Amundi MSCI All Country World UCITS ETF USD Acc, NAV, ETF, Net Asset Value, global ETF, investment, portfolio diversification.

Amundi MSCI All Country World UCITS ETF USD Acc, NAV, ETF, Net Asset Value, global ETF, investment, portfolio diversification.

The AMUNDI ETF's NAV, like any ETF tracking a broad global market index, is subject to numerous factors. Understanding these influences is key to interpreting its performance and making informed investment decisions.

Global Market Trends: Broad market movements significantly impact the AMUNDI ETF's NAV. A bullish global market generally leads to NAV appreciation, while bearish trends result in depreciation. This is because the ETF holds a diverse portfolio mirroring the MSCI All Country World Index. Monitoring global economic indicators, such as GDP growth and inflation rates, is crucial for predicting potential NAV fluctuations. Keywords: market trends, global economic indicators, GDP growth, inflation.

Currency Fluctuations (USD Acc): The "USD Acc" designation indicates that the ETF's NAV is denominated in US dollars. Fluctuations in the value of the US dollar against other currencies held within the ETF's underlying assets directly influence the reported NAV. A strengthening dollar can increase the NAV, while a weakening dollar can decrease it, even if the underlying assets maintain their value in their respective local currencies. Keywords: currency fluctuations, USD, exchange rate risk.

Sector and Asset Class Performance: The AMUNDI ETF's portfolio is diversified across various sectors and asset classes. Strong performance in specific sectors (e.g., technology, healthcare) will positively impact the NAV, while underperformance in others can lead to a decline. Analyzing the weightings of different sectors and asset classes within the ETF can help anticipate potential NAV movements. Keywords: sector performance, asset class allocation, portfolio composition, market capitalization.

Significant Events: Geopolitical events (e.g., wars, trade disputes), economic data releases (e.g., interest rate changes, employment figures), and unexpected market shocks (e.g., pandemics) can all substantially affect the AMUNDI ETF's NAV. These events create volatility and necessitate careful monitoring of news and economic forecasts. Keywords: geopolitical risk, economic indicators, market volatility.

(Insert a chart or graph here visually representing the historical NAV performance of the AMUNDI ETF. Ideally, this would cover a period of several years.)

Analyzing the historical NAV of the AMUNDI ETF reveals valuable insights. For example, periods of significant growth can often be correlated with positive global market sentiment and strong performance in specific sectors represented in the ETF's holdings. Conversely, declines may align with global market corrections or negative economic news. Studying the long-term trend helps gauge the ETF's overall performance and its potential for future growth. Comparing this data to relevant benchmarks, like other global ETFs tracking similar indices, allows for a comparative performance assessment. Keywords: historical performance, NAV chart, growth, decline, benchmark comparison, long-term trend.

NAV analysis is crucial for informing investment decisions.

Buy/Sell Signals: While not the sole determinant, NAV can provide insights into potential buy or sell signals. A consistently rising NAV might suggest a favorable investment climate, while a prolonged decline could signal a need for caution or even divestment. Keywords: investment strategy, buy signals, sell signals.

Entry and Exit Points: Monitoring NAV trends helps determine appropriate entry and exit points. Investors may seek to buy low (during NAV dips) and sell high (during NAV peaks). However, timing the market is inherently difficult, and long-term strategies often prioritize consistent investment over short-term gains. Keywords: entry points, exit points, market timing.

Long-Term vs. Short-Term: Long-term investors may be less concerned with short-term NAV fluctuations, focusing instead on the overall long-term growth potential of the ETF. Short-term traders, on the other hand, may actively exploit NAV movements for quicker profits but accept higher risk. Keywords: long-term investing, short-term trading, risk tolerance.

Risk and Return: NAV analysis helps assess risk and return. While higher NAV growth suggests higher potential returns, it's also crucial to consider the volatility associated with such growth. Keywords: risk management, return on investment.

The AMUNDI ETF isn't the only global ETF available. Comparing its performance and characteristics with competitors is vital. Key factors to consider include:

Expense Ratio: A lower expense ratio generally translates to higher returns for the investor. Compare the AMUNDI ETF's expense ratio to its competitors. Keywords: expense ratio, management fees, cost comparison.

Diversification: Assess the level of diversification across different sectors and geographies. The AMUNDI ETF aims for broad diversification, but subtle differences in index composition can lead to performance variations. Keywords: diversification, global diversification, portfolio holdings.

Tracking Error: This measures how closely the ETF tracks its benchmark index. A lower tracking error indicates better performance alignment with the index. Keywords: tracking error, index tracking.

Analyzing the NAV of the Amundi MSCI All Country World UCITS ETF USD Acc is crucial for making informed investment decisions. By understanding the factors influencing its fluctuations and comparing its performance to similar ETFs, investors can develop more effective strategies. Remember that while NAV is a significant indicator, it shouldn't be the sole factor determining investment choices. Conduct thorough research, consider your risk tolerance, and seek professional financial advice if needed. Stay informed about the Amundi MSCI All Country World UCITS ETF USD Acc NAV and make smarter investment decisions. Learn more about using NAV analysis for your global ETF investments.

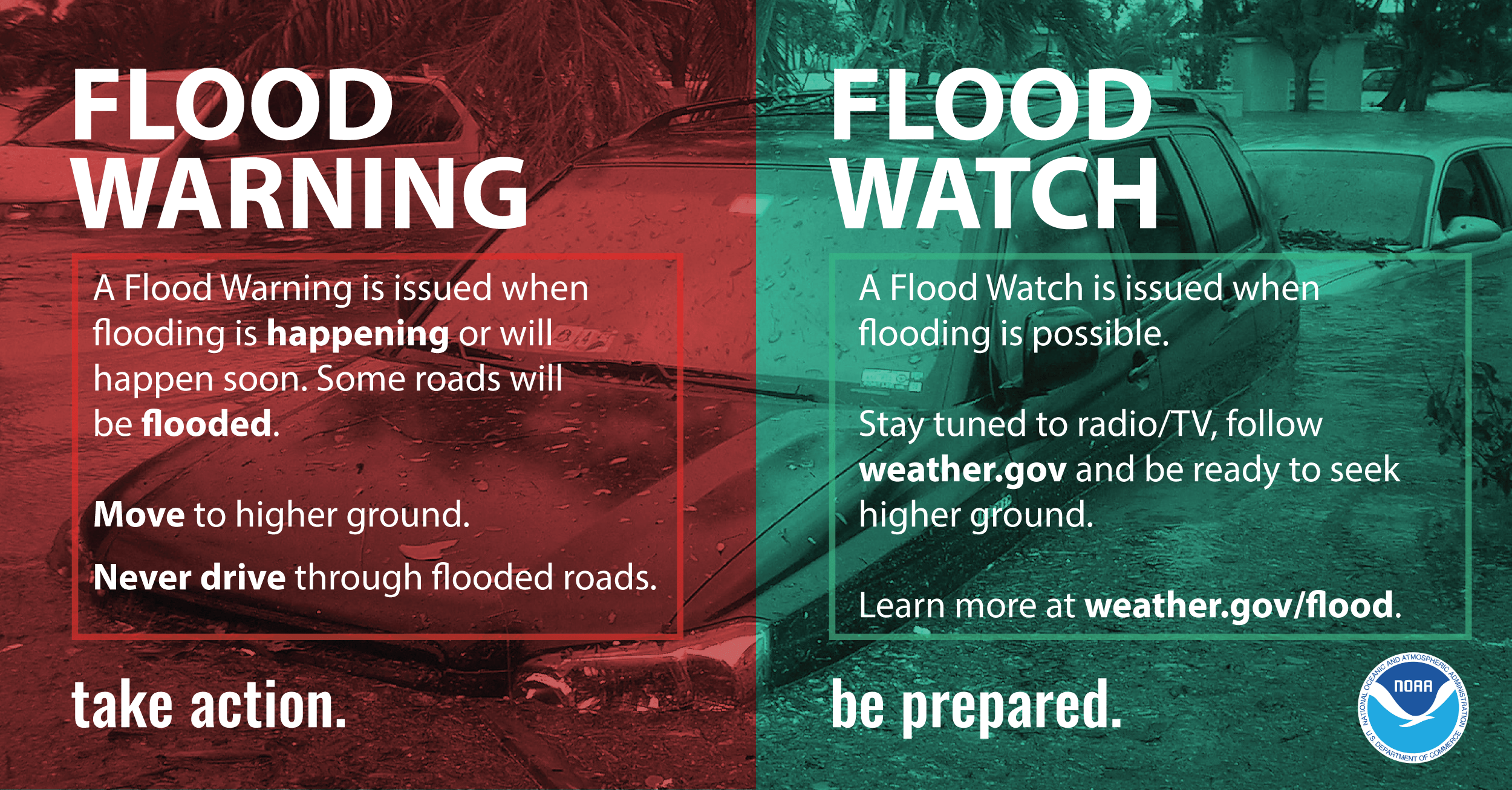

Severe Weather Update Flash Flood Warnings And April Tornado Count April 4 2025

Severe Weather Update Flash Flood Warnings And April Tornado Count April 4 2025

Porsche Koezuti Modell Legendas F1 Motorral

Porsche Koezuti Modell Legendas F1 Motorral

Nouveautes Technologiques Au Ces Unveiled Europe A Amsterdam

Nouveautes Technologiques Au Ces Unveiled Europe A Amsterdam

Sean Penn Casts Doubt On Dylan Farrows Sexual Assault Claim Against Woody Allen

Sean Penn Casts Doubt On Dylan Farrows Sexual Assault Claim Against Woody Allen

Schekotat Nervy Vzglyad Fedora Lavrova Na Pavla I I Zhanr Trillera

Schekotat Nervy Vzglyad Fedora Lavrova Na Pavla I I Zhanr Trillera