Amundi MSCI World Catholic Principles UCITS ETF Acc: A Guide To Its Net Asset Value (NAV)

Table of Contents

What is Net Asset Value (NAV)?

Net Asset Value (NAV) represents the underlying value of an investment fund's assets minus its liabilities, per share. For an exchange-traded fund (ETF) like the Amundi MSCI World Catholic Principles UCITS ETF Acc, the NAV is calculated by totaling the market value of all the securities (stocks, bonds, etc.) it holds, adding any cash reserves, and then subtracting any liabilities such as expenses. This figure is then divided by the total number of outstanding ETF shares.

- NAV reflects the intrinsic value of the ETF's holdings. This means it represents the true worth of the assets the fund owns, irrespective of the ETF's market price.

- Market price can fluctuate throughout the trading day. The market price is the price at which the ETF is bought and sold on the exchange. It can vary based on supply and demand, often diverging slightly from the NAV.

- NAV is typically calculated at the end of each trading day. This is the most common timeframe, ensuring a daily update on the fund’s underlying value.

- Understanding the difference helps avoid misinterpretations of ETF performance. Focusing solely on the market price without considering the NAV can lead to inaccurate assessments of the ETF's true performance.

Factors Affecting the Amundi MSCI World Catholic Principles UCITS ETF Acc NAV

Several factors influence the NAV of the Amundi MSCI World Catholic Principles UCITS ETF Acc. These are interconnected and impact the overall value of the ETF's underlying holdings.

-

Market performance of the underlying stocks: The NAV is directly affected by the performance of the global equities included in the ETF's portfolio. Strong market performance, particularly within the sectors represented in the ETF, will generally lead to a higher NAV. Conversely, market downturns will reduce the NAV. Global market trends and specific sector performance, such as technology or healthcare, will all play a significant role. Understanding the weightings of different sectors within the Amundi MSCI World Catholic Principles UCITS ETF Acc portfolio is essential for interpreting NAV fluctuations.

-

Currency fluctuations: As a global ETF, the Amundi MSCI World Catholic Principles UCITS ETF Acc holds assets denominated in various currencies. Fluctuations in exchange rates can significantly impact the NAV when converting these assets back to the base currency of the ETF. A strengthening of the Euro (or whichever the base currency is) against other currencies would generally increase the NAV, while a weakening would have the opposite effect.

-

Dividends and distributions: When underlying companies within the ETF pay dividends, these are typically passed on to ETF shareholders. While this is beneficial for investors, the NAV will usually adjust downwards to reflect the distribution of these dividends. The ex-dividend date is important to note as the NAV will typically reflect the dividend payout on that day.

-

Expense ratio: The expense ratio, which covers the fund's operating costs, has a subtle but cumulative impact on the NAV over time. Although small, these charges are deducted from the fund's assets, slightly reducing the NAV.

Where to Find the Amundi MSCI World Catholic Principles UCITS ETF Acc NAV

Several sources provide access to the daily NAV of the Amundi MSCI World Catholic Principles UCITS ETF Acc:

- Official ETF provider website (Amundi): Amundi's official website is the most reliable source for the NAV. Look for fund fact sheets or dedicated pages for the ETF.

- Financial news websites and data providers (Bloomberg, Yahoo Finance, Google Finance, etc.): Many financial websites provide real-time or near real-time data on ETF NAVs.

- Brokerage platforms: If you hold the Amundi MSCI World Catholic Principles UCITS ETF Acc through a brokerage account, the platform usually displays the current NAV along with other relevant information.

Interpreting the Amundi MSCI World Catholic Principles UCITS ETF Acc NAV for Investment Decisions

The Amundi MSCI World Catholic Principles UCITS ETF Acc NAV provides valuable information for investment decision-making.

-

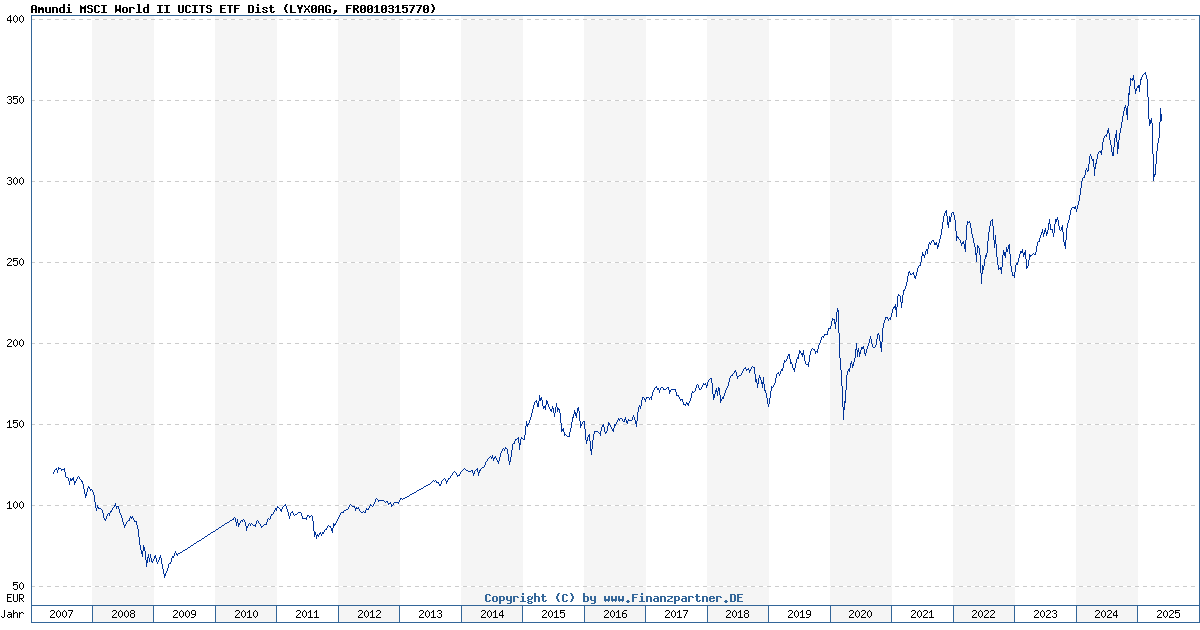

Using NAV to track performance over time: By regularly monitoring the NAV, investors can track the growth or decline in the value of their investment over time. Comparing past NAVs helps assess performance and returns.

-

Comparing NAV to other similar ETFs: Benchmarking the Amundi MSCI World Catholic Principles UCITS ETF Acc NAV against similar ethically-focused or globally diversified ETFs provides context and helps evaluate relative performance. This allows you to see how your choice compares to alternatives in the market.

-

Using NAV in conjunction with other investment metrics: While the NAV is crucial, it shouldn't be the sole factor in investment decisions. Consider other metrics such as the ETF’s expense ratio, historical volatility, and its alignment with your overall investment goals.

Conclusion

Understanding the Net Asset Value (NAV) of the Amundi MSCI World Catholic Principles UCITS ETF Acc is key to effective portfolio management. By understanding how it’s calculated, the factors that influence it, and where to find accurate data, you can make more informed investment decisions. Regularly monitor the Amundi MSCI World Catholic Principles UCITS ETF Acc NAV and utilize this knowledge to optimize your investment strategy. Learn more about Amundi MSCI World Catholic Principles UCITS ETF Acc NAV today and make informed investment choices!

Featured Posts

-

M6 Drivers Face Significant Delays Following Van Crash

May 25, 2025

M6 Drivers Face Significant Delays Following Van Crash

May 25, 2025 -

Accentures 50 000 Employee Promotion A Six Month Delay Explained

May 25, 2025

Accentures 50 000 Employee Promotion A Six Month Delay Explained

May 25, 2025 -

Bardellas Presidential Bid A Contender Or Outsider

May 25, 2025

Bardellas Presidential Bid A Contender Or Outsider

May 25, 2025 -

The Dylan Farrow Allegations Sean Penns Perspective

May 25, 2025

The Dylan Farrow Allegations Sean Penns Perspective

May 25, 2025 -

Vospominaniya O Sergee Yurskom V Teatre Mossoveta

May 25, 2025

Vospominaniya O Sergee Yurskom V Teatre Mossoveta

May 25, 2025