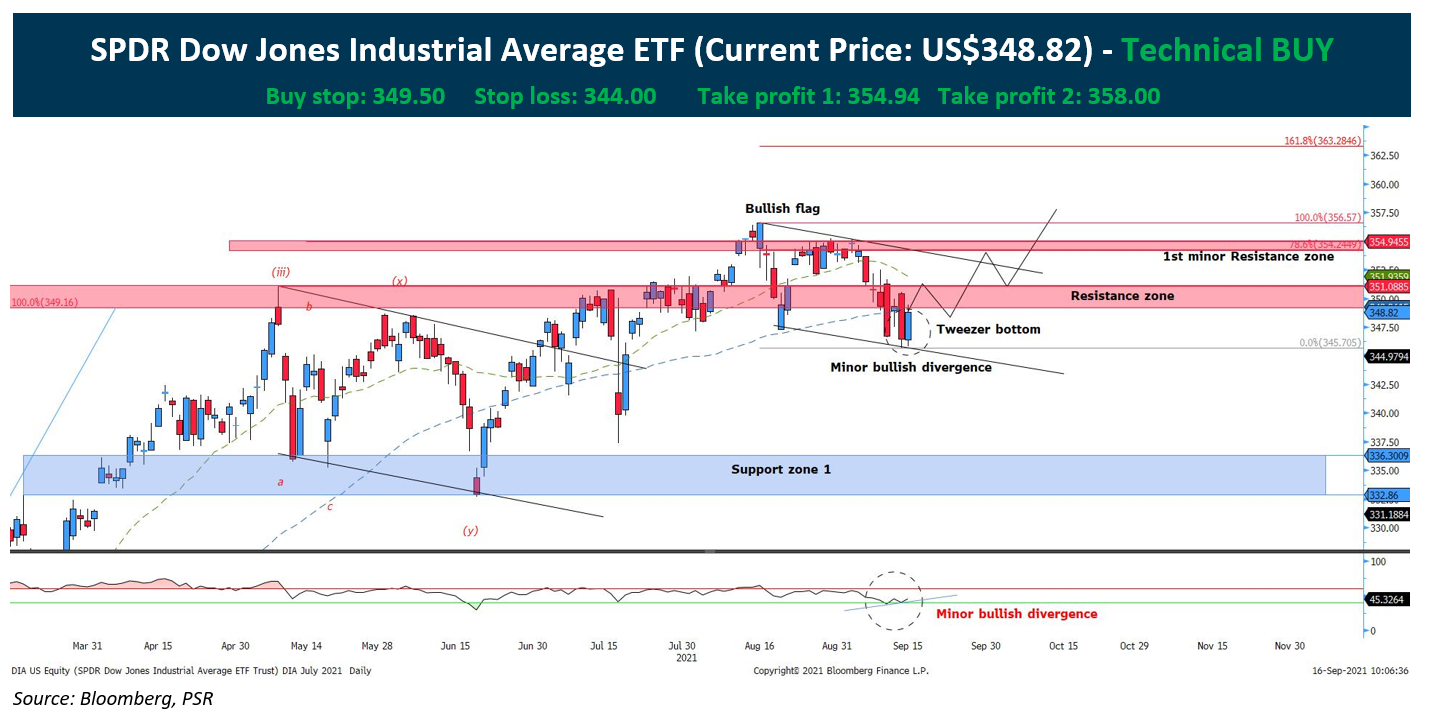

Amundi Dow Jones Industrial Average Ucits Etf Daily Nav And Its Implications

May 24, 2025

Amundi Dow Jones Industrial Average Ucits Etf Daily Nav And Its Implications

May 24, 2025

Latest Posts

-

Best Of Bangladesh In Europe 2nd Edition Focuses On Collaboration And Growth

May 24, 2025

Best Of Bangladesh In Europe 2nd Edition Focuses On Collaboration And Growth

May 24, 2025 -

Portrait Des Acteurs Du Brest Urban Trail De L Artiste Au Partenaire

May 24, 2025

Portrait Des Acteurs Du Brest Urban Trail De L Artiste Au Partenaire

May 24, 2025 -

Bangladesh Event In Netherlands To Draw 1 500 Visitors Including European Investors

May 24, 2025

Bangladesh Event In Netherlands To Draw 1 500 Visitors Including European Investors

May 24, 2025 -

Brest Urban Trail L Importance Des Benevoles Artistes Et Partenaires

May 24, 2025

Brest Urban Trail L Importance Des Benevoles Artistes Et Partenaires

May 24, 2025 -

Best Of Bangladesh Event In Netherlands Over 1 500 Expected

May 24, 2025

Best Of Bangladesh Event In Netherlands Over 1 500 Expected

May 24, 2025